I have had a back and forth relationship with Denbury Resources (DNR) over the last 6 months.

In November last year, I recommended buying DNR at $.98 and wrote an article about it for my subscribers called “10 Reasons Denbury Resources Is A Good Investment”. Then on December 22, I published it on Seeking Alpha. But by the time it was published I had already sold DNR for $1.48 for a nice 50% profit in less than a month.

Here’s how I described it to my subscribers:

“We’re up 50% in less than a month, that’s very fast. We bought at .98 on Nov. 25th. Still like it, but the data is not supporting this kind of rise in this short of time. If it drops back down we’ll look at it again. Who can complain about 50%?”

Well, not me that’s for sure. I took the 50% up and got out of Dodge.

But I kept my eye on DNR and when it fell back down to $.75 I bought it again on March 2. Needless to say, that was a big mistake.

I eventually sold DNR for .47 for a loss of almost 40%. So made 50% on the up and lost most of right back on the down. And I was lucky to get out when I did because DNR just keeps going down, currently sitting at about $.25.

DNR is really, really tied to oil prices

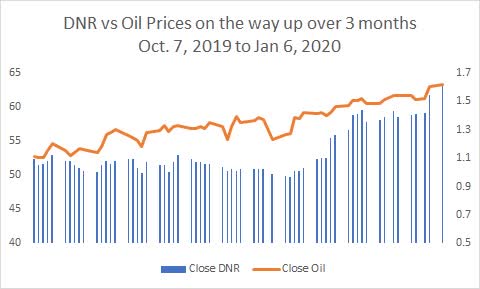

Here are two charts I developed to justify my 2nd purchase of DNR.

From the “up” chart, I deduced if you buy at $.75 and the oil price goes to $60 you will probably have another double. I mean why would Saudi Arabia and Russia not agree to cut production? I still don’t understand why they didn’t cut but that’s water under the bridge.

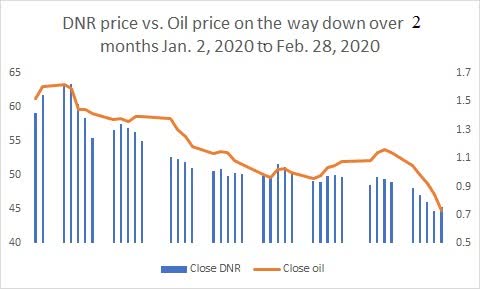

The 2nd chart showed what the dangers are when a stock like DNR has its future so directly tied to a commodity like oil.

Note the “down” chart as bad as it looks only goes down to an oil price of $45. Who would have thought $20 was possible? Not me. But the bottom of that “down” chart now would be zero.

Looks like Chapter 11 is in store for DNR

Being tied to oil prices means DNR has little or no chance of surviving into 2021. That’s because they have a large pile of debt and a big payment due in May of 2021.

Here’s Seeking Alpha’s take on the matter.

“Denbury has $615M of bonds with a 9% coupon due in May 2021 that are currently trading at just $0.18 on the dollar; the company had $527M of liquidity available at year-end 2019.”

They are not going to be able to make that payment barring a war in the Middle East and maybe not even then.

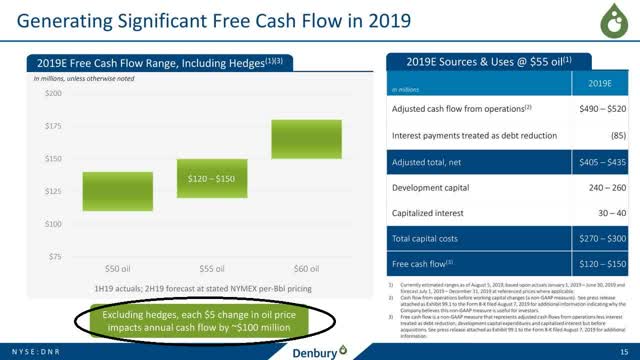

The reason is simple as they explained at their 2019 3rd quarter conference call: every $5 change in oil prices impacts free cash flow (FCF) by $100 million. And they were only expecting $120 million in FCF at $55 oil.

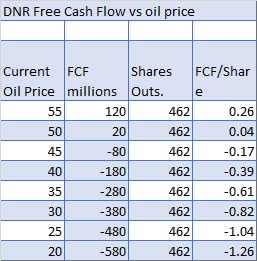

It really gets ugly for DNR when oil prices drop fast. Look at this chart and you can understand why Chapter 11 is inevitable even if they cut CAPEX to zero.

It really gets ugly for DNR when oil prices drop fast. Look at this chart and you can understand why Chapter 11 is inevitable even if they cut CAPEX to zero.

How I would play it

I like DNR’s assets. They are well placed, reliable and many of them use CO2 recovery techniques, a niche market DNR excels at. If DNR can get rid of most of its debt, they could be a very profitable oil company, assuming prices return to levels in the $40 range or above.

If you are brave, you sell DNR short into the potential bankruptcy, then buy it again when it comes out in a year or so.

Risks, alarm bells and red flags

In this volatile market, all investment decisions deserve extra caution. And oil is even more volatile than the market in general meaning DNR is even more volatile than the general market.

Meaning extraordinary caution is required.

There is nothing wrong with being in cash at this point in time until the market shows less volatility and more firm direction.

In addition, there could be a recession coming or even a depression according to several economists.

“Economic data in the near future will be not just bad, but unrecognizable,” Credit Suisse economists led by James Sweeney wrote last week. “Anomalies will be ubiquitous and old statistical relationships within economic data or between market and macro data might not always hold… There is no blueprint for the current shock, and uncertainty about the extent of contagion and the economic consequences is overwhelming.”

An investment in DNR is only for extremely risk-averse investors.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my “Turnaround Stock Advisory” service receive my articles prior to publication, plus real-time updates.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment