David Taljat

Business Overview: Danaos & Global Ship Lease

Danaos Corp. (NYSE:DAC) and Global Ship Lease (NYSE:GSL) are very similar businesses with the same general model as “containership lessors” or “tonnage providers.” These firms own and operate the vessels, which serve as the backbone for global trade; however, they do not handle the point-to-point logistics. DAC and GSL lease all of their ships out to major global liner companies like Maersk, Hapag-Lloyd, CMA CGM, and ZIM Integrated Shipping (ZIM). The rates and terms they can secure depend solely on the supply/demand balance for the vessels themselves. While the underlying freight market rates (i.e. shipping costs) factor into counterparty profits and overall counterparty credit risk, DAC and GSL are otherwise isolated from the volatile freight markets.

Danaos Corp. controls a fleet of 75 vessels (including six newbuilds due in 2024) and has approximately 20.6M shares outstanding for a market cap of roughly $1.35B with a current dividend yield of 4.6%. GSL controls a fleet of 66 vessels and has approximately 36.7M shares outstanding for a market cap of about $670M with a current dividend yield of 8.3%. Both firms have active repurchase programs and both firms are likely to significantly increase their dividend by early-2023.

Record Low Valuations

I have personally followed both of these firms for more than a decade, across a variety of market conditions. The current enterprise valuation levels (vs. EBITDA, cash flow, earnings, or fleet valuations) are at the lowest either of these firms have traded in their entire history while their balance sheets have never been stronger and contract backlog has never been higher. This is a perplexing valuation setup, which can only be explained by the horrendous macro sentiment and a mixture of investor misconceptions and mistrust for these business models.

Both of these firms carry an enterprise value (net debt + market cap of equity) which is below their secured EBITDA + fleet demolition value alone. This means the market is valuing the entire residual value of their fleet below $0. Climent Molins, associate researcher at Value Investor’s Edge, has recently published an excellent write-up on Global Ship Lease, which I recommend for more detail on the valuations. Danaos Corp. trades at a very similar valuation, which suggests this is more of an industry-wide misconception and valuation skew as opposed to something specifically ‘wrong’ or misunderstood about either DAC or GSL.

In this report, I am reiterating my maximum bullish posture on both DAC and GSL. These are among the best risk/reward setups I have seen in my career. If you do nothing else today, please set a one-year calendar reminder with: “J Mintzmyer: GSL $18, DAC $65.” I am willing to stake a portion of my portfolio and my reputation as an investor and industry expert on the setup with these two firms. Regardless of how the markets pan out, I encourage everyone to hold me accountable and check back in a year to see how things pan out.

Enterprise Value: Record Low Valuations

If someone quickly pulls up a simple stock price chart for DAC or GSL, they will see shares have appreciated by roughly 12x and 4x respectively over the past two years; however, this is just the common equity price, which started from extremely low levels. In the interim, both of these firms have massively paid down debt, generated significant free cash flow, and expanded their fleets. Since net debt has come down significantly while assets and contract backlogs have surged, both Danaos Corp. and Global Ship Lease are significantly cheaper today at $65 and $18 than they were in 2020 at $6 and $5.

Keep in mind that both firms now have far larger fleets, their balance sheets are night-and-day, and contract backlogs are now the largest in company history. I have never seen a valuation discrepancy like this where a company goes through such a massive transformation and yet overall enterprise value goes down!

Strength and Stability of Lease Contracts

A common misconception is that lease contracts are at high risk of being “renegotiated” if markets weaken. These vessel lease contracts are extremely strong and have been tested in the past; there is essentially no way for terms to change unless the counterparty goes bankrupt or both parties enter mutual negotiations around a major financial restructuring. This model has been stress-tested twice in recent decades when freight markets have struggled: immediately following the 2008-2009 global financial crisis and again during the multi-year freight market downturn from 2012-2018. With limited exceptions for bankruptcy (Hanjin, ZIM) or restructuring (HMM), these contracts were honored during both periods with no shenanigans.

Following the GFC and during the 2012-2018 downturn, liner balance sheets were very weak. Today, liner balance sheets are the strongest in modern history. Counterparty risk is essentially nil on these contracts, but a common refrain from those who do not understand the industry is that “contracts will be renegotiated if shipping rates drop.” That viewpoint is not supported by precedent. These contracts are extremely strong and there are no major historical cases of renegotiation outside of major financial distress. In the case of ZIM’s bankruptcy in 2013-2014, vessel owners received debt compensation and also received a large equity stake which would eventually provide over 10x returns vs. lost revenues. In HMM’s restructuring in 2016, vessel owners received 100% compensation in the form of unsecured bonds and new equity. There was only one clear case of major loss in the past twenty-years: when Hanjin went bankrupt in 2016. This was a complete bankruptcy (i.e. Hanjin ceased to exist as an entity) which also wiped out almost all creditors. There is zero precedent for liners renegotiating rates just because market conditions have changed or liners “don’t like” paying high lease rates.

Strong Contracts Are Still Being Signed

Despite weakening freight markets and horrendous macro sentiment, the market balance for vessels remains extremely tight and is expected to be tight through at least mid-2023. The orderbook is elevated (roughly 30%), but the deliveries are weighted mid-2023 onwards, and the industry is facing the largest environmental regulation in history: EEXI and EEDI, which will phase in from 2023-2027. This regulation will require older ships to significantly slow down, which will create a bifurcated market between legacy tonnage and modern eco-design vessels (2014 or newer) while also reducing available supply capacity (ships x speed) by up to 20% over the next five years.

Liners understand these dynamics even if they are far too nuanced for the equity markets to properly value. This is evidenced by a slew of massive contracts, which continue to be signed in recent weeks. Just last week, GSL announced a major forward contract extension for six modern ships with Hapag-Lloyd. This deal doesn’t even begin until late-2023 to mid-2024 and will extend contract cover by five years through 2029 at an estimated time-charter equivalent (“TCE”) rate of about $43k per day, for $393M in minimum EBITDA. This single deal, for just six vessels, is worth 60% of GSL’s entire market cap!

This latest announcement is in addition to a slew of deals previously signed by both DAC and GSL as well as those signed by numerous peers across the market (i.e. not just a ‘one-off’ deal). The recent contract was obviously good for Global Ship Lease, but arguably the even bigger implied winner was Danaos Corp. DAC owns six newbuilds of even higher specification (slightly larger, more efficient engine design, and dual-fuel methanol capable), all of which deliver around the same timeframe (early- to mid-2024). If GSL can fix their ships for five years at $43kpd, then I believe DAC can likely secure at least mid-$50k, likely for an even longer duration, potentially extending into the 2030s.

Ironically, DAC was widely panned by investors for its decision to add a handful of speculative newbuilds earlier this year, but based on the latest contract extension between GSL and Hapag-Lloyd, I believe Danaos is set to announce a major contract with lucrative terms, potentially announced within a matter of weeks.

Strong Conviction Based on Risk/Reward Skew

I have pounded the table on both Global Ship Lease and peer Danaos Corp. for most of this year (I have been net bullish on DAC dating back to September 2020 at $5.05/sh as well as GSL from the $4s), and I realize that I likely sound like a broken record or seem like the ‘boy who cried wolf’ at this point, but the cash flow should speak for itself. Eventually, I believe we will collectively look back at this market opportunity and wonder how things could ever have been so mispriced and so collectively misunderstood.

I have been investing in shipping for over 12 years now, and this is arguably the best risk/reward setup I have ever seen in my career. In discussions with other investors, I have noticed that many investors have differing views or constructs of what exactly “risk/reward” constitutes, so I will outline my framework and approach below, which is essentially part of the ‘secret sauce’ to our consistent and massive market-beating returns we have produced at Value Investor’s Edge.

Risk/Reward Framework

We talk a lot about ‘risk/reward’ on Value Investor’s Edge, but I have noticed a lot of people have their own definitions and views of what that means. When I discuss this concept, I am referring to the potential gains or losses across a variety of market scenarios. My typical target holding period in shipping is 12-24 months, but sometimes we get really lucky and an investment turns into a ‘trade.’

Some recent examples of investment-turned-trade include TORM (TRMD), where I was perfectly happy owning for a year or more, yet the market continued rising and people finally realized what we already knew (massive dividends incoming). This gave us liquidity and the chance for an amazing lay-up trade across the summer and I have since exited that position for massive gains after just a few months. Scorpio Tankers (STNG) was similar this Spring, where I loaded the wagons around $13/sh and was able to ride the position to $30 in a matter of months. ZIM Integrated Shipping was another position which worked out that way in early/mid-2021 and provided multi-bagger returns across a few quarters. Danaos Corp. itself was yet another example: $5.05 in September 2020 to over $100 in April 2022. Those were amazing setups and follow-throughs, but despite numerous multi-baggers in recent years, normally things take a little longer to pan out. My personal target for investments is normally 12-24 months.

As any seasoned investor knows, not everything goes according to plan with investing or trading. There can be bearish market and macro outcomes, which drag realistic value well below the initial base case. There can also be bullish outcomes, which shoot value far higher than initially expecting (e.g. ZIM in 2021 or STNG this year). Since I am certainly not infallible and I am prone to make mistakes judging future market conditions, the ‘secret’ to our massively outsized success over the years has been achieved by allocating to stocks with excellent risk/reward. These are positions where even if I am totally wrong and/or everything goes against us, the losses will be minimal. At the same time, the base case has significant upside, and any potential bullish surprise leads to enormous gains. If you invest with great risk/reward, you only have to hit big winners a limited amount of time (i.e. 1 out of 5 or even 1 out of 10 times). This is because you never really lose much with the ‘bad’ ones while the base case also provides strong average returns.

DAC and GSL are two of the best such setups I have ever seen in my career. It’s probably my fault for being a flawed communicator, but I haven’t been able to properly convey to skeptical investors just how cheap these names are. Our track record in shipping is well established and my bullish position is well known, yet both firms have traded poorly over the past 5-6 months. The slide has gotten so extreme that both firms are currently valued below their fixed contracts alone, yet they still have significant additional future value from demolishing their older ships and signing the remaining newer ships on new charters from 2024-onward. My ‘fair value estimates’, which imply around 100% upside for both firms, are already based on semi-bearish market outcomes. The orderbook is large? Yes. Obviously! We have been talking about the orderbook for over a year now… Macro conditions are rough? Obviously! That has also been clear for at least six months by now.

In the worst case of lease rates collapsing in the next few months and DAC and GSL never signing another deal (which seems odd, because GSL just signed six ships last week), DAC is still worth about $100/sh and GSL is worth about $30/sh. In the semi-bearish base case of about six months left of decent markets, followed by a subsequent collapse, I believe DAC is worth about $125 and GSL is worth about $40.

If anything happens remotely better than the above scenarios of a collapse in rates and charters within six months, then DAC could be a $200+ stock (DAC has a bit more leverage to upside because of their newbuilds and ZIM shares) and GSL could easily trade north of $50 by 2024.

Outcome Valuations

- GSL: $30 Bearish, $40 Base, $50+ Bull vs. $18.00

- DAC: $100 Bearish, $125 Base, $200+ Bull vs. $65.00

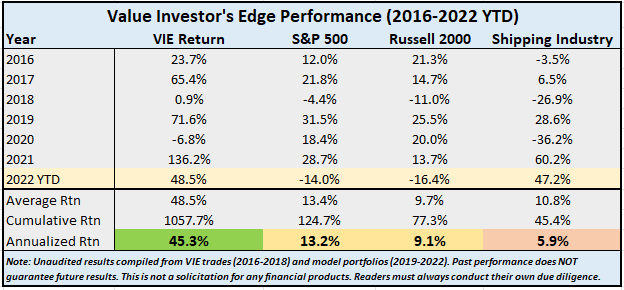

Yes, both DAC and GSL already trade at significant discounts to our most bearish outcome valuation! These are the types of stocks I’ve invested in over my career and the types of setups which have been the backbone and ‘secret’ to our success. Our track record over the years we have hosted Value Investor’s Edge:

Value Investor’s Edge

A previous track record is no guarantee of future results, but these results were compiled by repeatedly positioning our model portfolios into massively skewed bets like this.

Fair Value Estimates- DAC: $125.00, GSL: $40

Our current ‘fair value estimate’ at Value Investor’s Edge is $40/sh for GSL, which implies roughly 120% upside. Our ‘fair value estimate’ for DAC is $125/sh, which implies over 90% upside. Both value estimates are already based on semi-bearish scenario outcomes as outlined above.

Be the first to comment