kynny/iStock via Getty Images

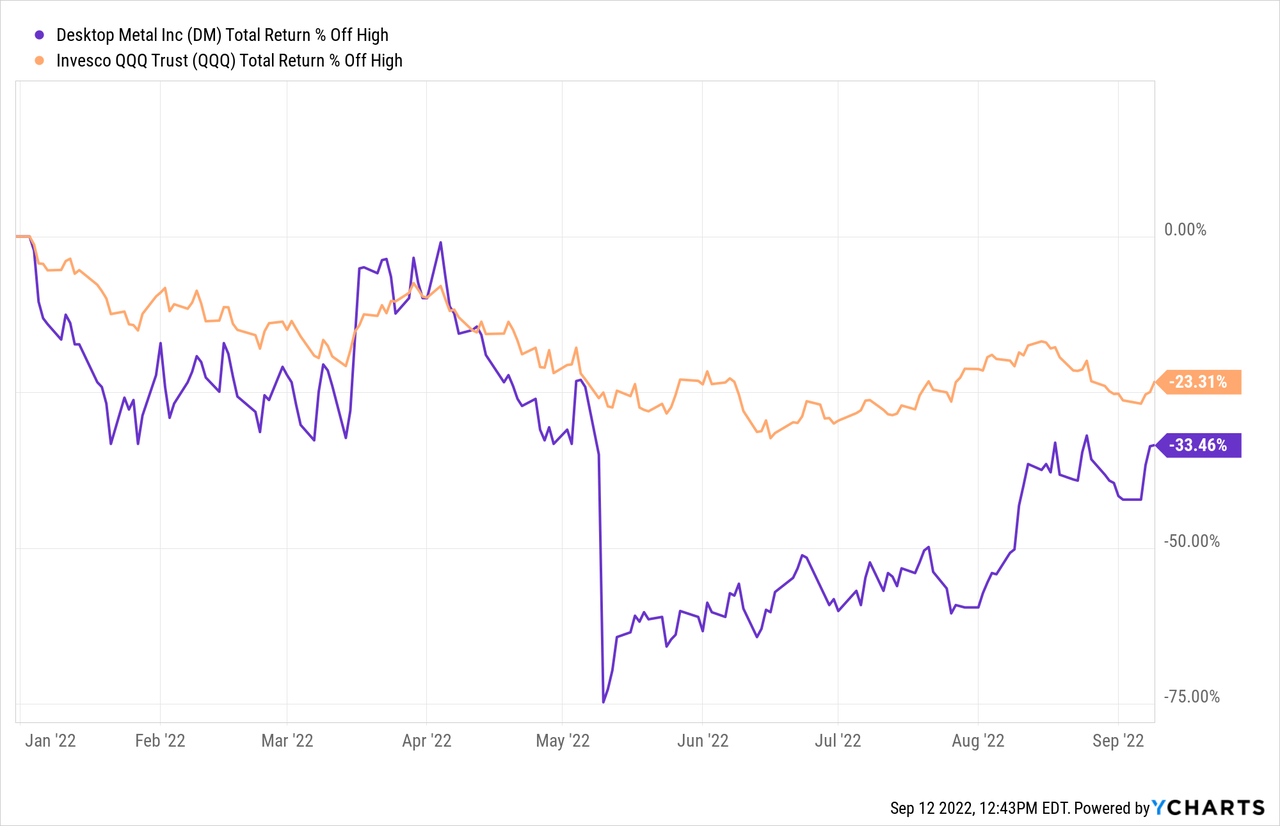

In our last article, we explained why Desktop Metal (NYSE:NYSE:DM), despite some problems, should still be considered a buy. Since the publication of that article, shares of Desktop Metal have risen a whopping 133.57% in just 4 months.

Today, we discuss why the recovery is not over yet, and why there is still tremendous upside potential for the stock.

A Tremendous Crash & Recovery In DM Stock

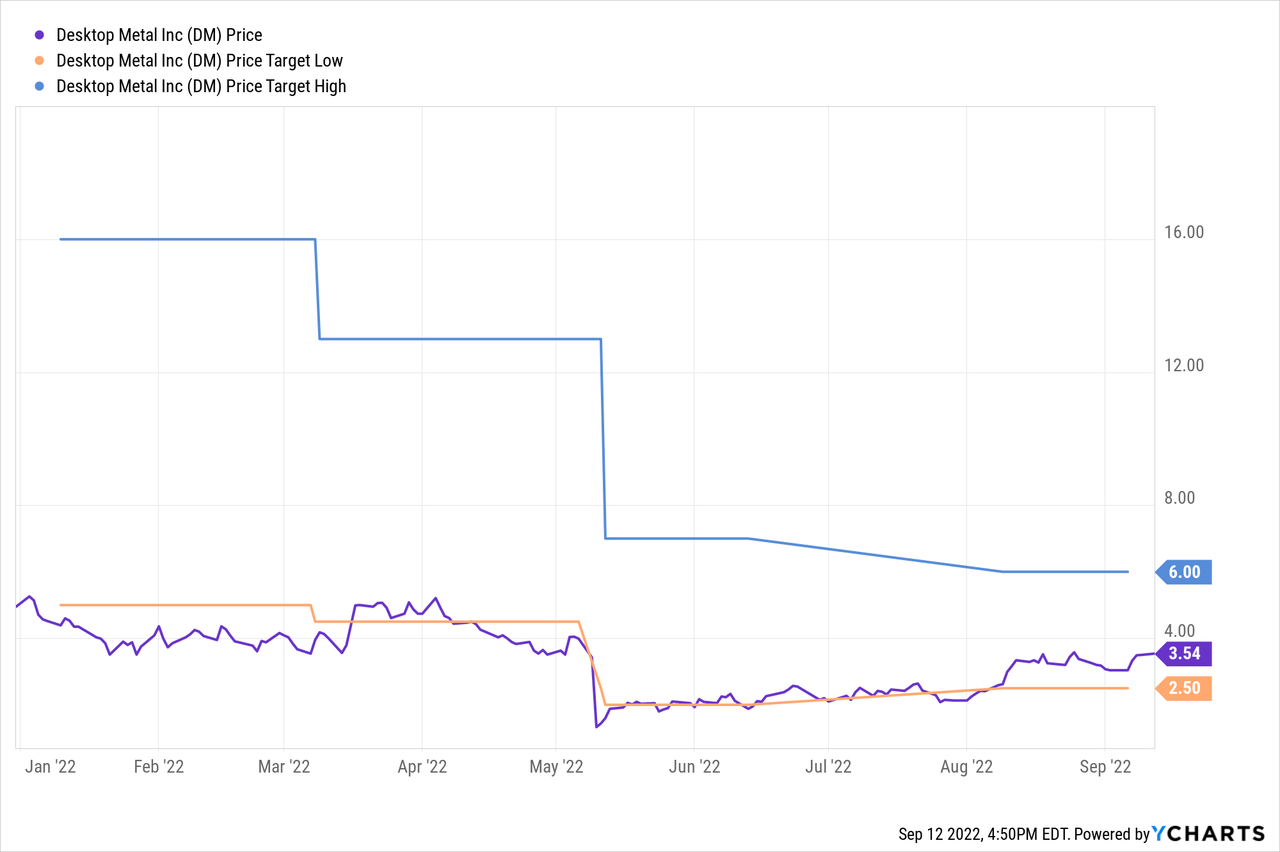

On May 10, Desktop Metal shared news that so alarmed investors that the stock plunged by as much as 61.1% in 1 day. This came after the company reported earnings figures for the first quarter, which were more or less in line with expectations, but also announced a US$100 million convertible senior notes to free up more liquidity as the economy faces tough times.

This was followed by some better news for investors in June, when Desktop Metal announced that it would implement a “cost optimization initiative” that is expected to save the company at least US$100 million in costs over the next 24 months. Which reassured investors, knowing that Desktop Metal is serious about limiting dilution and providing profits for its shareholders.

It is estimated that this workforce reduction will reduce 12% of the workforce to improve operational efficiency, along with other actions. This program is expected to generate cost savings of US$20 million in the second half of 2022, and has already provided margin improvements that were seen in the recent second quarter results, which we will discuss in the next segment.

Currently, the stock has recovered to pre-first quarter levels, following a number of other positive signs and improvements announced at the company.

Positive Signals & Q2 Results

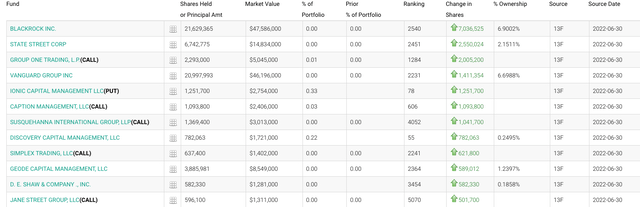

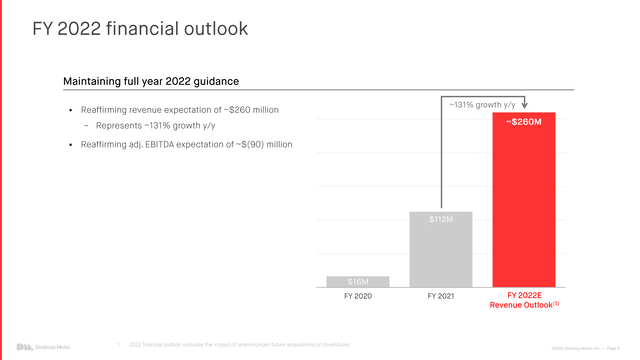

Since Desktop Metal’s crash, institutions have been gobbling up Desktop Metal shares because they probably believe the same story we do: we’ve had an overreaction, and Desktop Metal is too cheap to ignore with a price to tangible book value of nearly 1. Especially when you consider that Desktop Metal is on track to earn US$260M in FY2022.

Desktop Metal Institutional Buys (WhaleWisdom)

BlackRock acquired more than 7.03M shares, with State Street buying 2.55M more, and Vanguard buying US 1.4M more shares. Other firms such as Group One Trading, in addition to Caption Management, Susquehanna International, Jane Street, and Citadel bought calls.

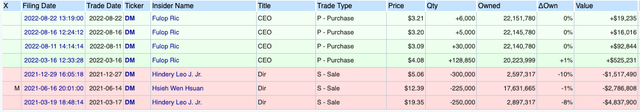

Not only institutions, but CEO Ric Fulop bought some more shares between mid-March and a few weeks ago, totaling US$653K, showing his confidence in the company and backing up his claims with his own capital.

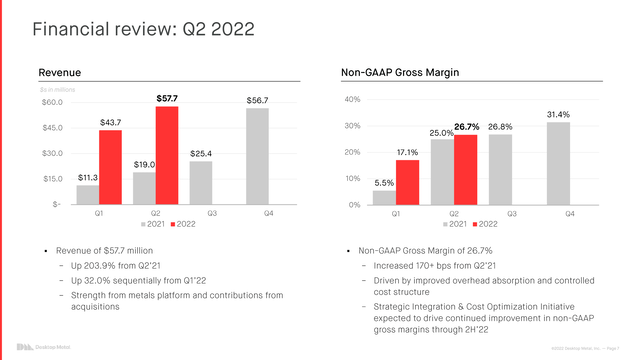

As for Q2 results, Desktop Metal managed to deliver on its promises to reduce operating costs, increase margins, and maintain revenue growth. They generated US$57.7M in revenue in Q2, giving them an annual revenue of US$230.8M. However, according to their latest earnings call, they still expect to reach the US$260M annual revenue target by the end of the year.

There is a huge difference between GAAP and non-GAAP reported earnings, though, mainly due to goodwill impairment totaling $229.5 million, a one-time expense. They also correct for almost everything else, including share-based compensation, acquisition-related costs, restructuring charges, and more.

Compared to the first quarter, revenues increased 32% and gross margins rose to 26.7%, after falling to 17.1% in the first quarter of 2022. In addition, they also announced that they received a subcontract from the Department of Defense, worth a potential US$15M.

Recession & Risks

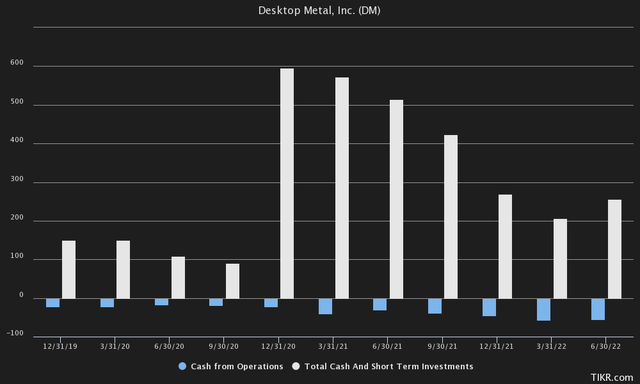

In terms of risks, Desktop Metal is still exposed to numerous risks, especially financial. They currently have US$255.7M in cash and short-term investments, despite a negative cash flow from operations of US$54.8M in the last quarter. Although they have raised US$100M in senior notes, they are currently only funding 2 quarters of cash burn with that.

This also means that Desktop Metal is only expected to be able to survive 4-5 quarters with its current liquidity, unless operating expenses drop quickly and significantly. We believe this puts Desktop Metal at serious risk of a capital shortfall while the Fed raises interest rates and is expected to keep them high. If Desktop Metal were to issue more debt, it could also become very expensive in terms of interest payments when interest rates will rise sharply.

However, Desktop Metal’s CFO mentioned in the latest quarterly call that their current cash balance combined with their cost optimization initiative gives the company enough room to achieve break-even cash flow.

We also see a number of red flags, such as excessive use of TAM (Total Addressable Market), and management’s overly optimistic outlook combined with excessive adjustment of GAAP measures, which may misrepresent what the company is actually performing.

Finally, management’s latest earnings call also failed to account for macro or supply issues, which are very likely to occur, in their outlook to reach US$260 million in revenue for fiscal year 2022.

The Financial Picture Of Desktop Metal

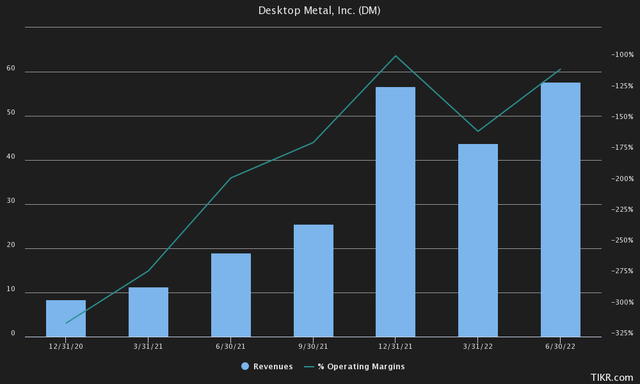

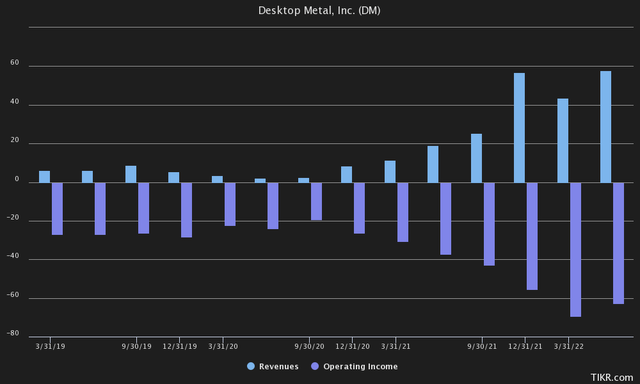

Looking at the financials, we saw very significant improvements in terms of operating margins. In terms of revenue growth, Desktop Metal was also able to live up to its claims of strong growth, by more than 26x compared to the same quarter two years ago. In comparison, operating income only multiplied by 2.6x.

The team expects the growth to continue, while at the same time reducing operating costs, reinforcing the path to profitability. We also believe they have a good point in their latest earnings call, telling us that they are deleveraging their stocks, which amount to US$88.6M as we enter a period of monetary tightening and a possible recession.

If stocks continue to rise, and we enter a recession, it would mean that margins would have to be squeezed significantly to get rid of stocks, which would further worsen their cash position and path to profitability. This inventory drawdown instead of the inventory build-up we were used to seeing could also lead to lower cash outlays and an easier path to cash flow profitability.

Management is also sticking strongly to its promises to maintain its FY2022 guidance of US$260M in revenue, coupled with leaving 2023 as EBITDA breakeven, on an adjusted basis. This quarter, the company reported an adjusted EBITDA loss of US$27.5M, despite US$54.8M in cash loss from operations, meaning they are unlikely to reach break-even cash flow until 2024 or later. For 2022, Desktop Metal expects adjusted EBITDA of -US$90M.

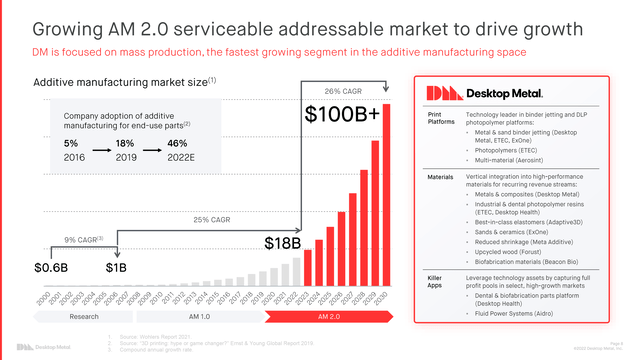

Desktop Metal’s long-term goal is to capture double-digit market share in the Additive Manufacturing industry, which is expected to reach more than $100 billion by 2030. If they succeed, they would generate more than $10 billion in revenue.

At an industry average of 2.97x Price to Sales, that would give Desktop Metal a market cap of US$29.7 billion, or $93.88 per share. Although that is a long way off, management has set a goal of reaching US$1 billion in revenue by 2025. If the company met this goal and traded at the same multiples as industry peers, the company would have a valuation of US$2.97 billion, or $9.39 per share. That is an upside potential of 165.25% over the current share price.

This also means that if Desktop Metal captured only a 1% market share in 2030, worth US$2.97 billion, the stock would still be trading at $9.39 per share, or an upside of 165.25%. That would be much better than the S&P 500, which typically gains only 114.4% over an 8-year period, at a CAGR of 10%.

Shareholder dilution has also improved significantly, with only a 1.5% increase in shares outstanding over the past 4 quarters. Along with Desktop Metal’s management, we believe there is only a small chance of further dilution, as Desktop Metal should have sufficient cash to achieve positive cash flow if operations proceed as planned.

In the last earnings call, the CFO also mentioned that there should be sufficient cash to achieve break-even cash flow.

The Bottom Line

Although Desktop Metal’s recovery is well underway, we think it is far from over. We think the company will certainly face some strong setbacks in the short term, such as rampant inflation and the Fed’s record raising of interest rates.

On the other hand, we think Desktop Metal is strongly positioned to capture a large share of market share in the Additive Manufacturing industry, which is expected to far outperform the S&P 500. We also believe Desktop Metal is fairly priced, compared to the overall industry and taking into account their growth rate.

Be the first to comment