nespix

A Quick Take On DigitalOcean Holdings

DigitalOcean Holdings, Inc. (NYSE:DOCN) went public in March 2021, raising approximately $776 million in gross proceeds in an IPO that was priced at $47.00 per share.

The firm provides infrastructure as a service to businesses seeking cloud-based applications hosting and related services.

I’m on Hold for DOCN in the near term, although the stock may have further growth potential ahead if recession fears subside.

DOCN Overview

New York, NY-based DigitalOcean was founded to develop an IT infrastructure platform that enables SMBs to acquire, configure and deploy their applications on its cloud-based SaaS subscription-based system.

Management is headed by Chief Executive Officer, Yancey Spruill, who has been with the firm since 2019 and was previously COO and CFO of SendGrid.

The company’s primary offerings include:

-

Compute

-

Managed Databases

-

Developer Tools

-

Storage

-

Networking

The firm acquires SMB customers primarily through online marketing efforts, funneling prospects to its self-serve service offerings.

DigitalOcean’s Market & Competition

According to a 2021 market research report, the global market for platform-as-a-service services was an estimated $6.9 billion in 2020 and is forecast to reach $19.2 billion by 2026.

This represents a forecast very strong CAGR of 18.5% from 2021 to 2026.

The main drivers for this expected growth are a continued transition from on-premises IT infrastructure to cloud-based systems as small to large businesses seek improvements in their information system capabilities.

Also, as customers need to integrate a greater number of services, they are looking for service simplification and vendor consolidation whenever possible.

Major competitive or other industry participants include:

DOCN’s Recent Financial Performance

-

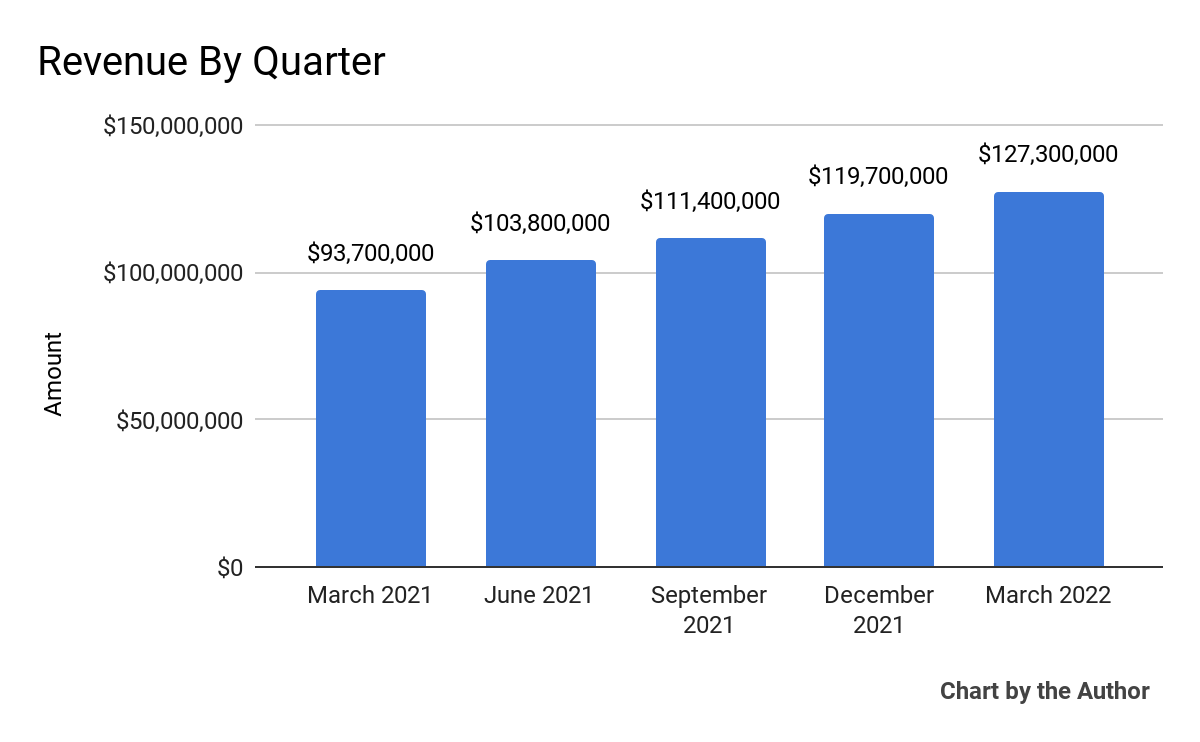

Total revenue by quarter has risen steadily as the chart shows below:

5 Quarter Total Revenue (Seeking Alpha)

-

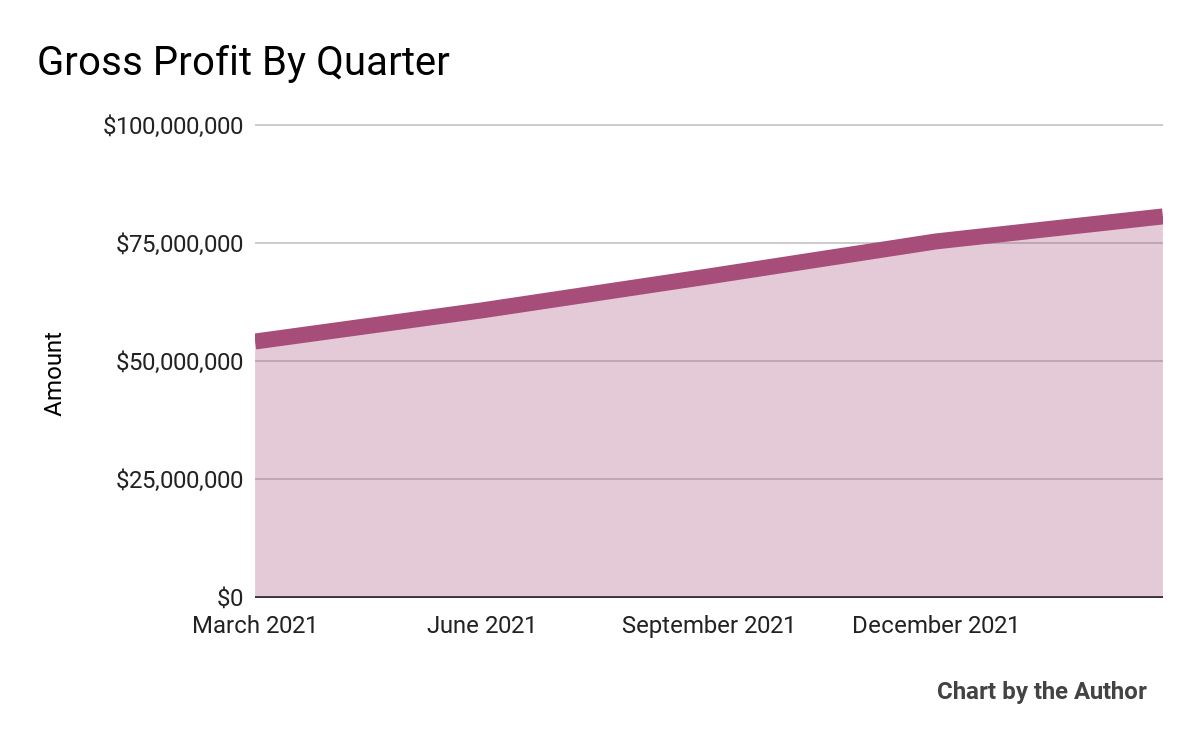

Gross profit by quarter has also risen at roughly the same trajectory as total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

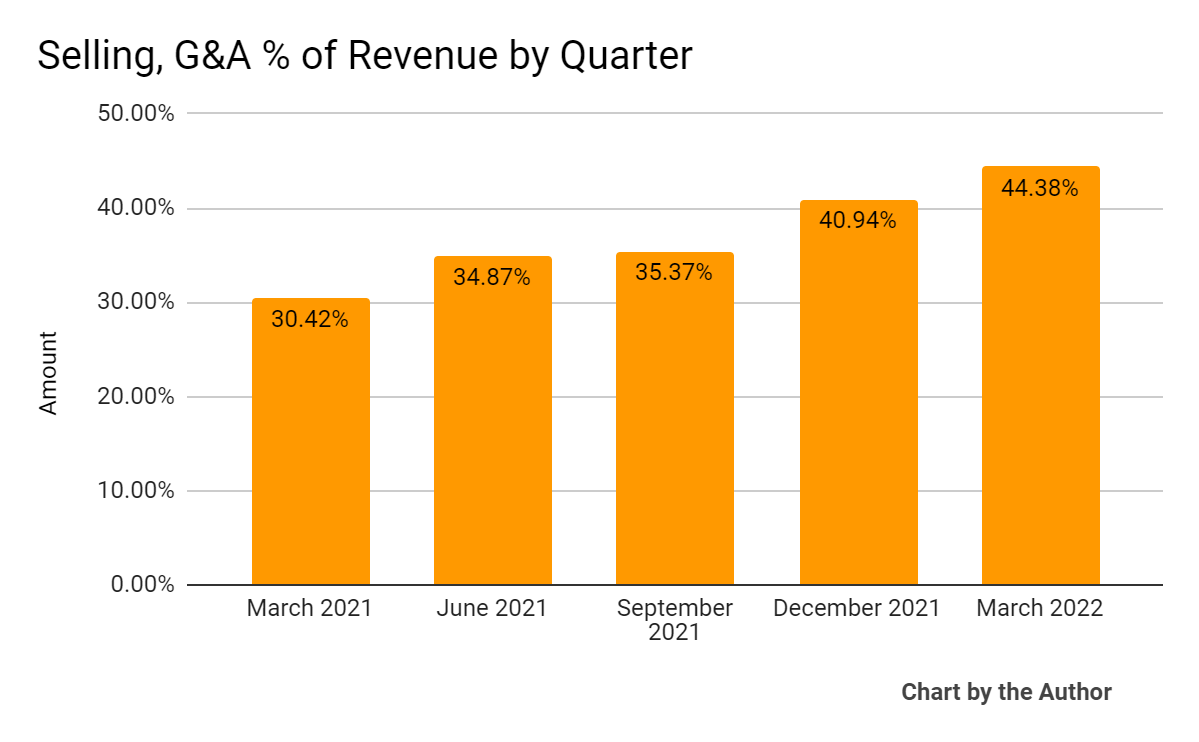

Selling, G&A expenses as a percentage of total revenue by quarter have risen markedly over the past 5 quarters, indicating the firm is becoming less efficient in this regard:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

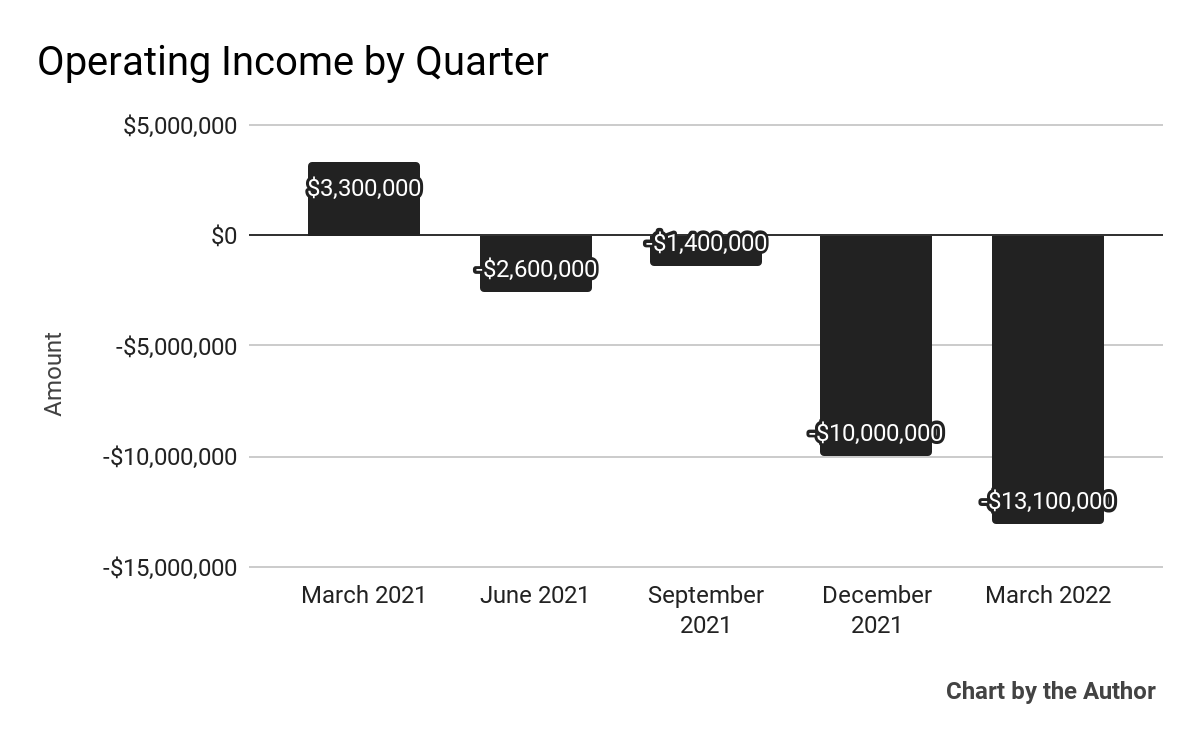

Operating income by quarter has dropped well into negative territory over the past few quarters:

5 Quarter Operating Income (Seeking Alpha)

-

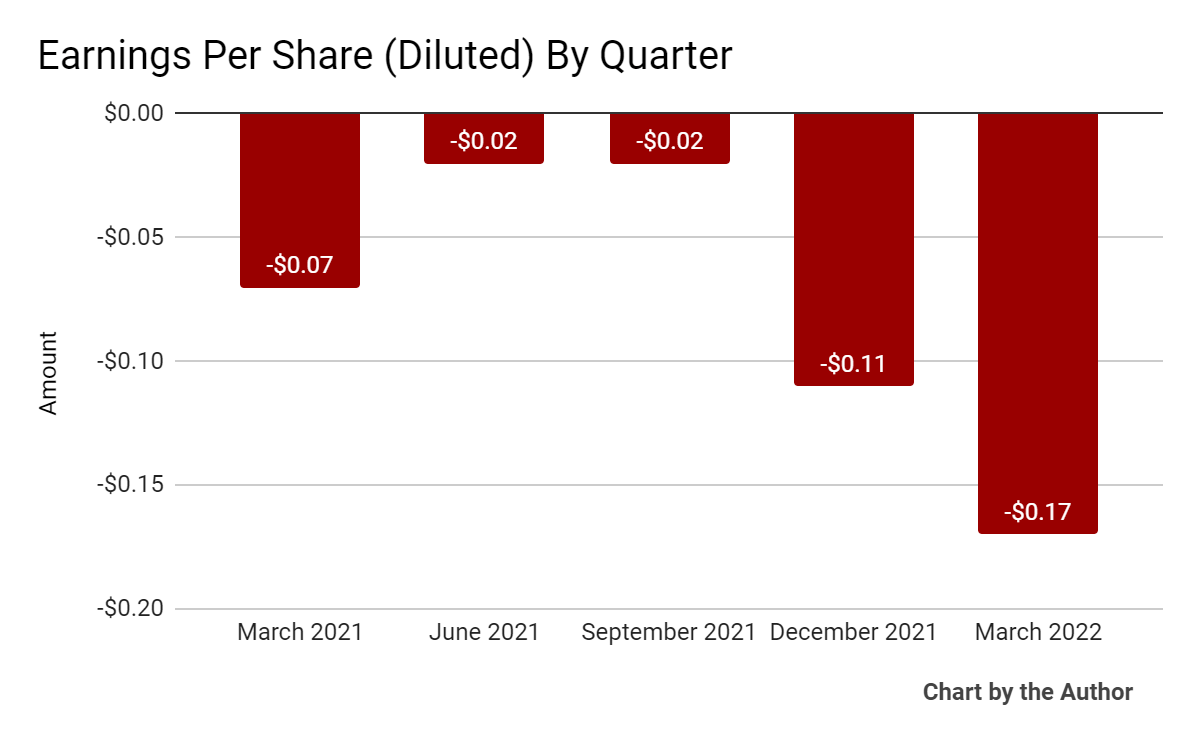

Earnings per share (Diluted) have remained negative and worsened in recent quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

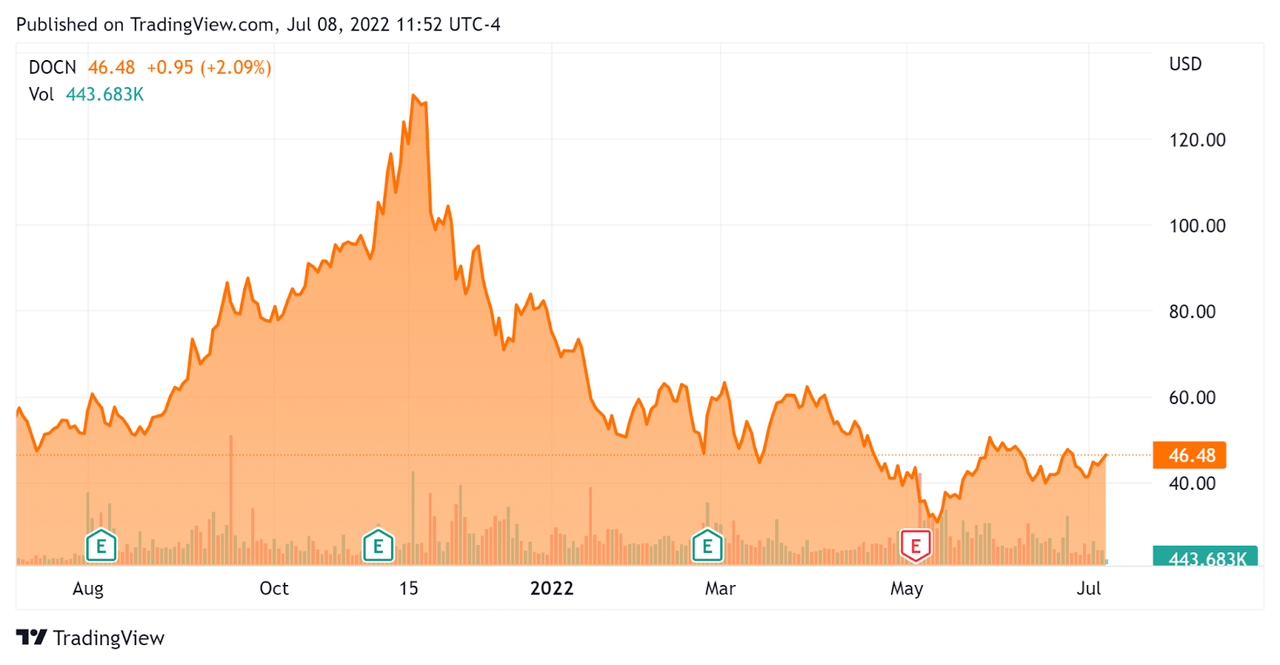

In the past 12 months, DOCN’s stock price has dropped 15.1% percent vs. the U.S. S&P 500 index’s fall of around 9.6 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For DOCN

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$4,560,000,000 |

|

Market Capitalization |

$4,650,000,000 |

|

Enterprise Value/Sales (TTM) |

9.86 |

|

Price/Sales (TTM) |

10.60 |

|

Revenue Growth Rate (TTM) |

36.25% |

|

Operating Cash Flow (TTM) |

$143,610,000 |

|

CapEx Ratio |

1.47 |

|

Earnings Per Share (Fully Diluted) |

-$0.32 |

(Source – Seeking Alpha)

Commentary On DigitalOcean

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted progress in growing its inbound and outbound sales efforts as a complement to its self-service channel.

The company also saw an increase in 70% in unique visitors to its website versus Q1 2021.

It is seeing strong interest in its new serverless functionality, which management believes will be a ‘rapidly growing adjacent market opportunity’ ahead.

As to customer spend, management noted that its “higher spending” customer cohort grew to 102,000, a rise of 20% year-over-year.

As to its financial results, revenue grew by 36% year-over-year while net dollar-based retention rate was 117%, a strong improvement from 107% in 2021’s Q1 period.

However, GAAP operating losses accelerated during the quarter, and the war in Ukraine negatively impacted its growth in Central Europe.

For cash flow, the quarter generated $4 million of free cash flow and the firm expects free cash flow for 2022 to be 9% of revenue at the expected range midpoint.

Looking ahead, management reiterated its previous full-year 2022 revenue guidance and non-GAAP operating margin to be 14% at the midpoint.

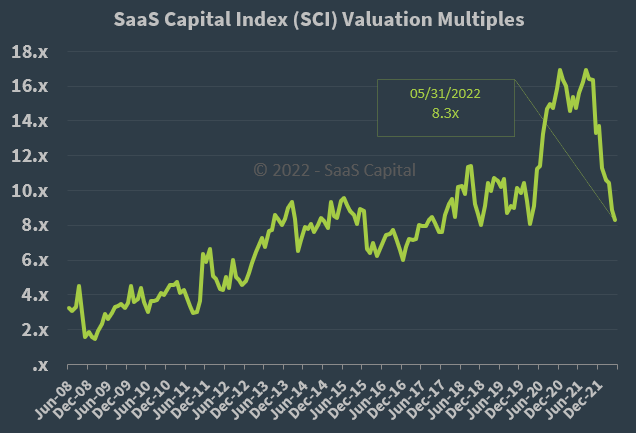

Regarding valuation, the market is valuing DOCN at an EV/Sales multiple of around 9.9x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 8.3x on May 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, DOCN is currently valued by the market at a premium to the SaaS Capital Index, at least as of May 31, 2022.

The primary risk to the company’s outlook is a global slowdown or recession, which would slow revenue growth and potentially worsen operating losses.

While the board’s decision to buy back $300 million in stock likely put a floor under the stock in the near term, the firm’s increasing spending on SG&A as a percentage of revenue indicates the company is becoming less efficient in obtaining new revenue.

The company’s worsening GAAP operating losses combined with a recession we may already be in lead me to be cautious on the stock in the near term, although it has seen significant recent price momentum.

I’m on Hold for DOCN in the near term, although the stock may have further growth potential ahead if recession fears subside.

Be the first to comment