nicomenijes/iStock via Getty Images

Editor’s note: Seeking Alpha is proud to welcome Arpit Sathavara as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

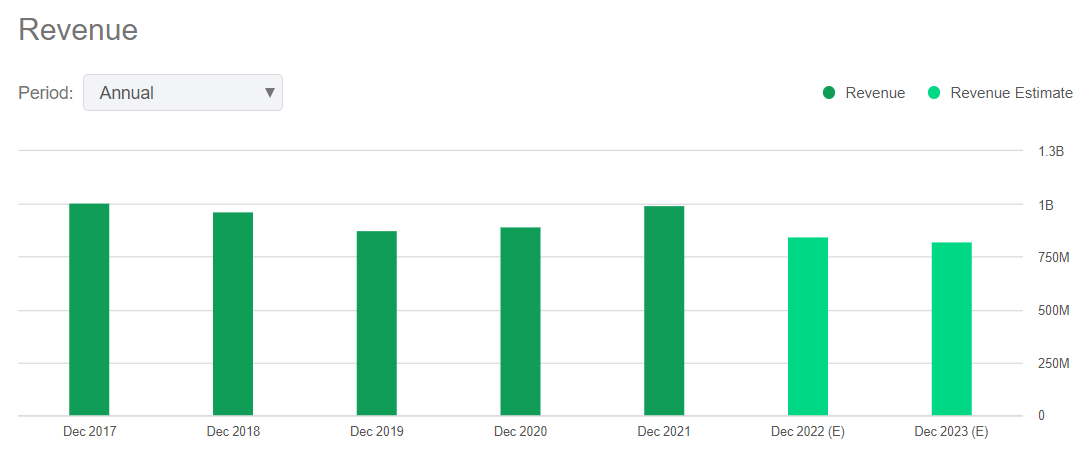

I am assigning an initial hold rating to Donnelley Financial Solutions (NYSE:DFIN). Since its spinoff from R.R. Donnelley in 2016, it has made strategic acquisitions to enhance its software-as-a-service (SaaS) products and software-enabled services. Despite these efforts, the company has struggled to consistently grow its revenue, with a three-year growth rate of 0.5% and a five-year growth rate of -2.1%. However, with a reduction in debt from about $450M in 2017 to $124M as of 2021, and direct costs, Donnelley Financial Solutions has seen a five-year growth rate of 19% in normalized net income as of 2022.

Unfortunately, the slowdown of the economy since Q2 2022 has had a negative impact on the company’s revenue, which saw a decrease of 7.4% in 2022. As economic conditions are expected to remain challenging in 2023, the company’s revenue is projected to fall by an additional 5%. Also, after a continuous reduction in debt for almost six years, it has seen a sharp increase of more than $70M in 2022, with interest rates increasing at unprecedented levels.

Seeking Alpha

DFIN is a leading provider of risk and compliance solutions for companies worldwide. Through its four segments, it offers tech-based platforms, print and distribution services, and turnkey proxy services. These business lines help its clients to manage transactions, meet Securities and Exchange Commission (SEC) requirements, and facilitate investor communications. The company’s solutions help clients manage their compliance and regulatory information efficiently.

Industry Analysis

Although it has undergone some consolidation in the risk and compliance segment, with the availability of alternatives and no heavy barriers to entry the industry is highly competitive in the U.S. Donnelley’s most prominent competitors include Broadridge Financial Solutions (BR), which provides investor communications and technology-driven solutions for the financial services industry, and Workiva (WK), which provides cloud-based compliance and regulatory reporting solutions worldwide. Hence, Donnelley’s most significant competitive strength is its ability to offer a wide range of regulatory communication and compliance services, a global platform, exceptional sales and service, and regulatory expertise. Also, Workiva has been accumulating operating losses since 2017, while Broadridge has head-to-head earnings before interest, tax, depreciation, and amortization (EBITDA) margins – with Donnelley at five-year levels.

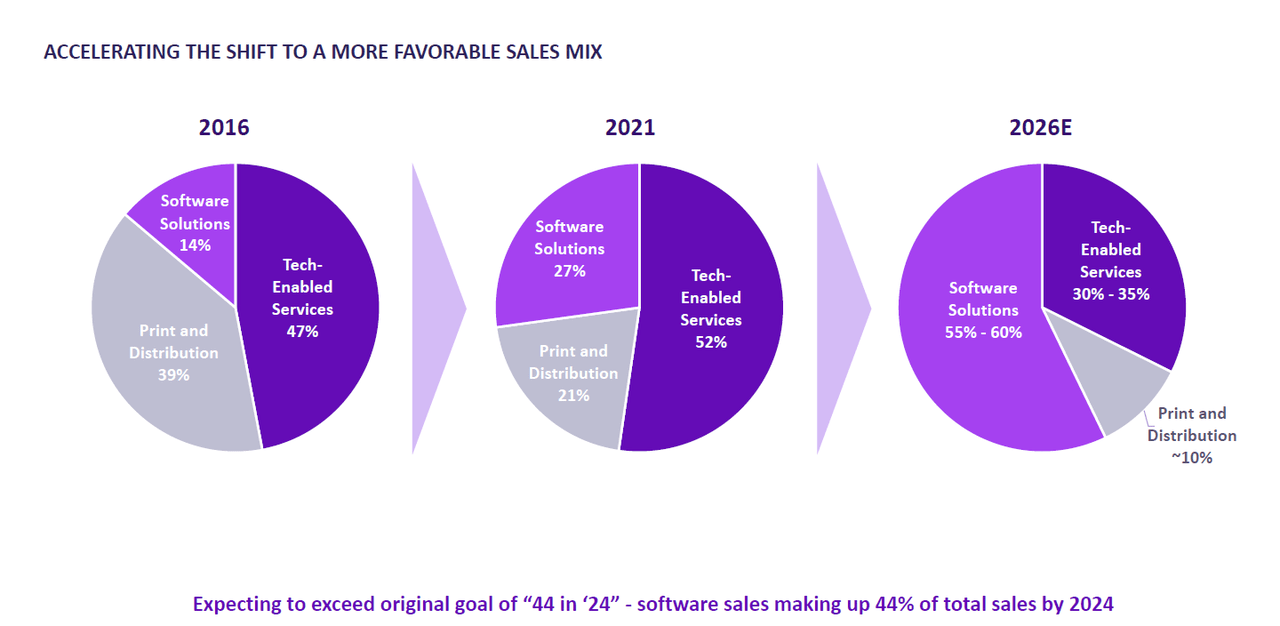

Changing Revenue Mix With Increasing Margins

Donnelley primarily offers three services: tech-enabled services, software solutions, and print distribution. The latter has faced a substantial setback since the SEC ruling on June 5, 2018, which permits certain registered investment companies to electronically deliver stockholder reports and other materials as an alternative to paper copies. Although this might appear to be an adverse development, it can also be seen as a double-edged sword. The gross margins for the print distribution services fall short of 25%, whereas the margins for the other two services surpass 50%. As the sales of print distribution have declined from 39% in 2016 to 21% in 2021, which are expected to be below 10% by 2026, its net margins might turn negative.

Simultaneously, there is an ongoing change in the revenue mix. As such, the loss of sales from print distribution services has been successfully compensated by the tech-enabled and software solutions services, which have and will continue to boost their profit margins. If it weren’t for the ruling, the company might not have aggressively increased its tech and software business.

According to the Q3 2022 earnings call presentation, by 2026 the company is projected to generate yearly revenue exceeding $500 million from its software solutions business, which is currently at $300 million, constituting over 55%-60% of the revenue mix. This appears achievable as the company’s software solutions segment is growing at a 15% compounded annual revenue growth (CAGR), and more resources are being allocated due to the reduction in print distribution services.

Donnelley Financial Solutions Q3 2022 Investor Presentation

As previously mentioned, the sales growth of the company has not picked up. Still, the change in the revenue mix has allowed the company to increase its cash flows and margins, resulting in one of the lowest debt/free cash flow ratios (at 4.7) in the financial exchanges and data industry, thereby fortifying its financial credibility.

Resurfacing Debt and Concerning Cash Flow Levels

As is the norm within the fintech sector, firms tend to forgo disbursing dividends. Nonetheless, in the first quarter of 2022, an announcement was made regarding a $150M share buyback aimed at recompensing the shareholders. Additionally, their trailing 12 months (TTM) accounts receivable increased by $24M despite a decrease in the revenue of $100M, and accounts payable decreased by $20M. This could result in substantial adverse impacts on the company’s cash flow. Projections indicate that there is a likelihood of incurring over $100 million in negative cash flows during the year 2022, thereby reducing the net cash and cash equivalents to below $10 million amid a turbulent economic landscape characterized by unprecedented interest levels that are expected to increase further.

After a downtrend in debt since its inception in 2016, the company broke the trend by raising more than $75M. This will increase their cash outflow by at least $5M, further denting their low cash levels. As per the estimates, the company’s revenues are also expected to fall further by more than 5% during the current fiscal year, which will downplay its target of achieving more than 70% recurring revenue from software solutions and EBITDA of more than 30%.

Valuation and Estimation

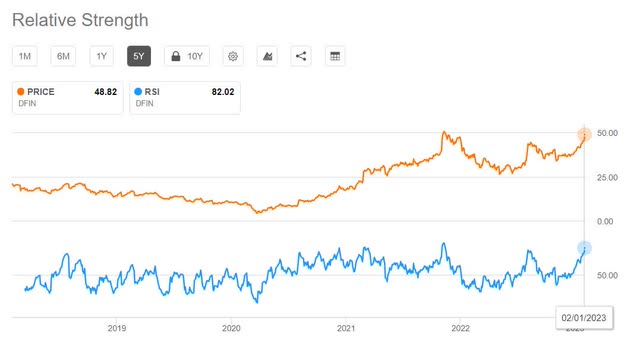

DFIN is presently trading at $48.85, which lies above its 50-day, 100-day, and 200-day simple moving averages (SMAs) and is close to its all-time high value of $50.16. Additionally, the relative strength index (RSI) of DFIN, which measures the stock’s overbought or oversold conditions on a scale of 1 to 100 (an RSI below 30 indicates an undervalued stock, and an RSI above 70 indicates an overvalued stock), stands at 85 as of this writing. This represents the second-highest RSI for Donnelley. In the past, whenever the RSI has crossed the 80 mark, the stock has corrected by a minimum of 10% in the following two to four weeks. While these are trailing technical indicators, they provide useful information regarding the short-term stock price fluctuations of the company.

These indicators notwithstanding, I have made the following assumptions for determining the price of a share of the company:

-

The company has a non-GAAP three-year P/E of 13.0 and a GAAP P/E (FWD) of 14.4. As it is one of the lowest in the industry, where the average is around 18x, I will take a conservative approach at 16x.

-

Considering the company’s estimate of software solution revenue making up at least 50% of the revenue mix and above $500M in revenue, the company is expected to surpass $1B in revenue by 2026. This might not be the most significant jump given the current revenue of approximately $900M, but it will have a bigger impact on net income due to increased margins.

-

The company might not repurchase shares for a few years to maintain the debt levels and a sustainable cash flow. This will keep the number of shares outstanding at the end the same at 29.1M, as per the latest 10-Q.

|

Year |

2026 |

2026 |

2026 |

2026 |

2026 |

2026 |

|

Net Income Margin (On $1000M Revenue) |

16% |

17% |

18% |

19% |

20% |

21% |

|

Net Income (In Million) |

$160 |

$170 |

$180 |

$190 |

$200 |

$210 |

|

EPS @ 29.1M Outstanding Shares |

$5.50 |

$5.84 |

$6.19 |

$6.53 |

$6.87 |

$7.22 |

|

Expected Share Price (At P/E 16x) |

$87.97 |

$93.47 |

$98.97 |

$104.47 |

$109.97 |

$115.46 |

The expected share price scenarios shown above justify the lower EV/sales ratio of 1.84 and lower price/sales ratio of 1.72. Also, it’s notable how technical analysis, which is helpful to evaluate the price fluctuation of the stock in the short term, contrasts with the increasing value of the stock in the medium to long term.

Conclusion

Stock Tracking Opinion

With sales and cash flows being a major concern for the company for 2023 and 2024, it will be interesting to see management’s approach in pushing their tech and software business, along with a reallocation of resources from their depleting print distribution business. Despite facing issues on the top line, the bottom line is showing great resistance. As the stock has beaten the S&P 500 over the past one-, three-, and five-year time frames, I will keep it on my watchlist.

Investment Opinion

Despite the Nasdaq 100 showing its best January performance in four decades, the cloud of skepticism from the broader stock market is not removed completely. I’d like to see a more sustained rally in the broader market and a breakout to new highs in DFIN before placing a buy rating on the shares. As such, my current rating for Donnelley Financial Solutions is hold.

Be the first to comment