akinbostanci

Investment Thesis

Daqo New Energy (NYSE:DQ) planned to pour RMB24.25B, or the equivalent of $3.4B into its new production plant in Inner Mongolia, which will aggressively expand its annual capacity in two phases by 251.51% to a total of 332K MT polysilicon by 2024. To date, the company guided up to 132K MT output for FY2022, indicating an excellent 53.4% increase YoY. Combined with its planned annual capacity of 21K MT for semiconductor-grade silicon, 300K MT for silicon metal projects, and another 200K MT for other silicon items from Inner Mongolia, it is apparent that there is no destruction of demand here.

DQ’s strategic efforts will naturally be top and bottom lines accretive in the long-term, due to the insatiable demand for solar panels in the Chinese market and globally, after the Xinjiang sanctions are lifted, of course. By the end of 2022, China is already expected to produce 3K TW-hours of clean energy electricity generation through solar and wind power, with an impressive energy share of 31.9% nationally. Furthermore, the country already boasts an impressive 323 GW of solar capacity by May 2022, with another tripling to 972 GW expected by 2030, assuming a similar rate of 108 GW of annual expansion as planned for 2022.

It is no wonder that China continues to be the undisputed leader in the global renewable movement, given the billions of government subsidies flowing into the sector thus far. Nonetheless, things may change soon, since the US is set to pour an eye-popping $385B into the domestic sector over the next ten years. The latter has planned expansions of approximately 550 GW for combined solar, wind, and energy storage capacities by 2030. Thereby, ambitiously expanding the renewables share from 23.2% to 50% by 2030, nearer to Biden’s highly ambitious plan of 80%. The EU proved highly aggressive as well, with 1 TW of solar installations planned by the end of the decade, with renewables share growing to 40% by 2030 against 22.2% in 2021.

Moving forward, DQ has also signed an excellent supply agreement for 135K MT of polysilicon through 2027. Hence, putting the brakes on any bearish sentiments, since it is the fourth long-term contract signed within FQ4’22. Thereby, ensuring the activation of its Phase 2 construction for the manufacturing plant in Inner Mongolia. Impressive indeed, providing DQ with a long runway for growth through the next decade.

DQ’s Margins And Execution Remain Impressive

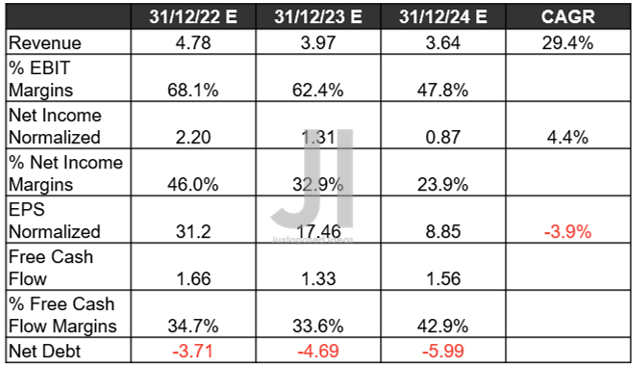

DQ Revenue, Net Income ( in million $ ) %, EBIT %, and EPS

In its recent FQ3’22 earnings call, DQ reported revenues of $1.21B and EBIT margins of 58.6%, indicating a notable decline of -1.96% and -17.8 percentage points QoQ, respectively. Otherwise, still a remarkable increase of 208.21%, though another -15.2 percentage points decline YoY. However, it is important to note that the decline is mostly attributed to the elevated stock-based compensation worth $263.4M in the latest quarter, which triggers an EBIT margin of 78.4% after adjustments. Still stellar indeed, since the number represents an expansion by 3.8 percentage points QoQ and 6.4 YoY instead.

In addition, DQ’s adj. profitability remains excellent, with net income of $590.4M and net income margins of 48.4% in FQ3’22, with the latter only indicating a minimal moderation of -2.1 percentage points QoQ and -1.9 YoY. Not too bad, since its EPS remains impressive at $7.70, expanding by 200.52% YoY despite the nominal -5.86% QoQ decline.

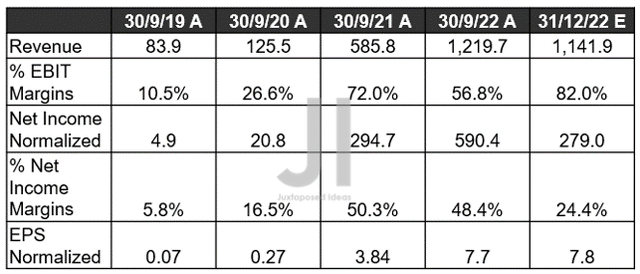

DQ Cash/ Equivalents, FCF ( in million $ ) %, and Debts

Furthermore, it is important to note that DQ reports practically zero debt and bank loans, with an impressive $4.6B balance sheet or $3.05B in immediate liquidity through cash and equivalents by FQ3’22. Therefore, anyone who bought in at current levels is also looking at an excellent book value of $55.67 per share. As a result, we are not overly concerned about its minimal Free Cash Flow (or FCF) generation, since it is attributed to the company’s aggressive capital expenditure in the 200K MT polysilicon production capacity in Mongolia through 2024.

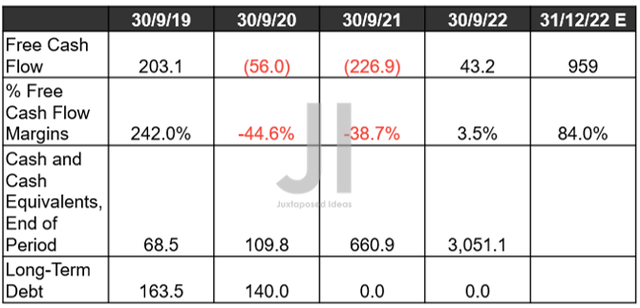

DQ Projected Revenue, Net Income ( in billion $ ) %, EBIT %, EPS, and FCF %

S&P Capital IQ

Besides, despite the supposed global economic slowdown, DQ’s forward execution has been upgraded multiple times thus far. The company’s top-line growth has been raised by 9.3% since October and 13.75% since August 2022, pointing to Mr. Market’s growing confidence indeed. Thereby, naturally explaining its decent growth at a revenue CAGR of 29.4% and net income CAGR of 4.4% through FY2024, against pre-pandemic levels of 15.2%/-19% and hyper-pandemic levels of 118.8%/419.5%, respectively.

Moreover, with its robust FCF generation at margins of 42.9% by FY2024, DQ will also be expanding its liquidity ahead, while remaining debt-free no matter the resulting recession or soft landing in 2023. In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Daqo New Energy: The 2 Bullish Reasons To Load Up Before Q3 Earnings

- Daqo New Energy: Shines Bright Like A Diamond – Not A Buy Now

So, Is DQ Stock A Buy, Sell, or Hold?

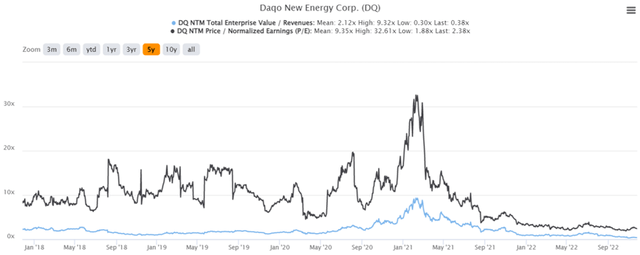

DQ 5Y EV/Revenue and P/E Valuations

DQ is currently trading at an EV/NTM Revenue of 0.38x and NTM P/E of 2.38x, lower than its 5Y mean of 2.12x and 9.35x, respectively. And also lower than its YTD mean of 0.87x and 2.73x, respectively. It is apparent that the stock continues to face immense valuation headwinds, due to the ongoing solar import bans from the Xinjiang region, worsening geopolitical tension between the US and China, and the latter’s Zero Covid Policy.

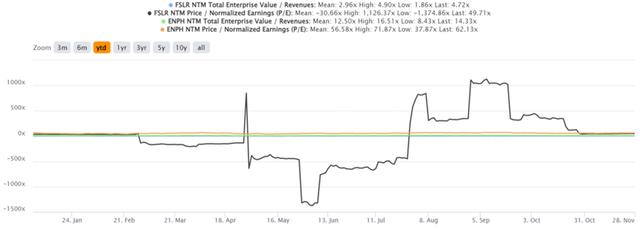

ENPH & FSLR YTD EV/Revenue and P/E Valuations

DQ’s situation is a drastic difference from Enphase Energy (NASDAQ:ENPH) and First Solar (NASDAQ:FSLR), which are trading at extreme premiums now. The former is currently at an EV/NTM Revenue of 14.33x and NTM P/E of 62.13x, nearing its YTD high of 16.51x and 71.87x, respectively. FSLR is no better, trading at an elevated EV/NTM Revenue of 4.72x and NTM P/E of 49.71x, against the start of the year at 2.71x and 38.15x, respectively.

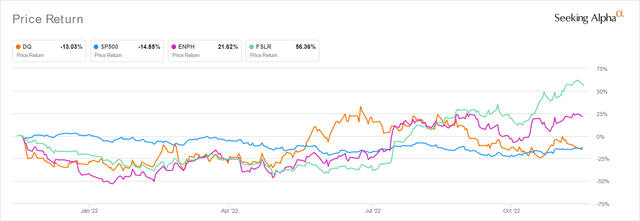

DQ, ENPH, & FSLR YTD Stock Price

At the time of writing, the DQ stock is trading at $50.45, down -34.63% from its 52 weeks high of $77.18, though at a premium of 56.67% from its 52 weeks low of $32.20. No doubt very different from ENPH and FSLR, which continue to trade nearer to their all-time highs. Nonetheless, consensus estimates remain bullish, due to their price target of $68.75 and a 36.27% upside from current prices. It is no wonder, since the DQ management has also launched a new $700M share-repurchase program, worth approximately 20% of its current market cap, on top of the $120M announced in June 2022 and fully exercised since. Impressive indeed, given the minimal dilutive effect of its stock-based compensation thus far, with its stock remaining relatively stable at 76.66M outstanding shares by FQ3’22.

Despite the recent 14.68% recovery from rock-bottom levels, DQ remains an excellent buy indeed. The stock will definitely rally once the geopolitical risks ease and macroeconomics improves. Assuming a similarly elevated P/E valuation as that of ENPH and FSLR, it is not too ambitious to assume that we may see the stock rally to a price target of $221.25, based on its EPS of $8.85 and moderate P/E of 25x by FY2024. Only time will tell.

Be the first to comment