Thinkhubstudio

|

Oct |

Nov |

Dec |

Q4 2022 |

2022 |

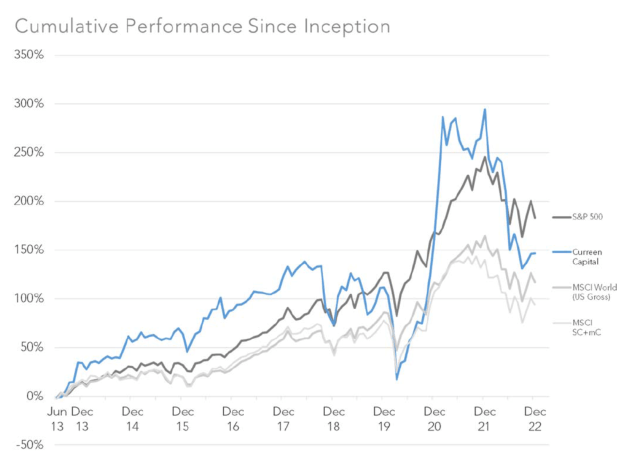

Since Inception |

Annualized |

|

|

Curreen Capital Partners LP |

2.83% |

3.48% |

0.11% |

6.53% |

-37.47% |

146.4% |

9.9% |

|

S&P 500 |

8.10% |

5.59% |

-5.76% |

7.57% |

-18.11% |

183.1% |

11.5% |

|

MSCI World (US Gross) |

7.20% |

7.00% |

-4.22% |

9.86% |

-17.87% |

117.0% |

8.4% |

Dear Partner,

Our fund was up 6.5% in the fourth quarter, and down 57.5% for the year. During the quarter we bought small positions in four companies. I wrote in our Q3 letter that I take the inverted yield curve as a strong signal to be conservative. I continue to believe this, and the majority of our fund is in cash.

This letter has two parts. First, I will review our performance for the year, which is largely a review of our portfolio from January until the beginning of September. Then I will discuss what we have done since the inverted yield curve signaled caution in early September, and how we are positioned going forward.

Review of a Challenging Year

Four positions caused the bulk of our losses in 2022: Jackson (JXN), Wickes, Truecaller and Artificial Solutions (OTC:ASAIF). Each one cost us between 6-7% points in return. In U.S. Dollar terms, all of our core investments declined in price in 2022, but these four accounted for much of our loss.

Overall, I think that most of our poor performance in 2022 came from owning unpopular ugly ducklings that fall especially hard when the stock market declines. Businesses like these rebound strongly when the stock market storm has passed, and perform well over time, which is why we focus on finding and owning them. While much of our decline came from ugly ducklings, I should have sold Artificial Solutions and Wickes earlier.

Part of our investment strategy is to focus on companies where directors and executives have bought stock. because this is often a sign of good things to come. I believe that directors and executives who invest their own money in a stock usually see a positive future for the business, and are more incentivized to drive shareholder value. But these positives do not always lead to good results, as exemplified by Artificial Solutions.

I initially found Artificial Solutions because the CEO, CFO, and a director were all buying stock in the business. We bought shares because I thought that the company was turning around, and that its sales wins would drive the company to be fast-growing and cash-flow positive.

During 2022, Artificial Solutions’ management and board members continued to buy shares, despite the company’s ongoing cash burn. I held on to our shares because I persisted in believing that a rational board and management would only buy stock if they saw good things coming (or were willing to cut costs). In retrospect I should have focused on the cash outflow and promptly sold the stock.

Academic research has shown that director and executive stock purchases have information value. For Curreen Capital, they continue to shine a light on attractive potential investments. Artificial Solutions’ cash burn was the key problem to solve, and despite their enthusiasm, management did not close the gap between revenues and costs. The key lesson that I take from Artificial Solutions is that I will not buy small and illiquid businesses that are cash-flow negative, even if directors and executives are buying stock, and even if other signs are also positive.

With Wickes, we bought a cash cow spinoff with good operating results. After we bought Wickes, its operating results came in weaker. I was patient, because I believed that the U.K. home repair and remodeling industry had cyclical tailwinds, and Wickes’ declines were merely off of the pandemic-driven boom. I began to more critically question the underlying industry tailwinds after several quarters of weak operating results, and after further analysis of the U.K. housing market, I determined that there was not a large backlog of pent-up demand. Instead of a business with tailwinds coming off of an especially strong year, I saw Wickes as a business with limited tailwinds, declining after a strong year. Viewed this way, it was not an attractive investment, and we sold.

Going forward, we will only own cyclical businesses if they have improving operating results, or if I have good data showing cyclical tailwinds. When Wickes’ operating results came in weak, I should have sold, or sought out more data on the underlying tailwinds.

Beyond Artificial Solutions and Wickes, the other positions in our portfolio declined in 2022. These businesses generally performed well, most were attractively valued throughout the year, and their stock prices declined anyway. Ugly ducklings perform poorly in market downturns, rebound strongly when the market storm has passed, and generate strong results over time as their qualities are recognized.

Where Are We Now?

In early January 2023 the U.S. Treasury yield curve continues to be inverted. As I wrote in the Q3 letter, an inverted yield curve is historically a warning signal for the stock market, and almost always precedes lower stock prices. It is no guarantee that the stock market will decline, and if it does there is no set time frame for when the decline begins.

My response to that signal is to hold cash, currently more than half of our fund, and to hunt for especially attractive opportunities. I aim to lessen the impact of potentially large stock price declines, and to seize opportunities to buy ugly ducklings at outstanding prices.

We continue to own our investments in GetBusy (OTCPK:GETBF) and Nilorn, because they are reasonably priced and operationally they are flowers. While I am cautious, I have continued to look for excellent businesses selling at attractive prices, and where I have found them, we have bought small (2% of our fund) positions. We bought four investments this way in the fourth quarter: Credit Acceptance (CACC, we paid 412.89/share), Dye & Durham (OTCPK:DYNDF, C$ 13.84/share), Frontdoor (FTDR, 19.23/share), and Truecaller (SEK 35.86/share).

We start 2023 with a cautious outlook, a stockpile of cash, and a willingness to invest in especially attractive businesses. Thank you for your commitment to Curreen Capital. I am grateful that we are making this journey together, and if you want to chat, please reach out. I enjoy speaking with current and prospective partners.

Sincerely,

Christian Ryther

Appendix

Curreen Capital Investments (Lists all positions larger than 5% of the fund)

GetBusy (GETB:GB): GetBusy provides online document exchange systems—primarily for accountants in the U.K.—and its Australian/New Zealand and U.S. business are growing well. GetBusy spun out of Reckon in August 2017, and has continued to grow since then. GetBusy does not earn money, investing through higher expenses to grow its existing businesses and attempting to launch new products. The underlying businesses are profitable and sustainable in the U.K., and potentially in the U.S. and Australia/New Zealand.

Nilörn Group (NILB:SS): Nilorn designs and delivers tags and labels for European clothing brands. The company combines just-in-time delivery with quality design that can elevate the customer’s products in the eyes of the end consumer. Management uses free cash flow to grow the business and pay a dividend. The company’s returns on capital are about 30%.

Performance Net of Fees, vs Alternatives

|

Curreen |

S&P 500 |

MSCI World |

MSCI SC+mC |

|

|

2013 |

34.299é |

14.8% |

14.1% |

16.4% |

|

2014 |

16.26% |

13.7% |

5.3% |

1.6% |

|

2015 |

5.05% |

1.4% |

—0.S% |

—0.2 |

|

2016 |

15.11% |

12.OF |

7.9 |

12.7% |

|

2017 |

18.21% |

21.8% |

22.8% |

23.2 |

|

2018 |

-22.32% |

4.4% |

—8.4% |

—14.3% |

|

2019 |

22.07% |

31.5% |

28.1% |

25.7% |

|

2020 |

23.55% |

18.4% |

16.3% |

16.5% |

|

2021 |

50.74% |

28.7% |

22.2 |

15.8% |

|

2022 |

-37.47% |

—18.1% |

—17.9 |

—19.OF |

|

Cumulative |

146.4% |

183.1% |

117.OF |

94.3% |

|

Annualized |

9.9% |

11.5% |

8.4% |

7.2 |

|

Fund inception on June 1, 2013 through year-end |

DISCLAIMERThe information contained herein regarding Curreen Capital Partners, LP (the “Fund”) is confidential and proprietary and is intended only for use by the recipient. The information and opinions expressed herein are as of the date appearing in this material only, are not complete, are subject to change without prior notice, and do not contain material information regarding the Fund, including specific information relating to an investment in the Fund and related important risk disclosures. This document is not intended to be, nor should it be construed or used as an offer to sell, or a solicitation of any offer to buy any interests in the Fund. If any offer is made, it shall be pursuant to a definitive Private Placement Memorandum prepared by or on behalf of the Fund which contains detailed information concerning the investment terms and the risks, fees and expenses associated with an investment in the Fund. An investment in the Fund is speculative and may involve substantial investment and other risks. Such risks may include, without limitation, risk of adverse or unanticipated market developments, risk of counterparty or issuer default, and risk of illiquidity. The performance results of the Fund can be volatile. No representation is made that the General Partner’s or the Fund’s risk management process or investment objectives will or are likely to be achieved or successful or that the Fund or any investment will make any profit or will not sustain losses. Unless otherwise stated, the performance information contained herein is for the Fund and is net of a 1.50% annual asset-based management fee and a 20% annual profit-based performance allocation. As with any hedge fund, the past performance of the Fund is no indication of future results. Actual returns for each investor in the Fund may differ due to the timing of investments. 2013 – 2021 returns were prepared based on audited financial statements, and 2022 performance information contained herein has not yet been independently audited or verified. While the data contained herein has been prepared from information that Curreen Capital GP, LLC, the general partner of the Fund (the “General Partner”), believes to be reliable, the General Partner does not warrant the accuracy or completeness of such information. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment