Disneyland Paris aureliefrance

Overview

Bob Iger’s return as CEO of Disney (NYSE:DIS) has many positive overtones. His record as CEO for 15 years has generally been good, especially on the early acquisition of Pixar, Marvel, and Lucasfilm (Star Wars franchise). However, it seems that he overpaid for Twentieth Century Fox entertainment assets. Rupert Murdoch, to make a pun, outfoxed him and was prescient in seeing that Fox could not gain sufficient scale in streaming or films and had a chance to become a major shareholder of a better growth vehicle in Disney shares.

Iger has also proven compatible with the creative community, who clearly welcome his return.

However, Disney is different now than it was five years ago, when the only thing needed to propel the share price higher was to show growth in streaming subscribers – to hell with showing any profits for the next couple of years. The streaming strategy was early and smart as compared to numerous competitors. But in retrospect, the even smarter strategy would have been to forget the Fox acquisition and instead to buy Netflix (NFLX). The biggest mistake of course was to anoint his successor, even after years of trying to find one steeped in the traditions and cultures and appeal of the company’s products and services to middle-income families.

Bob Chapek’s time as CEO was marked by many challenges that began with the pandemic shutting down most of Disney’s global businesses that included theme parks, cinemas, and cruise ships. At the time, I’d estimated that the company was losing $30 million a day.

However, soon after in late 2020, the company began to falter, in my opinion. It became a woke-driven company that seemed to forget that its history, traditions, underlying culture, and operating structure were intended to appeal to the core base of middle-income families.

In other areas, such as content distribution, Chapek approved a major reorganization that upset relations with creative talent. It will be a massive challenge for Iger to undo/fix this. In the process, much creative energy will be wasted as managers are reassigned and/or leave. This is the same situation faced by the AT&T/Warner (T) and then Warner Bros. Discovery (WBD) deals. Organizational stability will probably not soon be restored.

Changes in the lucrative cable network sides will also pressure earnings growth. The partial Hulu acquisition can be considered a good deal, but there will be intense negotiations in 2024 to buy the remaining shares from Comcast (CMCSA). Meanwhile, cord-cutting will continue to sap the high-margin profits of the cable networks as the transition to streaming is still largely a drain on cash flow. ESPN may eventually be spun off, and the linear ABC might also be headed for the same fate. Private equity companies are likely to be the buyers.

As for the parks, the company has alienated customers by raising admission prices to record heights. Maybe this works to raise profitability in an economic boom, but this was instead recently implemented in the face of a recession and major inflation worries for most middle-income families who would find the high prices of travel and attendance prohibitive.

Moreover, the company’s parks in Hong Kong and Shanghai, though thoughtfully designed and vetted, are such that Disney is beholden to and dependent on the goodwill of the Chinese Communist dictatorship. In other words, Disney does not have a range of freedom to do over there what needs to be done in films, tv shows, parks, and even merchandise.

Conclusion

From all this, it is difficult to see how Mr. Iger can navigate in two years through these challenges and also to finally designate a worthy successor, which the board has mandated.

To an extent, Mr. Iger’s previous stint as CEO was aided and abetted by near-zero interest rates and much lower debt levels: The wind was at his back in doing mergers, raising cable network fees and park prices, and growing streaming subscriptions.

This favorable environment no longer exists.

Mr. Iger has the ability and power to fix some of the current disorders but he can’t perform miracles. The debt level is relatively high ($45 billion in borrowings and $13 billion for other long-term liabilities). Commitments to future streaming production and sports rights payments may add more to the total debt and will likely make for a lower P/E multiple on earnings. In this respect, it should be noted that free cash flow for FY2022 fell to $1.059 billion from $1.988 billion the year before.

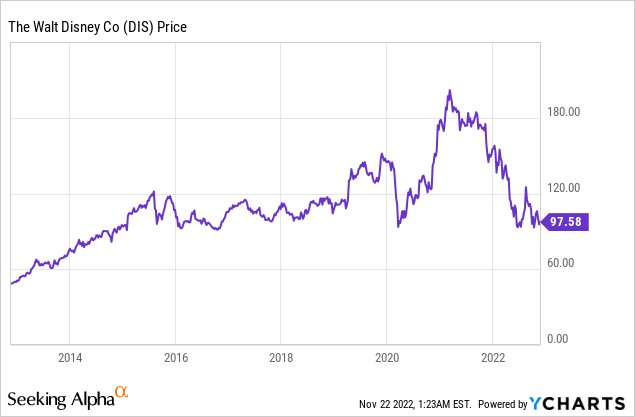

Another point that is not often recalled is that at the start of the streaming business in 2018, the bull market boosted Disney shares to record highs approaching $200. But if you look back, as shown on the chart below, Disney shares are now at the same price they were at in 2015! Optimists would say this makes the shares a bargain. Yet it will now be much more difficult to grow, and the P/E multiple will not likely soon expand given the probable deteriorating economic background over the next two years.

The outlook for Disney shares and for the market (see The Market Has No Business Hanging Around S&P 4000) is such that the stock will in my opinion at best go sideways, but more likely continue to decline.

I’d take the investors’ enthusiasm rally about Mr. Iger’s return as an opportunity to sell.

Be the first to comment