The best photo for all

Investment Thesis

DocuSign’s (NASDAQ:DOCU) Q2 2023 earnings were always going to set off fireworks, one way or another. But perhaps we should not have been too surprised to see the stock pop post-earnings.

Particularly given that in the past several days countless stocks have reported very much middle-of-the-road guidances, and their stocks have been rewarded. Specifically, stocks that are down +75% from their highs.

Does this mean that this is now the new bottom for DOCU?

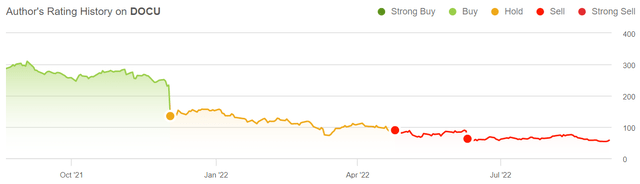

Altogether, I believe that there’s more to like here than not to like, so I’m asserting a hold rating on the name.

I no longer see the value in keeping my sell rating on this name.

This means that it could make sense for investors with a very diversified portfolio. But for investors that are running a more selective portfolio, you could probably look elsewhere.

DocuSign’s Revenue Growth Rates Fizzled Out

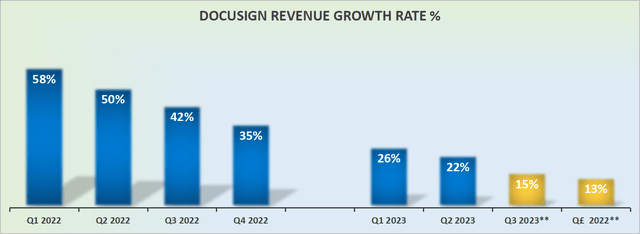

As you can see above, DocuSign’s revenue growth rates have been coming down and down.

Despite the slightly easier comparisons between Q1 and Q2 with the same periods in the prior year, DocuSign’s ability to report consistent revenue growth rates has been decelerating.

Furthermore, looking ahead to Q3 2023, even if we allow for DocuSign to be guiding low so that it ultimately beats the high end of its Q3 guidance by 200 to 300 basis points, the fact remains that DocuSign cannot be relied upon to deliver premium growth, meaning consistent growth above 20% CAGR.

What’s Next For DocuSign?

DocuSign is an e-signature leader.

While there’s plenty of competition in this space right now, there’s also a $50 billion TAM as more and more enterprises look to automation to keep improve efficiencies and traceability in their workflow.

Accordingly, DocuSign presently only reaches mid-single digits market share of this global opportunity.

What’s more, with the stock moving in only one direction this past year, DocuSign’s Board Chair stated on the call that ”DocuSign cannot be successful without strong shareholder support” and that the Board ”got the message”, that change is required.

So there’s a culmination of factors really at play right now, as investors see a business that is in internal turmoil, but at the same time, someway somehow DocuSign still managed to deliver above consensus revenue growth in the quarter.

Profits Leave Much to be Desired

A lot of investors extoll the fact that DocuSign’s business model carries high non-gross margins of 82%. And while that’s certainly great, the fact remains that its Q2 2023 GAAP margin moved in the wrong direction from negative 4% in the prior year to negative 7% in the recent quarter.

Meanwhile, as investors endure larger bottom-line losses, stock-based compensation increases by over 40% y/y. This strikes me as absurd.

Why should stock-based compensation increase so significantly when it’s outpacing revenue growth which was only up 22% y/y?

DOCU Stock Valuation – 5x Sales

As you can imply from my commentary, I’m not hugely bullish on this name. Yet I recognize that the stock has obviously popped after hours and is up more than 18% premarket. Why?

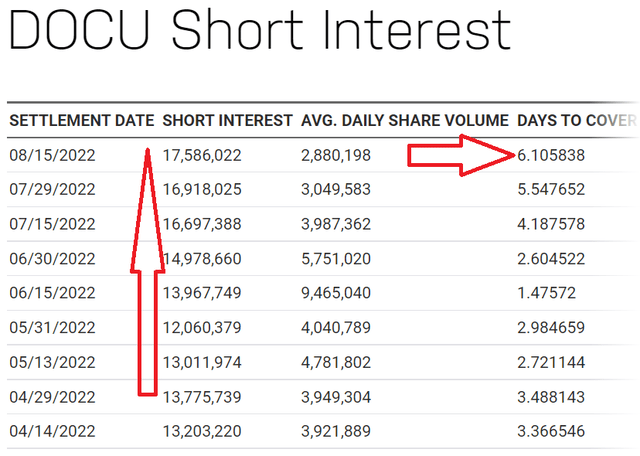

We need to look no further than the perspective that going into the print short interest had picked up. This meant that the days to cover ratio had more than doubled in the past 2 months.

Essentially, shorts were making a call on this earnings result, the trade got too crowded, and now there’s a short covering reaction.

In fact, consider this. If we were to assume that in fiscal 2024 (starting February 2023) DocuSign could grow at 15% CAGR, that would put next year’s revenues at $2.9 billion.

That means that DocuSign is being priced at 5x next year’s sales.

Even if I recognize that this is a much lower multiple than it traded at last year, it is still the case that stocks that are no longer reporting premium growth, cannot be expected to carry to premium multiple on their stock.

The Bottom Line

DocuSign has seen its multiple fully compress even though the company continues to hum along. This is where the bull case lies.

On the other side of the equation, we have a business that is reporting a positive free cash flow of $105 million, but that is only after adding back $141 million of stock-based compensation.

On the other hand, there’s no question that the stock is already down +70% in the past year. And even without allowing for price anchoring biases, we have to admit that there’s clearly a lot of negativity being priced in.

Indeed, as I highlighted already, the short interest in this name had picked up significantly going into the earnings report.

In summary, I believe that for investors with a widely diversified portfolio, DocuSign makes sense. But for investors that are more selective with a more concentrated portfolio, there are better opportunities available elsewhere. So I’m upgrading this stock to a hold.

Be the first to comment