MadamLead/iStock via Getty Images

Dominion Energy (NYSE:D) is a $66 billion market cap stock in the Utilities sector. Within the diversified energy utility industry, the company is often a reliable dividend payer without too much volatility. In today’s market, with the VIX currently above 30, investors might seek the relative safety of owning a steady eddy like D. I see risks, however.

For background, Dominion engages in the provision of electricity and natural gas to homes, businesses, and wholesale customers. Its operations also include a regulated interstate natural gas transmission pipeline and underground storage system, according to The Wall Street Journal. The Virginia-based utility serves a growing area of the country from South Carolina northward to its HQ in Virginia.

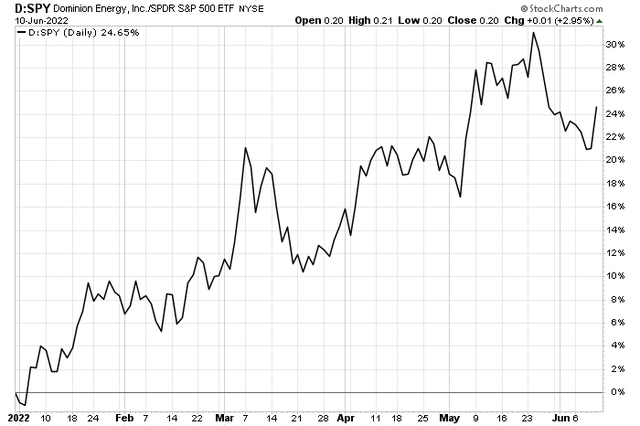

So far this year, the stock is about unchanged when you include dividends. Of course, that beats the pants off the S&P 500 SPDR ETF (SPY). The year-to-date relative chart of D vs SPY is impressive. Short-term momentum traders should consider a hedged trade: long D, short SPY based on the relative trend.

Dominion with Massive Relative Strength in 2022

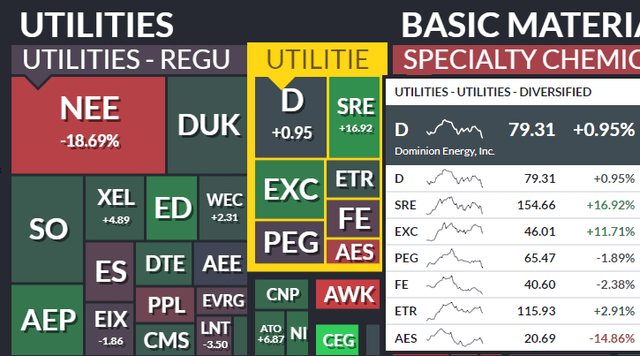

Utilities YTD Performance Heat Map: D +1%

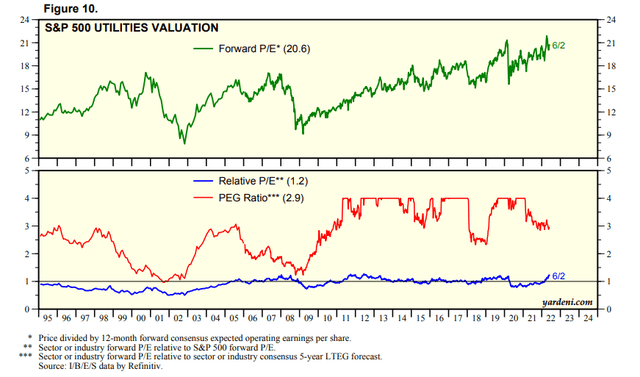

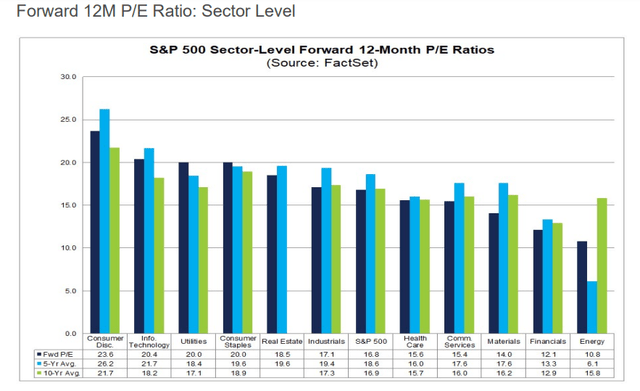

What concerns me, however, is Dominion’s valuation. According to Ed Yardeni’s research, the Utilities sector trades at nosebleed valuations. A forward P/E above 20x is extreme by historical standards. Its PEG ratio is elevated, too.

Utilities: Forward P/E > 20, High PEG Ratio vs History

Moreover, the sector is so expensive, according to FactSet, that its valuation using forward earnings estimates is comparable to Consumer Discretionary and Information Technology’s P/E. That’s pricey for a low-growth sector such as Utilities.

The Utilities Sector Valuation Is On Par with That of the IT Sector

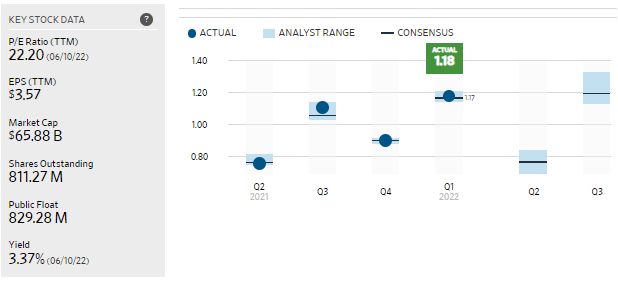

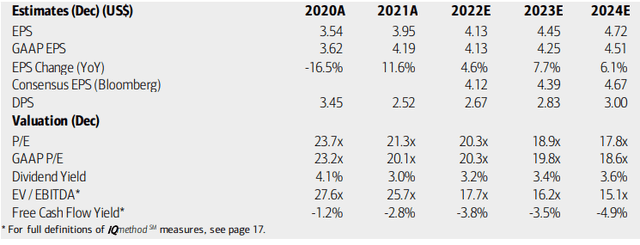

Getting back to Dominion, as you might expect, its recent earnings results have been in-line with forecasts since its operations are rather predictable. While that certainly feels like a warm blanket in today’s chaotic market, slow-growing EPS trends are risky in the long run.

Dominion Energy: High P/E, Solid Yield, Earnings Stability

Wall Street Journal

On valuation, Dominion is expected to sport a P/E ratio in the high teens if EPS increases as analysts at Bank of America expect in the coming years. That’s still too expensive in my book. I would like to see the price-to-earnings ratio drift toward the mid-teens before real value is seen. Also consider its free cash flow yield is negative, according to BofA.

BofA on Valuation: Expensive and Negative FCF Yield

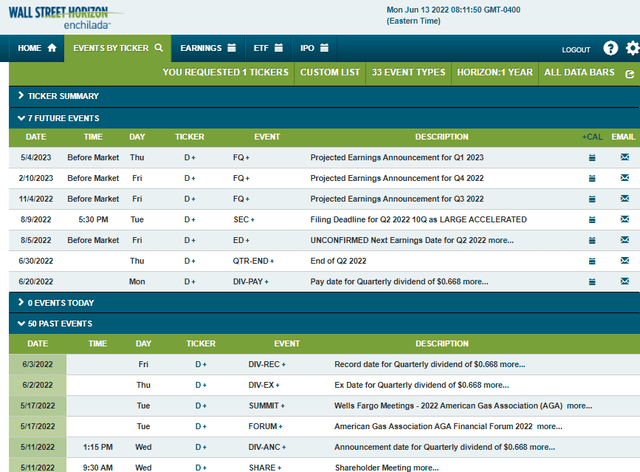

Looking ahead, the corporate event calendar is light according to Wall Street Horizon. The next earnings date is unconfirmed to be BMO on Friday, August 5. Be on the lookout for industry conferences – such as last month’s big American Gas Association event.

Corporate Event Calendar: Quiet Times

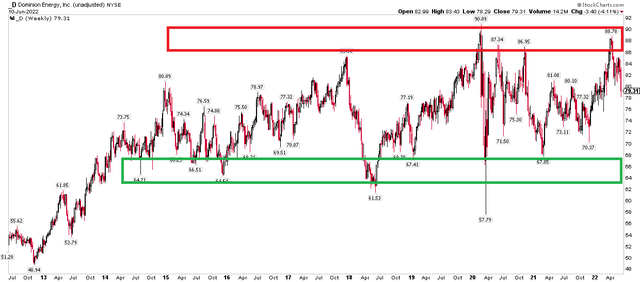

The Technical Take

Dominion’s valuation is high and technical price action is unimpressive. Still, as mentioned earlier, relative strength is huge right now. So, this could be a short-term stock to own, but not one you should be in long term. Resistance is in the upper $80s while solid support doesn’t enter the picture until the mid-upper $60s. We are in no-man’s land here in the high $70s. It’s a buy on both valuation and technical support about 20% lower from here.

A Rangebound Chart: Resistance and Support Zones Drawn

The Bottom Line

Dominion Energy has big-time relative strength this year as the stock market sells off. It’s an ideal spot if you must stay invested short term. Bigger picture, its valuation is high, and the technical chart is unimpressive. I’d avoid this expensive utility stock even with its decent yield.

Be the first to comment