omersukrugoksu/iStock via Getty Images

Introduction

The preferred shares with a fixed preferred dividend yield have been feeling the pain of the sudden reversal of the zero interest rate policy and are – in most cases – trading substantially below the issue prices and call prices. This means that most of my preferred share investments I committed to in the past year are showing a capital loss at this point, but I don’t really mind. As mentioned in a previous article, I’m planning to live for a few more decades, and fortunately, I’m in a position I can continue to move cash into my investment portfolio so as preferred share prices fall, I can add more but obviously on the condition the investment thesis has not changed.

I believe this could be a defining moment to invest in income securities offering a reliable and secure income stream as preferred yields are moving into the 7,8,9% territory. That doesn’t mean I’m planning to buy just anything. Unlike the Central Banks I cannot print money in my basement, so I still need to be careful and selective.

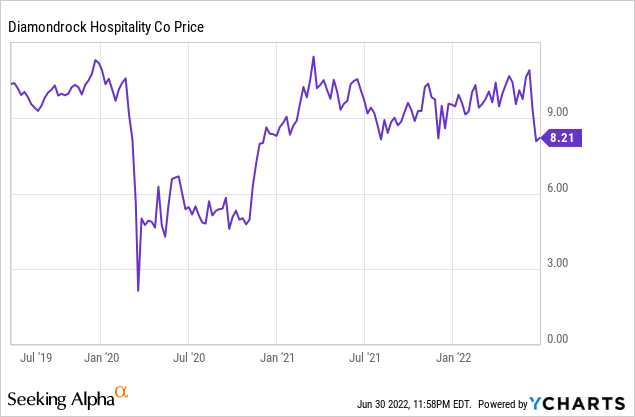

Although I’m not specifically interested in the hotel space, I do enjoy some of the quality balance sheets in the sector while some assets are truly unique. I have had DiamondRock Hospitality (NYSE:DRH) on my list for a while and now tourism is clearly picking up I wanted to see if the REIT’s preferred share issue matches my expectations.

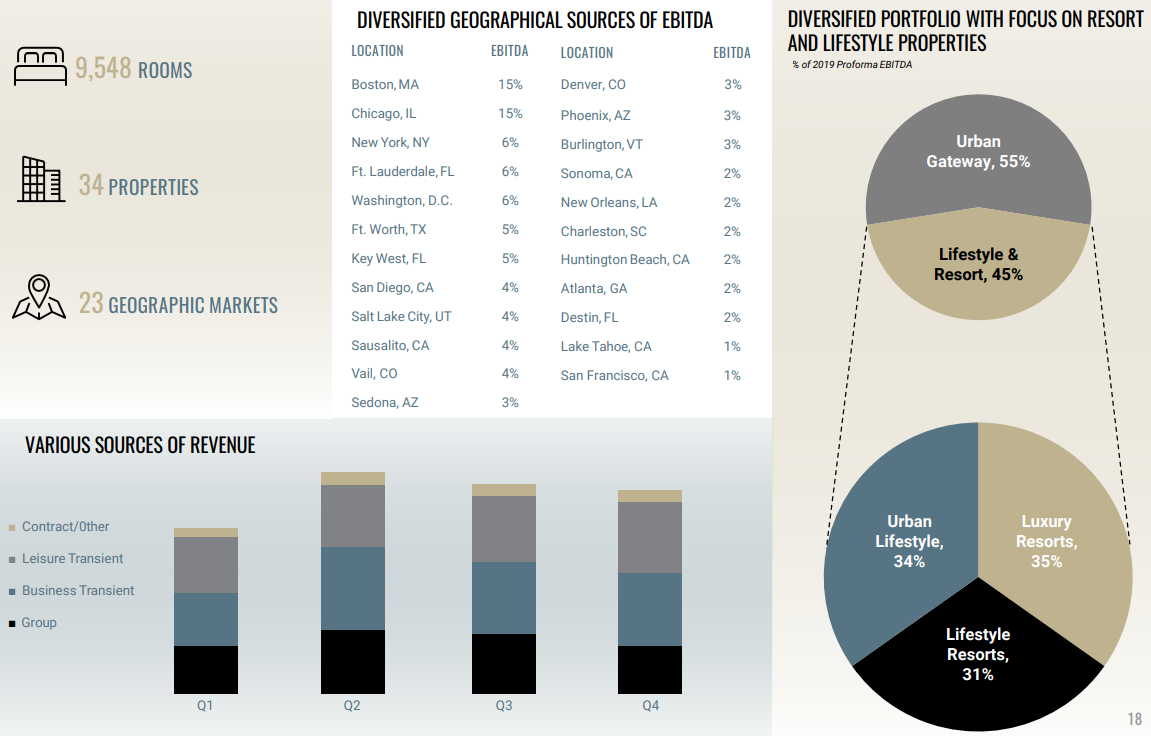

DRH Investor Relations

Tourism is back, and DRH should perform well this year

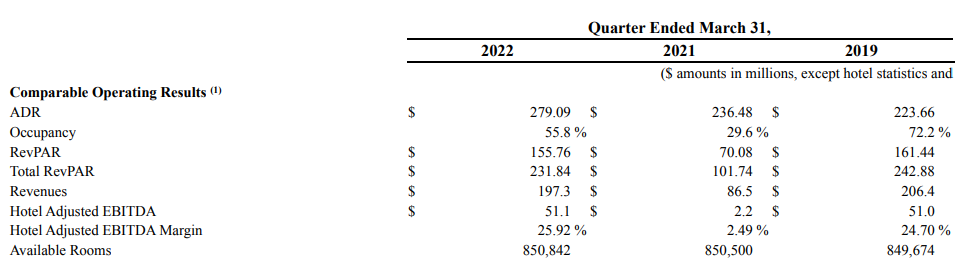

There was a very noticeable uptick in both the ADR as well as the Revenue per Available Room in the first quarter of this year compared to the same period last year. That shouldn’t be a surprise but it’s perhaps a good idea to dive into this as this will help to put the results into a better perspective.

DRH Investor Relations

As you can see in the image above the average daily rate increased substantially both compared to Q1 2021 as well as Q1 2019, the pre-COVID year. While the occupancy levels aren’t back at the 2019 levels yet, it’s important the RevPAR is getting close to the Q1 2019 level mainly thanks to the higher ADR. It’s important to keep in mind the Q1 FFO and AFFO are based on an occupancy level of just 55.8%, that’s definitely something to keep in the back of your mind.

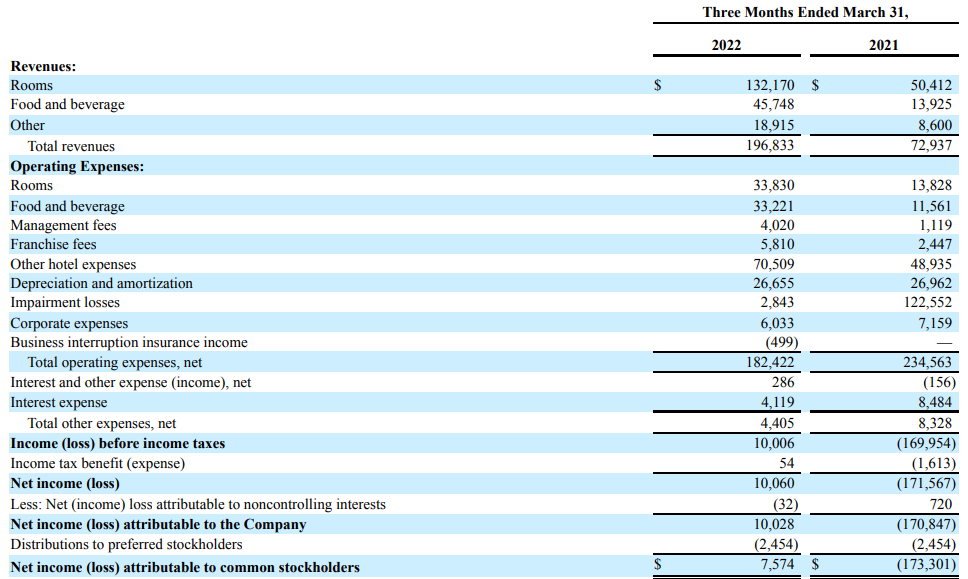

The total revenue almost tripled to just under $200M and DRH was even profitable: The bottom line shows a net income attributable to the common shareholders of approximately $7.6M which is $0.04/share.

DRH Investor Relations

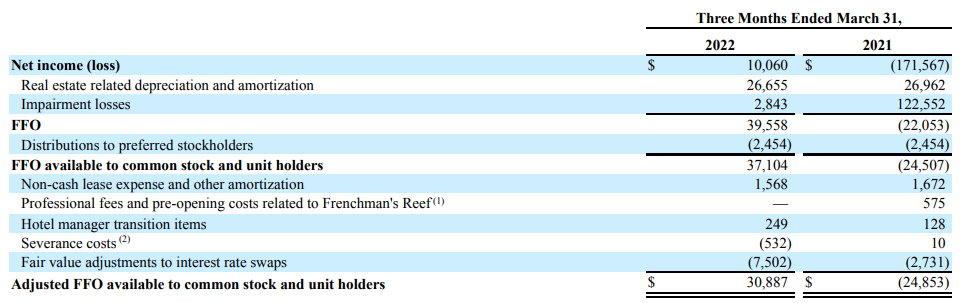

Not exceptionally impressive, but it doesn’t have to be: When you’re looking at REITs, the FFO and AFFO are much more important than the net income as the latter includes the (non-cash) depreciation and impairment charges.

By adding back those expense, we see the FFO available to the common unitholders is approximately $37.1M while the AFFO came in at just under $31M.

DRH Investor Relations

As there are just under 211M shares outstanding, the AFFO/share was just under $0.15. Not bad at all given the occupancy level in the mid-50s and travel only really picking up again in the current quarter. DiamondRock expects to be in a position again to pay a dividend from the current semester on. Before COVID hit, DiamondRock was paying $0.50 per share per year in dividends.

There’s only one series of preferred shares outstanding

DiamondRock has only one series of preferred shares outstanding so that makes the decision interesting: It either is a “go” or “no go.” The series A preferred shares are cumulative issue, offering an annual preferred dividend of $2.0625 per preferred share paid in four quarterly installments. The securities can be called from Aug. 31, 2025, on, which means that investors buying the security today can look forward to at least 13 quarterly payments.

Two elements matter to me when I look at preferred shares. The dividend coverage level and the asset coverage level.

Let’s start with the dividend coverage level. That’s an easy one. We know the Q1 AFFO was just under $31M and this already included the almost $2.5M in preferred dividend payments. This means the AFFO excluding preferred dividends was almost $33.5M which means the REIT only needed less than 8% of its AFFO to cover the preferred dividend. Even in 2021 the preferred dividends were fully covered by the AFFO and 2020 was the only year in the recent history where the preferred dividends would not have been fully covered. But let’s hope we won’t experience more years like 2020 was.

So, the DiamondRock preferred shares pass my dividend coverage test. Let’s have a look at the balance sheet.

DRH Investor Relations

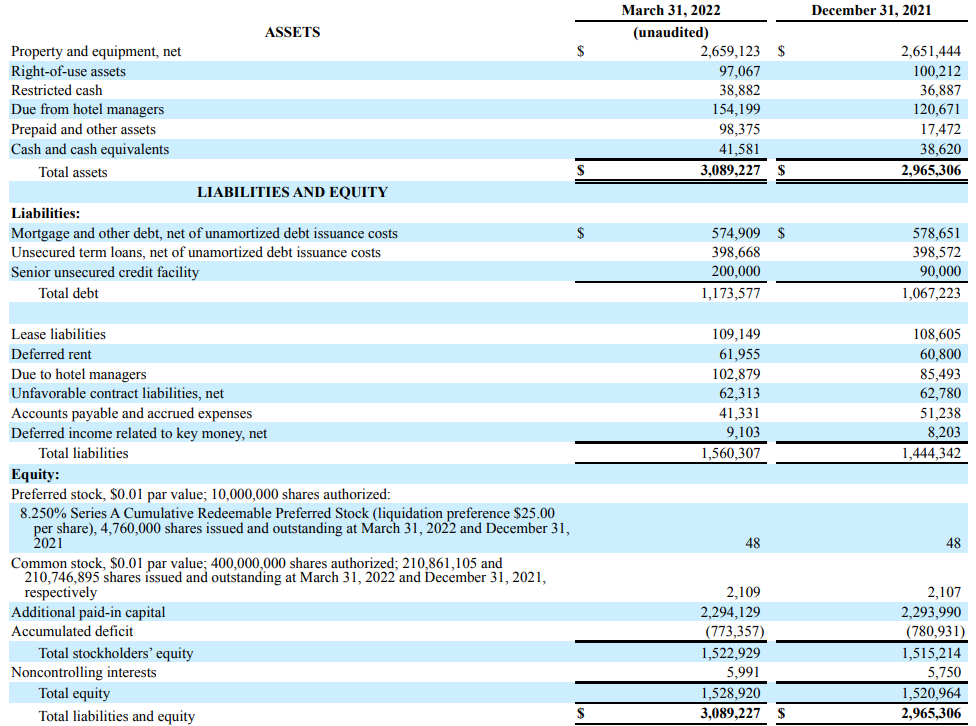

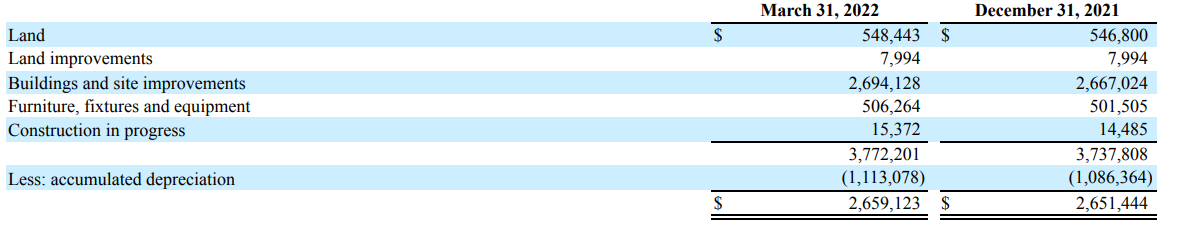

We see the balance sheet contains in excess of $3B in assets while the net debt comes in at approximately $1.13B (this excludes the restricted cash). Based on the book value of $2.66B, the LTV ratio is approximately 42%. That’s pretty low but keep in mind the $2.66B in book value already includes a substantial amount of accumulated depreciation. According to the footnotes (below), a total of $1.1B has already been depreciated.

DRH Investor Relations

Even if we would assume the furniture and equipment has zero value but the land and buildings still have the same value as the purchase value (I’d dare to argue in some cases the fair value will be higher than the purchase value), there’s about $600M in “hidden” assets on the balance sheet.

There are 4.76M preferred shares outstanding for a total value of $119M. Not only does this represent a fraction of the $1.52B equity value, if we would increase said equity value with the likely “hidden value” on the balance sheet, the asset coverage level would be excellent with in excess of $2B in capital ranking junior to the preferred shares. Another important fact here would be that 25 of the 33 hotels in the portfolio are unencumbered by mortgages. So DiamondRock should easily be able to access more liquidity if it needs to.

Investment thesis

Given the relatively small issue of the preferred shares and the rapidly improving financial performance of DiamondRock, it’s not unlikely the REIT will call the preferred shares in 2025. After all, if it returns to a $0.50 dividend, it can easily hoard enough cash between now and the 2025 call date to just simply repay the preferred shares using the cash it retained (assuming no global crisis will hit the hospitality sector again). Calling the preferred shares would increase the FFO and AFFO per share by almost 5 cents per year.

The preferred shares are currently trading at $25.65 which gives them a yield of 8.04%. However, I think it would be safer to use the “yield to call” here given the likelihood DiamondRock may call the preferreds. The yield to call is 7.34% which still offers an interesting risk/reward ratio.

Be the first to comment