aprott

At the conclusion of Meta Platforms’ (NASDAQ:META) most recent earnings call, Brent Thill of Jefferies asked a probing question that is at the core of Meta’s recent drawdown:

I think kind of summing up how investors are feeling right now is that there are just too many experimental bets versus proven bets on the core. … There is obviously a lot of focus on the investment side and I think everyone would love to hear why you think this pays off.

When Meta first leaned into the idea of pursuing Mark Zuckerberg’s metaverse vision, it was met with similar concern by analysts and investors as when Facebook originally IPOed (they’re not really going to be able to effectively monetize this thing…), as when Facebook made the transition to mobile (the value’s not going to transfer…), as when Facebook purchased Instagram for $1B (for an asset that produces zero income…), as when Facebook purchased WhatsApp for $19B (what are they thinking?), etc.

I’m not going to lie; I’ve shared some of those anxieties along the way since the company’s IPO just over a decade ago. Thus far, those concerns have proven inane. Some of Facebook’s initiatives have failed, sure – as you might (should) expect of any large innovative company – while others have succeeded beyond outside expectations, giving the company the sizable cash flow it realizes today.

So, what are these investments today that have analysts so downtrodden?

The Investments in Question

Their two largest investments right now are improving their AI capabilities and the metaverse. Although the metaverse investments seem to get more press, the AI focus is actually the much larger of the two. In fact, as CFO Dave Wehner said during the Q3 2022 earnings call (linked above), “those investments are driving substantially all of our capital expenditure growth in 2023.”

AI Infrastructure

This AI infrastructure has been Meta’s answer to TikTok cutting into their market share of users’ time, as well as helping them overcome Apple’s app tracking transparency (ATT) changes. This seems like a worthwhile endeavor to remain not only relevant, but at the forefront of users’ attention.

Incoming CFO Susan Li, also during the Q3 earnings call, provided this example:

In the Q2 call, we had shared that a single AI advancement in scaling our recommendations models had led to a 15% watch time gain for Facebook Reels, and that gain has continued to grow.

These efforts have allowed them to grow their daily Reels plays by more than 50% over the last six months. Sure, Reels is cannibalizing users’ time on other Meta-owned experiences, like Feed and Stories, both of which are better monetized. This accounts for some of the revenue decline (they estimate more than $500MM per quarter). But this sacrifice fits with the way Meta has approached this game from the beginning – user time on their platforms has always been priority number one. Monetization is secondary.

That said, they seem to be rationally approaching this behemoth task. Wehner further explained on the Q3 2022 call that the company is “carefully evaluating the return we achieved from these investments, which will inform the scale of our AI investment beyond 2023.” They expect their current elevated (for them) capital expenditures as a percentage of revenue to come down over the long term.

Family of Apps

They express the same plan for the added R&D expenditures of late.

Seeking Alpha

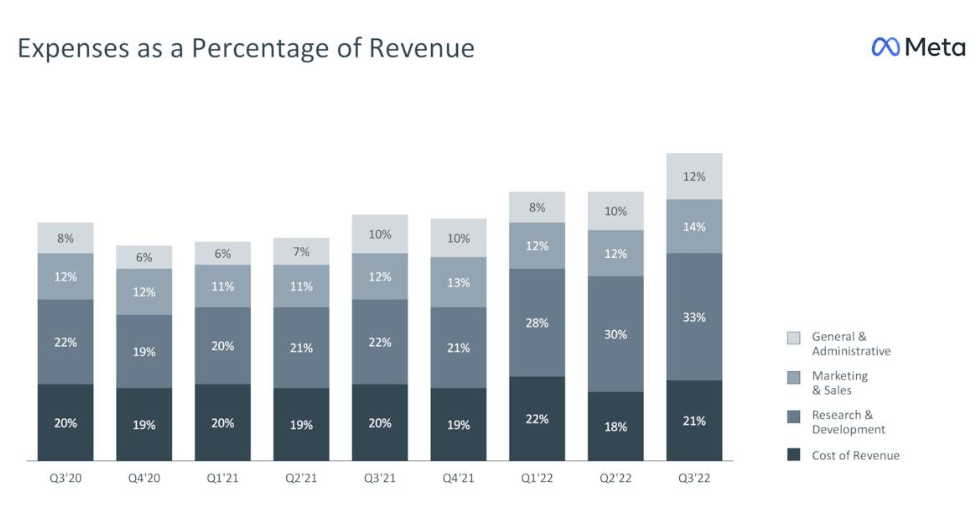

Historically, Meta has spent around 20% of their revenue on R&D. Today, that number has climbed to 33% and is expected to remain elevated throughout 2023. That increase in expenses has, of course, cut into the rich net profit margins to which investors have grown accustomed (26%-40% from 2016-21).

But, again, most of that added expense appears to be focused right where I would think any investor would want it to be: on the long-term monetization of their core business, Meta’s Family of Apps. Here’s how they broke it down during the most recent earnings call:

We continue to direct the majority of our investments towards the development and operation of our Family of Apps. In Q3, Family of Apps expenses were $18.1 billion, representing 82% of our overall expenses.

Although as investors, or potential investors, we don’t get a specific breakdown of exactly where advertising revenue is coming from within the Family of Apps – Facebook’s Feed vs. Instagram’s Stories, for example – we do, on occasion, hear about some specific promising fruits from these investments. Regarding Reels specifically, Zuckerberg teased some of the rapid growth they’re seeing during the last earnings call:

I mentioned last quarter that Instagram Reels had crossed a $1 billion annual revenue run-rate. We continue scaling monetization across both Instagram and Facebook and the combined run-rate across these apps is now $3 billion.

When I first made a video diving deep into Meta, they had just started exploring WhatsApp and Messenger monetization. Here’s what they shared about that in the most recent call:

We started with click-to-messaging ads which lets businesses run ads on Facebook and Instagram that start a thread on Messenger, WhatsApp or Instagram Direct, so they can communicate with customers directly. And this is one of our fastest growing ads products with a $9 billion annual run-rate. And this revenue is mostly on click to Messenger today since we started there first, but click to WhatsApp just passed a $1.5 billion run rate and is growing more than 80% year-over-year.

And then additionally (during that same call) for WhatsApp:

We are putting the foundation in place now to scale this with key partnerships like Salesforce, which lets all businesses on their platform use WhatsApp as the main messaging service to answer customer questions and updates and sell directly in chat. And we also launched JioMart on WhatsApp in India, and it’s our first end-to-end shopping experience that shows the potential for chat-based commerce through messaging.

This is exactly what I would like to see as an investor in any company: the next generation of revenue drivers.

Metaverse

When it comes to the metaverse, however, I’m skeptical. I admit, any monetization from that feels so distant – if they’re even successful with the initiative at all.

Seven years before Netflix (NFLX) came on the scene, Enron entered a deal with Blockbuster to shake up their market promising to deliver video-on-demand. (This is perhaps a terrible comparison, but it’s what comes to mind, so forgive me.) The idea wasn’t bad, even though most people thought it impossible at the time. Enron, however, failed miserably – obviously they had one or two other things distracting them at the time – terminating their 20 year deal after just eight months.

So what if Meta is too early to this metaverse party? At least they’re funding it (for the most part) with cash flows and not complex layers of debt. Even if they’re not successful with this particular initiative, I would expect them to make some bets on the future – similar to Google (GOOG)(GOOGL), Amazon (AMZN), Microsoft (MSFT), and other corporate juggernauts trying to diversify and remain relevant to ultimately profit as much as possible for as long as possible. Here’s how they broke it down during the Q3 2022 earnings call:

Beyond 2023, we expect to pace Reality Labs investments to ensure that we can achieve our goal of growing overall company operating income. … Our capital allocation philosophy over the long-term is to allocate a portion of the profits generated from the Family of Apps towards these future-focused areas while enabling a greater return of capital to shareholders.

Makes sense to me. I’ve always viewed these low-to-no debt, cash cow, innovator companies as though they have their own little internal VC firms. And in this case, their cash flows are so profound that they can accomplish this without seeking outside investment, diluting shareholders, or taking on much debt.

Analyst Expectations

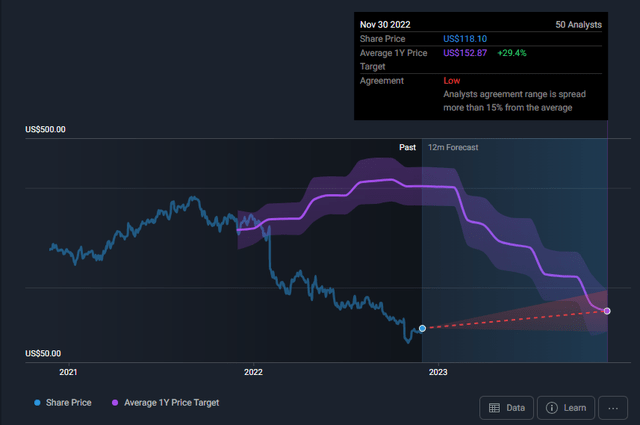

So, do you think analysts should be as scared as they sound?

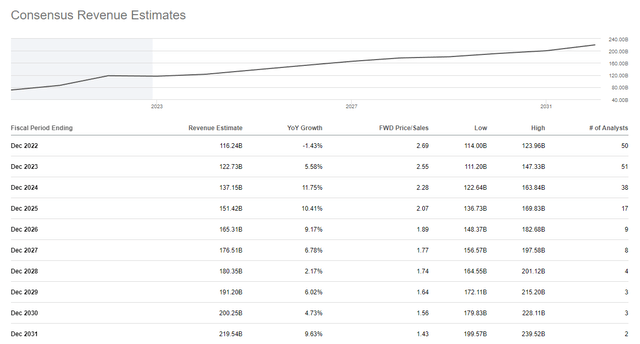

Enough to drop their average revenue growth projections from the 22%-58% range that Meta realized from 2012-21 all the way down to less than 12% for the foreseeable future?

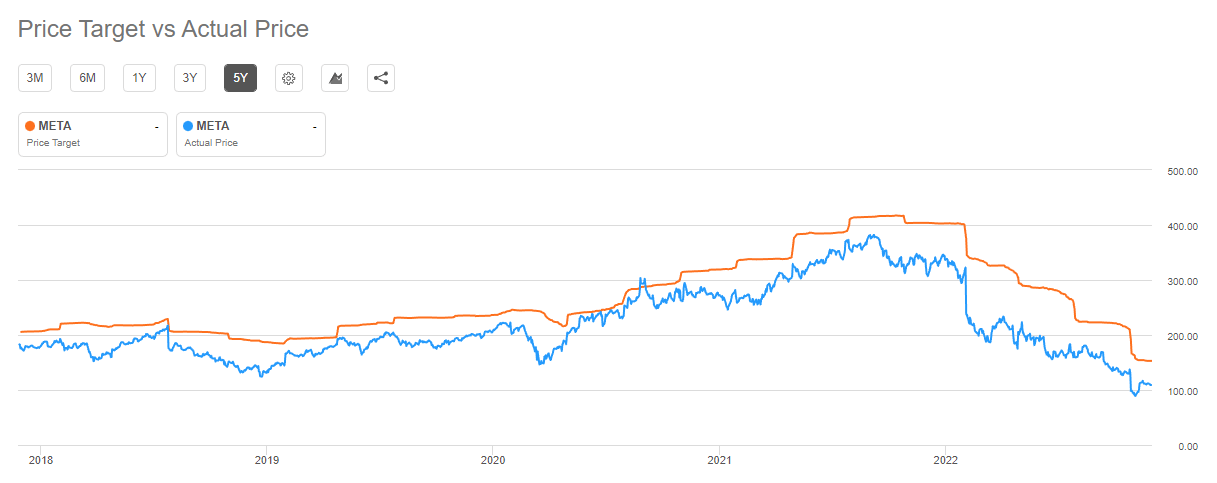

Or are they just tweaking their numbers to get their targets closer to the actual price – as analysts are wont to do?

Seeking Alpha

Well, what would it look like if the company’s revenue growth actually did drop down to those levels they’re estimating? For our valuation modeling purposes, we’ll call this our bear case as it seems rather overly pessimistic.

Valuation

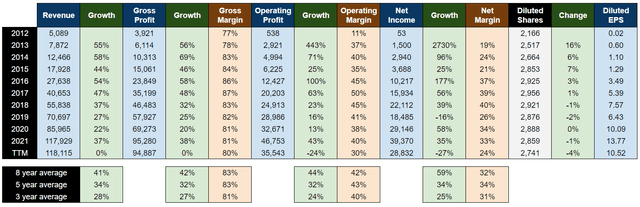

Here is Meta’s historical income statement data:

Author (Table), Seeking Alpha (Data)

Now, there are a lot of reasons for the revenue decline over the trailing 12 months. Back in February, I mentioned the likelihood of further downward pressure on Meta’s ad spend. Meta was not public during the GFC, but advertising budgets took a noticeable hit during that time and took years to recover.

Management provided us with a few other explanations for this lackluster performance. I already mentioned the Reels headwind. Wehner provided another during the latest earnings call:

Had foreign exchange rates remained constant with Q3 of last year, total revenue would have been approximately $1.8 billion higher.

That’s just one of the costs of doing business internationally – you’re going to have some volatility in the exchange rates. The U.S. dollar has been on a relative tear of late; the US Dollar Index (DXY) is up more than 10% YTD. So there’s another 1.8 billion to account for the 1.3 billion dollar drop in revenue compared to this same quarter last year.

Most of the reasons for this revenue decline do not seem lasting. I do, of course, understand and acknowledge the risk of additional short-term pain from prolonged macroeconomic concerns over the next couple of years. But it’s hard for me to come to terms with analysts’ revenue estimations over the medium and long term.

Meta’s revenue growth rate since IPO has ranged from 22% to 58%. The last eight, five, and three years have seen an average growth rate of 41%, 34%, and 28%, respectively. Over the medium term (say, over the next seven or so years), I think Meta realizing an average annual growth rate of 22% (the previous low they hit in 2020) coming out of this recessionary period would be a conservative estimate.

We’ll use that for our base case, but for now let’s channel the despondence of Brett Thill there at the beginning and his analyst ilk as we lean into a rather pessimistic bear case.

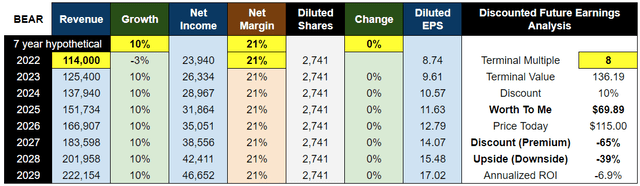

Bear Case

Let’s use the low end analyst estimate here for 2022 full-year revenue of $114B. That will serve as the starting point for our annualized growth over the next seven years. To get from that point to the average analyst revenue estimate for 2025 of $151.42B would require a meager (relative to Meta’s history) 9.9% growth rate.

There are a few more variables we’ll manipulate here for each of our cases – they’re highlighted accordingly – but we’ll dive into the rest later. Here’s that pessimistic bear:

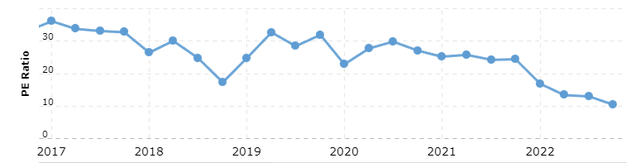

From 2017 through 2021, Meta’s P/E ratio ranged from 17.32 to 36.15 (prior to 2017 it was much higher).

Today that number is around 10. If Meta was only realizing a 10% annualized growth rate (as analysts are estimating), it would surely be awarded a valuation of a much more mature technology company. Thus, the terminal multiple I used of eight.

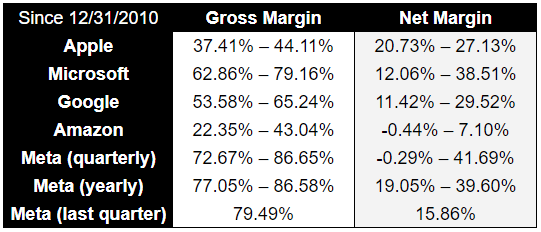

As for the net margins, it might help to put into perspective how much Meta investors have been spoiled by how good their margins have been. Look at how much higher their margins have been compared to other tech giants:

Author (Table), MacroTrends (Data)

Management is dipping into those healthy margins to pursue the initiatives we’ve discussed thus far, but they do at least talk about returning to these or similar levels in the future.

For 2022, in all our scenarios here, I use a 21% margin (the year is almost over and that looks like a safe conservative estimate). For our bear case, I continued to pull that net margin through all seven years -essentially, they keep spending like they have been recently yet nothing really comes to fruition. For context, Meta’s historical average net margin is in the low 30% range.

The company has also been pursuing buybacks. Over the trailing 12 months, for example, the company has reduced its share count by greater than 4%.

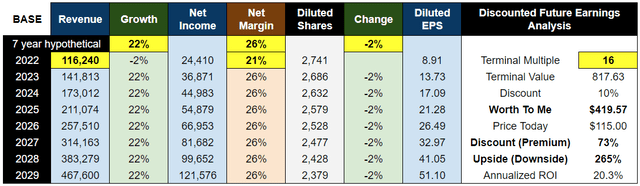

Base Case

For our base case, we can start with the average analyst estimate for 2022 revenue of $116.24B. We’ll use that 22% growth rate mentioned previously, a 26% net profit margin from 2023 on, a terminal value of 16 (still below that pre-2022 historical low, which is fair), and assume a 2% annualized reduction in the number of shares outstanding due to buybacks.

When studying Meta’s history, these numbers seem much more in line with a reasonable expectation – conservative even – for their future growth and profitability.

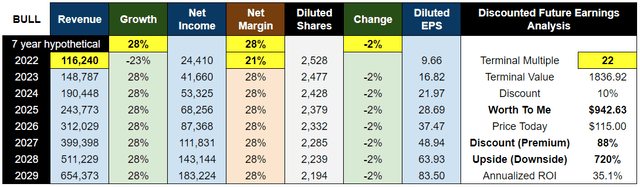

Bull Case

Finally, if the metaverse actually ends up playing out the way management seems to think it will, these bull case numbers will likely be far too conservative. I am not, however, comfortable making pie-in-the-sky estimations on profitability concepts I do not yet fully grasp. I’m not sure they even have a clear idea yet of what exactly that would look like. That’s OK, as they’ve always built first and monetized later. But that reality makes me inclined to not just throw out some random guesses.

I’m fine with being conservative here, too. Honestly, I could see a scenario where the economy recovers more quickly than expected (during yet another period of monetary easing by central banks, for example), which I believe could easily lead to a higher average return over the next seven years than I’m going to use here even without any benefit from the metaverse.

We’ll start with that same $116.24B FY22 annual revenue figure, a 28% growth rate (the same as their last three-year average), a 28% net profit margin from 2023 on (which is still lower than any of their historical averages – three-, five-, or eight-year), and we’ll stick with that same 2% annualized share count reduction (even though they’ve reduced by more than twice that percentage over the trailing 12 months).

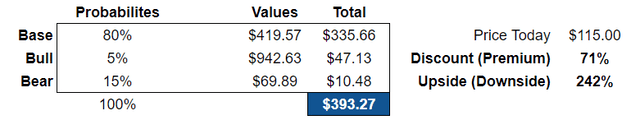

Probability Analysis

I like to work in conservatism wherever I can in my valuations because, well, I’m obviously missing something (or a lot of things, as I’m sure many readers will kindly point out).

So even though I believe both the bull and bear cases to be similarly unlikely, I’d tend to weigh the bear case heavier in a probability analysis.

Maybe this valuation seems high to you, given most analyst expectations. But then again, they’ve all been at this level before. Even Thill agreed with me just a little over a year ago:

Jefferies analyst Brent Thill raised the firm’s price target on Facebook to $400 from $385…

But of course, it wouldn’t behoove a Wall Street analyst to stick out quite so far above the rest, just in case they end up being wrong – which I absolutely might be (I certainly will be about some of it). This is all just a game of probabilities. There are no guarantees. Meta has its risks to be sure.

Risks

Prolonged macroeconomic uncertainty would weigh on all businesses, which of course would lead to continued pressure on corporate marketing budgets. For Meta specifically, this would mean longer-than-estimated (in our models) suppressed revenue growth and potentially, if they didn’t curb spending soon enough, prolonged margin suppression as well.

Management could, of course, not stick to their commitments of bringing margins back up after 2023. That would change the narrative in a potentially meaningful way.

They could also pursue debt more aggressively than they have in the past. Their previously debt-free nature, despite arguably not being “best practice,” was one of the facts in which I took a great deal of comfort. They could spend some of that cash flow on projects I didn’t fully understand or necessarily agree with if they wanted and I wouldn’t have to be too worried. Their relatively new $10B inaugural debt load spread out over the next 40 years is not concerning in and of itself, but it does add another element of future management decisions on which investors should keep a close eye.

Regulatory issues should always be of concern as well with these tech giants.

Conclusion

Meta created the perfect storm for investors by embarking on such an “out there” innovation development project, while also having to deal with one of their toughest competitors yet (TikTok), all while many global macroeconomic concerns came to a head. Accordingly, I expect relative volatility for the stock to remain elevated. But when we dig into the details, I do not believe the concerns spooking investors today will have as significant of a negative impact as analysts are projecting.

For the patient, long-term investor, I believe this stock presents asymmetric upside potential.

Be the first to comment