iprogressman/iStock via Getty Images

Thesis

Digital Turbine (NASDAQ:APPS) will report its highly anticipated FQ1’23 earnings release on August 8. We noted in our previous June article that APPS was at a bottom, and its valuation is undemanding. APPS has also recovered robustly from its May/June lows, following the improvement in market sentiments.

Given the massive battering seen in APPS over the past year, we are confident that its June lows should hold robustly. Despite the recent recovery, we believe its valuation is still attractive and should undergird a robust medium-term recovery after lapping its challenging FY22 performance.

Notwithstanding, we believe the market’s de-rating is justified, given the significant deterioration in its near-term profitability due to its dilutive acquisitions, amid the ad spending downturn. Therefore, the reset is necessary for Digital Turbine to prove its outperformance again and lift investors’ sentiments subsequently.

As such, we reiterate our Buy rating on APPS and raise our medium-term price target (PT) to $35 (implying a potential upside of 52% as of August 4).

Near-Term Headwinds From Digital Turbine’s Acquisitions Impacted Its Profitability

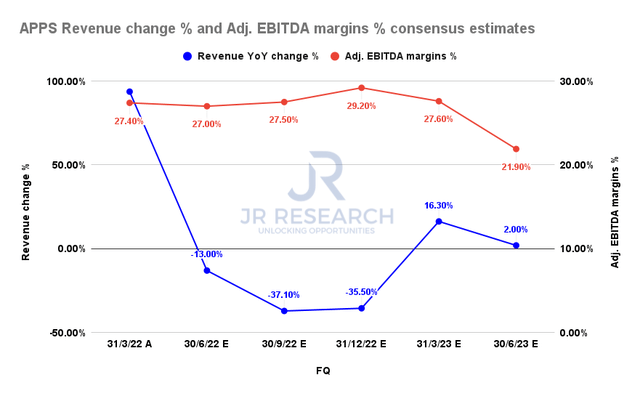

APPS revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

Digital Turbine has also been buffeted by the macro headwinds impacting ad spending in 2022, with sentiments worsened by its revenue restatement last quarter. Furthermore, the recent weak guidance issued by Snap (SNAP) and Meta (META) highlighted the ongoing challenges of mobile display advertising due to the macroeconomic slowdown.

Coupled with its margins-dilutive acquisitions, we believe the market is justifiably concerned about whether Digital Turbine can recover its growth cadence.

However, investors should recall that Digital Turbine is in an enviable position in the ad tech industry, given its unique positioning and relationship with its telco partners. Oppenheimer also highlighted its competitive moat in a recent note following Unity’s (U) ironSource (IS) deal (edited):

This could put Digital Turbine in play as the only other dominant source for on-device presence, as the diversity of data is one of the drivers of the deal. The implied multiple for IS at 4.3x 23E FV/revenue and 13x EBITDA are more than double APPS’s current 2x revenue and 6.5x EBITDA, demonstrating DT’s extreme undervaluedness and attractiveness of its 14% FCF yield. – StreetInsider

As a result, we believe the Street’s estimates (very bullish) on its impending recovery in its revenue growth cadence are credible as APPS laps challenging comps, as seen above.

Competitive Position Is Strengthened, Leading To Higher Medium-Term Margins

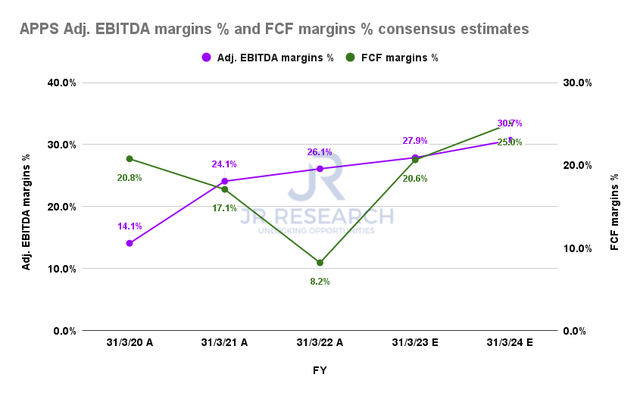

APPS adjusted EBITDA margins % and FCF margins % consensus estimates (S&P Cap IQ)

Notwithstanding, we are confident that Digital Turbine’s recent acquisitions have improved its competitive moat, which should be accretive to its monetization potential.

The consensus estimates also suggest that the company’s profitability margins should recover markedly from FY23 after FY22’s disappointment. Therefore, we urge investors to pay close attention to management’s Q1 commentary to assess whether its medium-term growth trajectory remains intact.

Management also highlighted its strengthened core competencies in the company’s recent rebranding. It added (edited):

Bringing all of our companies together under one brand reflects our ongoing commitment to expanding the value that we deliver to our partners, making it simple for them to use more of our products to drive meaningful business growth. We’ve seen incredible success in customers adopting our full offering. For example, Accuweather is one of many leveraging our platform across app distribution, audience development, and in-app monetization to achieve even greater growth. – Digital Turbine

APPS’ Valuation Is Still Undemanding

| Stock | APPS |

| Hurdle rate [CAGR] | 25% |

| Current market cap | $2.29B |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 6.5% |

| Assumed TTM FCF margin in CQ4’26 | 22.5% |

| Implied TTM revenue by CQ4’26 | $1.77B |

APPS reverse cash flow valuation model. Data source: S&P Cap IQ, author

Despite its remarkable recovery from its May/June bottom, our valuation analysis suggests that APPS’ valuation is still attractive.

We also applied a much higher free cash flow (FCF) yield to test our assumptions and assume a higher margin of safety.

As a result, we are confident that APPS can still meet our TTM revenue target of $1.77B by CQ4’26 if management continues to execute well.

Is APPS Stock A Buy, Sell, Or Hold?

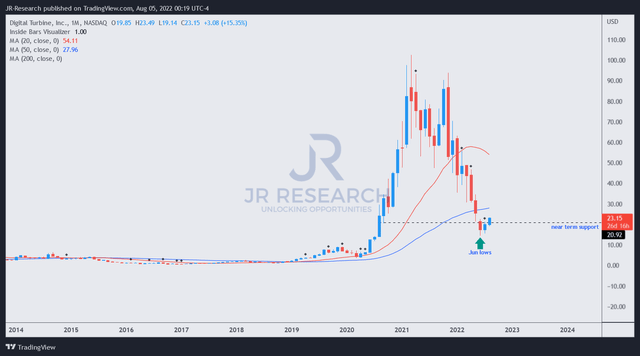

APPS price chart (monthly) (TradingView)

As seen above, APPS traded in line with its long-term support at its June lows. Further selling downside was also denied in July, as long-term dip buyers returned to stanch the selling momentum.

Therefore, we believe the recovery moving forward is sustainable, even though APPS is technically near-term overbought. Given its compelling valuation and improving market sentiments, we are buyers at the current levels.

Accordingly, we reiterate our Buy rating on APPS, with a medium-term PT of $35.

Be the first to comment