Lemon_tm

With the Fed decision and the upcoming jobs report, markets are due for another round of volatility. The S&P 500/SPX (SP500), other major averages, and stocks generally are at another critical inflection point. The SPX has had a nice 11% rally off the recent bottom, and the $64,000 question now is, can it keep going higher? The Fed’s 75 basis point benchmark increase is likely priced in. Therefore, we need the Fed to come out with a neutral or mildly dovish statement for the risk asset rally to continue. However, Friday’s jobs report adds an element of uncertainty. We also have a hectic earnings week on top of everything. Nevertheless, if several critical factors align constructively, we could see the SPX breakout into the 4,000-4,200 range.

The Technical Setup is Bullish

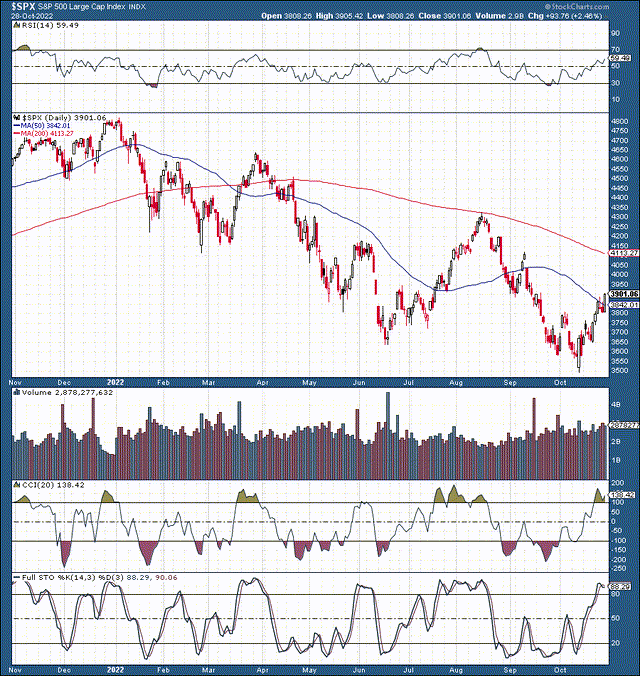

SPX (StockCharts.com )

The technical setup is bullish for the rally to continue in the near term. I mentioned that stocks would be heading higher after the capitulation-style reversal in mid-October. Moreover, we now have a bullish inverse head and shoulders pattern forming with the neckline (breakout point) around the 3,900-3,950 range. Once above this level, the SPX can move into the 4,000-4,200. This advance would represent approximately a 15-20% gain from the recent low of around 3,500. While it will be challenging to sustain the rally above 4,200, we can realize substantial profits in the coming weeks as this countertrend rally may have more room to run.

What’s The Fed’s Move Here?

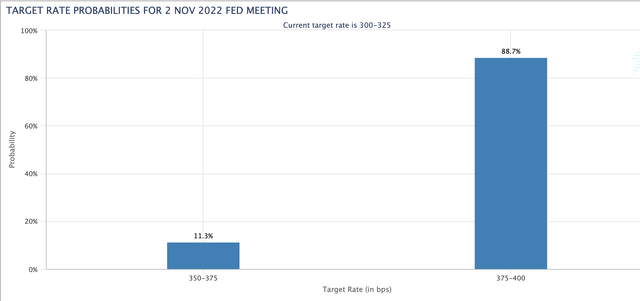

Rate probabilities (CMEGroup.com )

There is almost a 90% probability that we will see another 75 basis point increase in the benchmark rate on November second. This rise will bring the benchmark up to 3.75-4%. While the economy should slow more substantially with high rates, we still see many positive economic readings, implying that a soft landing is still possible. Jerome Powell’s speech will be critical, but the market should react poorly to a hawkish overtone.

However, with the benchmark rate around 4%, how hawkish can the Fed be? There is a 50% probability for just a 25 or 50-basis point move in December. Therefore, once the market gets the expected 75 basis point hike on Wednesday, it may rally due to expectations for reduced future rate increases. The target rate probabilities for December 2023 imply that the market expects the benchmark to be around 4.25-4.75% at the end of next year. This rate increase trajectory leaves the Fed with little room to raise in the coming quarters. We may see another 50 basis point increase, but if the economic slowdown intensifies, the Fed could pivot soon (early to mid-2023).

Economic Indicators Holding Up

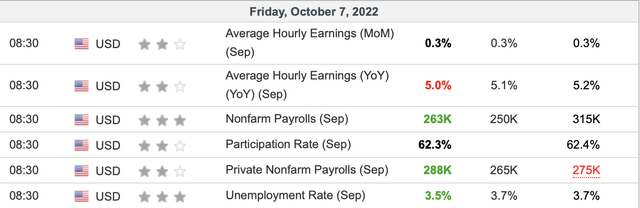

Economic data (Investing.com)

Last month’s jobs report came in better than anticipated. The economy added more jobs than expected, and unemployment dropped to a rock bottom of 3.5%. We also saw more robust than expected retail sales, consumer sentiment, and other relatively strong data. In addition, Q3 QoQ GDP came in at 2.6%, better than the 2.4% forecast figure. Therefore, despite the Fed increasing rates substantially, we do not see significant signs of a deteriorating economy.

The Next Big Test for the Market

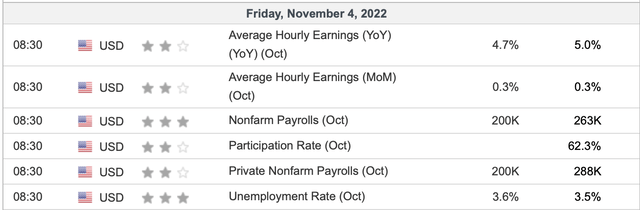

Upcoming jobs report (Investing.com)

The next big test for the market is coming this Friday with October’s Nonfarm Payrolls numbers. The market anticipates that 200,000 new jobs were created in October, and the unemployment rate is expected to tick up to 3.6%. The upcoming jobs report is critical and could make or break the current stock market rally. Ideally, we want to see a number that is in line with or slightly better than the estimate. The goldilocks number would be in the 200-250K range, illustrating a relatively robust labor market despite the Fed’s continued tightening policy. A number above 300K may get an adverse reaction as it would increase probabilities for another 75 basis point move in December. On the other hand, a number too low (below 150K) would imply that the labor market may be starting to deteriorate. While this dynamic may also lead to higher stock prices in the near term, I’d prefer to see continued strength in the jobs market.

More Earnings On Deck

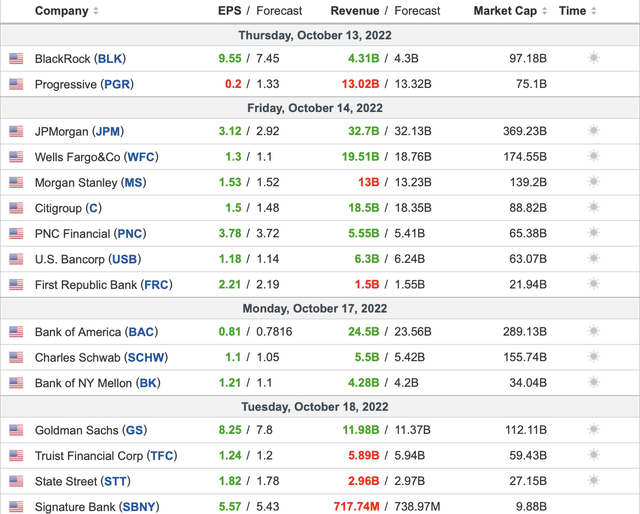

Recent earnings were relatively strong. Early in the season, we saw big banks and other bellwethers report stronger than anticipated results.

Bank earnings (Investing.com )

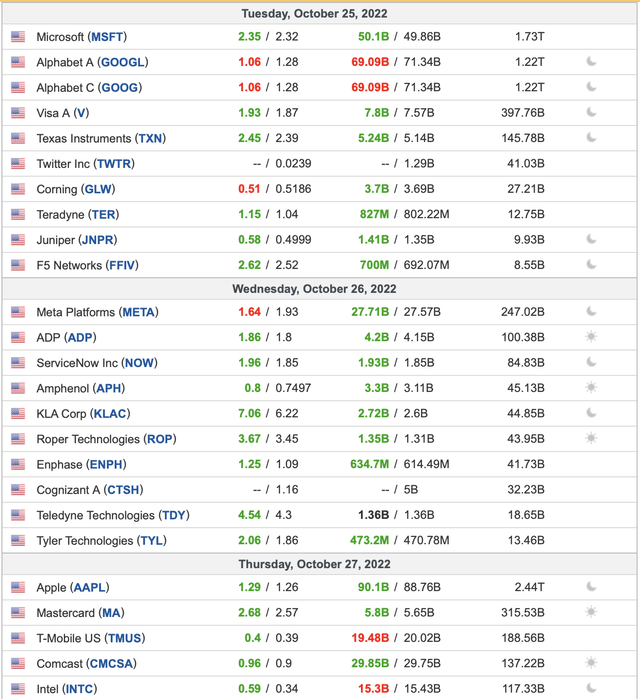

Last week we saw the mega-cap tech companies reporting. Despite several challenging reports, many companies beat top and bottom line estimates.

Tech/other earnings (Investing.com)

Excluding Alphabet (GOOG) (GOOGL), Meta (META), and several other red spots, there’s a lot of green on here. The beat rate remains relatively high among bellwether companies. Therefore, we’re not seeing signs of deteriorating earnings here.

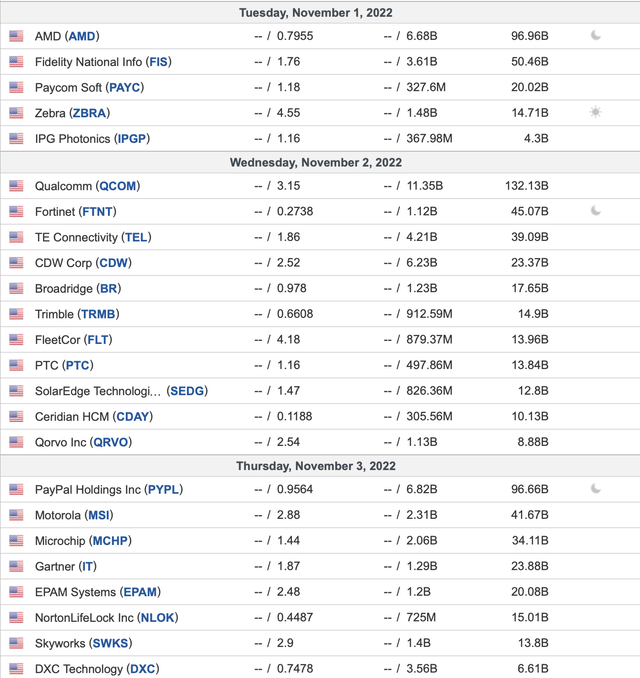

More Tech Earnings This Week

Upcoming tech earnings (Investing.com)

This week I am primarily concerned with tech earnings coming out of Advanced Micro Devices (AMD), Qualcomm (QCOM), and PayPal (PYPL). The bar has been lowered for these companies. Thus, we may see more beats. However, even if we see big misses out of companies like AMD, we can hedge, and most of the significant earnings that had the potential to tank the market have passed.

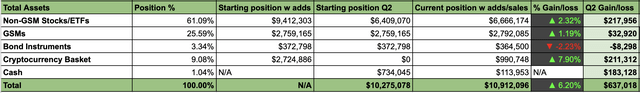

Portfolio Overview

We discussed adding numerous stocks around the recent bottom in mid-October. Some more recent additions to the All-Weather Portfolio include Amazon (AMZN), Meta (META), Mosaic (MOS), Intrepid Potash (IPI), Alibaba (BABA), Baidu (BIDU), Pinduoduo (PDD), and several other companies that went on sale recently. In addition, I’ve increased the cryptocurrency basket to about 9% of portfolio holdings during the recent upswing. Furthermore, I’m implementing a covered call dividend “CCD” strategy and have “Collar Plays” set up on several stocks.

The AWP (The Financial Prophet )

While the AWP is positioned somewhat aggressively for the near-term, many positions are defensive, and some are hedged. Therefore, profits will likely increase as we continue grinding through the bear market. The AWP is up by approximately 6% this quarter. YTD, the AWP has returned 13%, significantly outperforming the S&P 500 and other major market averages.

Be the first to comment