GaryPhoto/iStock Editorial via Getty Images

It’s been an eventful 49 months since I put out my bullish article on Discover Financial Services (NYSE:DFS), and in that time, the shares have returned about 54% against a gain of ~63.5% for the S&P 500. I thought it’d would fun to review this investment, and determine whether or not it makes sense to buy some more. I’ll make this determination by looking at the recent financial history, and by looking at the stock as a thing distinct from the underlying business. Also, I can’t help myself. I’m going to write about put options. The puts I wrote on this name several years ago were interesting for me (perhaps “less dull” for you) because they caused me to alter the type of puts I sold. Because I’m a very unoriginal creature of habit, I’m going to recommend selling puts again.

Welcome to the “thesis statement” paragraph, dear readers. This is where I outline my arguments in broad strokes in order that you won’t have to wade into the entirety of the article. I do this to protect the more squeamish among us who have a low level of tolerance for my immature rants and bad jokes. Here goes. I’m of the view that this company has performed well financially, and I think the dividend is well covered, and I think the valuation is now even more attractive than it was when I last reviewed the name. For that reason I’ll be adding to my position here. In addition, being the greedy sort that I am, I’ll be selling the January 2023 put options with a strike of $85 for approximately $5 each. I consider this to be a “win-win” trade. There you have it. I’ve just given you 90% of the “juice” of this article at a tiny fraction of the “squeeze.” Some would call me a hero for doing this. I would agree with that assessment, but words like “hero” are cheap. If you’re interested in rewarding me materially for what I’ve done for you here today, feel free to contact me and I’ll get back to you with my current “wish list.”

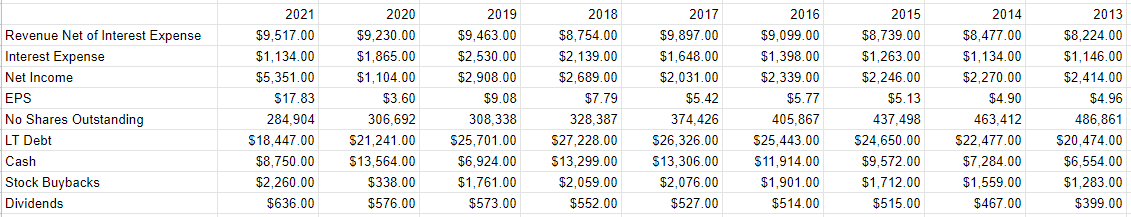

Financial Snapshot

I think the financial performance here has been quite good over the past year. While revenue was up by only ~3% in 2021 relative to 2020, net income exploded higher by just under 385%. Management has rewarded shareholders with a 10.4% uptick in dividends, and a buyback program that dropped shares outstanding by over 7% during the year. Additionally, the capital structure has improved nicely, with long term debt down about 13% relative to the same period in 2020.

In case you’re worried that I’m “cherry picking” by comparing the most recent year to a “soft” 2020, fret no longer, dear readers. Although revenue in 2021 was only marginally higher than it was in 2019, both net income, and EPS are up significantly (by 84% and 96% respectively).

It should be noted that most of this financial improvement has come from a collapse in interest expenses, and a collapse in provisions for credit losses. The former is down ~39% from 2020, and is 55% lower than it was in 2019. Meanwhile, provision for credit losses is down just under 96% from 2020, and just over 93% from 2019.

From a financial perspective, it’s hard to find fault with this company. Given that the annual dividend payment represents only about 7% of cash on hand, I’d be comfortable adding more of this sustainable dividend at the right price.

Discover Financial Services Financials (Discover Financial Services investor relations)

The Stock

Those of you who know my writing know that it’s at this point in the article where I spoil the mood by moaning about how great companies like this one can be terrible investments at the wrong price. This is because, at base, all businesses are about selling goods and/or services for an economic profit. On the other hand, stocks are supposed proxies that allegedly track the changing fortunes of the business, but in reality they seem to reflect more the mood of the crowd than anything happening at the company. Specifically, changing prices more closely reflect the crowd’s views about the far future profitability of the business. The stock is this proxy that floats up and down in price depending on how people feel today about what’s going to happen in 2023 and beyond.

Although I’ve made a sound argument just now, I’m never one to pass up the chance to bore my audience even more thoroughly, so with that warning out of the way, allow me to beat this proverbial deceased horse. I’ll drive this point home by using Discover Financial stock itself as an example. The company released full year results on February 24. Had an investor bought that day, they’re sitting on a loss of about 4.25%. Had they waited until March 7 to buy virtually identical shares, they’re up about 12% since. Not much changed at the firm over this very short time span to justify a 16.25% swing in returns. The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did better than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks.

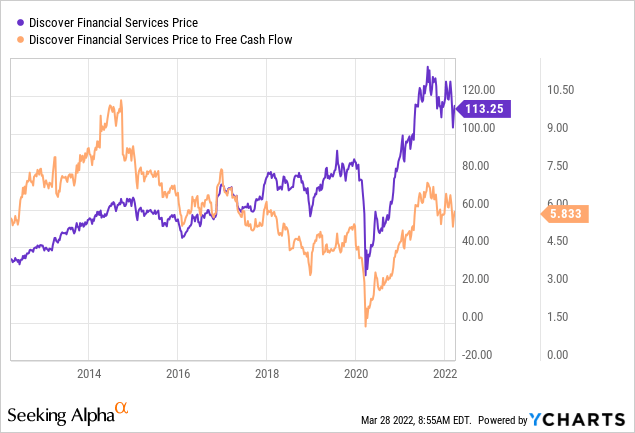

I measure how cheap a stock is in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In case you don’t happen to remember the specifics of my four-year old argument about Discover Financial, I’ll remind you that I was impressed by the fact that the shares were trading at a price to free cash flow of just under 6 times. In spite of the uptick in price, the shares remain very near that valuation, per the following:

Source: YCharts

My regulars know that in addition to simple ratios I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the said formula. Applying this approach to Discover Financial at the moment suggests the market is assuming that this company will be out of business in about 10 years. I consider this to be nicely pessimistic, and for that reason I’m willing to add to my position at current prices.

How Discover Financial Services Changed My Options Strategy

I mentioned it above, and now I’m going to tell you the whole story, dear readers. In my previous article on this name, I took a shine to the valuation, and decided to sell at the money puts (strike $80) that expired in five months from the time I wrote the piece. The shares dropped to the low $70s, because of course they did, and the shares were put to me at a net price of ~$75.50 (I received ~$4.50 per share in premium for selling the puts). This was emotionally stressful for a time, because the shares sank to the mid-$50s before the year was up. Those who know me best know that one of my many unflattering traits is my stubbornness, so I hung on to the shares, and breathed a sigh of relief as 2019 came to a close, and the world was good again. As we entered the year 2020, I was hopeful that the capital losses I had suffered to that point were behind me. Poor, naive man. In case you have forgotten, dear readers, 2020 was actually quite a “spicy meatball” for stock markets, and my shares were dunked into the mid-$20s for a time. It was not a pleasant experience.

After suffering these short term losses, I changed my strategy, and I now generally avoid selling at the money puts. I acknowledge that my strategy has very definitely cost me financially, as the premia for much safer puts is obviously lower. For my part, though, my interest isn’t in maximizing my returns, it’s in maximizing my risk adjusted returns.

Now, just because I prefer safer, risk adjusted returns doesn’t mean I’m not greedy. So, in addition to buying a few shares at current prices, I want to sell some puts on this name again.

As you may know, I consider these to be “win-win” trades, because the outcome is positive no matter what happens. If the stock price remains above the strike price, I’m happy. If the shares fall below the strike price, I’ll be obliged to buy, but will do so at a price that I’ve determined to be acceptable.

In terms of specifics, I’m a fan of the January 2023 Discover puts with a strike of $85. These are currently bid at $5. If the shares remain above $85 over the next 10 months, I’ll simply pocket the premium. If the shares fall in price, I’ll be obliged to buy some more, but will do so at a price that is about 23% below the current, already reasonable, level. Holding all else constant, at that price, the dividend yield jumps to 2.35%. Either outcome is very good for me, hence my characterisation of these as “win-win” trades.

Now that you’re hopefully excited about the prospects of a “win-win” trade, it’s time to change the tone a little bit by writing about risks. I expect that deflating your expectations a little bit will cause you some emotional pain, and I need you to know that I’m very comfortable writing this section in spite of the negative effects it may have on you. The bottom line is that it’s all well and good for some stranger on the internet to write about how these things are “win-win” trades, but everything comes with some measure of risk, and short puts are no exception. I’m starting to divide the risks here between the economic and the emotional. Let’s review these in turn.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m now only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. While my original Discover trade met this criteria, I typically now only ever sell puts that are fairly deep out of the money. So, rule one is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

The two other risks associated with my short-put strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that the market really likes what’s happening at Discover Financial Services, and the shares jump to $150 this year. The short put only offers you the option premium. The return from the short put may be lower risk, but it’s certainly limited, and that can be emotionally painful for many.

Secondly, as I “discovered” (sorry, couldn’t resist) with this stock, it is emotionally painful when the shares crash below your strike price. While this and other similar trades have so far worked out well for me, it is emotionally painful in the short term. So, I can make a reasonable argument that Discover shares are a screaming bargain at $85, but if they drop to $50 because of a market meltdown, for instance, that will take an emotional toll. I think people who sell puts should be aware of these emotional risks before selling.

I’ll conclude this rather long, drawn out, ponderous discussion of risks by looking again at the specifics of the trade I’m recommending. If Discover Financial Services shares remain above $85 over the next ten months, I’ll simply add the premium to the whiskey acquisition fund and move on. If the shares fall over 20% in price, I’ll be obliged to buy, but will do so at a price that lines up with a price to free cash flow of 4.4 times, and a very nice dividend yield. This is why I consider this to be a risk reducing trade. If you think it’s odd of me to end a discussion of short put risks by writing about how these reduce risk, you’re right. I’m odd. If this is news to you, well I don’t know what to say.

Conclusion

I think the business is performing very well, and I think management has rewarded shareholders nicely with an increased dividend, and substantial buyback. In spite of this, the shares are reasonably valued at the moment, so I’ve got no problem adding a few hundred shares. In addition, because I’m a greedy sort, I’m comfortable generating a little bit of premium by selling deep out of the money puts. If these expire, the whiskey acquisition fund will expand a little bit. If the shares are “put” to me again, I’ll be obliged to buy a great business at a great price. If you’re comfortable with put options, I’d recommend this or a similar trade.

Be the first to comment