Nicholas Hunt

This article is part of a series that provides an ongoing analysis of the changes made to Dan Loeb’s 13F stock portfolio on a quarterly basis. It is based on Third Point’s regulatory 13F Form filed on 8/15/2022. Please visit our Tracking Dan Loeb’s Third Point Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q1 2022.

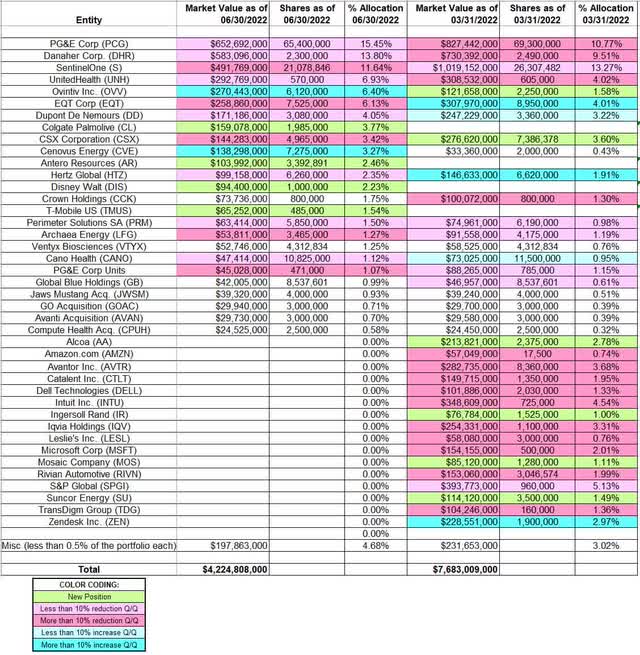

This quarter, Loeb’s 13F portfolio value decreased ~45% from $7.68B to $4.22B as they reduced or sold several positions. The 13F portfolio is very concentrated with the top three holdings accounting ~41% of the entire portfolio. The number of holdings decreased from 75 to 58. 25 of the holdings are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five individual stock positions are PG&E, Danaher Corp, SentinelOne, UnitedHealth, and Ovintiv.

Third Point returned negative 19.9% in 2022 through June compared to negative 20% for the S&P 500 Index. Annualized returns since December 1996 inception are at 13.7% compared to 8.5% for the S&P 500 Index. AUM is distributed among several strategies of which the long/short equity portion is roughly 33%, down from 55% as of Q4 2021. In addition to partner stakes, Third Point also invests the float of SiriusPoint (NYSE:SPNT) and capital from London listed closed-end fund Third Point (OTCPK:TPNTF). To know more about Dan Loeb’s Third Point, check-out his letters to shareholders at their site. His activist investing style is covered in the book “The Alpha Masters: Unlocking the genius of the world’s top hedge funds“.

Note 1: They have a significant portfolio of investments through their venture firm Third Point Ventures. Q1 2022 letter had a special mention on ConsenSys Software. They invested in the Series C funding round at a valuation of $3.2B and the Series D at $7B valuation.

Note 2: Large equity investments not in the 13F report include Shell plc (SHEL), Glencore plc (OTCPK:GLNCY), Sony (SONY), EssilorLuxottica (OTCPK:ESLOY), and Nestle (OTCPK:NSRGY). The Shell stake was built over the three quarters through Q1 2022 while the Glencore plc position was established last quarter. SONY is a $1.5B investment made in June 2019 when the stock was trading at around $50 per share. It is currently at ~$85. The ESLOY investment was made in early 2019 when the stock was trading at ~$62.50 per share. It currently trades at ~$78. The NSRGY position is from 2017 and the stock has moved from ~$75 to ~$121 now.

New Stakes:

Colgate-Palmolive (CL), Antero Resources (AR), Walt Disney (DIS), and T-Mobile US (TMUS): CL is a fairly large 3.77% of the portfolio position established this quarter at prices between ~$74 and ~$82 and the stock currently trades at the top end of that range at ~$82. The 2.46% of the portfolio stake in AR was purchased at prices between ~$30.50 and ~$48 and it is now at $43.26. DIS is a 2.23% of the portfolio stake established at prices between ~$93 and ~$139 and it now goes for ~$116. The 1.54% TMUS position was purchased at prices between ~$122 and ~$139 and it currently trades above that range at ~$145.

Note 1: Their Q2 2022 letter released last week said Disney was their largest recent addition in the portfolio. So, the Disney stake was likely increased after the quarter ended.

Note 2: Disney is back in the portfolio after a quarter’s gap. A 2.16% DIS stake was purchased in H1 2020 at prices between $85 and $148. It was sold over the last two quarters at prices between ~$129 and ~$178.

Stake Disposals:

Amazon.com (AMZN): AMZN was a large (top five) 5.47% of the portfolio position purchased in Q4 2019 at prices between ~$85 and ~$94. The stake saw a ~200% increase in Q1 2020 at prices between ~$84 and ~$109. There was a ~30% selling in Q4 2020 at prices between ~$150 and ~$172. Next quarter saw another ~20% reduction at prices between ~$148 and ~$169. Last three quarters of 2021 had seen a stake doubling at prices between ~$155 and ~$187. Last quarter saw the position reduced by ~90% to a very small 0.74% stake at prices between ~$136 and ~$170. The remainder stake was disposed this quarter. The stock currently trades at ~$133.

S&P Global (SPGI): SPGI was a fairly large (top five) 5.13% stake established in Q2 2016 at prices between $96 and $128. The position has wavered. Recent activity follows: the five quarters through Q1 2019 saw a combined ~60% selling at prices between $164 and $213. There was a ~30% stake increase over the two quarters through Q1 2021 at prices between ~$306 and ~$379. The position was sold this quarter at prices between ~$316 and ~$415. The stock is now at ~$376.

Intuit Inc. (INTU): INTU was a 4.54% of the portfolio stake built over the four quarters through Q1 2021 at prices between ~$218 and ~$422. Last quarter saw a ~40% selling at prices between ~$425 and ~$632. The elimination this quarter was at prices between ~$353 and ~$506. The stock currently trades at ~$446.

Avantor, Inc. (AVTR): The 3.68% AVTR stake was established in Q3 2020 at prices between ~$17 and ~$23 and increased by ~235% next quarter at prices between ~$22.50 and ~$28. There was a ~23% reduction last quarter at prices between ~$32.50 and ~$40.60. The disposal this quarter was at prices between ~$29 and ~$34. The stock currently trades at $26.16.

IQVIA Holdings (IQV): A 3.31% IQV position was purchased in Q3 2018 at prices between $99 and $131 and increased by ~25% in Q3 2019 at prices between $143 and $162. There was a one-third selling in Q2 2021 at prices between ~$193 and ~$247. Last two quarters saw the stake sold at prices between ~$196 and ~$274. The stock currently trades at ~$232.

Microsoft Corp. (MSFT): A ~2% of the portfolio MSFT stake was purchased in Q3 2020 at prices between ~$200 and ~$232. The two quarters through Q1 2021 had seen a ~60% stake increase at prices between ~$200 and ~$245. Last two quarters saw the elimination at prices between ~$242 and ~$335. The stock currently trades at ~$278.

Rivian Automotive (RIVN): A ~2% of the portfolio RIVN stake was first disclosed in their Q3 2021 investor letter. They made the investment in two rounds prior to the IPO: a small stake in late 2020 and a larger one in July last year prior to the IPO. They reduced the position in late January and bought most of it back at much lower prices later in the quarter. This quarter saw the position sold at prices between ~$21 and ~$50. The stock currently trades at ~$33.

Alcoa (AA): A 2.78% of the portfolio AA stake was established last quarter at prices between ~$56 and ~$95. It was disposed this quarter at prices between ~$46 and ~$91. The stock is now at $50.27.

Zendesk, Inc. (ZEN): ZEN was a ~3% position built during Q4 2021 & Q1 2022 at prices between ~$91 and ~$135. It was sold this quarter at prices between ~$54.50 and ~$129. The stock currently trades at $76.52.

Note: In June, Zendesk agreed to a $77.50 per share (~$10.2B all-cash deal) take-private PE offer. Notably, they had rejected a ~$17B PE offer in February.

Catalent, Inc. (CTLT), Dell Technologies (DELL), Leslie’s, Inc. (LESL), and TransDigm Group (TDG): These small (less than ~2% of the portfolio each) stakes were disposed during the quarter.

Suncor Energy (SU), Mosaic Company (MOS) and Ingersoll Rand (IR): These small (less than ~1.5% of the portfolio each) stakes established last quarter were disposed this quarter.

Stake Increases:

Ovintiv Inc. (OVV): OVV is a large (top five) 6.40% of the portfolio position purchased last quarter at prices between ~$35 and $55 and increased by ~175% this quarter at prices between ~$42 and ~$62. The stock currently trades at ~$50.

Cenovus Energy (CVE): The 3.27% CVE stake was built this quarter at prices between ~$16.50 and ~$24.75. The stock is now at $18.32.

Stake Decreases:

PG&E Corp. (PCG) & Units: PCG is currently the largest 13F stake at ~16% of the portfolio. The position came about as a result of participating in a PIPE (terms for the bankruptcy exit financing in 2020 called for up to $10.50 per share purchase price). Last two quarters have seen minor trimming. The stock currently trades at $11.72.

Note: Third Point is very bullish on PG&E. The Q1 2022 letter had the following: the stock is trading at 12x 2022 earnings compared to 21x for the utility index as a whole and well below its closest comparable, Edison International at 15x. Further, the stock should benefit from the expected reinstatement of cash dividend in 2023 and inclusion in S&P 500 index eventually.

Danaher Corp. (DHR): The top three ~14% DHR stake was established in Q3 2015 at prices between $60.90 and $71.50 and increased by two-thirds in Q1 2016 at prices between $62 and $74. There was a ~20% stake increase in Q1 2019 at prices between $98 and $132 while H1 2020 saw a ~20% selling at prices between $129 and $177. Last two quarters have seen another similar reduction at prices between ~$237 and ~$316. It currently trades at ~$286.

Note: The prices quoted above are adjusted for the Fortive (FTV) spin-off in July 2016.

SentinelOne (S): SentinelOne is the third largest position at 11.64% of the portfolio. The stake goes back to 2015 when they led the Series B funding round at a post-money valuation of $98M. They participated in each subsequent round as well as the IPO and after-market. The stock currently trades at $26.21 at a valuation of ~$6B – their initial 2015 investment has so far returned a stunning 60x. There was minor trimming this quarter.

Note: They have a ~10% ownership stake in the business.

UnitedHealth (UNH): The large ~7% UNH position was purchased during Q4 2020 and Q1 2021 at prices between ~$305 and ~$377. Last quarter saw a ~23% selling at prices between ~$456 and ~$521. The stock currently trades at ~$545. There was a minor ~6% trimming this quarter.

EQT Corp. (EQT), and Hertz Global (HTZ): The fairly large 6.13% EQT stake was established in Q4 2021 at prices between ~$18 and ~$23 and increased by ~80% last quarter at prices between ~$20 and ~$36. The stock currently trades well above those ranges at $49.12. This quarter saw a ~15% trimming. The 2.35% HTZ position was purchased during Q4 2021 at prices between ~$19 and ~$35 and it is now near the low end of that range at $19.47. Last quarter saw a ~10% increase while in this quarter there was a ~5% trimming.

DuPont de Nemours (DD): The ~4% of the portfolio stake in DD was established in Q1 2021 at prices between ~$69 and ~$86 and it is now below that range at $58.26. There was a ~11% stake increase in Q4 2021 while this quarter saw similar trimming.

CSX Corporation (CSX): CSX is a 3.42% of the portfolio position purchased last quarter at prices between ~$33 and ~$38. It was sold down by roughly one-third this quarter at prices between ~$28.75 and ~$37.50. The stock currently trades at $33.56.

Archaea Energy (LFG), Cano Health (CANO), and Perimeter Solutions, SA (PRM): These small (less than ~1.5% of the portfolio each) stakes were reduced during the quarter.

Note: They have a ~5.3% ownership stake in Cano Health.

Kept Steady:

Avanti Acquisition (AVAN), Compute Health Acquisition (CPUH), Crown Holdings (CCK), Global Blue (GB), GO Acquisition (GOAC), Jaws Mustang Acquisition (JWSM), and Ventyx Biosciences (VTYX): These small (less than ~2% of the portfolio each) stakes were kept steady this quarter.

The spreadsheet below highlights changes to Loeb’s 13F stock holdings in Q2 2022:

Dan Loeb – Third Point’s Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment