yangphoto/iStock via Getty Images

Article Thesis

Devon Energy Corporation (DVN) has rallied by a massive 190% over the last year, and yet, shares are not particularly expensive — the combination of a massively better outlook due to the recovering oil price, and the ultra-low valuation one year ago mean that Devon does not look pricey today, even following this gain. In 2022, important factors include the oil price trajectory — with potential for further huge gains — and Devon’s actions, e.g. when it comes to deploying cash in a way that creates shareholder value. Overall, Devon Energy Corporation looks like a reasonable investment at current prices, I believe.

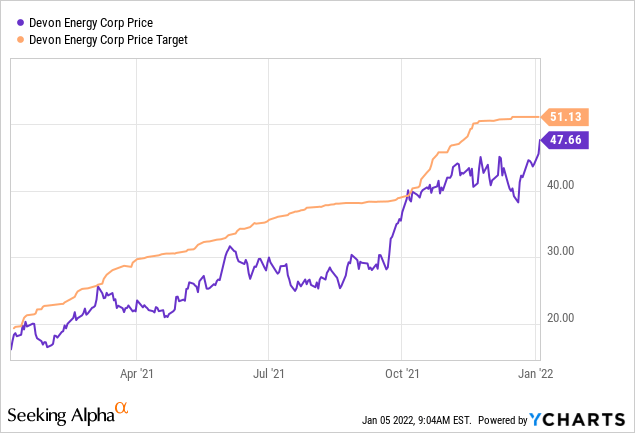

Devon Stock In 2021

2021 was a banner year for Devon Energy Corporation, that is true. The company was, in fact, the best-performing stock in the entire S&P 500 index. No high-flying cloud computing company, no electric vehicle player, or promising biotech company in the index performed as well as Devon Energy — which is surely surprising to some, as many had claimed that oil/energy would not be a strong investment ever again. Devon Energy Corporation has, however, delivered returns of close to 200% in 2021, thanks to tailwinds from rising oil prices, earnings growth, and due to the fact that DVN had entered 2021 with a very low valuation.

Devon has not reported its Q4 results yet, so we don’t have final results for the last year. We can, however, look at the company’s Q3 report in order to get a rough estimate where the company has gone in 2021.

Source: Seeking Alpha

Devon Energy delivered strong results in basically every metric. Revenue exploded upwards, rising more than threefold, while the company also easily beat earnings estimates as analysts had predicted significantly lower profit levels. Free cash flow generation, which is needed for deleveraging and for shareholder returns, rose 700% versus the last quarter of 2020, and Devon boosted its cash balances significantly.

These strong results allowed Devon Energy Corporation to raise its shareholder payouts tremendously. The company employs a fixed-plus-variable dividend policy, the payout for the most recent quarter — Q3 2021 — totaled $0.84 per share. That makes for an annual payout of $3.36, which would translate into a dividend yield of 7%. It is, however, important to note that this dividend is not set in stone. Depending on future earnings performance, future dividend payments could be significantly lower again — the variable portion of the dividend is not set in stone at all. Still, the hefty payout for Q3, at close to 2% for a single quarter, shows that Devon Energy is ambitious when it comes to rewarding its shareholders when the times are good. For someone that bought shares around $15 in early 2021, the Q3 dividend alone equated to a 5.6% cash on cash return for a single quarter, proving again what a great investment Devon had been at the beginning of 2021. Devon Energy being a great investment in early 2021 does not equate to it being a great investment today, however, thus investors need to consider what the outlook from the current level looks like — another 190% share price gain from current prices seems very unlikely.

What Is Devon Energy’s Stock Price Target?

Looking at current analyst consensus estimates, we see that shares have some upside potential:

Analysts are currently seeing a share price of $51 as appropriate, which pencils out to price appreciation potential of around 7% in 2022 (share price targets are usually given with a 12-month time horizon). Adding the dividend, which we can’t forecast exactly due to the variable nature of the payout, 10%+ annual returns seem achievable. Analyst estimates do not reflect the potential for a huge increase in oil prices yet, however, and factor in a relatively undemanding valuation. Based on current earnings per share estimates for 2022 (the consensus stands at $5.20), Devon Energy is trading at just 9x forward net profits. If its earnings multiple climbs to 10, which would still be far from pricey, shares would trade at $52, pretty close to the current consensus price target. Even an earnings multiple of 11 would not seem high, in this case, shares would have upside potential of around 20%, to $57. Some commodity analysts, e.g. from JPMorgan (JPM), forecast that oil could run to $125 this year, from a current level of slightly below $80. In that case, profits for Devon Energy Corporation, as well as for all of its peers, would soar well above current estimates. Soaring profits and cash flows would, in turn, allow for faster deleveraging, higher shareholder payouts, and would thereby likely attract many more investors. In this case, Devon and other energy stocks could have an excellent 2022. Importantly, however, a huge increase in oil prices is not required for Devon Energy Corporation to be a solid investment. Even if oil prices stay around current levels of around $80 per barrel, Devon Energy will be highly profitable and could, I believe, easily deliver 10%+ returns this year, thanks to its dividend policy that will likely lead to an attractive payout.

DVN Stock Forecast For 2022

The actual performance does depend, as noted above, on the oil price trajectory, while other factors, such as broad market sentiment and interest rates, play a role as well. If oil prices were to drop sharply, so would Devon’s stock, but I do believe that this is not very likely. Global economies are opening up, international travel will make a big return in 2022, I believe, and at the same time, OPEC is having problems when it comes to raising production volumes in line with stated goals. The combination of climbing demand, dropping inventory levels, and reluctant output growth is positive for oil prices, which is why I do believe that there is a high likelihood that oil prices will either stay at current levels or climb further, whereas I believe that the likelihood of a falling oil price is low. Devon has a good chance of delivering 10%+ returns this year, through dividends and some share price appreciation, if oil prices are flat. At the same time, DVN has more upside potential if oil prices rise further, which is why I believe that overall, the outlook for the current year is pretty solid. A return like what we saw last year is highly unlikely, however, as that was an absolute outlier year. Even 10% or 20% this year would be quite attractive, however, considering that equity markets do usually deliver returns in the 7%-10% range annually.

Is DVN Stock A Buy, Sell, Or Hold?

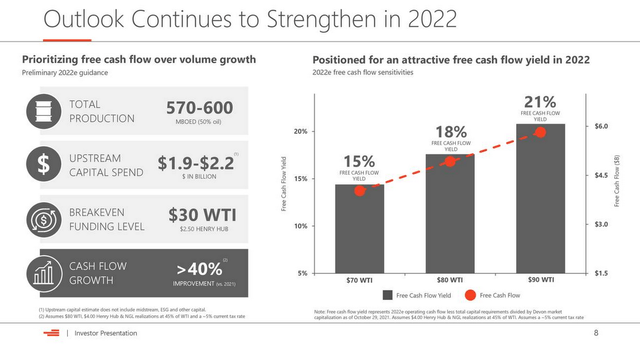

Devon is a well-positioned energy company with attractive assets in the Delaware Basin. Thanks to low break-even costs, the company has turned into a highly profitable company generating strong cash flows, even after paying for capital expenditures:

Source: DVN presentation

Devon guides for production of close to 600 million barrels of oil equivalent per day this year, on the back of around $2 billion of capital spending. With operating cash flows soaring this year on the back of higher oil prices — oil was way cheaper in early 2021, compared to today — the company aims for huge free cash flows. With WTI at $80, which does not make for an especially aggressive target for 2022, I believe, due to the aforementioned oil demand recovery, DVN will generate an 18% free cash flow yield, based on its market capitalization at the end of October. Its share price has risen since then, which is why the FCF yield with oil at $80 will be around 16% per my calculation. This is still highly attractive, and will allow for a combination of further debt reduction and attractive dividend payments. Devon Energy will also have ample cash for share repurchases — the current program worth $1 billion covers a little more than 3% of the share count. If oil prices were to climb above $80, which is definitely possible, I believe, free cash flows could rise further, which would allow for higher dividends, even more aggressive deleveraging (which isn’t really needed), or more buybacks. Either way, DVN seems well-positioned for the current year.

The company currently has around 350 wells online, and owns a large inventory of around 4,000 derisked locations. Depending on how exploration projects turn out, management believes that the inventory could rise by more than 2,000 additional locations going forward. This makes for an attractive asset base that should allow Devon Energy to produce oil at current production levels for at least another decade, and possibly much more. It should also be noted that a further increase in oil price levels would make more locations economically attractive, thereby increasing Devon Energy’s reserves further. Most of those assets are located in the Delaware Basin, but DVN also has been expanding its footprint in the Anadarko Basin, where its partnership with Dow (DOW) is poised to generate growth opportunities without a need for heavy investment on Devon’s side.

All in all, I do believe that Devon Energy is a solid investment at current prices, trading at an undemanding valuation (the enterprise value to EBITDA ratio stands at just 5.0) and offering the potential for highly attractive shareholder returns. Massive share price increases like what we saw in 2021 will not repeat, but DVN still has upside, especially if oil prices continue to rise — which is not guaranteed, but which is also, I believe, not unlikely.

Be the first to comment