Editor’s note: Seeking Alpha is proud to welcome Alex Syku as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

andresr/E+ via Getty Images

Introduction

Delta Apparel Inc. (NYSE:DLA) has popped up on small-cap investors’ radar as of recent for recording record profit in 2021. Bulls attribute Delta’s success to product demand growth and more specifically, the company’s digital printing business, DTG2GO. Its other revenue segment, Salt Life, has grown from $39.4 million in 2018 to $49.7 million as of FY 2021. Its share buyback program has returned $47 million to shareholders in the past, with an additional $13 million authorized for further repurchases. In addition, Delta Apparel has recently announced a partnership with global digital sports platform, Fanatics, which has only strengthened the optimism. Delta Apparel and its investors also take into account Delta’s vertically-integrated business model which allows for lower costs and improved profitability with economies of scale. In fact, with a current TTM P/E of 9, many small-cap investors are convinced that the market is undervaluing Delta Apparel and its growth prospects. However, a closer look at cost inflation, the FIFO method, and Delta’s consistently low inventory turnover gives a different perspective on Delta’s current valuation and future profitability.

Rising Costs = Rising Prices

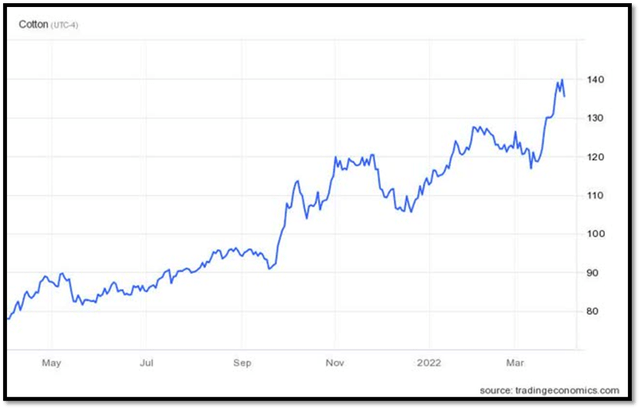

Due to the nature of Delta Apparel’s business, the increasing prices of cotton will certainly force Delta Apparel to raise their prices or see their gross profit margins shrink. Taking a look at cotton prices over the past year, we can see a massive spike from $80/lb in March 2021 to over $110/lb in October 2021. Prices have not let up since as they are hovering around $120/lb this past quarter. See chart below:

Cotton (USD/lbs) (Trading Economics)

Due to this surge in cotton prices along with other supply chain costs, management has stated that they have increased selling prices with an intent to increase them further if raw material inflation persists. Evidence of these statements are shown in the earnings calls snippets below:

CEO Bob Humphreys Q3 ’21 Earnings Call Transcript (Seeking Alpha)

On an earnings call in August 2021, Bob Humphreys stated that there were a number of price increases since the beginning of the year. While this may not be an immediate cause for concern, it is important to keep price hikes in mind when analyzing Delta Apparel’s revenue growth. Below are more snippets of Delta Apparel management stating they have raised selling prices:

CFO Deborah Merrill Q4 ’21 Earnings Call Transcript (Seeking Alpha)

CEO Robert Humphreys Q1 ’22 Earnings Call Transcript (Seeking Alpha)

Looking back at the past three earnings calls, we can see clear statements made by management indicating that they have raised prices to combat inflationary pressures.

So, costs are up and Delta Apparel has raised selling prices: what exactly is the issue?

Like other apparel companies, Delta is simply increasing their prices to offset inflationary pressure, so what does this have to do with their recent success? This is where Delta’s cost flow method choice comes into play. Delta uses first-in first-out (FIFO) cost flow assumption to allocate inventory cost to the income statement. This is problematic when cotton prices have increased more than 50% in just a year and nearly 40% over the past two quarters, among other costs. Delta Apparel’s COGS reflects inventory prices that are behind current cost trends while their revenue reflects price increases that are ahead of rising costs. This combination should result in a larger gross margin than usual, and sure enough gross margin was a record 23.3% in 2021 which is much higher than the 20.7% they posted in 2018 and 2019 (excluding 2020 due to lockdowns/restrictions, using non-GAAP 2019 gross margin due to costs associated with discontinued FunTees business). In fact, their quarterly gross margins hit an astonishing 25.4% in Q3 ’21.

On the revenue side, comparing TTM revenue with 2019 revenue shows only a 4.89% increase. This is alarming due to the fact that we now know a portion, possibly even all, of this revenue growth is due to Delta Apparel increasing their prices rather than actual product demand growth. So, if recent revenue growth is a result of increased prices, and recent COGS is a reflection of raw materials purchased before significant spikes in cotton and other essential materials, when will these numbers show up on the income statement?

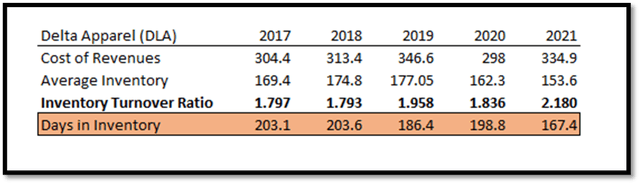

To measure the lag time between current labor and raw material costs and reported COGS, we look to Delta Apparel’s current and past inventory turnover ratios. Below is a 5-year breakdown of their inventory turnover ratio:

DLA 5-yr Inventory Turnover Ratio/Days in Inventory (Author)

A close look at their inventory turnover ratio shows weak sales and inventory that is sold and replaced every 6 months with 2021 being their best showing (2.18). The higher 2021 figure is likely due to a lower beginning inventory caused by COVID-related suspended operations during FY 2020. These low inventory turnover numbers indicate that recently purchased inventory takes around 6 months to show up as COGS on the income statement. With cotton prices surging even higher over the past 6 months and other related costs rising as well (labor, freight, dyes, etc), I believe Delta’s next couple of earnings reports will not be a pretty sight for bullish investors. In my view, gross and net margins will surely shrink causing a price target revision from many analysts and investors. While that may be alarming, the severity of the losses depends on how overvalued Delta Apparel’s shares are.

Valuation

While low valuation was the argument for most bulls, adjustments have to be made now that there is an explanation for their record net income last year. Rather than immediately map out a price target with various assumptions, I’d rather work backwards starting with the current stock price.

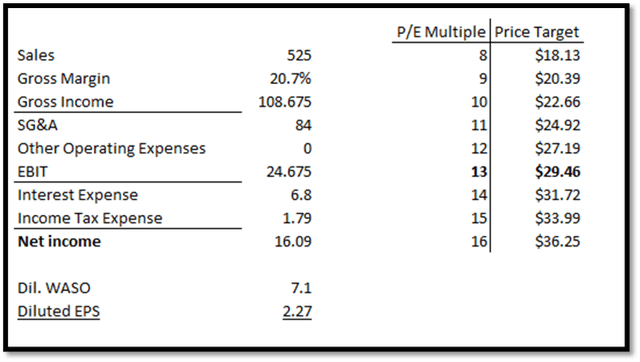

Currently, Delta Apparel hovers around $30/sh while riding the ups and downs associated with recent macro headlines. To justify this share price, we have to stabilize their gross margins moving forward as their rising costs will inevitably catch up with them. In fact, their recent Q1 ’22 gross margin was 20.7% which is much more in-line with previous pre-pandemic quarters. 20.7% is far more realistic than their gross margins of 25.5% in Q3 and 23.3% in Q4 of FY 2021. Unfortunately, this recent quarter’s gross margin figure also indicates a downward trend that will likely continue. As for SG&A and interest expense, they have been consistent enough in the past to predict with reasonable certainty. To elaborate, SG&A as a % of revenue has fluctuated around 16% the past few years and interest expense for current outstanding debt is approximately 6.8 million a year. As for their income tax expense, Delta’s effective income tax rate fluctuates due to recording income in foreign jurisdictions that are either exempt from income taxes or have a lower tax rate than the United States. Therefore, I will use a conservative 10% effective tax rate assumption so that the income tax expense can be accounted for without aggressively affecting the bottom line. See inputs and results below:

Justification for $30 share price (Author)

Using these conservative assumptions to determine what future results will justify the $30/sh price, we arrive at the number 525. Yes, you read that correctly. At $525 million in revenue with conservative inputs, net income comes out to $16.1 million which results in a $2.27 Diluted EPS. At a sector median 13x FWD P/E multiple, the fair value price target is $29.46. Recording $525 million in sales would represent a 20% increase from FY 2021’s revenue, which is already skewed due to the inflation related price hikes mentioned earlier. This would also be the most revenue posted for the company in its history, and to be frank, it is an extremely unlikely scenario. To make matters worse, even at an aggressive 15x FWD P/E the fair value price target ends up at $34, which only offers a 13% return from its current price. So, if that is the upside, how bad is the downside?

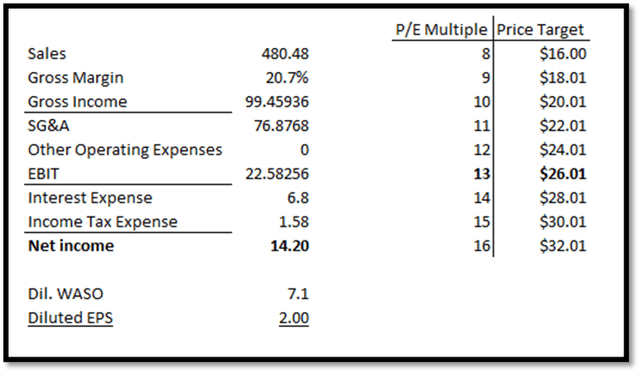

In an attempt to play along with the bulls, I worked out a scenario where Delta Apparel managed to increase sales by 10% in FY 2022 compared to FY 2021. I kept the gross margin input at 20.7%, which implies rising costs over the past 6 months only brought gross margins back down to pre-pandemic normality and did not have a greater negative effect. With these assumptions, sales come out to $480 million with the bottom line at $14.18 million. This translates to a $2.00 EPS and a $26 fair value price at 13x FWD P/E. This bullish scenario offers a 13.33% decline from Delta’s current price. Again, this is with a very bullish revenue assumption and a lenient 13x valuation multiple.

10% revenue growth, 20.7% gross margin (Author)

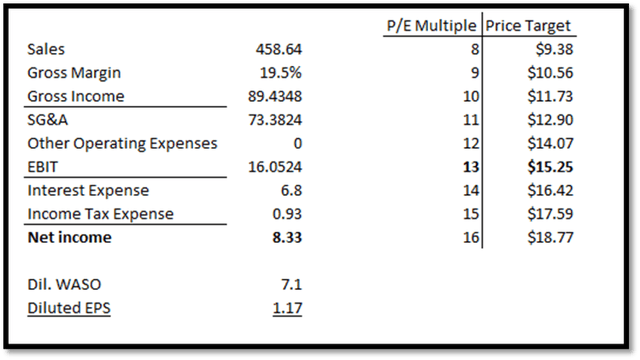

To really put things into perspective, I decided to put in a neutral scenario that is not far-fetched in the slightest. Sticking with an increase in revenue, this time around 5%, for FY 2022, I used a 19.5% gross margin instead. With 20.7% being Delta’s normal gross margin in the past, it would not be surprising if rising costs in the past 6 months brought gross margins down to below 20% for FY 2022. While Delta Apparel can contemplate raising prices to sustain gross margins above 20%, it lacks the competitive advantage to completely offset any upcoming cost inflation. Therefore, gross margins shrinking these next few quarters is highly likely and while they could very well shrink below 19.5%, I want to keep assumptions as conservative as possible. Unfortunately, even with my conservative assumptions, Delta Apparel’s fair value, at an aggressive 13x FWD P/E, would translate to $15.25. This would mean a nearly 50% decline from its current price even with the optimistic 5% revenue growth assumption.

5% revenue growth, 19.5% gross margin (Author)

Risks

Based off my analysis and opinions, the case for a decline in stock price these next few quarters is strong. However, there are certain risk factors that could end up minimizing or completely offsetting my bearish arguments. These are

- Fanatics Partnership fuels major growth

- While Delta Apparel has consistently stated in annual reports that no customer has made up more than 10% of revenue, more business with Fanatics could end up being that exception and leading to sales growth and improved reputation.

- Major growth in Salt Life brand

- While the Salt Life brand makes up about 1/8th of Delta Apparel’s revenue, its margins are much larger (47.9% as of FY 2021) than the Delta Group segment. Double-digit growth could add several millions to Delta Apparel’s bottom line.

Conclusion

Long-time Delta Apparel investors are currently ecstatic about the $30 share price, and many are optimistically holding due to a low 9x P/E multiple when using the current price and the exceptional results of the previous 4 quarters. Newer investors may have also hopped on for the same reason, optimistic that Delta’s current growth prospects will soon be factored in at a higher P/E multiple. However, when incorporating Delta’s FIFO cost flow method and its advantages given rising costs, most notably cotton, their previous COGS numbers are not a full reflection of the actual costs. To make matters worse, Delta’s price hikes last year only further expanded the misleading gross and, ultimately, net margins. With an average of around 6 months to sell and replace their inventory, I believe upcoming earnings reports will likely sour old and new investors’ optimism. Nevertheless, based on my aggressively bullish scenarios, buying Delta Apparel’s stock now offers just a 13% return. On the flip side, a very likely bear scenario could see the stock plummet 50% or more. It is my belief that the risk/reward tradeoff is simply not there, even for the most risk-tolerant small-cap investors.

Be the first to comment