RealDealPhoto

By: Alex Rosen

Summary

The Chinese economy seems to be trending downward, especially with the installment of Xi Jinping for a third term, who seems to be cracking down on dissension and thus stifling economic growth. Due to the strong dollar and the global supply chain issues, the Chinese manufacturing sector looks set to face a serious decline. As a result, sectors producing less tangible goods, such as digital technology seem poised to take over as the dominant future industries for the Asian giant.

Strategy

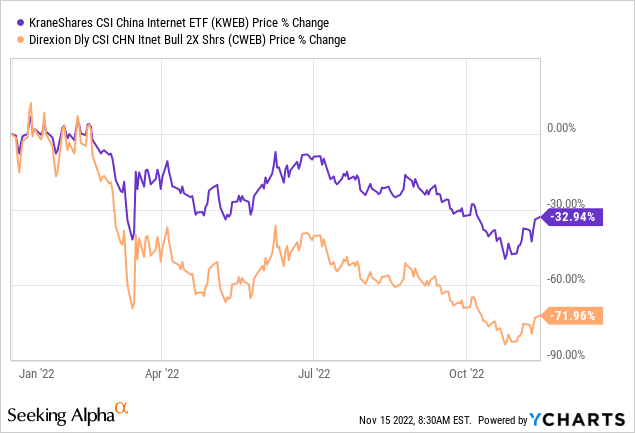

Direxion Daily CSI China Internet Index Bull 2X Shares (NYSEARCA:CWEB) follows KraneShares CSI China Internet ETF (KWEB) step for step in holdings, with the one caveat that CWEB has twice the exposure. This model really buys into the Chinese digital technology sector, with a 10% cap on any one holding. The fund is also re-balanced semiannually. The good news is, for investors who are really bullish on the Chinese digital sector, here’s an opportunity to go all in.

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Technology/Internet

- Sub-Segment: China large cap blue chip

- Correlation (vs. S&P 500): Low

- Expected Volatility (vs. S&P 500): High

Holding Analysis

CWEB has shown a surprisingly high volatility for a large cap blue chip ETF, having a 60% turnover ratio. However, as long as Alibaba (BABA) and Tencent (OTCPK:TCEHY), among other major Chinese internet companies, anchor the holdings, the model should hold consistent.

Strengths

Over the last three decades, China has evolved from being a base manufacturing country to developing one of the most sophisticated technology sectors in the world. Despite the recent macroeconomic shocks to China’s economy, they remain one of the world’s economic superpowers and will continue to be as such as they are still a rising hegemon who has yet to reach the pinnacle of its supremacy. This confidence in China’s ascension is based in no small part by the tremendous growth in the digital sector.

Weaknesses

CWEB has essentially put all its eggs in one basket. The lack of global diversification makes it particularly vulnerable to trends within the Chinese market. Right now we are seeing a great example of that, as the political issues in China are greatly affecting sectors which really shouldn’t be affected. That said, if you are going to put all your eggs in one basket, China is a good one to choose.

Opportunities

Currently the Chinese markets are in deep turmoil as investors await to see what the outcome of the Chinese Communist party’s five-yearly congress will be. Xi Jinping has clearly consolidated his power and has yet to clarify which direction he will take China, whether it be continued crackdowns on dissension that inhibit the flow of capital from Hong Kong, or a full-scale invasion of Taiwan. Or, on the other hand, it may have been all just saber rattling in order to ensure full support from the old guard in China. However, out of chaos comes order, and as such, whichever direction China goes, I think they will continue to be a leader in the digital sector.

Threats

Long-term, it is very difficult to see any exogenous threats, as China has worked diligently to ensure its digital sector is at the top of the food chain. In the short-term, the greatest threats to CWEB are purely endogenous. For example, the Russian energy sector was also seen as bulletproof, until the Russians started firing bullets. The greatest short-term threat would be if China decided to invade Taiwan. This could greatly upset the balance of power, and then all bets are off.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Sell

- Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

CWEB is made up of some of China’s strongest tech companies. In an investment landscape pitted with landmines, the simplicity of CWEB’s model makes it a very reliable option that should be able to hold its position regardless of external factors.

ETF Investment Opinion

For all the reasons laid out above, we value KWEB as a good addition to a broader portfolio. However CWEB is redundant and completely unnecessary. If you want exposure to the Chinese digital sector, look at KWEB. If you want to wrap yourself in a digital Chinese blanket, then CWEB might be the ETF you’ve been searching for.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment