Andrii Yalanskyi

In investing, there’s no limit to how high a stock can go. Worst case, a stock can go off the board (i.e., to zero), and you’ll lose what you put in. But best case, a stock can go up 2x, 5x, 10x or more, delivering massive gains to the long-term investor.

This wide range of outcomes is the exact reason for diversifying. Diversification can provide long-term benefits by reducing overexposure to any one particular asset. Yes, splitting up your holdings into dozens of smaller investments will make big gains less likely, but it will also reduce your likelihood of significant losses.

This is a welcome tradeoff as long-term growth that compounds over time is the ultimate goal – and a more reliable way to achieve your objectives. You can see the benefits looking back at history, not only across specific stocks, but even large asset classes.

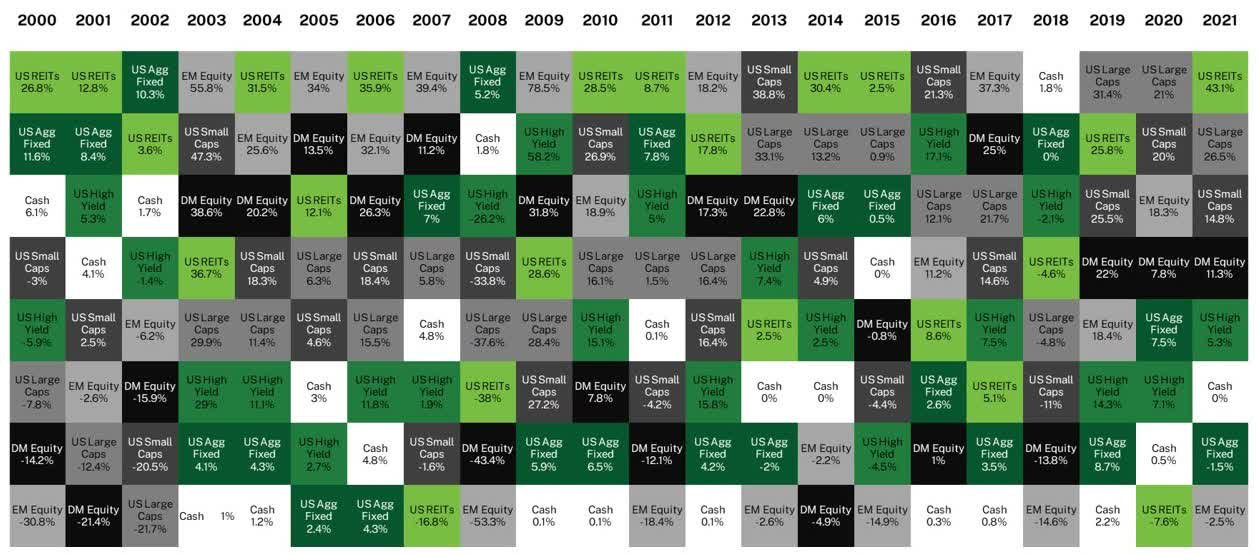

Looking back since the year 2000, below, we visualized the annual returns of eight of the broadest financial market asset classes. The results jump off the page. Which is to say, the winners became losers, and the losers became winners, and back again, seemingly at random, from each year to the next.

The Quilt of Financial Market Returns

Source: Bloomberg (12/2000 – 12/2021).

Less Volatility, Better Results

The benefits of diversification go beyond simply minimizing your risk to any single position. A well-balanced portfolio across various uncorrelated asset classes can provide a few other benefits.

When building portfolios, it is optimal to have assets that are different, or in investment speak, uncorrelated. This means that when one rises, the other is likely to falls. Traditionally, stocks and bonds are uncorrelated, which is why they are viewed as the foundational building blocks of portfolios. When stocks fall, bonds usually rise. This stabilizes your portfolio, helping it be more resilient in down markets.

In addition, more stable portfolios deliver better returns than more volatile portfolios (aka volatility drag), and it’s not a hunch or a theory, it’s simple math. If a portfolio goes up 8% in one year and 8% the next, versus down 2% and up 18%—note they both add to 16% total—the more stable portfolio will deliver better results (see below visual). The return difference of $100 amounts to a full 1% of the original $10,000 investment, and it does so after just two years! Adding extra percentage points of return on top of the long-term power of compounding can make a sizeable performance difference over time.

|

Stable |

Volatile |

|

|

Year 0 |

$10,000 |

$10,000 |

|

Returns |

8% |

-2% |

|

Year 1 |

$10,800 |

$9,800 |

|

Returns |

8% |

18% |

|

Year 2 |

$11,664 |

$11,564 |

For illustrative purposes only. Analysis: Manning & Napier.

Conclusion

Everyone knows someone who ‘hit it big’ on an investment. But for every person talking about their big winner, there’s dozens more who put too much into one investment with a much worse result. While it may seem like the grass is always greener on the other side, putting all your eggs in one basket does more harm than good. If you ever feel like you’re on the wrong path – stay patient, stay the course, and talk with your financial consultant about stress testing your plan to see your options.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment