metamorworks

A Quick Take On CytoMed Therapeutics Pte. Ltd.

CytoMed Therapeutics Pte. Ltd. (GDTC) has filed to raise an undisclosed amount in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm is a pre-clinical biopharma company developing CAR-T cell treatments for various cancers.

CytoMed is still at a preclinical stage of development, so the IPO is extremely high risk.

I’ll provide a final opinion when we learn more details about the IPO from management.

CytoMed Overview

Singapore-based CytoMed Therapeutics Pte. Ltd. was founded to develop novel patient blood cell-independent platform technologies to create what it calls ‘off the shelf’ immunotherapies.

Management is headed by Chairman Mr. CHOO Chee Kong, who has been with the firm since its inception in March 2018 and was previously executive vice chairman of CNMC Goldmine Holdings and worked at DBS Bank Ltd of Singapore.

The firm’s lead candidate, CTM-N2D ‘consists of expanded gamma delta T cells grafted with NKG2DL-targeting CAR to enhance anti-cancer cytotoxicity.’

Management is seeking to finalize the details of an initial trial through the National University Hospital of Singapore and begin recruiting its first patients in the second half of 2023.

CytoMed has booked fair market value investment of $7.2 million in convertible debt and equity as of December 31, 2021, from investors including Glorious Finance Limited, WANG Shu, mDR Limited, and ZENG Jieming.

CytoMed’s Market & Competition

CAR-T cell cancer treatment is a type of immunotherapy that uses genetically engineered T cells to attack cancer cells. The T cells are modified to express a chimeric antigen receptor [CAR] that recognizes a protein on the surface of cancer cells. This helps the T cells to identify and kill the cancer cells.

According to a 2018 market research report by Mordor Intelligence, the global CAGR for solid tumor treatments is expected to be 15% between 2019 and 2024.

This is a very strong growth rate, as the overall solid tumor treatment market is extremely large, in the hundreds of billions of dollars annually.

Key elements driving this expected growth are increasing government initiatives, new product approvals in ovarian, pancreatic, and prostate cancers, and growing incidence and awareness of cancer.

Also, the research report states that “cancer rates could further increase by 50%, to 15 million new cases by 2020, as per the World Cancer Report.”

The most common cancers in 2016 were breast, lung and bronchus, prostate, colon, and rectum, as well as bladder cancers, melanoma of the skin, non-Hodgkin lymphoma, thyroid cancer, kidney, and renal pelvis cancer, leukemia, endometrial cancer, and pancreatic cancer.

Major competitive vendors that provide or are developing related treatments include:

-

Adagene

-

Agenus

-

AstraZeneca

-

BioAtla

-

Bristol Myers Squibb

-

CytomX Therapeutics

-

MacroGenics

-

Others

CytoMed Therapeutics Pte. Ltd. Financial Status

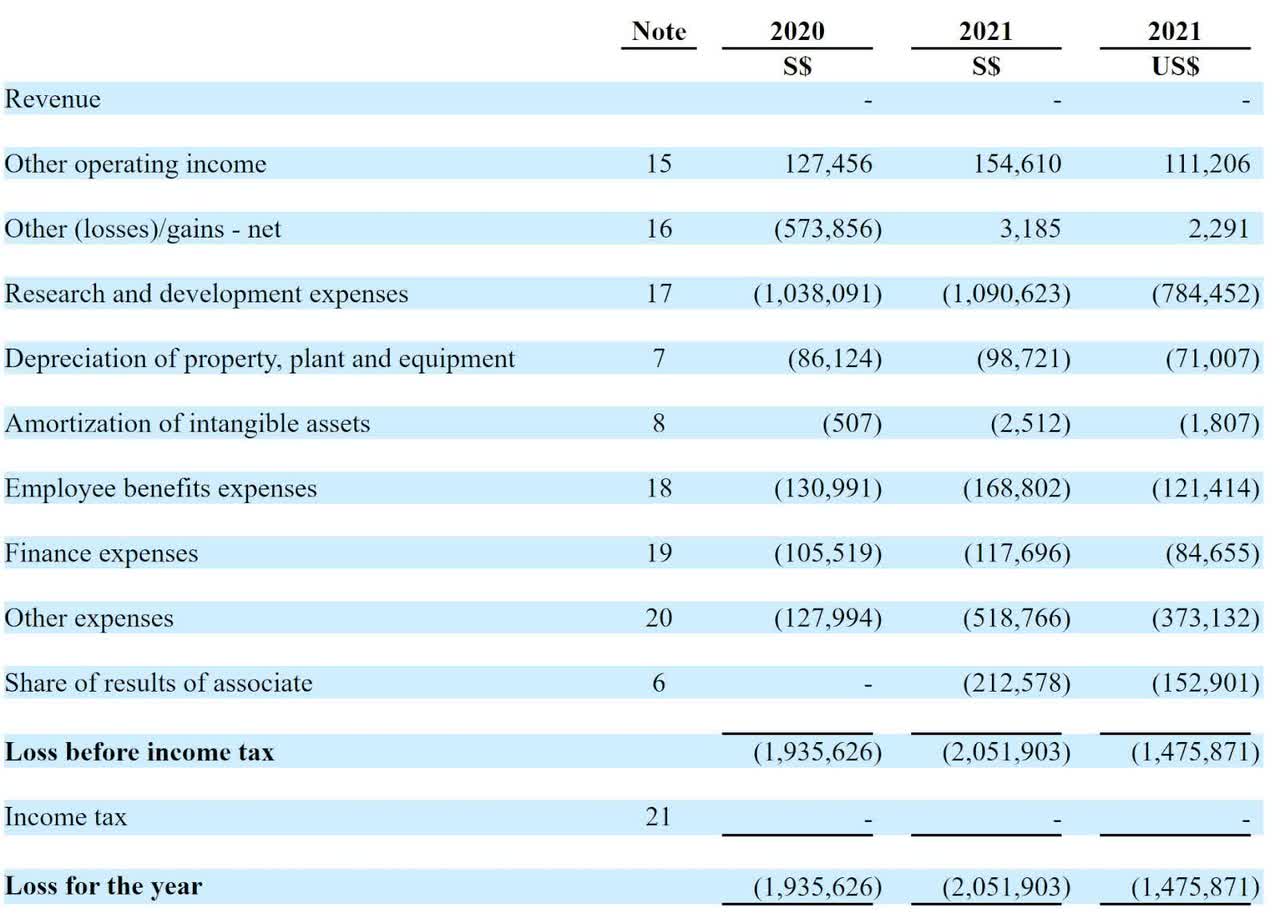

The firm’s recent financial results are typical of a pre-clinical stage biopharma in that they feature no revenue and significant R&D and other expenses associated with its drug candidate development efforts.

Below are the company’s financial results for the past two years:

Company Financial Results (SEC)

As of December 31, 2021, the company had $1.8 million in cash and $2.5 million in total liabilities.

CytoMed Therapeutics Pte. Ltd. IPO Details

CytoMed intends to raise an undisclosed amount in gross proceeds from an IPO of its ordinary shares.

No existing shareholders have indicated an interest in purchasing shares at the IPO price, although this element may become a feature of the IPO if disclosed in a future filing.

Management says it will use the net proceeds from the IPO as follows:

Approximately U.S.$ [2] million or [28.6%] to advance the clinical development of CTM-N2D including the CTA application, the initiation of a Phase I clinical trial, and up to the stage of commencing a Phase II clinical trial;

Approximately U.S.$ [2] million or [28.6%] to continue technology development of iPSC-gdNKT;

Approximately U.S.$ [1] million or [14.3%] to advance the clinical development of CTM-GDT including the CTX application, for a Phase I clinical trial in Malaysia; and

the remainder to fund other R&D activities, manufacturing expansion, working capital and general corporate purposes;

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management did not characterize the status of legal proceedings, if any, against the firm.

Listed bookrunners of the IPO are The Benchmark Company and Axiom Capital Management.

Commentary About CytoMed’s IPO

GDTC is seeking U.S. public capital market investment to advance its pipeline of drug candidates into clinical trials.

The firm’s lead candidate, CTM-N2D, ‘consists of expanded gamma delta T cells grafted with NKG2DL-targeting CAR to enhance anti-cancer cytotoxicity.’

Management is targeting late 2023 at the earliest to enroll patients into its Phase 1 safety trial.

The market opportunity for treating solid tumors is extremely large and is expected to grow substantially as the global population ages and becomes more susceptible to cancer conditions due to reduced immune system performance.

Also, Asian countries have historically had fewer cancer treatments available to treat their populations, and as those populations have gained in income and age, they are demanding better healthcare treatment options.

Management hasn’t disclosed any major pharma firm collaboration agreements or relationships.

The company’s investor syndicate does not include any well-known life science venture capital firm investors or strategic investors.

The Benchmark Company is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of 94.5% since their IPO. This is a top-tier performance for all significant underwriters during the period.

CytoMed is still at a preclinical stage of development, so the IPO is extremely high risk.

I’ll provide a final opinion when we learn more IPO details from management.

Expected IPO Pricing Date: To be announced.

Be the first to comment