Sergei Dubrovskii

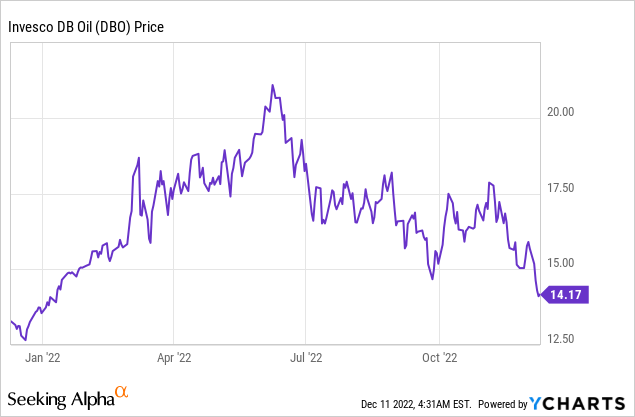

The Invesco DB Oil ETF (NYSEARCA:DBO) is designed for investors who want to invest in oil futures, as I will elaborate upon later. While still exhibiting a gain over the last year, its value has lost more than 30% during the past six months, as shown in the chart below.

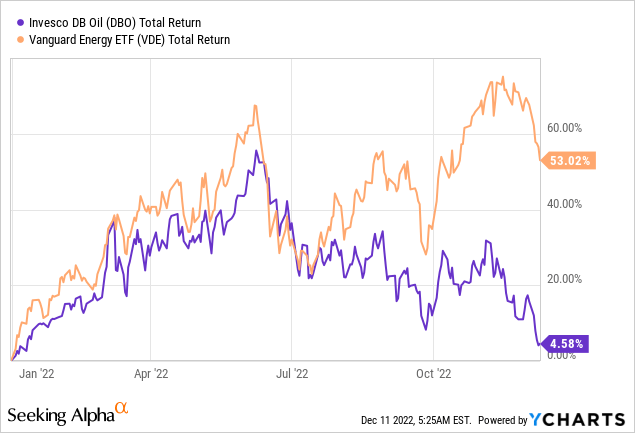

My objective with this thesis is to assess, using the variables in the demand-supply equation, whether it is time to put some money at work in this ETF. Using total returns, I will also show how it is different from investing in companies that extract and process crude oil through the Vanguard Energy ETF (VDE).

The Demand-Supply Equation

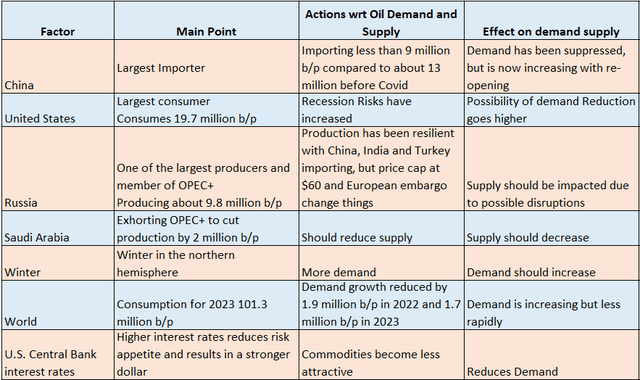

There are several variables that impinge on demand and supply as seen in the table below, which in turn determine the price of oil.

Table built using data from (www.seekingalpha.com)

However, even after having computed the above, it is not easy to make an accurate forecast as so many other variables can emerge like faults occurring in major transportation infrastructures like the Keystone pipeline which carries Canadian crude to the U.S., or inflows in major oil storages like the Strategic Petroleum Reserve.

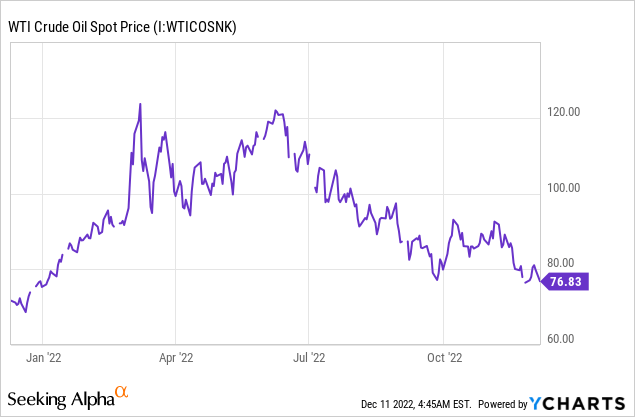

Starting with some recent price action, the price of Texas Intermediate oil (“WTI”) rose briefly above $75 this Thursday or on December 8, after having fallen through the support $80 level as the market sentiment was marked by increasing risks of a recession, which is normally synonymous with low demand.

I had predicted this bearish trend for energy using the ProShares UltraShort Bloomberg Natural Gas ETF (KOLD) two weeks back, but my thesis was based more on an increase in natural gas storage levels on both sides of the Atlantic, amid above-average seasonal (winter) demand.

Staying within the realms of inventory, the EIA or Energy Information Administration reported last week that crude oil inventories decreased by 5.2 million barrels or more than was expected by analysts. However, this decrease, which is notably occurring in winter and only a week away from the Christmas driving season, should have logically been favorable to higher crude prices. The fact that this has not happened shows that traders are more concerned with demand destruction caused by a potential economic slowdown, in turn, induced by the Fed’s aggressive interest rate hikes, which were primarily aimed at taming inflation but have also resulted in risk-aversion as borrowing costs have surged.

Shifting to the world’s largest importer (or China as per the above table), even the easing of Covid related health measures, which should allow the full resumption of economic activity, appears not to have been fully digested by market participants. The reason is that when you reopen cities that were the subject to drastic lockdowns it just means that the Covid virus will spread more quickly among the population, as research has shown. Add to this the fact in China, the vaccination rate for older people, or those who are more likely to develop the illness after being infected, lags behind the U.S., then there may be a risk that the country’s health system is overwhelmed.

DBO Holdings and Risks

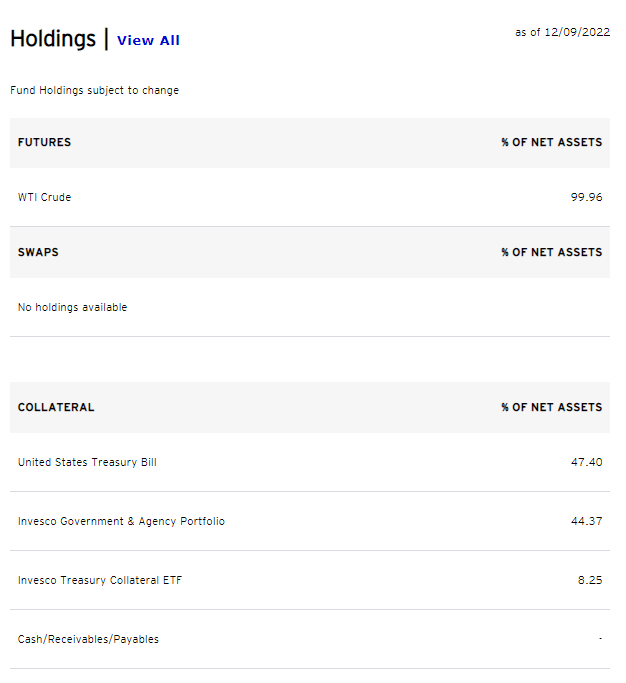

Thus, it is the China factor, as the world’s second-largest consumer in 2021, in addition to recession fears in the U.S. that is dragging down the price of oil with DBO also feeling the pain. As pictured below, the ETF only holds WTI Crude and charges a management Fee of 0.75%. It pays dividends, but the last time distributions were made was only in December 2019.

DBO Holdings (www.invesco.com)

As shown by the price action in the introductory chart, buying and holding the shares of an ETF composed of futures contracts based on light sweet crude oil or WTI futures during current market conditions has been detrimental to the investors. Thus, DBO is not for investing as part of a long-term buy-and-hold strategy as for other ETFs which hold the stocks of oil companies, like the Vanguard Energy ETF (VDE) for example.

The reason for this is the performance as shown by the chart below, where an investment in VDE has yielded total returns of above 50% which also includes the dividends in case these are reinvested. This is more than ten times what DBO has produced.

This is not an apple-to-apple comparison as DBO tracks changes in the level of the DBIQ Optimum Yield Crude Oil Index Excess Return, whereas VDE tracks the MSCI US Investable Market Energy 25/50 Index, which is a benchmark composed of multi-cap U.S. stocks. However, my point is to show the difference between holding futures and stocks, especially when the market conditions deteriorate for the commodity as of June.

Thus, Invesco’s ETF is more suitable for those with a speculative nature and prepared to trade in very volatile markets, as is the case for energy, where a lot of variables are at play as I detailed earlier. Thus, long-term investment in WTI futures contracts is not advisable as it amounts to taking on big risks of losing money, where it is the frequency of the movements in market prices which result in large losses.

This is the reason why DBO makes more sense for trading the oil market, and only over the short term.

Elaborating a Short-term Scenario

Coming back to the China reopening story, it has failed to provide meaningful support but that’s not all. In this respect, the entry into force of the price cap mechanism to limit Russian Ural oil exported to destinations other than Europe to $60 does not seem to have caused any disruption, at least up to now.

Added to this are doubts about the ability of the Organization of the Petroleum Exporting Countries (OPEC) and its allies following the December 4 meeting to implement the two million barrels per day reduction in output, as agreed earlier in October.

On the other hand, the price cap mechanism on Russian oil as well as the European oil embargo, which initially resulted in the price of the Urals benchmark dropping by 5.5%, could have an opposite effect in the coming week as it creates some uncertainty for tankers which have to cross the Turkish Straits. Now, as per the price cap, tankers will be delivered insurance certificates only if they prove that the oil they are transporting has been purchased at $60 or less as I explained in a recent thesis. This may prove difficult to implement as evidenced by the number of vessels stuck in the Black Sea last week, as shipowners were unable to provide insurance certificates to Turkish authorities. According to some more recent sources, there could be around 23 million barrels of oil lying in as many as 26 tankers with some from neighboring Kazakhstan, whereas it should be only Russian oil that should be targeted. The reason is that Kazakh oil is loaded into tankers only after being transported by pipeline across Russia and there could be some issues to prove their origin.

Therefore, if the problem lingers on, it is possible for DBO to make up for some lost ground after nearly a 16% downside during the last month, but, this will all depend on the way the news hit the market. For this purpose, this ETF’s Average Daily Dollar Volume is much higher when compared to peers like the ProShares K-1 Free Crude Oil Strategy ETF (OILK) which means that it is traded more heavily.

DBO’s last month’s price action (www.seekingalpha.com)

Now, this should constitute only a short-term trading opportunity, where you are ready to exit rapidly with a stop loss instead of patiently waiting for elusive gains, in case oil prices fail to produce an uptrend. Therefore, timing is key for trading DBO which is directly correlated to the price of WTI, and this is only within the realms of the most astute traders.

In support of this statement and as I have elaborated above, market sentiment remains generally bearish toward oil due to fears of economic slowdown in the U.S. as the largest consumer as of 2021 (above table) and doubts whether China’s reopening will go on smoothly. Along the same lines, the price mechanism system is not designed to block Russian exports, but rather to put a ceiling on the price of crude imported from that country.

Conclusion

Another factor that supports bearishness for energy prices is the market structure for WTI contracts now trading in contango over the next year, and this, for the first time since Nov. 2020, according to data from the Financial Post. This basically means that spot oil prices (as shown in the chart above) are less than futures contracts for delivery in the future), implying that traders have relatively less concern for the supply of oil at the moment, most probably due to weakened demand.

In these circumstances and in light of the above, unless you are an oil trader and are looking for some additional information prior to putting some money into DBO, this ETF does not make for an investment. Instead, I have already provided an alternative.

Be the first to comment