shaunl/iStock Unreleased via Getty Images

Investment thesis

Although I am a fan of John Deere’s tractors and I like the company and its brand value, I still don’t see the opportunity to go long on John Deere. In fact, as I will show in this article, the company has suffered more than its main competitors in terms of margin contraction. Even though John Deere is quickly recovering, there are still at play some factors that should benefit more its peers. Furthermore, the company’s guidance is slowly turning less bullish than investors expected. Finally, the valuation, although almost $100 lower that its ATH still seems a bit stretched and doesn’t give enough margin of safety to initiate a position. Thus, I still position myself on the sidelines, waiting for a better price to go long Deere & Company (NYSE:DE).

Summary of previous coverage

In the past few months, I covered the main agriculture and farming machinery manufacturers: John Deere, CNH Industrial (CNHI) and AGCO Company (AGCO). Here are the articles I wrote and a brief summary of their content:

- John Deere At Fair Value Ahead of Q2 Earnings Report.

- AGCO: A Buy With Plenty Of Room To Grow

- Could Supply Chain Constraints Help AGCO Face A Recession?

- CNHI Is A Buy As It Harvests On Growing Margins

- AGCO And CNH Industrial: A Comparison Of 2 ‘Buys’

These articles show that all the three major players repeatedly reported strong demand that could not be met on time due to supply chain issues. The global outlook for the industry sees the three players agree that while North America and Latin America will grow by 10-15%, Europe will be barely positive while Asia, due to China’s lockdowns and zero-covid policy, could see its sales decline.

Now, strong demand and not enough supply is the perfect environment for companies that have pricing power. John Deere is one of these. However, John Deere came out of Q1 with low operating margins in the high single digits compared to the 20% and more that it usually delivered. This was partially due to the well-known UAW strike that hindered production and partially because the company had not been able to offset production costs with pricing. In any case, the company’s management had not been able to time correctly the inflationary wave that started hitting the economy in the second half of 2021.

AGCO, too, felt somehow a little pressure on its margins. Moreover, the company is exposed to Europe for more than half of its sales. However, given its renewed focus on North America and its smaller size, compared to Deere, the company has managed to deliver good results supported by strong order books. This made me throw the hypothesis that, in case of mild recession, the order backlog could even be enough to go through a couple of rough quarters without being hurt too much.

CNH Industrial is currently my pick in the industry. I saw two major tailwinds for the company. First of all, the recent spin-off of Iveco Group (here is an article covering Iveco) made CNH Industrial a more profitable company focused on the Off-Highway business. Secondly, in an economic environment where machine availability is the main driver, usually the second largest player in the industry finds the perfect situation to close the gap in terms of profitability with the industry leader. In fact, as the industry leader can only satisfy a certain share of total demand, the remaining part turns to the second most known and established brand. Usually, this demand is from customers who were willing to pay the premium usually given to the market leader. This enables the second-best player to raise prices (and margins) without fearing that customers will flee away. So far, CNH Industrial has been the best one in terms of keeping margins up, with a 14% for the agriculture business unit. My thesis so far has been confirmed by fundamentals and I do think that the stock will move sooner or later accordingly to this.

John Deere’s Q3 earnings

The good

The management had announced it and the results didn’t fall short of expectations: in Q3 investors did see John Deere gaining back its well-known profitability with margins moving back towards the 20% benchmark.

In fact, in the 3Q Press Release, we see that the operating profit for the quarter was back in the double digits reaching 18.8% of total revenues. Compared to the 8.8% operating margin Deere posted in Q1, we are clearly before a company that is back on track towards its marginality above 20%.

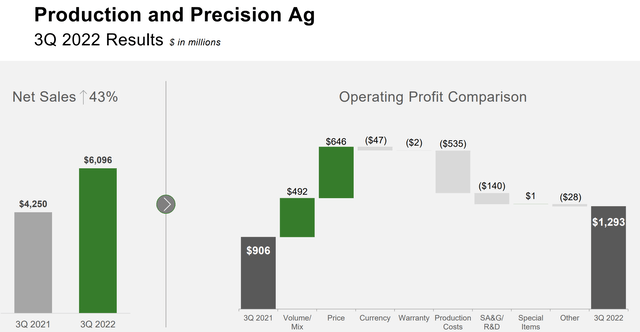

This time all the three main divisions of the company were able to offset production costs by price increases, as we can see in the 3Q Results Presentation, of which I would like to show the slide regarding production and precision agriculture.

As we can see, this segment reached a staggering 43% increase in net sales, largely due to higher production and shipment volumes. Thanks to price realization of $646 million, Deere was finally able to offset completely the $535 million of production costs, unlike it had done just two quarters ago.

As the company reported during the 3Q earnings call, this division’s net sales are forecasted up between 25% and 30% for 2022. In this forecast, Deere is assuming 14 points of positive price realization in order to be price/cost positive for the fiscal year. These were the results and the guidance we were waiting for.

Furthermore, it was reported that the company’s order books are beginning to fill for 2023, making the management state that the expectations for next year are still very good. That demand is still strong is true to the point that Cory Reed, president of production and precision Ag, had to talk about the particular situation of Brazil saying that

in Brazil, we are releasing production monthly to maintain tight controls between inflation and pricing. And we’re seeing our calendars fill up within hours of releasing them. We fully expect this strong demand cycle in Brazil will continue in 2023.

Given this situation, the company is focusing on not adding more partially completed machines to inventory, but actually completing the inventory in order to get it shipped to dealers and customers.

Regarding the other two business division, the small ag & turf segment is expected to have net sales up between 10% and 15% for year, with 9 points of positive price realization and an operating margin between 14% and 15%.

Construction & Forest’s net sales were up 8% YoY thanks to price realization, which was able to offset higher production costs. The operating margin was 16%.

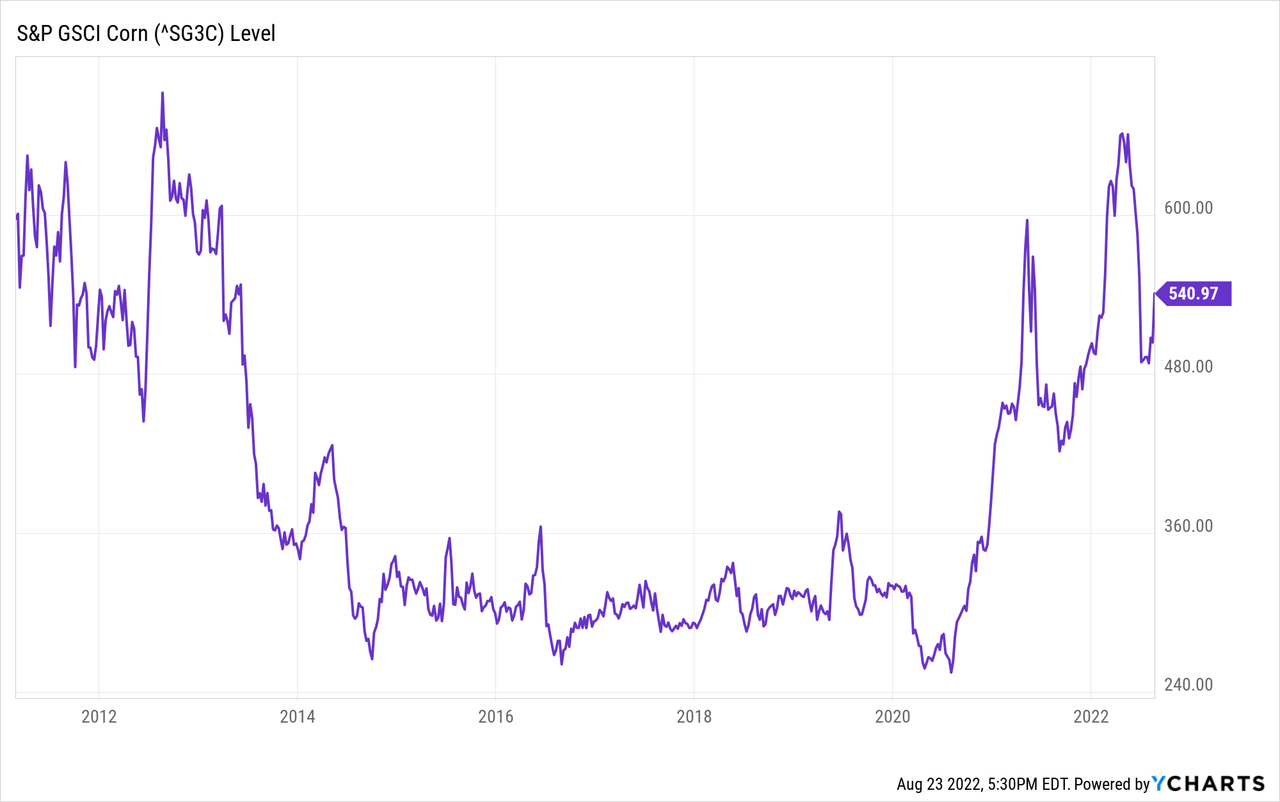

One of the aspects investors always look at in order to assess John Deere and the industry is to consider farmer income. To understand and forecast what it may be in the future, we can look at the historical data of corn prices in the past ten years.

We can get a quick grasp of the level corn price is at right now. Even though it just went through a big drop, it is still more than twice the lows its reached from 2014 onwards and it is still a lot higher also compared to the highs prior to the pandemic.

Of course, Deere looks at this data too and during the earnings call its management noted that even though corn and soy prices have declined, farmer income should not be hurt as fertilizers and other materials saw the same drop in price. The management also reported that global stocks are tight and this should continue to support elevated crop prices. With order books for the first quarter of 2023 already being filled, Deere seems confident that 2023 could be yet another year of good results that would consolidate the company at its post-pandemic results.

The bad

So far so good. However, while Deere beat revenue expectations for the quarter by $1.26 billion (a 10% beat), the bottom line didn’t impress the market as EPS expectations were of $6.69 instead of the actual $6.16 (an 8% miss). The explanation is simple: supply chain issues and production costs were expected to be lower.

While margins did go up, they are still below the 20% level that Deere has usually reached. This keeps on helping its major peer, CNH Industrial, that can increase prices at a higher pace that Deere enjoying the strong demand for tractors that Deere can’t fulfill completely. In fact, I have pointed out in my other articles on CNH Industrial that this year the company has been able to raise prices quickly and offset inflation to a larger extent than Deere.

Moreover, the company lowered a little bit its full year guidance, stating that net income should be in the range of $7 to $7.2 billion instead of the range given a quarter ago around $7 to $7.4 billion. This caused a quick 7% sell-off that was completely recovered during the day to make Deere close slightly in the green with a gain around 0.5%.

The results were good, forecasts were too high

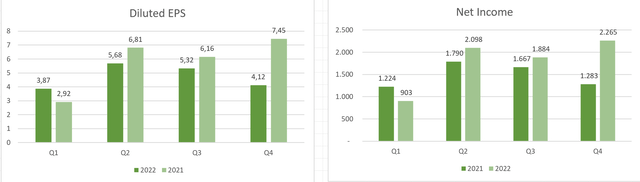

Let me post two graphs that compared last year to this year. With the new guidance we can now calculate both the expected net income for the next quarter and the EPS.

Author, with data from John Deere’s Investor Relations

If we look at these graphs, we see that Deere is actually improving compared to last year which was an outstanding year for industrials and a year that led to great results. Yet, Deere, apart from the problems in Q1 we already mentioned, was able to increase in Q2 and Q3 YoY in terms of net income and EPS. In Q2 the company beat the 2021 EPS result by 20%, in Q3 the company was able to improve last year’s EPS result by 16%. However, the forecast was that the company would have earned almost 26% more YoY. This is a particularly strange forecast because it assumed that Q3 would be stronger than Q2 which usually is not. In addition, many analysts underestimated the impact of supply chain woes that contributed to high inventories of unfinished tractors and high raw material costs for the past quarter.

When I look at the two graphs, I am pleased and I don’t see a company in trouble. However, John Deere is beginning to be considered with very high expectations that do not take into account that this company operates in a cyclical industry that is subject, thought to a lesser extent than other industrials, to economic swings.

It is also being more and more common to talk about Deere as the “Tesla of tractors” due to the company’s efforts in autonomous and precision agriculture combined with the development of electric tractors. I don’t think this way to look at the company is healthy for two reasons. First of all, when people look for the new Tesla, they are not looking for a business but for a stock that can double, triple or even more in a short time. Secondly, it creates very high expectations for a company that is already in its mature stage and that focuses on growing and innovating while keeping margins in the right range and generating strong free cash flow to foster shareholder return in the form of dividends and share buybacks.

Shareholder return

One of the reasons I have Deere on my watchlist is that I would like to add it to my dividend growth portfolio. The dividend history speaks for itself, the payout ratio is very healthy since it currently is around 22%. In the past five years the dividend grew at a compound rate of 12%.

The yield is currently low at around 1.16% well supported by a free cash flow yield around 4%. Clearly, the yield is so low because of the high stock price the company trades at even after a big sell off in the first half of the year.

Share repurchases are also very strong and are 2.5x the amount of dividend paid during this year. As reported in the press release, for the first nine months of the year, Deere has repurchased $2.4 billion of common stock and paid $971 million in dividends. Thus the company returned almost $3.5 billion to its shareholders which equals to 2.8% of the current market cap. If we factor in the next dividend and another quarter of buybacks, the total return will be above 3.5% which could already be interesting for some investors.

Valuation

The real problem I have with Deere is its valuation. The company is trading around its fair value, but I don’t see enough margin of safety to initiate a position. True, the company is very high quality and one could argue that once it trades around its fair value, long-term investors can start buying. However, with very uncertain times ahead of us, I don’t think the stock is pricing in a real economic slowdown that could actually happen.

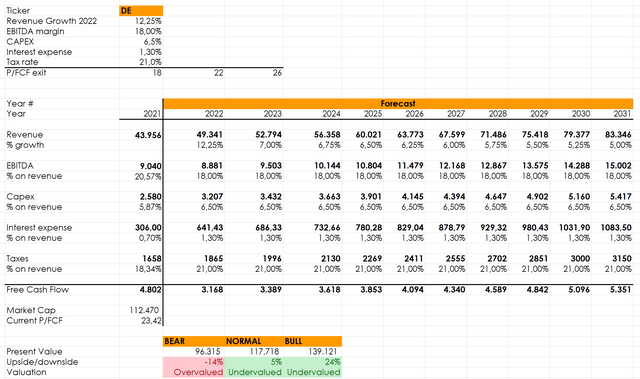

I would like to share with the Seeking Alpha community both my models to show why, at the moment, I rate the stock as a hold.

In this model I start from the income statement top line and then forecast what the future free cash flow will be for the next decade. I assume that this year’s revenue growth will be around 12% but that starting from 2023 it will decreased to 7% and then reach 5% in 2031. Keep in mind that this may be looked at as a somewhat bullish scenario that doesn’t forecast any major downturns. It could be true, but I think that lowering year after year the expected revenue growth takes into account the fact that Deere has gotten investors used to drawdowns but also major upswings in revenue during economic recoveries.

I use three possible price/free cash flow exit multiples to outline three different scenarios. Keeping a P/FCF exit multiple of 22, the stock is just slightly undervalued. With a higher multiple of 26, I reach a 24% undervaluation which would be interesting for dividend growth investors who seek some capital gain, too.

Author with data from Seeking Alpha

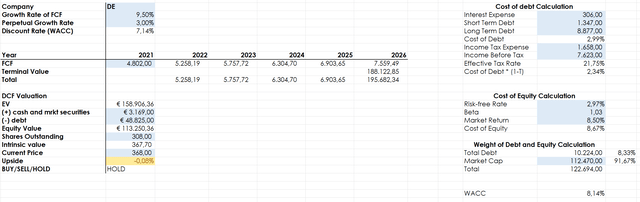

In this second model I start from the reported free cash flow and then forecast its growth over the next five years. I discount this at a rate that starts from the company’s calculated WACC. In case of John Deere, given the quality of the company, I lowered its WACC by 1 percentage point accepting to discount its future free cash flow at a 7.14% rate. I also expect the company to grow its free cash flow at a rate around 9% for the next five years which I think is reasonable given the fact that raw material prices could come down a bit compared to the prices we have seen in the past twelve months.

In this case, I reach a fair price or $368, which is very close to the price of $367,70 (at the time of writing).

Author, with data from Seeking Alpha

Combining the two models, I rate the stock as a hold, suggesting that investors wait for a better opportunity to buy once again the stock of a company whose brand value, products, execution, and shareholder returns are very reliable.

Be the first to comment