Luis Alvarez/DigitalVision via Getty Images

Investment Thesis

Day One Biopharmaceuticals (NASDAQ:DAWN) joined the Nasdaq in late May 2021, raising $160m via an upsized IPO at $16 per share. Initially the biotech – which is focused on tackling pediatric cancers from the moment they are diagnosed, hence the “Day One” company name – saw its share price rise to a peak of $28 by early September, for a 75% gain.

The protracted biotech bear market brought an end to the surge of investor optimism however, and prior to last week, shares had hit an all-time low of $5.7, dragging the company valuation well below >$500m, when once it had been valued >$1.5bn.

There are two drugs in Day One’s pipeline. The lead candidate is Tovorafenib – formerly known as DAY101 – an investigational, orally administered, central nervous system (“CNS”) penetrant pan-RAF inhibitor that has received Breakthrough Therapy Designation, Rare Pediatric Disease Designation, and Orphan Drug Designation (in the US and EU).

Tovorafenib is being evaluated as a once weekly therapy in tablet and liquid form – a convenient dosing regime for children – in relapsed and frontline Pediatric Low-Grade Glioma (“PLGG”), or brain cancer, and it was the release of data from its Phase 2 study of relapsed pLGG this week that sent Day One’s share price soaring – to ~$15 at the time of writing – and dragged the company’s market cap valuation back towards the $1bn mark.

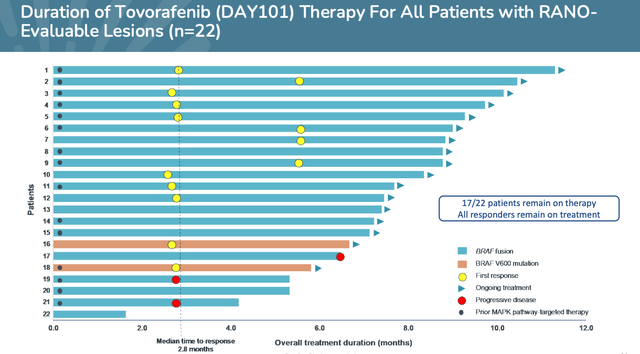

The data – albeit taken from a small patient population of 22 – was very positive, with an Overall Response Rate (“ORR”) of 64% observed in patients who had failed to respond to prior therapies, with a median of 3 prior lines of therapy, and a Clinical Benefit Rate (“CBR”) of 91%.

Of the first 22 Response Assessment for Neuro-Oncology (“RANO”)-evaluable patients, 14 Partial Responses (“PR”) were observed, plus six patients with stable disease, who all had tumor shrinkage, and the median time to response was 2.8 months. On the safety side, treatment related adverse events (“TRAEs”) of grade 3 or worse occurred in nine, or 36% of patients.

Given that there are no approved therapies to treat pLGG, it’s hardly surprising that analysts and investors greeted the initial data readouts from Day One’s FIREFLY-1 pivotal trial with enthusiasm, sending shares back above their IPO price.

Day One management estimates that BRAF-altered pLGG – the type that Tovorafenib can treat, which is ~70% of all low grade pediatric gliomas – has an annual incidence of ~1,100 patients, and an estimated prevalence of ~26,000, which. Given the average list price of a cancer drug is now trending >$100k, such a patient population ought to make the drug a blockbuster (>$1bn per annum) seller.

Full results from the FIREFLY-1 trial ought to be available by Q123, and with a Fast Track Designation from the FDA already secured, Tovorafenib could be approved as early as next year if the later stage data proves as strong as this interim data. It’s easy to see why investors are excited, and it gets better, too, since Day One is also running a trial of Tovorafenib in newly diagnosed pLGG, bringing a larger first-line treatment market into play.

Day One management even sees opportunities outside of pLGG, and is testing Tovorafenib in RAF-altered solid tumors, as well as testing their second drug candidate, Pimasertib – a small-molecule inhibitor of MEK1/2 on the MAPK pathway acquired from Pharma giant Merck (MRK) in February last year – in combo with Tovorafenib in solid tumors – first patients were dosed in both of these trials last month.

Although it’s heartening to see a newly IPOed company buck the miserable downward trend of the biotech bear market – which has hit early-stage drug developers especially hard – it’s also important not to get too carried away with Day One’s data.

There’s no placebo arm to compare the effects of Tovorafenib against for a start, and the duration of response has not yet been tested, there are some question marks around safety, and there is no guarantee that the FDA will accept the FIREFLY trial data alone as sufficient to warrant a full approval.

In the rest of this post I will take a deeper dive look at Day One the company, Tovorafenib and its history, the study results, prospects for success in first line pLGG, label expansion opportunities, and finally, speculate on whether investors would be wise to buy a chunk of Day One stock at the current valuation and share price.

Day One and Tovorafenib Overview

Day One came into being in May 2020 thanks to $60m series A round, funded by early stage VC firm Canaan Partners, Access Biotechnology and Atlas Venture, specifically to try to develop more cancer drugs for children. As co-founder Julie Grant puts it:

Over twenty years, the FDA approved over 200 new oncology drugs to treat adults, yet fewer than 10 new drugs have been FDA-approved for children with cancer.

Slow development times, uncertain health insurance reimbursement, and long-lasting side effects due to the toxicity of cancer drugs are other issues the biotech is attempting to solve for children with cancer.

Whilst Grant is now Chairman of the Board of Directors, co-founder Samuel Blackman – a biotech veteran – is Chief Medical Officer, and Jeremy Bender has joined as CEO from Gilead Sciences (GILD), where he was Vice President of Corporate Development.

Chief Commercial Officer Lisa Bowers and Chief Development Officer Davy Chiodin had long careers at Roche (OTCQX:RHHBY) drug development subsidiary Genentech, and Chief of Technology Operations Mike Preigh had a lengthy career at Array Biopharma where he specialized in the filing of Investigational New Drug (“IND”) applications. One of Day One’s stated ambitions is to grow its portfolio of pipeline assets.

Its first candidate of note is Tovorafenib, which is much older than Day One, having first been developed by Sunesis and the large Pharma Biogen (BIIB) in 2004, before being spun out to Japanese Pharma Takeda (TAK), and evaluated (together with Sunesis) as a potential therapy for melanoma.

Day One purchased Tovorafenib from Takeda, and after the collapse of Sunesis, and its reversal into Viracta Therapeutics (VIRX), Viracta sold the rights to development and commercial milestone payments to Xoma Corporation (XOMA), (according to Evaluate Biotech).

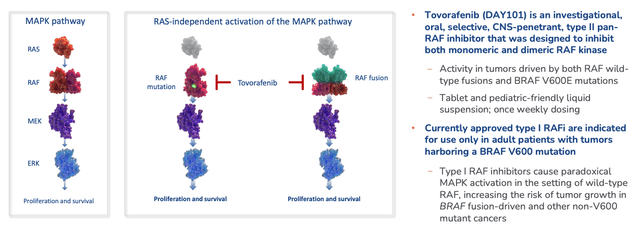

Tovorafenib is designed to deal with the dysregulation of the MAPK signalling pathway – one of the most commonly mutated oncogenic pathways in cancer. It is (according to Day One’s 2021 10K submission to the SEC) a type II pan-rapidly accelerated fibrosarcoma, or pan-RAF, kinase inhibitor that inhibits both monomeric and dimeric RAF kinase.

It’s – theoretically at least – superior to “Type 1” RAF inhibitors which target monomeric kinase only, such as the approved therapies Zelboraf, owned by Roche and indicated for melanoma and rare blood cancers, making sales of ~$200m per annum, and Pfizer’s (PFE) Braftovi, developed by Array BioPharma prior to its acquisition by the big pharma, and approved for melanoma, and more recently, Colorectal cancer, with blockbuster sales a possibility. A third approved BRAF inhibitor is Novartis’ (NVS) Tafinlar, used in combo with MEK inhibitor Mekinist, and generating >$450m sales in Q421.

BRAF is one of three RAF genes and its most common mutation is V600, which Tovorafenib is designed to deal with, along with RAF-wild-type fusions, which are beyond the scope of Type 1 inhibitors Day One says, as shown below.

Tovorafenib Mechanism of Action. (presentation)

Source: Day One Corporate Presentation.

Day One also states in relation to Type-1 BRAF inhibitors that “despite initial clinical responses, most patients relapse within one year due to drug resistance,” although presently, it does not have the durable data to prove that its own drug won’t face a similar problem, despite its theoretical advantages.

Pediatric Low Grade Glioma Treatment and Trial Overview

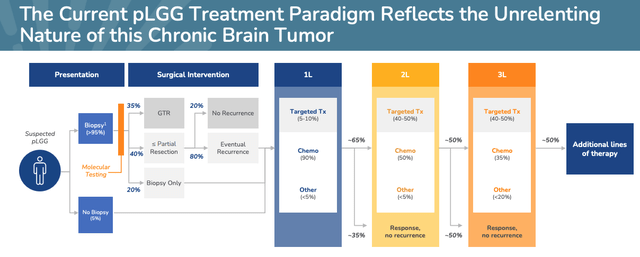

pLGG is the most common brain tumor diagnosed in children accounting for 30-50% of all CNS tumors, although most children survive into adulthood.

Existing treatments include surgery to remove tumors, chemotherapy, and radiation therapy. Day One’s therapy is known as targeted therapy, and the company’s ambition is to ensure patients’ experience fewer long-term side effects, and to try to limit the number of therapies children must undergo, shown below.

Current pLGG treatment paradigm. (presentation)

Source: Day One Corporate Presentation

A once-weekly oral therapy in liquid form that is effective and safe and requires none of the dangerous, expensive, and laborious procedures discussed above is clearly what Day One is aiming for, but management has sensibly prioritized approval in heavily pre-treated patients for its first approval shot, and as discussed above, the results indicate that Tovorafenib is working.

Results from Phase 2 FIREFLY-1 trial. (presentation)

Source: Day One Corporate Presentation

Eventually, in Q123, management hopes, there will be data from 60 patients, and it will be longer term, data, also, which is important when we consider the issues associated with so-called Type 1 BRAF inhibitors highlighted by Day One.

Without a placebo arm in this trial, the FDA may be reluctant to approve Tovorafenib right away, however, since it cannot be certain that the drug is responsible for the improvement in patient’s condition. That would mean a further trial may be necessary, and push back Day One commercialisation ambitions. I also would be a little wary of the safety data. If the main purpose of the drug is to avoid toxicities associated with chemo and surgery, it doesn’t look ideal that, alopecia, pruritis and anemia were relatively common side-effects.

The FIREFLY-2 pivotal Phase 3 trial of Tovorafenib in newly diagnosed pLGG patients will, however, have a standard of care chemotherapy arm to compare results against. The primary endpoint in this trial is ORR , with Progression Free Survival (“PfS”), and Duration of Response (“DoR”) both secondary endpoints.

Could data from FIREFLY-2 be used to support the New Drug Application (“NDA”) in later stage pLGG? It doesn’t seem impossible to me, given the Fast Track Designation already awarded to the drug suggests the FDA is impatient to approve a potential new best-in-class, standard of care drug. This latter trial will enroll 400 patients, and feature long-term follow-up of 48 months, with a dose level of 420mg administered weekly. This could the trial outcome to invest in, rather than FIREFLY-1.

Label Expansion Opportunities – Solid Tumors and MEK Combo

If the likes of Novartis, Roche and Pfizer can generate blockbuster sales outside of pLGG with first generation BRAF inhibitors, then why not Day One too?

That certainly appears to be management’s ambition as it pushed Tovorafenib into a RAF-altered solid tumor study, FIRELIGHT-1, which began last November. It’s a small study, with only ~40 patients enrolled, and a primary endpoint of ORR, and its likeliest win would appear to be in melanoma, given the success of Zelboraf, Braktovi and Tafinlar in this indication.

Like the big pharmas, Day One management also is pursuing a combination of its BRAF-inhibitor with a MEK inhibitor, based on “strong scientific rationale” that it can work well alongside an additional MAPK pathway inhibitor. Merck may have given up on Pimasertib, its MEK1/2 inhibitor, and licensed it to Day One, but Day One management believes it has numerous competitive advantages, not least “nearly three-fold higher CNS penetration than other MEKi inhibitors.”

This time, however, Day One will target an adult patient population with advanced solid tumor patients with any MAPK alteration. Endpoints will once again be ORR, and DOR.

Conclusion – Day One Has Delivered But Its Journey Has Just Begun – Let The Dust Settle Before Considering A Position

Although Day One’s early pLGG data is undeniably impressive and probably did deserve to push the company’s market cap valuation back toward $1bn, it’s probably also right that the surge has stopped just short of that psychological barrier, and has not matched the share price highs of the post-IPO period.

Two to three years from now, and perhaps beginning as early as next year, Day One appears to have a solid opportunity to become a commercial stage biotech with meaningful revenue generation – at least a few hundred million in time if things go well with later stage data – and encouragingly, the company has reported a cash position of $262.7m as of Q122.

Management were not slow to initiate a new fundraising of $150m after announcing the FIREFLY-1 results, either, at $15 per share – in truth, that’s likely what stopped shares surging higher.

With a war chest of >$400m, and a quarterly net loss of just $27.7m in Q122, Day One ought to be able to fund a commercialisation push and campaigns to make physicians and patients aware of a potential new standard of care in pLGG, which is an enticing prospect for its shareholders. We already know the BRAF-inhibitor class of drugs can sell, although doubts remain over their durability.

That brings us to the negatives in relation to Day One as an investment opportunity. To date, we only have short-term interim data to go on, with no placebo or standard of care arm to compare to, so the sensible thing to do from an investor’s perspective is to wait for the full data from FIREFLY-1 in Q123, even if means paying a higher premium for shares, or even to wait for FIREFLY-2 data.

In terms of Day One’s mission statement, there does not appear to have been much progress made in terms of bringing new pediatric therapies into its pipeline – instead it seems the company is trying to mimic the success of Novartis, Roche et al in attempting to combine Tovorafenib with a MEK inhibitor and targeting an adult population. That strikes me as a little disingenuous, although perhaps we will hear of more pediatric developments soon.

The age of Tovorafenib and the fact that Takeda and Biogen were willing to let the drug grow also suggests that it may not be the “second generation” of BRAF-inhibitors that Day One management is trumpeting it as – it’s not a new drug, having been developed in 2004.

These doubts around the duration of response, lack of a placebo arm in the FIREFLY-1 trial, length of time Tovorafenib has been in the clinic for, long-term safety, and an uncertain mission statement – would make me hesitant to buy in to the Day One story at the present time, although the company has undoubtedly brought some cheer to a gloomy biotech bear market.

That makes me wonder of there could be M&A activity in the near future, although management’s fundraising activities suggest they would prefer to try to commercialize themselves. The reality is that often in biotech such attempts to take on the big pharmas at their own game don’t succeed, either due to a lack of funds, a lack of efficacy, or a lack of sufficient differentiation from standard of care.

Time will tell for Day One – it will be interesting to see how management develops its lead asset and whether its stays true to its original objective of developing cancer drugs for children. That may reveal whether management is trying to find a market for a drug it has obtained at a knockdown price, or has genuinely long-term ambitions in the pediatric oncology space.

Be the first to comment