olaser/iStock via Getty Images

Sometimes finding good returns requires a lot of work and parsing through tons of data. At other times, all it requires is a dose of common sense and putting aside the silly notion that the market is always right. Our last call on the popular funds definitely fell into the latter category.

The Funds

Flaherty & Crumrine have five closed end funds and they unfortunately have named them with less passion than what they apply to their management.

- Flaherty & Crumrine Dynamic Preferred and Income Fund (NYSE:DFP)

- Flaherty & Crumrine Preferred Income Fund (NYSE:PFD)

- Flaherty & Crumrine Preferred and Income Securities Fund (FFC)

- Flaherty & Crumrine Total Return Fund (FLC)

- Flaherty & Crumrine Preferred Income Opportunity Fund (PFO)

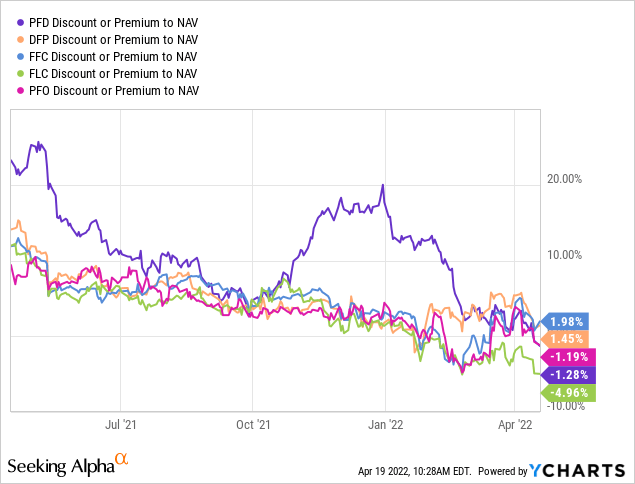

The funds are even more similar in what they hold, than their names imply. Over time, their NAVs tend to move in almost identical manner. When we last covered them, we identified why perhaps some were outperforming to a slight extent. We did however leave you with one incredible free lunch.

No, the free lunch for you my friends is here. PFD trades at a 12.7% premium to its NAV. Selling PFD and jumping into any of the rest is a free lunch. Bon Appétit.

Source: Where Is My Free Lunch?

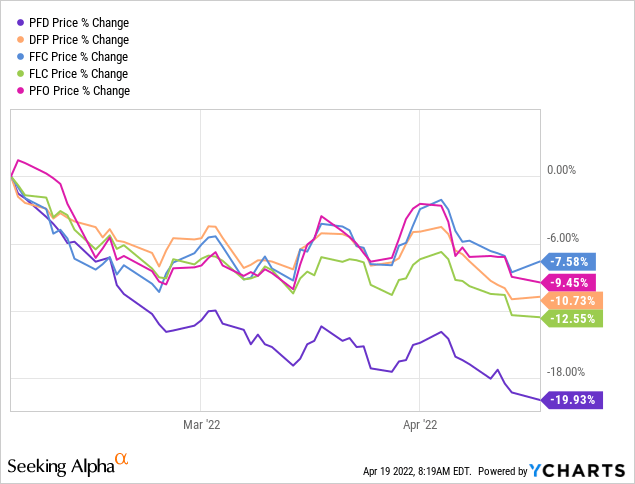

In the midst of a good selloff in fixed income, how did our bold call fair?

It did pretty well, if we might say so ourselves. PFD got shellacked and lost about 10% more, than the average of the other four funds. In other words our call provided you with a simple 40% annualized “alpha” for free with zero requirement for Pepto-Bismol. Now let’s look at where these funds stand today and whether you might want to start buying any of these.

The Macro Outlook

Our contention has been for some time that bond yields would have to rise. That was one of the easiest calls to make as the price for being wrong was little to nothing. If we did not indulge in the stupidity of holding a 10-Year Treasury bond when it yielded 0.5%, our maximum opportunity cost was zero. We don’t mean this figuratively. We mean this literally as all the popular actively managed bond funds have expense ratios in that neighborhood. So mathematically there was a zero chance that if you bought and held any of the funds promoted by the popular deflation cheerleaders (and we won’t name names) you would make money. We only could be superbly right (which we were) or not wrong.

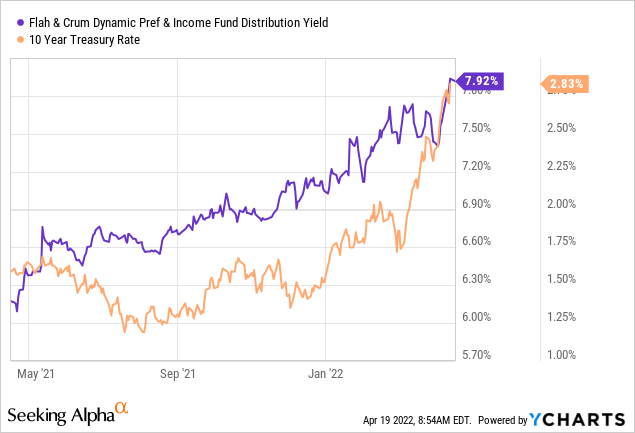

As this call has played out, the distress in the preferred shares and junk bonds has started to show. Below we have compared the distribution yield on DFP to that of the 10-Year Treasury yield.

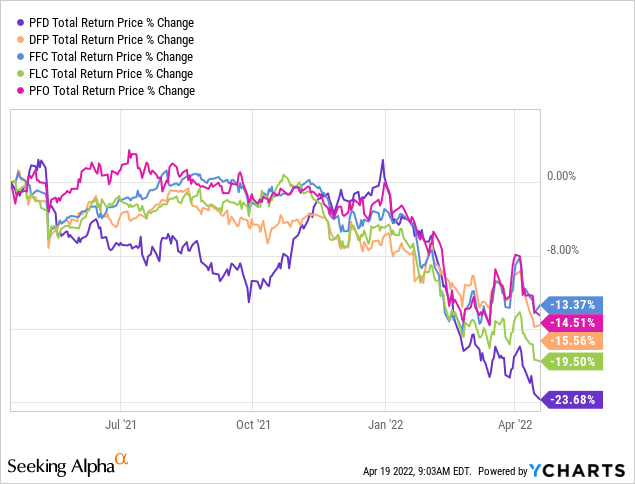

The risk free rate moving up tends to push up everything else, quality notwithstanding. For example, Granite REIT (GRP.U) issued bonds in 2020 at a 2.378% yield. These mature in December 2030. In the last two years the value of GRP.U’s properties has only gone up. Their performance has been spectacular. There is now less time left to maturity than when the bonds were issued. Yet this $100 par value bond trades at $83.30 and now yields over 4.55% to maturity. So the price decline on all five of these funds was pretty predictable. Your one-year total return, which includes all your “I can see nothing but my dividends”, was between negative 13.37% to negative 23.68%.

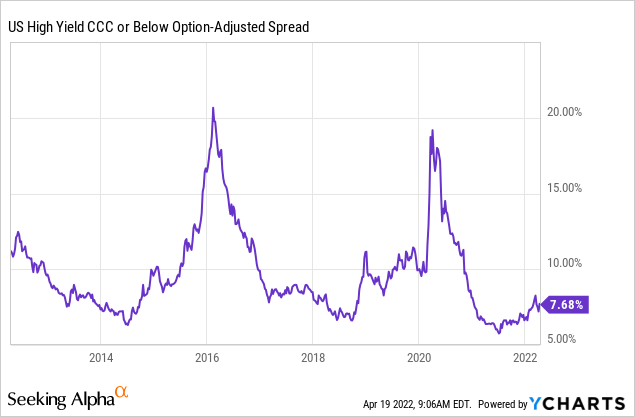

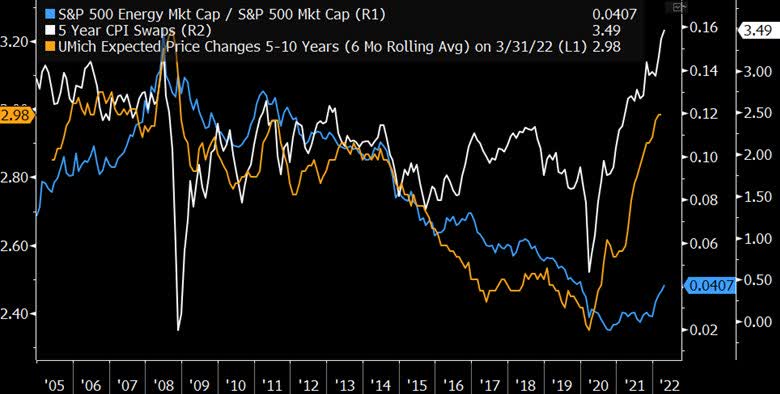

At this point the risk has diminished from the movement in the 10-Year Treasury rate. After all, it is extremely unlikely that the 10-Year rate moves up another 160 basis points in the next year. The risk has however not diminished from a credit stand point. We use a wide variety of indicators to gauge stress in the credit markets and if we are to break the inflation run, we will need this one below for example, to move closer to 10%.

Now you might argue that the Fed has already telegraphed its tightening and things are likely to ease up. In our opinion, this is just a wishful fantasy. Inflation break-evens and 5-Year CPI Swaps, both of which measure the extent of the inflation mentality, are actually rising despite the most hawkish stance by the Federal Reserve.

Inflation Expectations (Bloomberg)

Why is that? Well for one, the Fed is so far behind the curve that all that hawkish talk amounts to very little.

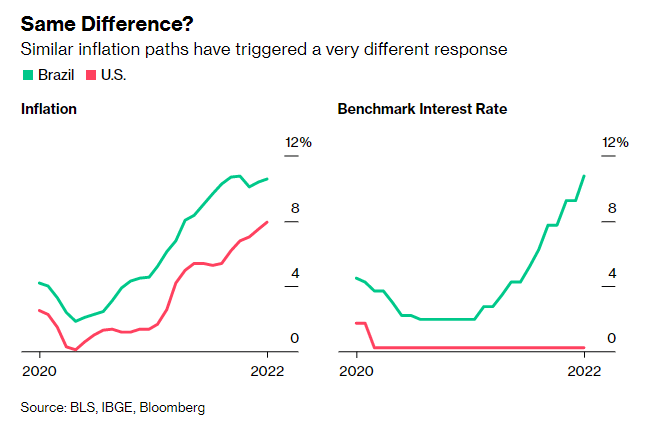

Brazil Vs US, A Tale Of Two Central Banks (Bloomberg)

If they have to salvage any credibility here they will have to break things and that means more tightening than you have so far envisioned.

Verdict

The five funds remain on our radar for a buy, even though they don’t fare very well on our proprietary Kenny Loggins Scale.

Kenny Loggins Danger Zone Scale (Trapping Value)

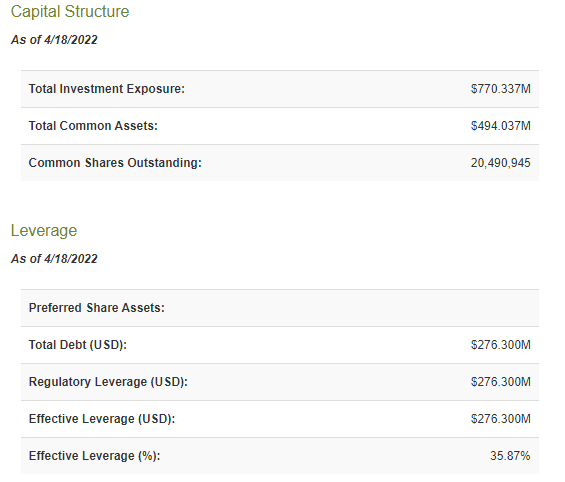

This rating signifies a 50%-75% probability of distribution cut in the next 12 months. As borrowing costs rise and some fixed to float rate preferred shares reset lower (despite rising rates) there will be pressure on spread income. There is also pressure from maintaining constant leverage when prices are falling. The only way to do that is by selling preferred shares at progressively lower prices. We can see that in DFP’s case, total assets are 55% higher than common assets of $494 million.

DFP Leverage (CEF Connect)

We prefer that measure of leverage rather than the 35.87% shown. So when total assets drop by 10%, thanks to weakening price, leverage rises from 55% to 66% ($693/$417). In order to keep leverage constant, the fund has to sell $46.65 million of assets. There will be a lot more of this coming and hence we are still staying away from leveraged closed end funds, even though we are now finding attractive individual preferred shares. If you still have a bullish bent, well we have another free lunch for you. FLC is really cheap compared to the rest and that is the one we would buy, if we had to.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment