Editor’s note: Seeking Alpha is proud to welcome Jun Hao as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

We Are

Investment Thesis

My primary thesis for Digital Turbine (NASDAQ:APPS) lies in that (1) it serves as a critical middleman between OEMs/operators and publishers, and (2) it owns the end-to-end digital supply chain from the demand-side platform (DSP) to an ad exchange to the supply-side platform (SSP) after their major acquisitions of Appreciate, AdColony, and Fyber. I believe that when successfully integrated, they can remove tons of inefficiencies in the supply chain and create multiple cross-sell opportunities to drive incremental revenue and margins.

After looking at the company’s most recent 1Q23 result, I believe that the fundamentals are intact as the company is still displaying strong profitability, Single-Tap is gaining traction, and the distribution footprint continues to grow. However, the slower rollout of the mobile posse and the M&A integration is something to monitor closely.

Let’s head into the article for a more in-depth analysis.

Macro Challenges

Right off the bat on the earnings call, CEO Bill Stone named 4 macro challenges.

These are primarily the COVID impact which lengthens the sales cycle to onboard customers or partners, supply chain disruption for operators and OEM partners, wage increases in hiring tech talents, and recessionary concerns as advertisers are more cautious of spending, plus the COVID pandemic in China that has slowed down the progress with China OEMs, although it’s only a minor headwind.

With multiple headwinds going on, how have they then performed during the quarter?

Company Overview

Revenue

APPS IR

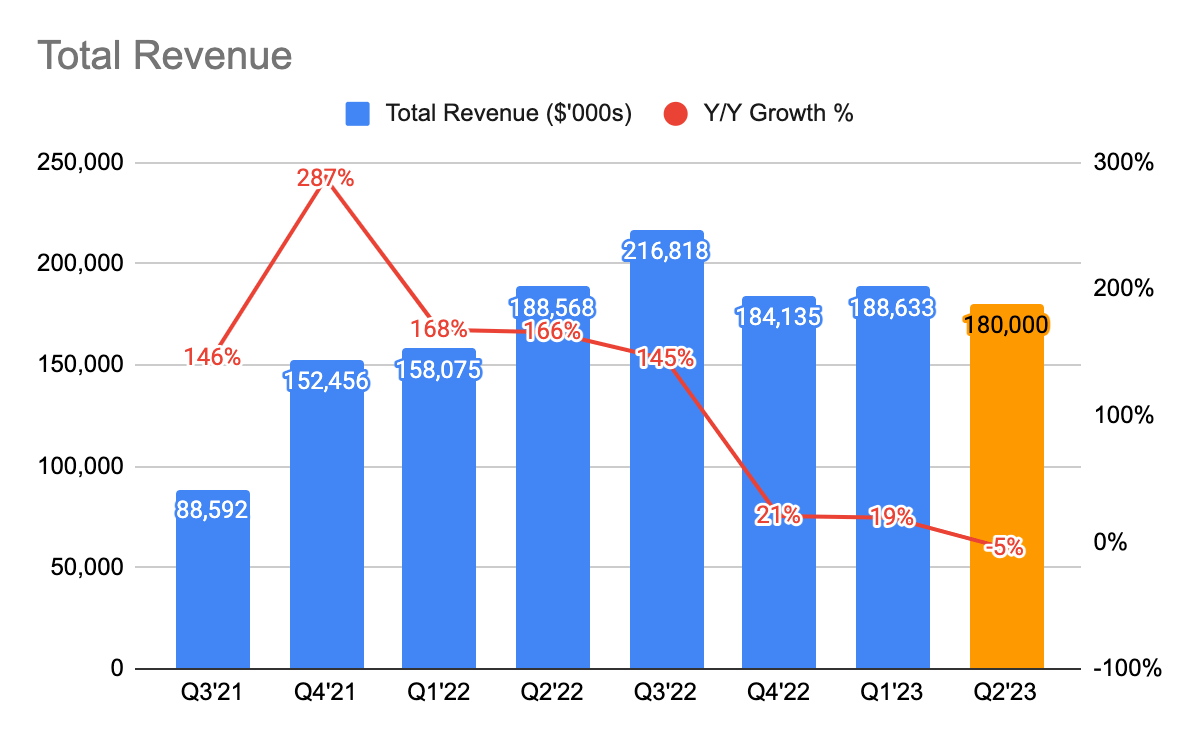

The company’s total revenue came in at $188 million, a 19% Y/Y growth. This slightly exceeded the top-end of the guidance of $187 million.

In the earnings call, the management stated that they were focused on gross margin expansion which led to a revenue trade-off. With the company facing multiple headwinds and taking into consideration this is a seasonally weaker quarter in the ad industry, this was a pretty decent growth. I do believe this can be better if not for the decline in on-device solution (“ODS”) revenue, but first, let’s focus on the overall business before we dive deeper into the ODS revenue.

Strong Profitability Growth

On the other hand, there was substantial growth in profitability.

APPS IR APPS IR APPS IR

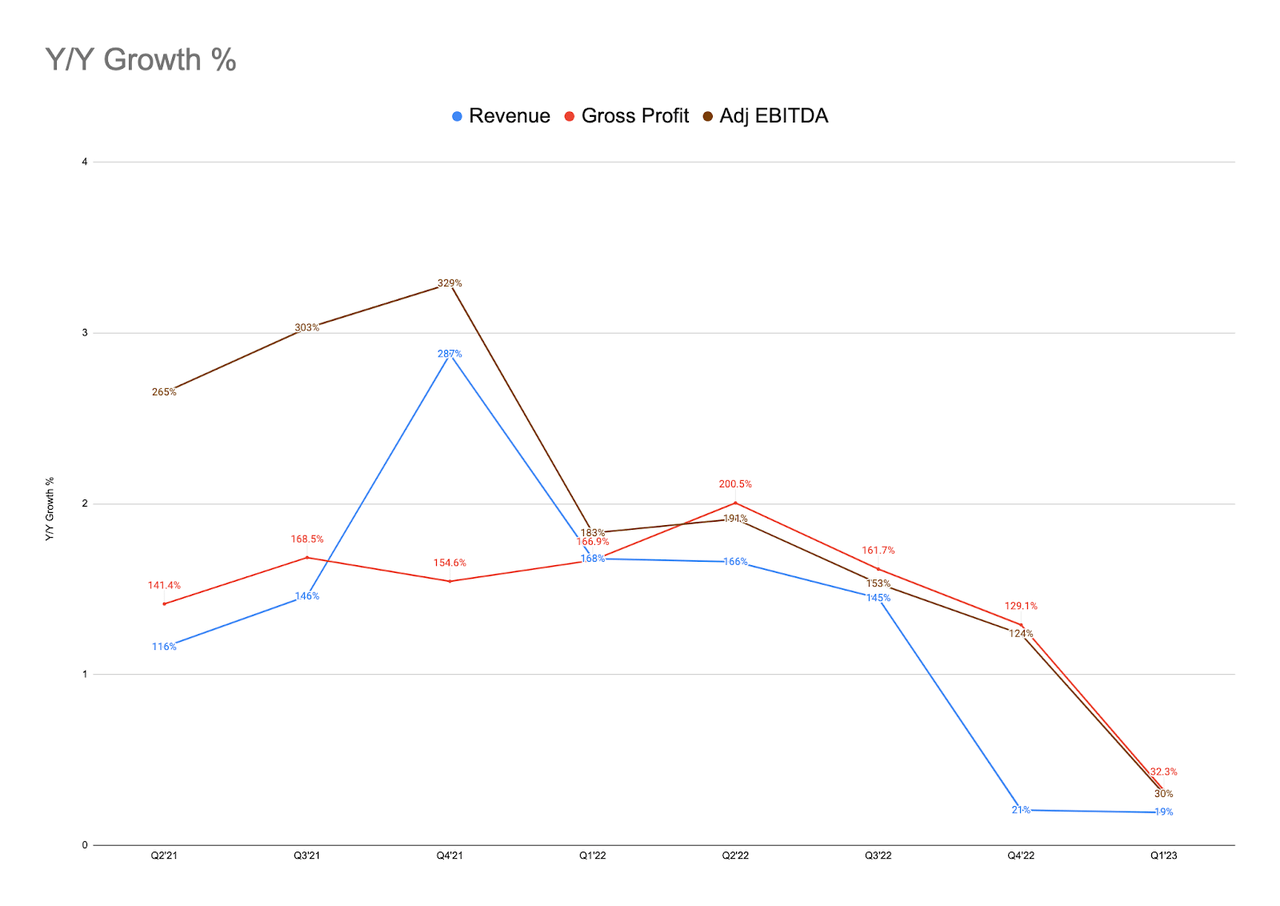

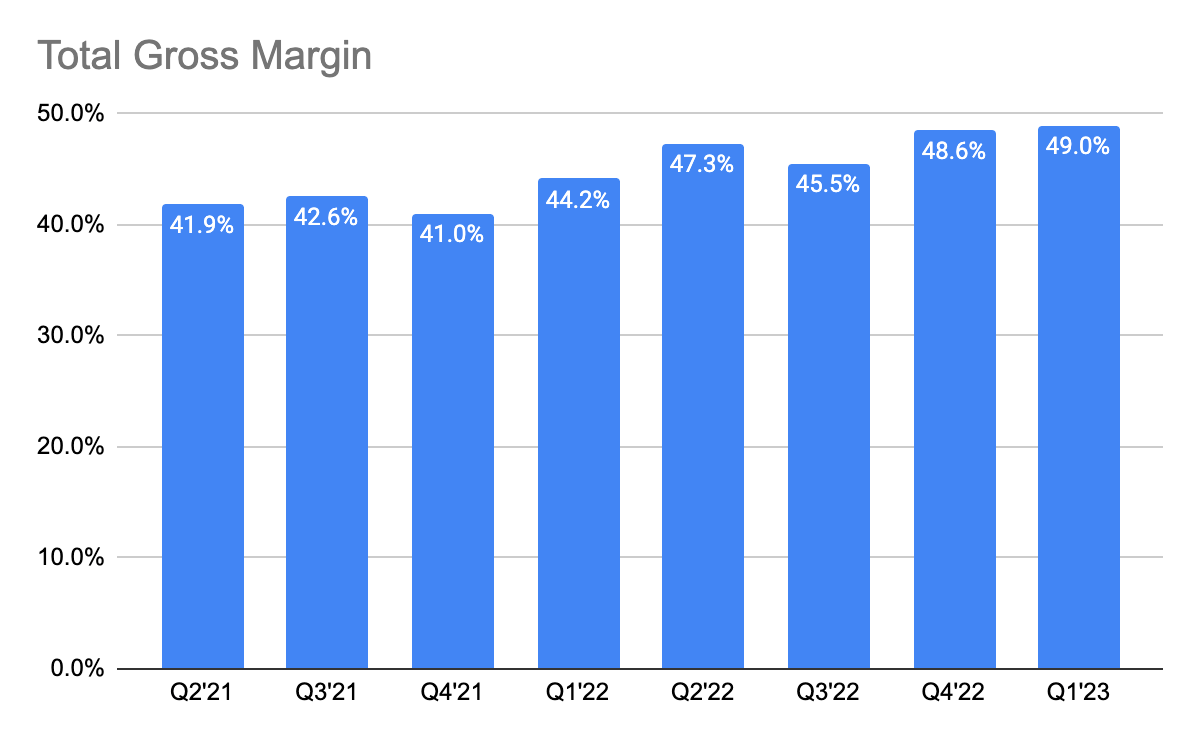

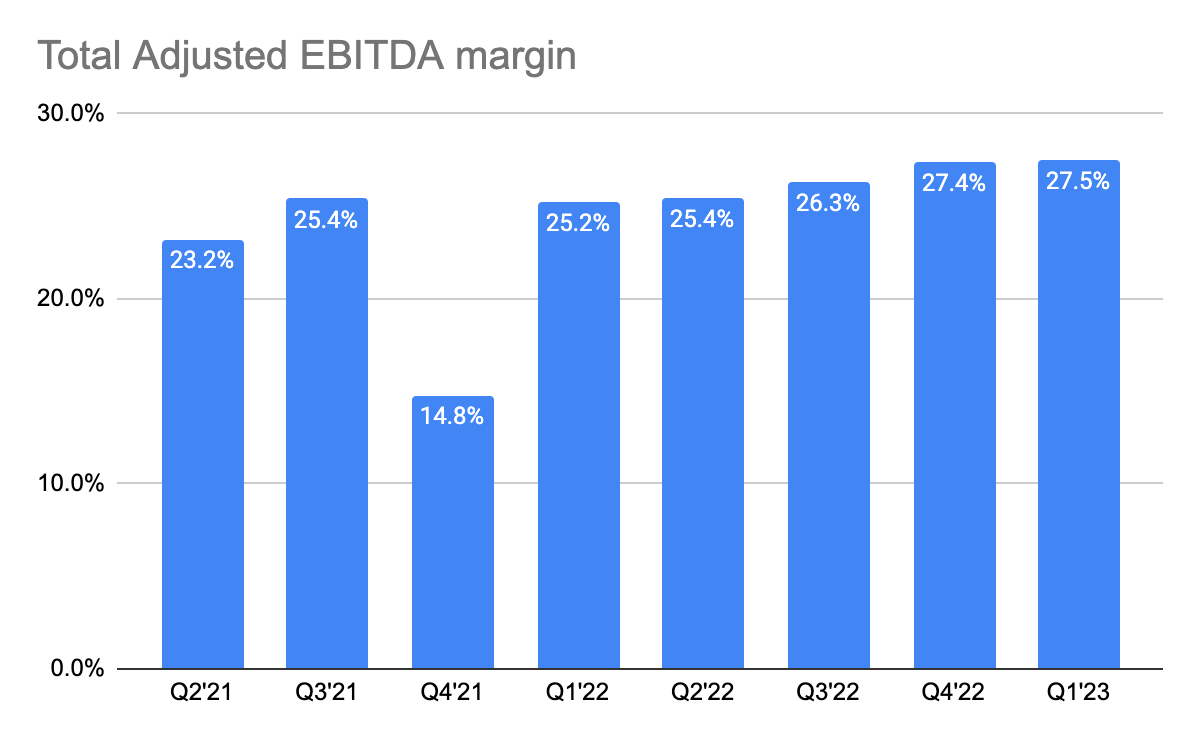

Looking at the chart above, the management has demonstrated that it could grow its gross profit (+32% Y/Y) and adjusted EBITDA (+30% Y/Y) faster than its revenue growth (+19% Y/Y) consistently in the past 5 quarters, after the acquisitions made in 4Q21.

This quarter’s gross margin was 49% (up from 44% a year ago), and the adjusted EBITDA margin was 27.4% (up from 25.2% a year ago), making it the highest quarter ever in the company’s history. According to CEO Bill Stone, a portion of the margin expansion was due to one-off benefits.

Incredibly, the company continues to extract strong operating leverage, and this shows that Digital Turbine is a highly profitable business. Keep in mind that this does not include the revenue from the cross-sell opportunities between Single-Tap, Fyber, and AdColony as the M&A integration is still in progress. When completed, which will take time, we should start to see incremental revenue coming in, and expect it to drive up gross and adjusted EBITDA margin.

This can be referenced from the company’s 4Q21 earnings call:

“…we’re over 10% of our revenues…to launch in the next few months some new initiatives that should help accelerate those revenue synergies and simultaneously help drive more profitable top line growth…. a few examples are consolidating our ad tech on the legacy Fyber and AdColony devices into one exchange, where demand and supply platforms such as The Trade Desk can purchase more inventory at scale. We anticipate this will generate many tens of millions of dollars of incremental revenue this fiscal year and begin next quarter….secondly, we are integrating our SingleTap capabilities into the Fyber exchange…make it more attractive for advertisers to bid on Fyber inventory, which in turn should be an overall growth driver for our app growth business…”

CEO Bill Stone has been talking about revenue synergies in the past few earnings calls, and we have yet to see any incremental revenue coming in this quarter. I personally felt that there was a lack of commentary on the integrations as the CEO’s response to analyst Anthony Stoss on the revenue synergies was – “we’re hanging in that ballpark (10%)…”

Next, let’s break down its business into 2 segments – (1) on-device solutions (previously on-device media), and (2) app growth platforms (Fyber & AdColony), to dive deeper into how each segment is doing.

On-Device Solution (ODS)

Revenue

APPS IR

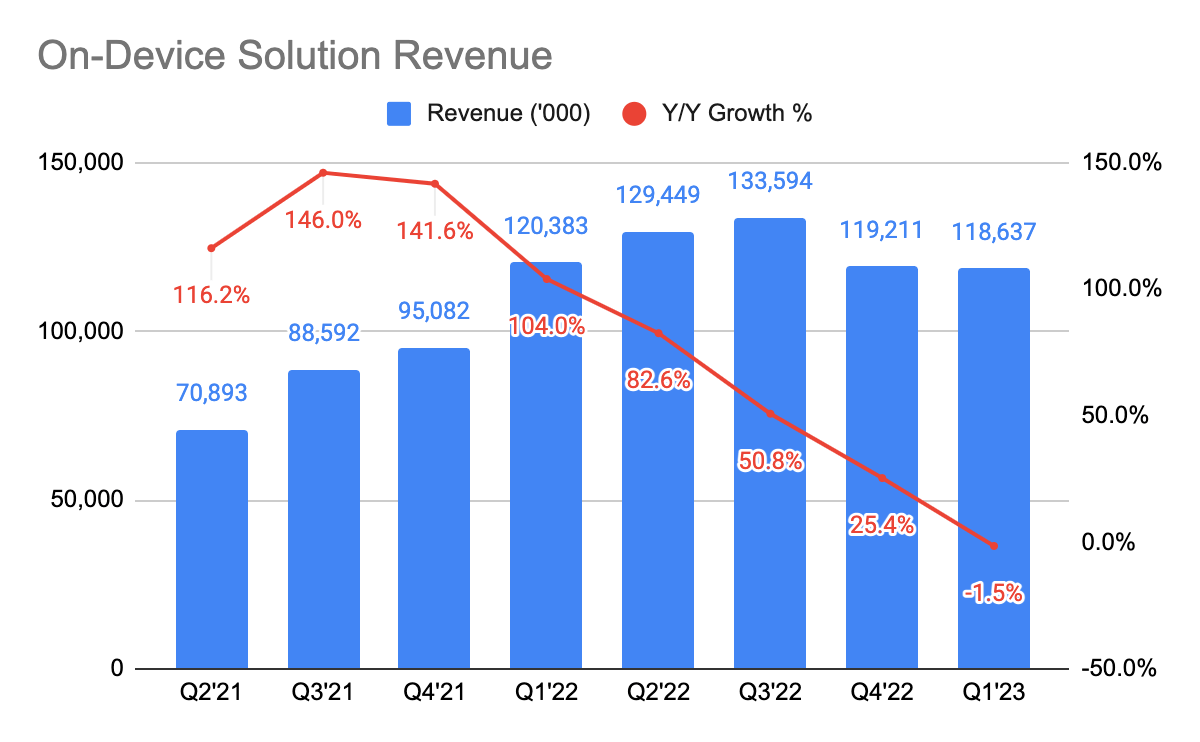

ODS consists of 2 businesses – app media and mobile posse (content media). The ODS revenue declined by 1.5% Y/Y, and the reasons are (1) the slowdown in content media revenue due to a change in customer acquisition strategy, and (2) the focus on margin expansion which led to a revenue trade-off.

Here is CEO Bill Stone on the shift in customer acquisition strategy for mobile posse:

“…more than 90% of my revenues had come on prepaid. I made some material investments of really going after postpaid just because of the larger addressable market, both in terms of users as Ill as advertising dollars…now we’re starting to see some much more engagement from my larger U.S. carrier partners…given some of their desires to drive increased revenue engagement from their users”

Now, back to APPS’ 4Q22 result, I suspect a massive decline in mobile posse revenue since 3Q22, which caused the ODS revenue growth to decline drastically from 2Q22 (82.6% growth) to 4Q22 (25.4% growth).

APPS IR

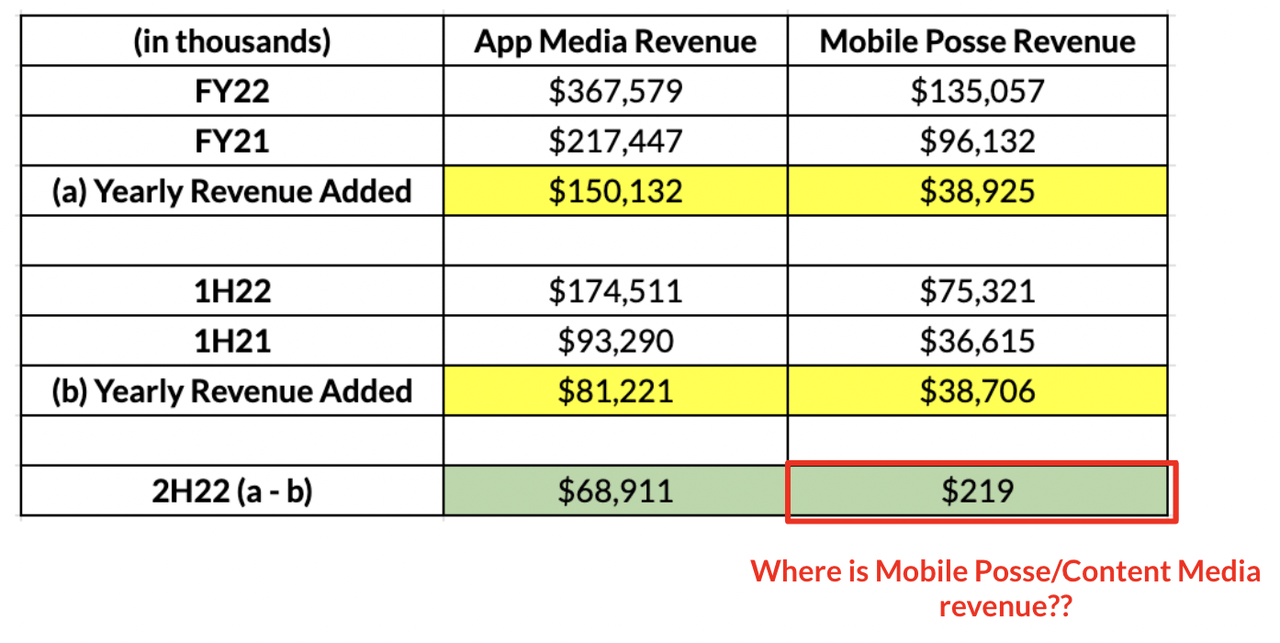

For readers’ sake, let me walk you through how I came to that conclusion. I’m attempting to derive the revenue added for mobile posse in 2H22, and that is because management has not disclosed its revenue for 3Q22 and 4Q22.

1) In APPS FY22 10-K, we can find out the revenue added for app media ($150,132) and mobile posse ($38,925) from FY21 to FY22.

2) CEO Bill Stone broke down the app media and mobile posse revenue in both 1Q21 and 2Q21. Adding both quarters’ revenue will give us a 1H22 revenue for each segment – app media is $93,290, and the mobile posse is $36,615.

3) In 1Q22, CEO Bill Stone broke down the revenue growth for each segment – 81% Y/Y for app media & 150% Y/Y for mobile posse, then we can find the exact revenue using 1Q21 numbers. On 2Q22, mobile posse did $35 million in revenue. Finally, we can compute the 1H22 revenue by adding 1Q22 and 2Q22 revenue for each segment.

4) The difference between the revenue added from FY21 to FY22, and revenue added from 1H21 to 1H22 will give us 2H22’s content media revenue of $0.219 million.

As you can see, there was little to no revenue added for mobile posse business.

Here is the portion I find particularly strange – why did it take the management took 9 months to communicate to investors that there was a slower rollout of mobile posse when it first happened in 3Q22? This is something that I didn’t particularly like and I will appreciate more clarity from the management. Combined with the macro headwinds, I suspect that they are being conservative in their forward negative 5% Y/Y revenue growth for 2Q23.

I do not think this poses a long-term threat to the business but do keep an eye out for any material progress made in the mobile posse rollout. Hopefully, there will be more clarity in upcoming quarters. According to this quarter’s earnings call, they are gaining traction with Verizon (VZ) and AT&T (T).

Growing Distribution Footprint

APPS IR

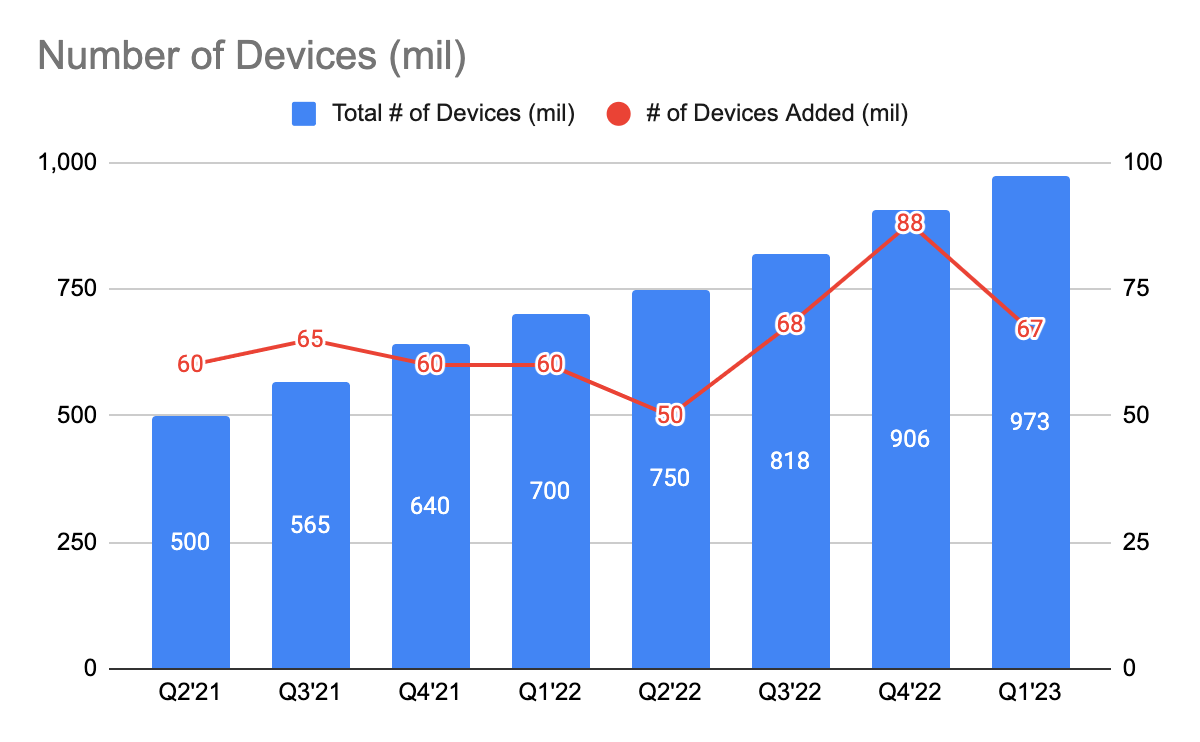

The total number of devices continues to grow strongly as Digital Turbine added 67 million new devices (from 88 million last quarter), bringing the total to 973 million devices.

Despite the supply chain issues, partners are still launching more devices via Digital Turbine, and its growth momentum has not died down. The company continues to grow its market share as it becomes an increasingly critical intermediary for operators and OEMs to monetize their devices.

Furthermore, CEO Bill Stone states that partners are increasingly looking for additional income streams as recessionary fear creeps in, and they are “seeing increased traction with many global operators and OEMs”.

The company’s US revenue-per-device (“RPD”) now stands at $5, a 20% Y/Y growth and 6% Q/Q growth ($4.70 in FY22), indicating that partners are increasing their spending.

Single-Tap

APPS IR

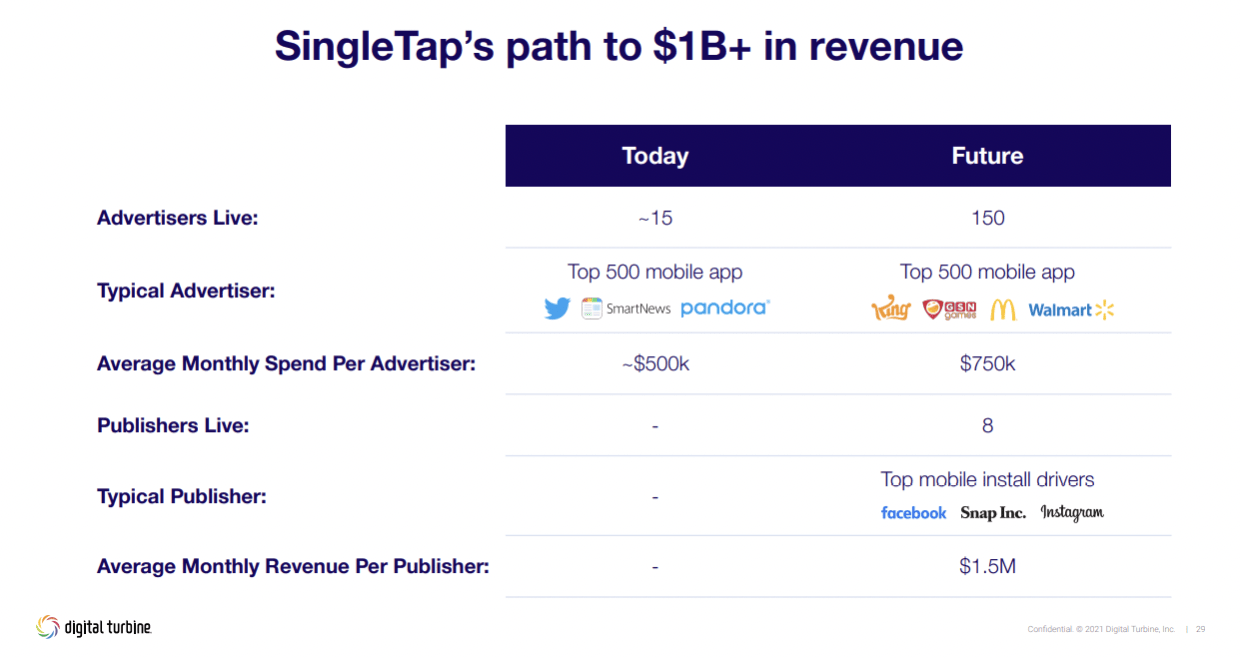

What is incredibly exciting is that Single-Tap is rolling out to 5 partners by 2Q23 and 10 by 3Q22, and they will be a mix of tier 1 and 2 partners.

So….Meta (META) incoming? Finger-cross.

Quick math tells us that:

-

$1.5 million monthly revenue * 10 partners = $15 million of total monthly revenue

-

$15 million * 12 = $180 million in annual revenue. This is equivalent to the total net revenue in 1Q23.

Aside from being a huge driver of revenue, it also helps to drive margins higher. However, it takes time for partners to ramp up their spending, so these are not immediate revenue. Moreover, they are launching Single-Tap on Fyber exchange as well as leveraging AdColony’s relationship with its publishers, which they have been discussing in the past few earnings calls.

I am seeing things materializing for Single-Tap and this is undoubtedly one of the most exciting segments of the company.

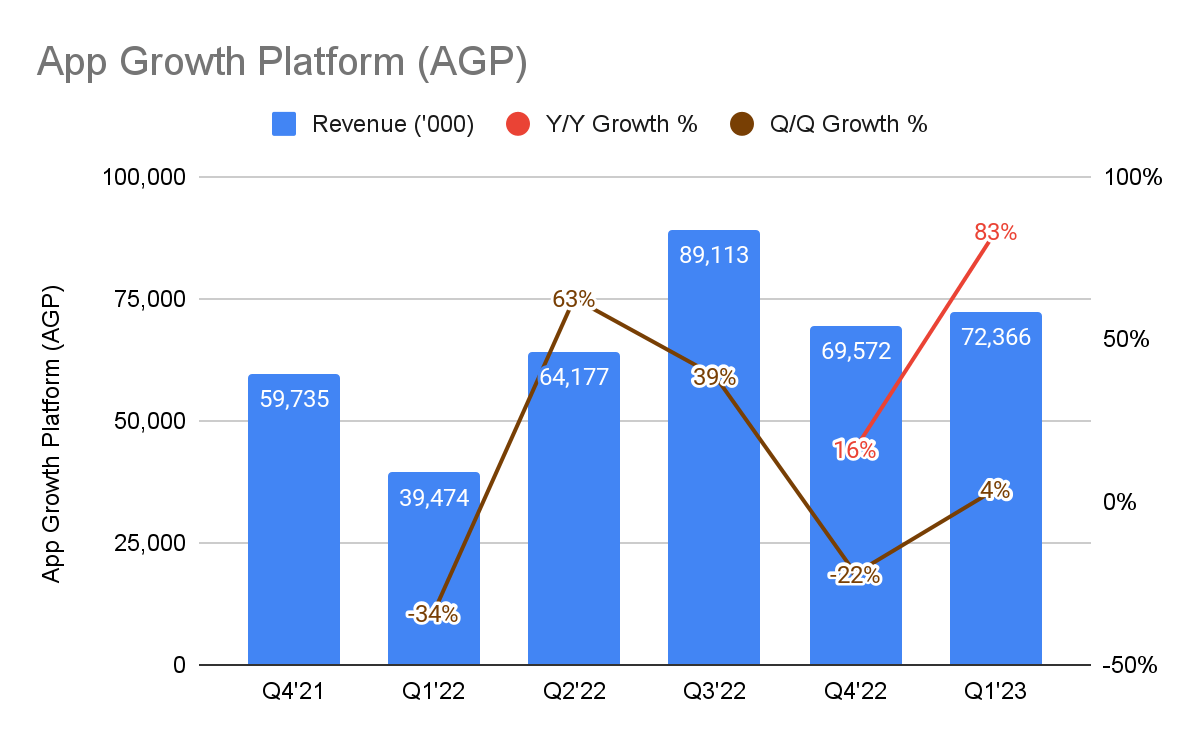

App Growth Platform (AGP)

APPS IR

Turning over to AGP, its revenue grew 83% Y/Y, as they account for the full operations of Fyber & AdColony. On a quarterly basis, they are growing at 4% Q/Q. The reason for the growth is even though spending has slowed, they are seeing a higher volume of impressions.

Here is another critical commentary from CEO Bill Stone on how advertisers are thinking about spending during a recessionary period:

“…I’ve seen a slowdown in the digital ad market as advertisers rethink their investment strategies. This has negatively impacted my recent results and near-term outlook. However, I expect this to be a temporary versus permanent dynamic…majority of ad spenders are more in a wait-and-see mode versus a I-don’t-have-money-to-spend mode.”

And then Jeff Green, the CEO of The Trade Desk (TTD) said this during the 2Q22 earnings call:

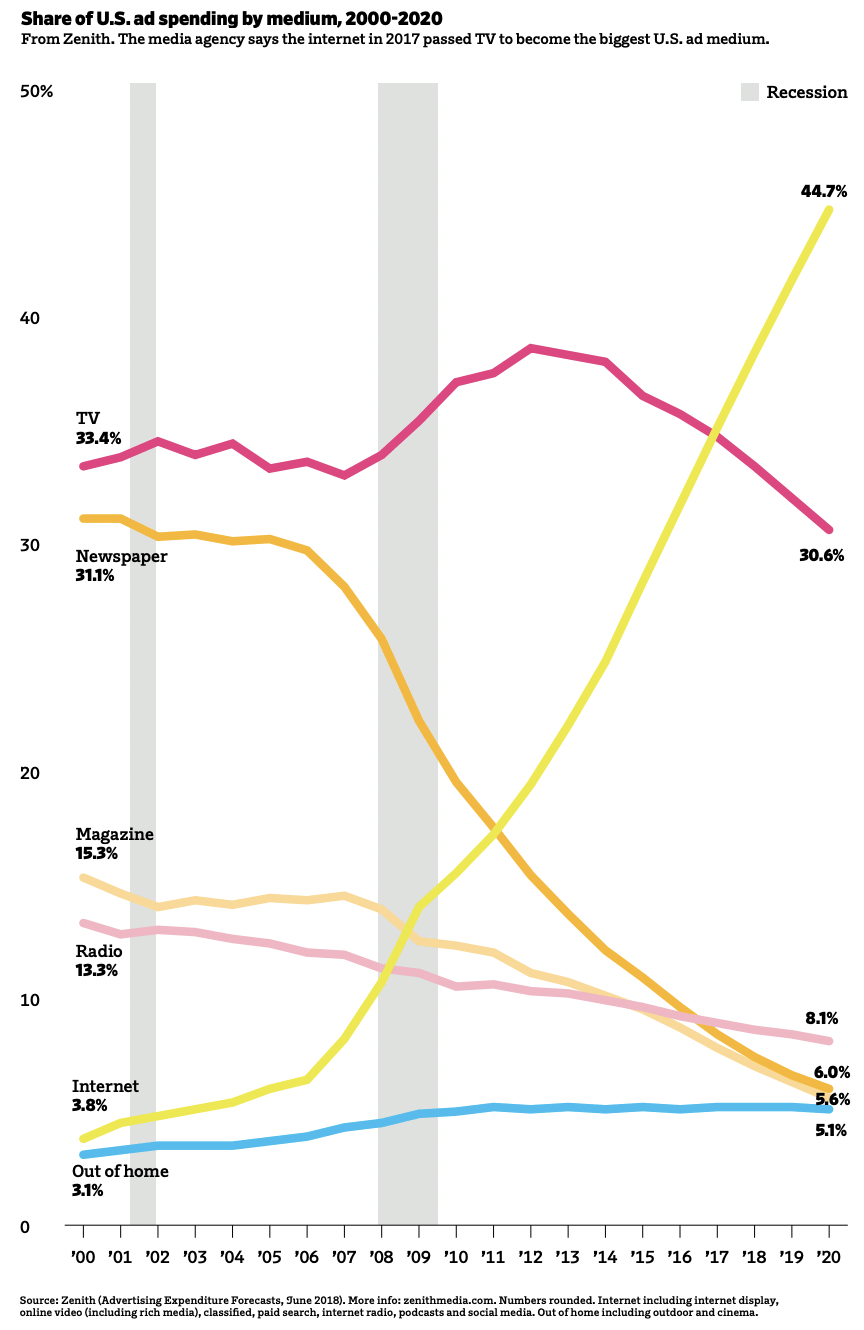

“In the first half of the year, marketers shifted to decision data-driven advertising on the open Internet more rapidly than ever.”

While investors may argue that ad spendings are first to be cut during a recession, it seems that advertisers are still spending money on digital ads. Referencing from The Trade Desk, I do expect 2H23 to be seasonally better quarters so revenue is likely to be higher.

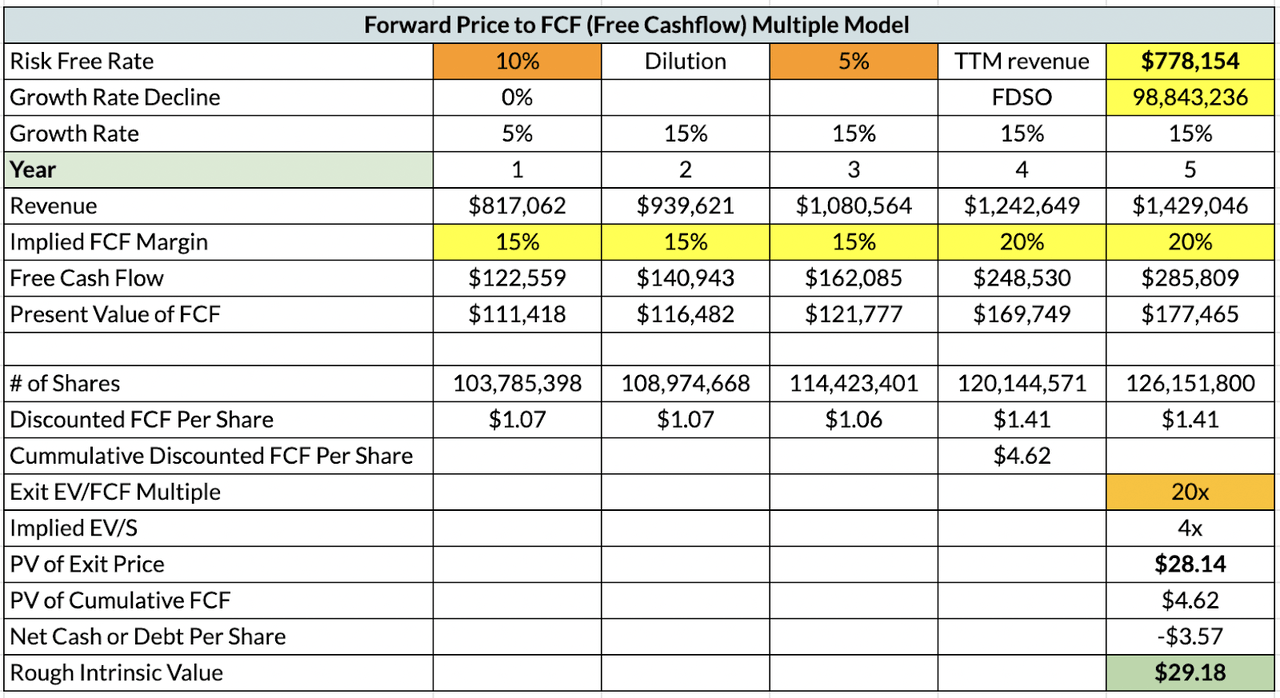

Valuation

APPS IR

I am using the discounted FCF model for my valuation. First, I am implying a 10% risk-free rate (“RFR”), and this is to benchmark against the S&P 500 average annual return. In other words, I am expecting a minimal return of 10% over my course of investment.

Next, in my revenue estimations, I am assuming a 5% forward 1-year revenue. This is taking into account the macro headwinds, slowdown in ODS revenue, and the single-tap revenue coming in from 2H23. Then, I expect a revenue re-acceleration from the second year onwards, with a reasonable growth of 15% CAGR till the end of year 5, with the assumption that more partners are using Single-Tap, M&A integrations are progressing further & therefore generating revenue from cross-selling opportunities, and mobile posse will roll out. Not forgetting, these are margin drivers too.

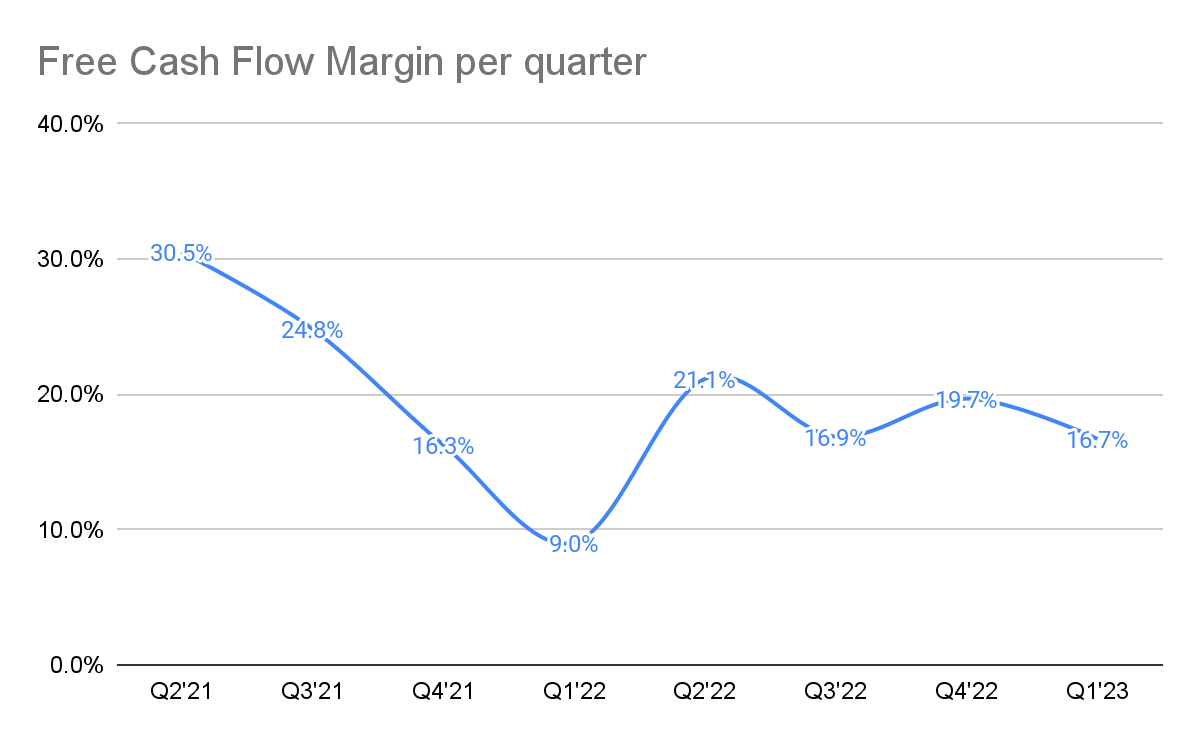

My 16% FCF margin is based on the current non-GAAP FCF margin they are achieving right now, and I foresee increasing over time to 20%. Applying the 10% RFR & a 5% shares dilution gives us the discounted FCF per share.

Then, I am implying a 20x FCF multiple, derived through comparing to peers like The Trade Desk & PubMatic.

Finally, I add in the present value of cumulative FCF per share from year 1 to 4, and net debt per share, this gives us an intrinsic value of $29.18. As of 12 Aug 2022, the current share price is $23.12, indicating that the APPS stock is trading at a fair value.

As valuation is dynamic, at any point in time when the company experiences a higher-than-expected growth rate or achieves a higher-than-reported FCF margin, the valuation will change accordingly.

Till then, I will be monitoring the company’s earnings and progress as I update you through the quarters.

Risks

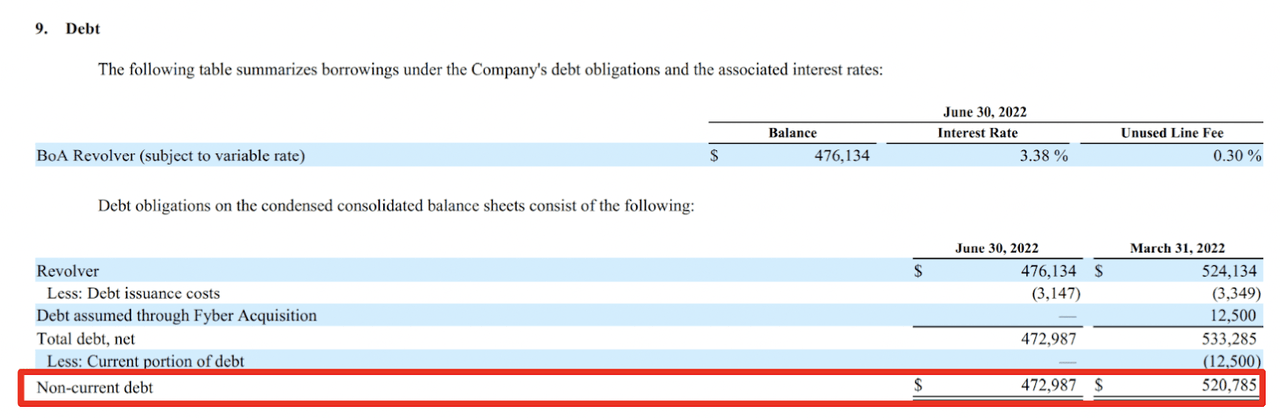

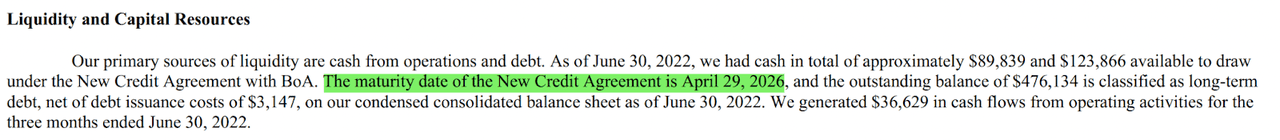

Inability To Pay Off Long-Term Debt?

APPS IR APPS IR

One of the positives of this quarter is that the company has reduced its long-term debt from $520 million in FY22 to $472 million.

Those are paid off using its cash in the balance sheet (from $126 million in FY22 to $86 million in 1Q23) as well as its free cash flow (FCF). With the maturity date at April 29, 2026, looking at the health of its FCF generation is extremely critical in evaluating if they could pay off.

Let’s take a look at it.

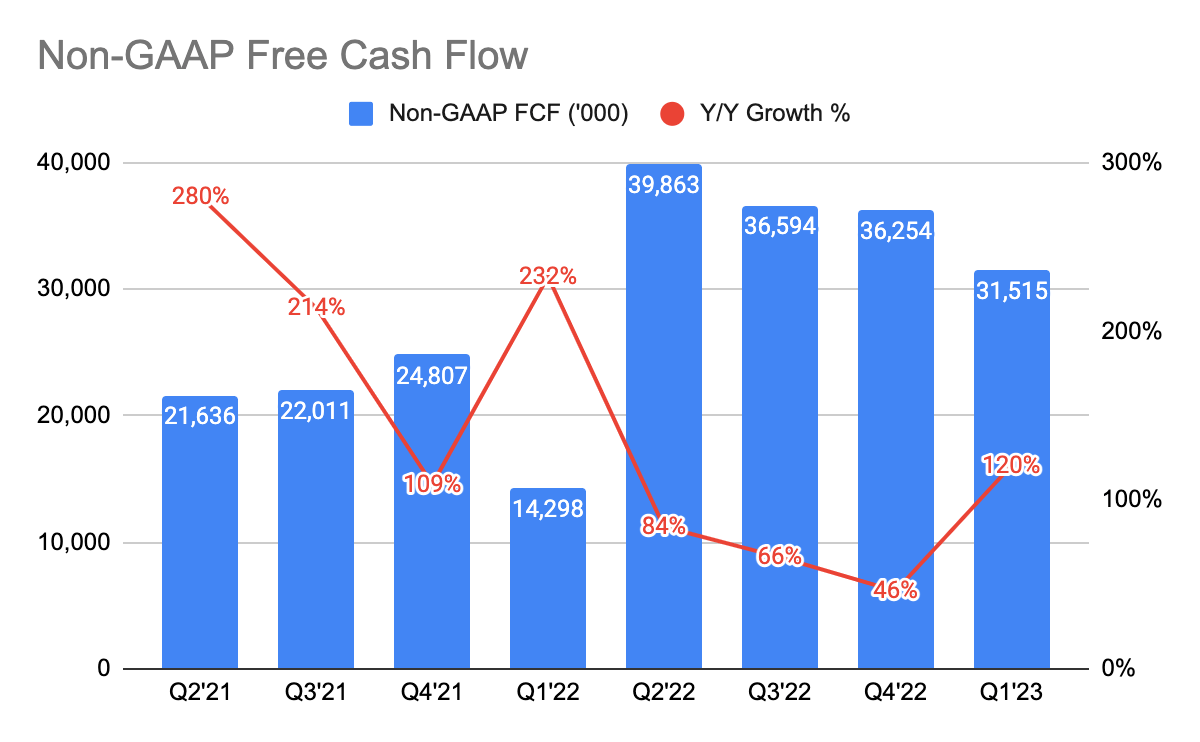

APPS IR APPS IR

Looking at these, the company has been growing its non-GAAP FCF strongly in the past few quarters, with 1Q23 growing at 120% Y/Y. This is inclusive of the FCF from Fyber & AdColony. In terms of FCF margin, it stands at 16.7%.

Given the strong FCF generation and cash reserves, I think that the possibility of paying off the debt is low. But of course, some factors could render the company unable to pay off debt, and one of the risks is if revenue grows slowly, earnings decline, and FCF deteriorates.

Delay In Content Media Revenue

I have been talking about the slowdown in content media revenue, and with the delay in the rollout of mobile posse via AT&T and Verizon due to the shift in customer acquisition strategy, it is important to track whether there is going to be any revenue coming in as provided by the management in the upcoming quarters.

Unable To Create Cross-Selling Opportunities

Digital Turbine is currently handing the back-end integrations of its M&As and it remains to be seen whether they can create cross-selling opportunities between its on-device solutions and the app growth platform. An inability to do so will be a thesis breaker for me.

Unfortunately, CEO Bill Stone did not provide much commentary on the integrations which I certainly hope so too in the next couple of quarters.

Closing Thoughts

In closing, Digital Turbine is faced with multiple macro headwinds, as well as the slowdown in mobile posse revenue, impacting its overall revenue growth in FY23.

However, I do anticipate a growth re-acceleration from FY24 onwards as they make further progress on M&A integrations, thus creating cross-sell revenue opportunities, onboarding new partners, and increasing the spending of partners on Single-Tap, and also achieve the rollout of mobile posse.

Despite the revenue slowing down, management consistently proved that they can grow and manage profitability and cash flow as gross profit, adjusted EBITDA, and FCF are growing strongly.

As per my valuation, Digital Turbine is trading at a fair value, and any further re-acceleration in growth, and thus margin expansion, are further upsides for the company.

While I do acknowledge that there are short-term headwinds (and pain), I do not think the long-term business fundamentals are impaired.

Adage

I thought it’s worth bringing up this graph on how resilient digital ad spending has been over the years. This may be a great opportunity for long-term investors willing to look past the short-term headwinds. However, if you value certainty more and you like to see better execution, you can choose to monitor the coming quarters.

What are your thoughts on this quarter’s results? Let me know in the comments section below.

Be the first to comment