acprints/E+ via Getty Images

Underperformance Since 2021 IPO

Dole IPO’d in July 2021 at $16 per share. Still then there’s been a general pattern of steady price declines caused by elevated freight costs, product recalls, currency movements and perhaps some distrust of the pro forma numbers of the combined Dole and Total Produce merger which completed with the IPO. However, with Q3 2022 results that may be changing and the business is starting to show its potential.

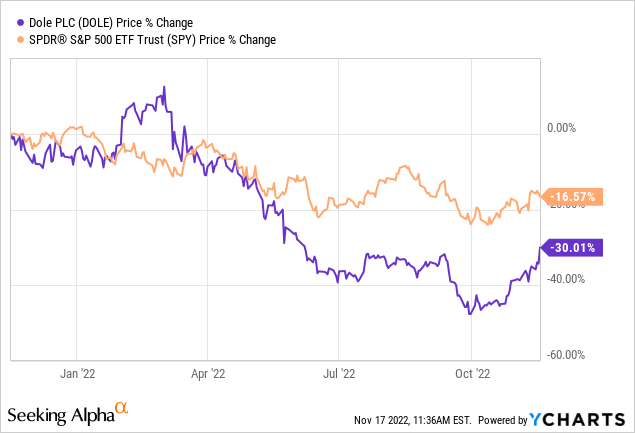

The below chart shows Dole (purple) relative to the S&P 500 (orange) in percentage performance terms. Clearly the company IPO’d into a bear market, but it has still underperformed the broader market, a trend that may have turned in recent weeks. Reasonable Q3 results perhaps explain why the market is becoming a little more optimistic.

Valuation

Dole is now an inexpensive business. Here are the rough numbers, with approximate high and low watermarks for performance and a more conservative (10x) and aggressive (15x) multiple. This helps explain why I am optimistic on Dole given the potential for shares to trade at closer to $30 than today’s price of a little under $10. However, it also shows the bear case where the company struggles to generate cashflow given its high debt-load and capital intensity. There is a high degree of operational and financial leverage at Dole. That cuts both ways.

| High/Bullish | Low/Bearish | |

| EBITDA (current guidance is $330M-$350M) | $400M | $300M |

| Interest expense (4x $18M interest Q3 ’22) | $68M | $68M |

| Capex (bullish is 2022, bearish is 2021) | $90M | $190M |

| Tax (25% tax rate) | $60M | $10M |

| Equity FCF | $188M | $38M |

| FCF multiple | 15x | 10x |

| Resulting valuation per share (diluted) | $28.69 | $3.32 |

Drivers of Valuation

I think there’s a pretty clear bridge from 2022 EBITDA of around $330M at the low-end of guidance to a stronger 2023. Here’s how that might play out:

| 2022 EBITDA (low end) | $330M |

| Improved banana pricing | +$50M |

| Fresh vegetables break-even | +$30M |

| Resulting 2023 EBITDA (est.) | $410M |

Of course, there are lot of moving parts to Dole’s business given its diversity across geography and products. But I’d like to highlight the two key variables above.

Banana Pricing

Here is global banana pricing from the International Monetary Fund. You will notice that it’s up over 50% year-on-year. This is benefiting Dole and its not unreasonable to think that the trend can continue, though management has referred to the global banana market currently as “unprecedented”.

Improvements In Fresh Vegetables

So far in 2022, the fresh vegetables segment has lost almost $30M. In 2021 it basically broke-even. I don’t know that this is a great business, but just assuming that they cease to lose money on it creates a material EBITDA boost.

Other Risks

The simple valuation framework above, also highlights two other risks to the business. These are high leverage and capital intensity.

Leverage

Dole has roughly $1.1B of net debt. They are currently over their 3x leverage target due to weaker EBITDA. In their most recent 20-F they said the following. “Excluding the impact of hedging instruments, Dole plc estimates that a 1% increase in interest rates would result in a negative impact of $13.3 million on the results of our operations.” This does create risk and I have interest payments running at a higher rate going forward than management’s guidance of $60M for 2022. The impact of the sharp rise in rates in 2022 may have been softened for Dole due to hedging. The company has $72M of interest rate swaps on the balance sheet currently, this suggests that interest rates are going higher for Dole, but are being held down by hedging currently. It’s unclear how long that benefit will last. Still, with $1.1B of net debt and $68M of estimated interest cost that’s an effective interest rate of 6.1% so Dole’s current interest rates aren’t completely out of line with the market.

Capex

Related to the high leverage, Dole is a capital-intensive business as they own ships, warehouses and farms. These are expensive to maintain. Given the recent merger with Total Produce normalized capex is hard to pin down. Depreciation is running at around $130M on an annualized basis. Capex is a expected to come in a little under that at around $90M for 2022, but it is unclear how sustainable that is.

Conclusion

Dole appears an inexpensive business set to benefit from positive trends in banana pricing, and simply losing less money in the fresh vegetable segment.

However, $1.1B of floating rate net debt and potentially high levels of capex should be closely monitored. These could mean that expected improvements in EBITDA in 2023, should they occur, would not completely drop down as cashflow for shareholders.

Still Dole appears attractively valued at current levels. The timing of the IPO was unfortunate, and positive medium-term performance could cause the shares to re-rate considerably as 2023 progresses.

Given the costs of interest expense and capex, Dole equity holders are exposed during periods of poor business performance, but it seems 2022 may represent a relative low for EBITDA and in 2023 the business should re-rate.

Be the first to comment