Marc Bruxelle/iStock Editorial via Getty Images

Purpose & Introduction

Dollarama Inc., (TSX:DOL:CA), the largest discount dollar store chain in Canada, reported earnings that met analysts high expectations, as consumers continued to trade down amid a high inflation environment. The company posted strong numbers across the top and bottom lines, and re-iterated their previous guidance on both financial performance and retail growth expansion, highlighting their success throughout 2022. All numbers in CAD unless otherwise noted.

My recent Q1 review on DOL:CA showcased a bull view, and most of the highlighted tailwinds remain intact. With the macro environment likely to remain challenged as inflation remains elevated and supply chain woes drag on, DOL:CA remains well positioned to succeed and I rate them a “Buy” with an $85 price target over an 18-month view, up from $82 previously.

Q2 Review

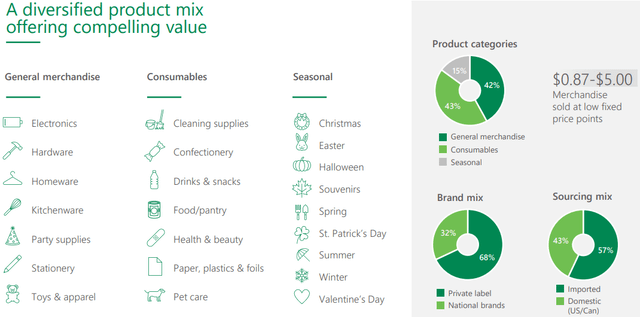

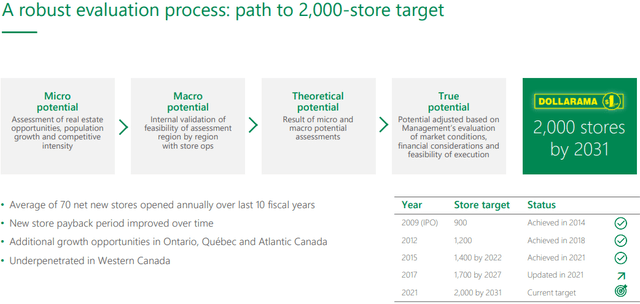

DOL:CA reported $1.2Bn in revenue, sporting impressive sales growth of 18.2%, and an 13.2% increase in comparable store sales growth. Margins held up as well, jumping 0.2% to 43.6%, as consumables continued to grow as a part of the sales mix. EBITDA increased by 25.8% to $369.4MM, which totaled 30.4% of total sales. DOL:CA generated $193.5MM of net income and notched $0.66 earnings per share, far and away besting Q2 2021, which was $0.48. SG&A spend increased just 7.1% to $168.3MM, as the company’s tight cost structure held up even in the high growth period. While inventory was elevated in Q2, executives remained steadfast that in-stock inventory was appropriate and that the mix continues to improve. Dollarcity, the company’s 50.1% owned South American subsidiary, posted $7.7MM in net earnings for DOL:CA, and continues to slowly become a material part of the earnings portfolio. The company also opened 13 net new stores, while Dollarcity opened 19 net new stores. Additionally, DOL:CA bought back almost 4MM of shares, and based on the Q2 results, seem to be chugging along quite well toward their targets.

Executives highlighted some other financial and operating metrics in the conference call in early September. Net debt to EBITA was 2.79X, within the previously announced comfort zone of 2.75x to 3x for adjusted net debt to EBITDA. J.P. Towner, CFO of DOL:CA, noted that the company amended its credit facilities in Q2, increasing the lines from $800MM to $1.5Bn and extending the tranches by another year. He mentioned that this included the company’s U.S. commercial paper program, which jumped from $500MM to $700MM. Not only were these facilities increased, DOL:CA specifically tied the sustainability facilities to two performance targets related to their overall ESG strategy. I still believe that being a leader on ESG targets in a retail industry will improve its image in investors and consumers eyes in the long term. Given management’s confidence in achieving these goals, the ESG angle is a unique offering that distinguishes DOL:CA from its peers.

The company also re-iterated its previous guidance, notably to open 60-70 net new stores this year, to achieve a gross margin between 42.9%-43.9%, to keep SG&A in line between 13.8%-14.3%, and to deploy $160MM-$170MM in CAPEX spend. However, the company upgraded its comparable store sales growth assumption for FY2023 from a range of 4.0%-5.0% to a range of 6.5%-7.5%. DOL:CA noted in the earnings release that the forecast was due to stronger demand for lower-margin consumable products, notably canned food and other small food and drink. Overall, this quarter met expectations. While analysts expected discount retail to outperform given consumers are struggling with soaring inflation, DOL:CA has continued to operate efficiently and grow at a fast pace while keeping margins intact. Management has continued to outline a steady plan to achieve long-term growth, and this Q2 has proven that DOL:CA remains a strong pick as inflation remains elevated.

Model Shows Some Upside

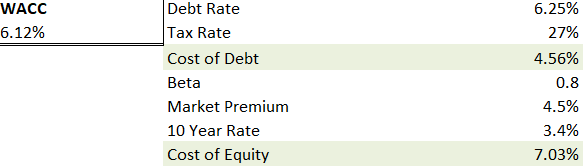

DOL:CA keeps chugging along quietly, and the fundamentals support a lift in share price. While the company’s net cash position dropped given management’s interest on buying back stock, the company has sufficient cash balances and outstanding revolvers to fund current growth plans. The model forecasts a WACC of 6.1%. With rising rates, I anticipate the cost of debt rising should DOL:CA attempt to leverage in this environment, even with their previous fixed rate debt rates between 1.5%-3.6%.

Author WACC

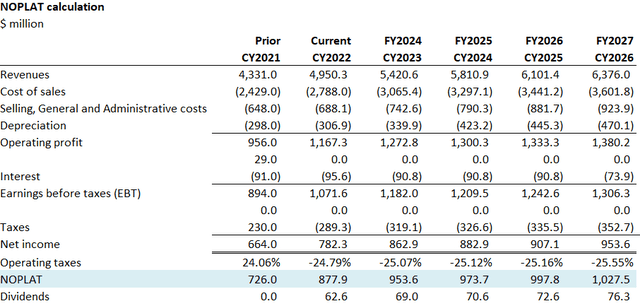

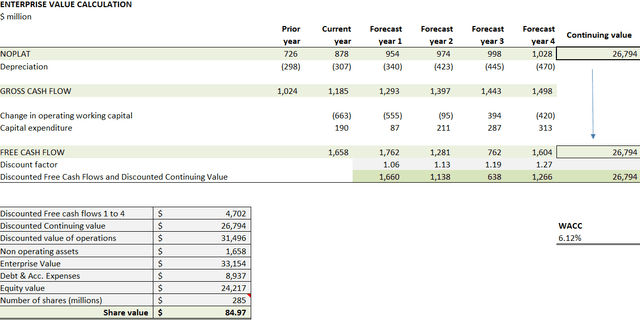

I forecast the continuing value of $26.8B, given a 14% revenue increase this year and blended revenue growth of ~6.5% for three years as same store sales growth continues to impress. I see the margins ending up near the top of guidance, at 43.7%, for the year. I hold other cost ratios mostly equal to guidance, as it was conservative given the strong Q1 numbers. Given an estimate on share repurchases, an $85 share price (see below) can be supported with fundamentals. The share price is supported by a 28 P/E ratio on EPS of $3.03 in CY2023 and showcases a 20.5 CY2023 EV/EBITDA ratio, in line with industry peers and analyst estimates. In today’s price target, I estimate shares outstanding of 285MM, down from 290MM, given DOL bought back 3.7MM shares last quarter, and continue to highlight this initiative as a focus.

Author Revenue Forecasts Author EV Calculation

Conclusion

DOL:CA remains the undisputed leader in discount retail within Canada and should benefit from high inflation as consumers trade down in consumables. The company sports robust operations and continues to improve its standing in South America through Dollarcity. While fairly valued, I think DOL:CA is worth a cautious buy, with a price forecast of $85 CAD over an 18-month term.

Be the first to comment