cagkansayin/iStock via Getty Images

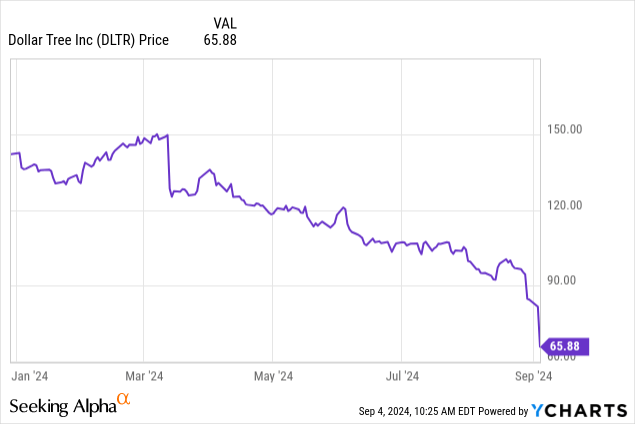

Dollar Tree, Inc. (NASDAQ:DLTR) stock became expensive again earlier this year after a great run with the market. But over the last few months a correction has emerged, and the stock is down some 50% plus.

The stock has been crushed. This is pretty brutal. But is it really as dire as the market is suggesting? While it is always tough to try and catch a falling knife, we see it as a lucrative but still speculative buy. The company is facing some short-term issues, but we think a trade can work here as the stock is correcting following the just-reported Q2 earnings. Make no mistake, retail is tough, especially if the consumer is weakening, or we do approach a recession, but in both cases, Dollar Tree should do well as shoppers trade down to save money, even if there are near-term issues.

Discussion

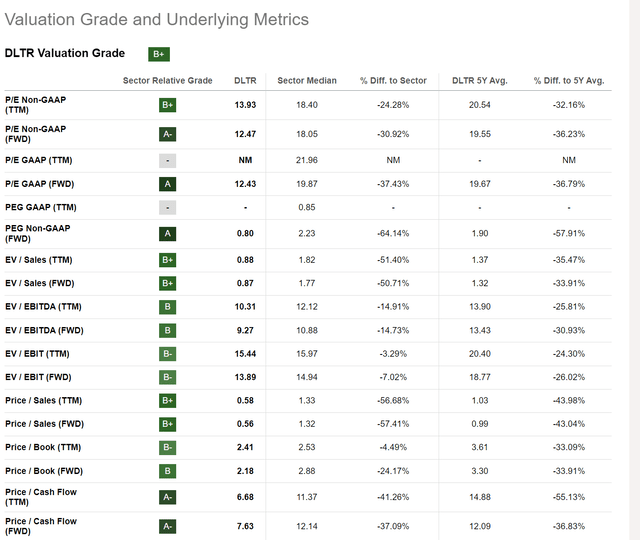

This drop is warranted on the double miss and a bit of a disappointing guide. The reality is that valuation has now completely reset from being overvalued to fairly if not undervalued. Take a look at the valuation here:

Seeking Alpha DLTR Valuation Page

With the selloff today, these valuation figures are improving further, and valuation is now really attractive, but it comes with pain on the growth front. Dollar Tree, Inc. stock is now “cheap,” at $65 a share. This is an attractive place to start entry in our opinion. The stock is getting hammered. But core lower income customers are feeling the pressure. Macro pressures are having a buying impact on these customers. This comes despite a strong transformation in the last few years.

One of the significant changes at Dollar Tree was across-the-board price hikes, and now some stores have even more expensive items being offered. Then, the company worked through a difficult inventory situation and has also undertaken renovations of thousands of Family Dollar stores.

So what about the sales? They missed estimates. Sales increased 0.7% to $7.38 billion versus last year. This comes as same-store sales increased 0.7% as well. We always consider comparable same-store sales as a key figure. With comparable sales positive, we have a good sign. Sales were led by Dollar Tree branded store, where same-store sales were up 1.3%. This was due to a 1.4% increase in traffic, yet was offset by a 0.1% decline in average ticket price. Family Dollar’s -0.1% same-store sales decline was due to a 0.7% increase in traffic along with a 0.8% decrease in average ticket price.

Now, despite the sales pressure, we liked the fact that gross profit increased 3.7% to $2.21 billion and gross margin expanded 80 basis points to 30.0%. This was a result of much lower freight costs, and higher allowances. However, this was partially offset by increased sales of higher cost consumable merchandise. There also were higher occupancy costs in the Dollar Tree segment resulting from the loss of leverage from the low single-digit comparable store net sales increase, and higher distribution costs in the Family Dollar segment. And believe it or not, but theft is an issue even in these low dollar stores, as there is a nationwide elevated shrink issue, that also impacts gross profit.

As for operating income, we saw some pain on operating income due to liability claims. On an adjusted basis, adjusted operating income decreased 24.2% to $218.1 million and adjusted operating margin declined 90 basis points to 3.0%. Net income was $132.4 million and earnings per share were $0.62. On an adjusted basis, adjusted net income was $143.4 million and adjusted diluted EPS was $0.67, a strong miss against estimates of $0.37. This is leading to today’s selloff along with the adjusted guidance, which came off as disappointing. The company now sees net sales for full-year fiscal 2024 to be $30.6 billion to $30.9 billion. This compares to a sales outlook of $31.0 billion to $32.0 billion to start the year.

That is painful. This view comes from expectations of roughly low single-digit comparable store sales increase for the year. EPS was guided at $5.20 to $5.60. This is way down from the $6.70 to $7.30 for 2024 seen at the start of the year versus $7.07 estimated.

So, this is why shares are getting crushed. You have a 23% reduction in expected EPS for the year. In turn, shares are down over 50% in this time. This may be a bit of an overreaction, frankly. We view the low $60s as a speculative buying opportunity for a bet on a turnaround. There is still some fallout from a tornado that damaged a distribution center earlier this year.

The company is also in the midst of a strategic review and a portfolio optimization review, which could lead to numerous store closings. As a result of the portfolio optimization review, management identified approximately 970 underperforming Family Dollar stores. As of August 3, 2024, Dollar Tree has closed approximately 655 stores identified under the portfolio optimization review and the company expects to close an additional 45 during the remainder of fiscal 2024.

As we look ahead, this is a time to consider a contrarian buy in Dollar Tree, Inc. stock now. The company is transitioning. It is painful right now, but you have to buy when everyone is fearful for your potential profit.

Be the first to comment