JHVEPhoto

Thesis

The Walt Disney Company’s (NYSE:DIS) post-earnings selloff could be seen as a reset that took out dip buyers in July and October, as the market forced weak holders to flee.

We had anticipated in our previous update that its previous lows should hold robustly. But, we also emphasized that it could form a consolidation phase. Therefore, for a solid consolidation phase to form, it must indicate constructive signs of buyer accumulation, resolutely rejecting further selling downside. We are increasingly confident that we saw what we had postulated in the recent selldown.

Disney remains in a transition and recovery phase. Therefore, we aren’t surprised with the tepid forward guidance provided at its recent earnings call. Notwithstanding, the underperformance on both lines against the previous consensus estimates was unexpected. So, the question is whether the market has reflected the weak forward guidance in its current valuation as Disney embarks on profitable growth for its direct-to-consumer (DTC) segment to lift its operating leverage.

While Disney has an enviable and highly competitive moat in its Parks business, investors should be reminded that much of DIS’ valuation premium is likely attributed to its media properties. Therefore, Disney’s push to achieve DTC profitability is integral to justifying its valuation premium relative to historical averages. Thus, it’s easy to understand why CEO Bob Chapek’s commentary at its FQ4 earnings commentary was pretty much focused on driving profitable growth for its media business.

Our analysis suggests that the market has de-rated DIS sufficiently to account for its execution challenges through the coming recession. Also, its forward guidance suggests that FY23 was a much weaker year than what Wall Street had previously penciled in. As a result, we believe the company’s guidance has likely contemplated significant execution challenges over the next year.

Therefore, we think the market had correctly anticipated Disney’s struggle as it sent DIS down nearly 40% YTD, closing in on its COVID lows. With this reset, we are confident that Disney’s execution risks have been de-risked adequately to help it regain operating leverage through FY24, working on its DTC profitability.

Maintain Buy with a medium-term price target (PT) of $120.

Disney Remains In Transition

With the pandemic behind us, investors expecting a massive lift on DIS from its Park Business, coupled with its robust streaming subscriptions growth, could have been sorely disappointed.

While Parks was again the critical revenue and profitability growth driver in FQ4, its Media business continued to suffer from profitability challenges due to massive DTC losses. Accordingly, DTC’s -$1.47B in operating income was a significant headwind against its Linear networks’ operating income of $1.74B. As a result, we believe the analysts’ estimates were way off here, which resulted in Disney underperforming significantly against the Street’s expectations.

Hence, the Street’s anxiety was palpable in Disney’s earnings commentary as they parsed the company’s path toward sustainable profitability in a highly competitive business.

The launch of ad-supported streaming in Disney+ could also lead to unexpected churn that could lead to significant execution issues. Notwithstanding, Chapek attempted to assure investors that the company’s media business remains in great hands.

Chapek & team clearly understood Disney’s immense challenges as its valuation premium was primarily predicated on its Media properties. Therefore, it’s critical for Chapek & team to understand that the market would not be keen to see Disney continuing to burn significant losses on DTC moving forward and wants to see a meaningful profitability pivot. Accordingly, Chapek articulated:

Our financial results this quarter represent a turning point as we reached peak DTC operating losses. We believe we are on a path to [a] profitable streaming business that generates shareholder value long into the future. And assuming we do not see a meaningful shift in the economic climate, we still expect Disney+ to achieve profitability in fiscal 2024 as losses begin to shrink in the first quarter of fiscal 2023. (Disney FQ4’22 earnings call)

Is DIS Stock A Buy, Sell, Or Hold?

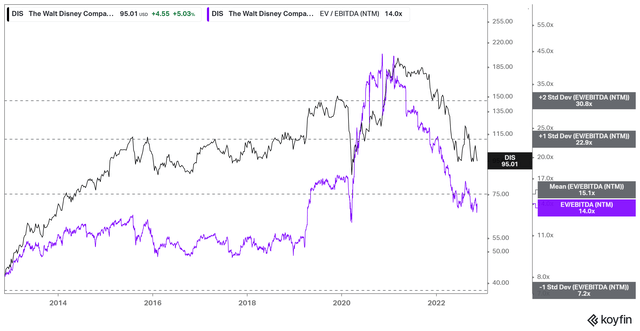

DIS NTM EBITDA multiples valuation trend (koyfin)

As seen above, DIS last traded at an NTM EBITDA multiple of 14x. However, it has consistently traded well below its 10Y mean of 15.1x in its pre-COVID days.

Hence, it’s clear that the market had re-rated DIS in anticipation of the growth drivers from its DTC segment.

Trefis’ sum-of-the-parts (SOTP) valuation suggests that its Media segment accounted for nearly 70% of DIS valuation. We also gleaned that its entertainment peers traded at an NTM median EBITDA multiple of 13.1x. In contrast, its Leisure peers traded at an NTM median EBITDA multiple of 9.8x.

Hence, the market is looking at DIS justifying its Entertainment premium. However, the business was unfortunately subjected to the pandemic boom-and-bust story over the past two years, which saw its valuation lifted to unsustainable heights.

So, the critical question is whether the market is keen to re-rate DIS from here despite significant execution challenges through the recession, with a DTC business that has not proved its profitability.

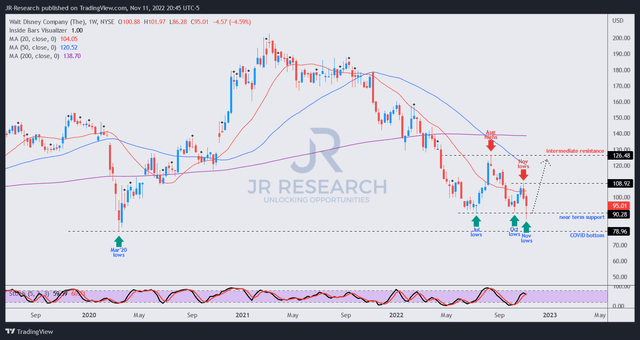

DIS price chart (weekly) (TradingView)

We postulate that the post-earnings selloff had led to a reset against its July and October lows that likely sent weak holders fleeing.

However, a potential bullish reversal could also be validated (still pending) as buying support appears robust at its recent lows. Therefore, we are confident that our consolidation thesis at the current levels remains intact, as the market used the recent selloff to shake out weak hands astutely.

But, we need to urge investors to be cautious in expecting DIS to retake its 2021 highs anytime soon.

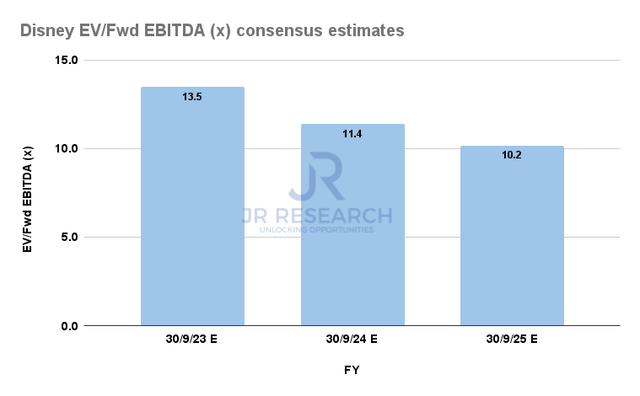

DIS forward EBITDA multiples consensus estimates (S&P Cap IQ)

DIS last traded at an FY24 EBITDA multiple of 11.4x. If we re-rate DIS according to its mean multiple of 15x, there’s a potential upside of about 30% if the market re-rates DIS higher through FY24.

That level was also in line with DIS’ August highs when it met with stiff selling resistance. Hence, we think that’s a reasonable level for a medium-term PT on DIS.

Much depends on whether Disney could execute its DTC profitability pivot after management disappointed investors with its FQ4 results. Hence, we are not looking to re-rate DIS much higher than its historical average multiple or peers’ median multiples for now.

Maintain Buy with a medium-term PT of $120.

Be the first to comment