Zach Gibson

On August 8th, the management team at Dominion Energy (NYSE:D) announced financial results covering the second quarter of the company’s 2022 fiscal year. The results provided by management were mixed in nature, with revenue beating expectations and earnings missing. Despite these mixed results, the company remains confident in its long-term trajectory, with earnings forecasted to grow as the company continues investing heavily into growth projects. For the most part, shares of the company do look to be near the cheap end of what similar players are trading for. Though on an absolute basis, I would argue that shares are not exactly cheap. But that’s to be expected in the utility space. The company is unlikely to appeal to very many value-oriented investors. But for those who believe in management’s ability to grow moving forward and who are drawn to the utility space, it could make for a reasonable prospect to consider.

A look at Dominion Energy’s Q2 earnings results

Today, Dominion Energy operates as one of the largest producers and distributors of energy in the US. As of the end of its latest fiscal year, the company had 30.2 GW of electric generating capacity, 10,700 miles of electric transmission lines, 78,000 miles of electric distribution lines, and 95,700 miles of gas distribution mains and related service facilities. The company’s operations span 13 states and service roughly 7 million customers. Over the years, the company has continued to transition into an entity that’s more focused on state-regulated earnings. This has involved a number of transactions, including its various growth investments in regulated infrastructure, its combination with SCANA, the sale of its gas transmission and storage operations, the sale of interests in non-regulated generating facilities and natural gas gathering and processing investments, and more. The company’s ultimate goal is to generate at least 90% of the earnings from its primary operating segments from state-regulated electric and natural gas utility businesses. But of course, such a significant amount of change is not easy and it most certainly is not quick. It’s truly transformative, as the company’s financial data has shown.

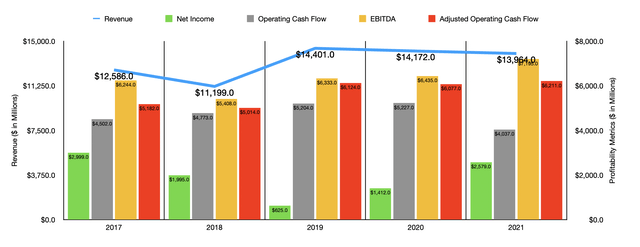

Author – SEC EDGAR Data

The past few years have been rather interesting for Dominion Energy. The company has shown no true trend when it comes to growth. For instance, revenue went from $12.59 billion in 2017 to $11.20 billion one year later. In 2019, sales jumped to $14.40 billion before dipping to $14.17 billion in 2020. Sales fell further in 2021, dropping to $13.96 billion. Volatility like this from year to year is generally associated with corporate instability. But that is not exactly the case here. The fact of the matter is that Dominion Energy is an incredibly large and complex company with many working parts and a lot of activity going on. For instance, from 2020 to 2021, sales were hit to the tune of $402 million because of decreased market prices affecting its Millstone assets. This was offset to some degree by a $390 million increase in fuel costs that were included in utility rates as a result of an increase in commodity costs associated with sales to gas utility customers and electric utility retail customers. But this is only the tip of the iceberg. The company’s annual report lists six major contributors to decreased sales, with eight different contributors that helped to offset this to some degree. Again, some of this volatility can be related to the company’s aforementioned changes.

Although the revenue picture for the company has been all over the place, some profitability metrics have trended higher. But of course, not all of them have. Consider net income. This metric fell from roughly $3 billion in 2017 to $625 million in 2019 before rebounding and eventually climbing to $2.58 billion last year. Operating cash flow, meanwhile, saw a consistent trend, climbing from $4.50 billion in 2017 to $5.23 billion in 2020. In 2021, it ultimately fell to $4.04 billion. If we adjust for changes in working capital, the picture becomes somewhat more volatile. But the overall trend is so positive, with a metric climbing from $5.18 billion to $6.21 billion over the past five years. And finally, EBITDA has trended mostly positive, climbing from $6.24 billion to $7.20 billion over the past five years.

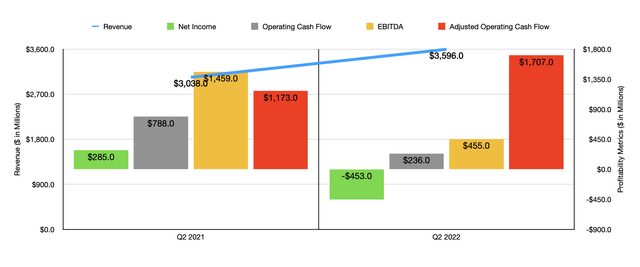

Author – SEC EDGAR Data

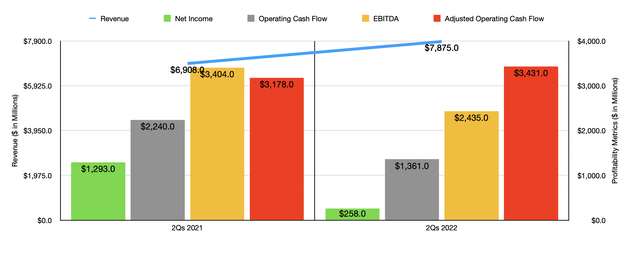

So far for 2022, the picture for the company has been somewhat mixed. Consider the latest quarter. In the second quarter of the year, the company generated revenue of $3.60 billion. In addition to beating the $3.04 billion generated in the second quarter of 2021, it beat analysts’ expectations by $88.53 million. Even though revenue increased, profitability did suffer some. Net income turned from a positive $285 million to a negative $453 million. On a per-share basis, the company generated a loss of $0.58. This missed analysts’ expectations by $1.33 per share. On the other hand, if we use the adjusted figures, earnings would have been $0.77, beating expectations by $0.02. Operating cash flow declined from $788 million to $236 million. But if we adjust for changes in working capital, it would have risen from $1.17 billion to $1.71 billion. Meanwhile, however, EBITDA also fell, dropping from $1.46 billion to $455 million. All of this can be seen in the chart above, while in the chart below you can see data that shows a similar trend for the full first half of the year.

Author – SEC EDGAR Data

When it comes to the 2022 fiscal year as a whole, the only guidance management gave involved earnings per share. They currently expect this to be between $3.95 and $4.25. Using midpoint figures, this would translate to net income of $3.41 billion. We don’t really know what to expect for the rest of the profitability metrics. But if we were to annualize those, we should anticipate adjusted operating cash flow of $6.71 billion and EBITDA of around $5.15 billion.

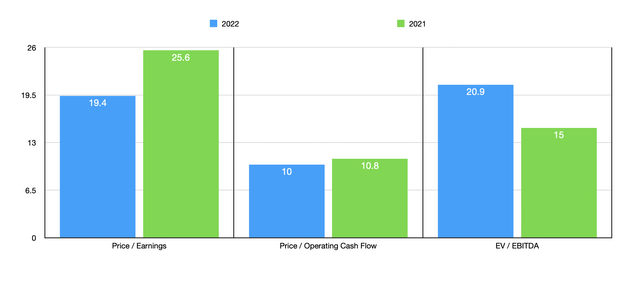

Author – SEC EDGAR Data

Using these figures, we can easily value the company. On a price-to-earnings basis, the firm is trading at a forward multiple of 19.4. That’s down from the 25.6 multiple we get if we use 2021 estimates. The price to adjusted operating cash flow multiple should drop from 10.8 to 10. And the EV to EBITDA multiple should increase from 15 to 20.9. As part of my analysis, I decided to compare the company to five similar firms. On a price-to-earnings basis, the four companies with positive results ranged from a low of 19.3 to a high of 24.1. Using the price to operating cash flow approach, the range was from 7.4 to 31.3. In both cases, only one of the companies was cheaper than Dominion Energy. Using the EV to EBITDA approach, however, Dominion Energy was the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Dominion Energy | 19.4 | 10.0 | 20.9 |

| Sempra (SRE) | 19.3 | 12.8 | 15.9 |

| National Grid (NGG) | N/A | 7.4 | 13.9 |

| Consolidated Edison (ED) | 21.6 | 10.6 | 11.7 |

| WEC Energy Group (WEC) | 24.1 | 12.8 | 15.8 |

| Public Service Enterprise Group (PEG) | 20.2 | 31.3 | 18.3 |

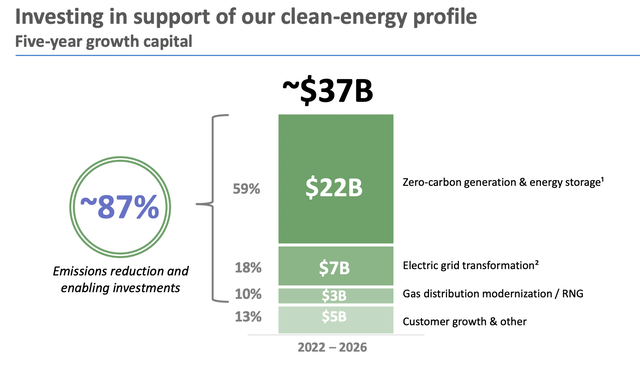

For the most part, Dominion Energy looks to be more or less attractively priced, even though it is at the expensive end of the range when using the EV to EBITDA approach. However, it should get cheaper over time if management can achieve its targets. You see, at present, the company is investing heavily in transforming its business. Between 2022 and 2026, for instance, the business expects to allocate $37 billion to growth capital projects. $22 billion of this will be centered around zero-carbon generation and energy storage activities. The company will spend $7 billion on electric grid transformation, while $3 billion will go toward gas distribution modernization. The remaining $5 billion is expected to go toward customer growth and other projects.

Dominion Energy

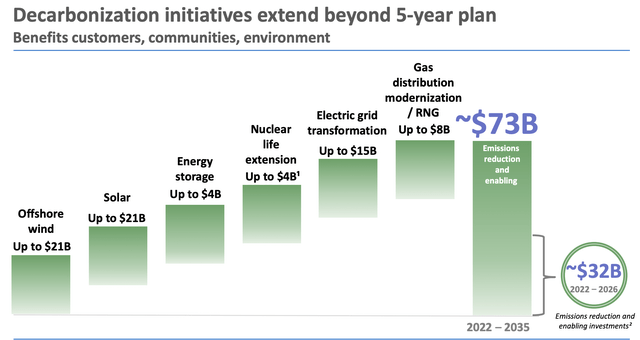

This is only part of the $73 billion the company intends to allocate toward growth spending between 2022 and 2035, with the vast majority being dedicated toward emissions reduction and related activities. Along the way here, management expects to continue growing earnings per share at a rate of about 6.5% per annum. Presumably, operating cash flow and EBITDA should also rise. If this does come to fruition, it could result in some nice upside for investors.

Dominion Energy

Takeaway

All things considered, I think that Dominion Energy offers investors with an interesting set of opportunities. In two out of three ways, shares of the business are cheap relative to similar firms. They are also not all that pricey from an absolute perspective. I wouldn’t call the company a value prospect by any means, but for investors who like utilities, and who believe in management growth initiatives, Dominion Energy is definitely a great candidate to consider.

Be the first to comment