Fly View Productions

Biotechnology Recovers, CureVac N.V. Not Yet

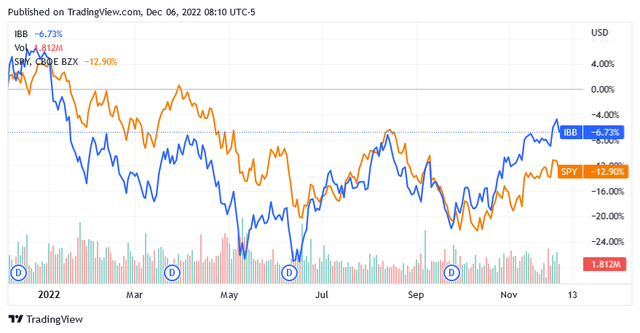

A 6.73% drop in the iShares Biotechnology ETF (IBB) benchmark index proves that the past 12 months have not been ideal for investing in US-listed biotechnology stocks. The industry has been hit by the same headwinds that have pushed the entire US stock market lower.

The SPDR S&P 500 ETF Trust (SPY) is down nearly 13% at the time of writing, owing to the aftermath of Russian aggression in Ukraine, runaway inflation, and recession risk brought on by tightening monetary policy.

However, over the past two months, biotech stocks have recovered faster than the broader market, which could point to the following new trend. Traders seem willing to take on more risk when investing in biotech stocks, as the industry is teeming with growth stocks whose share price is likely to skyrocket as inflation continues to fall and the possibility of only a mild recession in 2023 gradually takes shape.

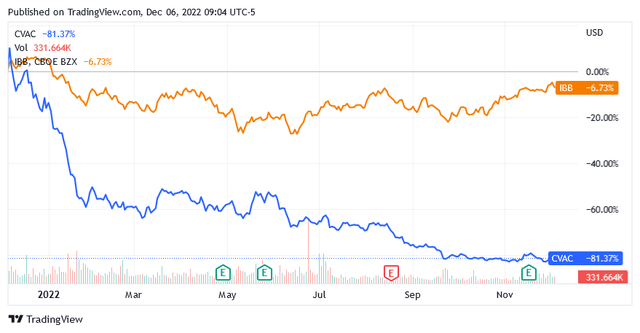

CureVac N.V. (NASDAQ:CVAC) is certainly not in this group of bullish biotech stocks, as its shares have also fallen sharply over the past 2 months while the sector instead went back into rally mode.

With CureVac N.V. the market sees the end of a cycle but not the beginning of a new one. As a developer of a vaccine against the Covid-19 virus and rare infectious diseases, CureVac N.V. has run out of fuel after giving it all during the pandemic crisis, and shares have not had a real chance to recover from these levels so far.

CureVac N.V. In The Biotechnology Industry

Headquartered in Tübingen, Germany, CureVac is a global biopharmaceutical company focused on messenger RNA [mRNA] technology.

The company uses this mRNA technology to develop vaccines against viral infections.

mRNA [messenger ribonucleic acid] are molecules that contain the genetic information the body needs to make certain proteins. The mRNA molecule carries the genetic information from the nucleus to the cytoplasm. More specifically, genetic information is the DNA, while the information in the cytoplasm enables the production of proteins. These proteins help the human body fight against a wide range of viral diseases.

As of July 2020, CureVac has been collaborating with GSK plc (GSK) to jointly develop prophylactic vaccines against various viral infections and COVID-19 vaccine products and to develop vaccines based on modified mRNA technology, all using CureVac’s second-generation mRNA technology.

Prophylactic Vaccines from CureVac: An Analysis

Prophylactic vaccines are medical remedies used to avoid the occurrence of various viral infectious diseases. These include smallpox, poliomyelitis, and measles, but also yellow fever and hepatitis caused by the B virus [HBV], and vaccines to prevent the human papillomavirus [HPV] infection.

In some cases, it’s about preventing diseases that have been eradicated for years, such as smallpox, or that are endemic to a few countries, such as Pakistan and Afghanistan for the polio virus.

Children are vaccinated against measles, but with the world’s declining birth rate and fierce competition from the presence of many manufacturers, this business is unlikely to be as profitable as others that sell treatments for the most common diseases affecting the world’s population.

Vaccination against the yellow fever virus is available for travelers who need to reach certain tropical and subtropical areas of the African continent and South America, but vaccination is not mandatory outside of these very specific contexts.

HBV has a low incidence in developed countries [as a guide, 0.33% to 0.72% in the US adult population]. The percentage in parentheses is the number of US citizens living with HBV infection [between 0.88 million and 1.89 million in 2021] divided by the US adult population [about 264.14 million in 2022].

Also, the transmission routes are limited to a few specific circumstances, such as unprotected sex and the use of intravenous drugs. There have been cases of transmission through blood transfusions in the past, but that doesn’t happen anymore because all blood is tested very well and screening technologies have been developed to research many things.

Individuals can get vaccinated against HBV, but only for specific reasons: e.g., travelers flying to underdeveloped or poor countries where there is a risk of contracting the virus. In addition, healthcare workers receive the vaccination against HBV.

However, apart from the above risk factors, which as seen are very limited, experts do not recommend preventive vaccination against HBV.

Although HPV, transmitted through unprotected sex, can cause cervical cancer in women, the risk is still quite low and in 9 out of 10 infected women the condition resolves itself within about two years.

Again, the chances of generating significant revenue from the sale of preventive HPV vaccines are slim.

The Vaccine Against the COVID-19 Virus Infection and Its Future Possibilities and Other Minor Pipeline Developments

In terms of principle of operation, CureVac’s project of a vaccine against the COVID-19 virus is not different from the vaccines that have been given to people through various mass vaccination campaigns around the world for about a year.

After that, the COVID-19 virus vaccine based on mRNA technology is inoculated into the organism and the cells carry out the instruction to produce part of the coronavirus proteins. These are viral hermit proteins that alone are unable to regenerate the virus by reassembling it.

Therefore, these protein molecules make up the antigen which, when introduced parenterally [to be injected] into the individual’s bloodstream, induces the formation of certain substances called antibodies.

The antibodies selectively bind to the inducer antigen and inactivate or break it down.

About 2 weeks after vaccination, the human body has sufficient antibodies to counteract infection with the COVID-19 virus or certain mutations of the coronavirus. The protection thus acquired is effective for a few months, not in the sense that it prevents contracting the COVID-19 virus or its variants but it reduces the risk of developing severe symptoms of the infectious disease.

Inhibiting the disease from developing severe symptoms also reduces the risk of transmission.

As for the COVID-19 virus, there is no longer a global health emergency as the coronavirus that caused the 2020 pandemic has morphed into much less aggressive variants that only pose a threat to certain groups of people. These are people whose immune system has been weakened by stressful therapies, illnesses, or old age.

Of course, world health authorities are right to recommend the greatest attention to this virus, which to date has caused 6.64 million deaths out of 646 million infections worldwide. However, judging by the shape of the infection and death curves, it really seems that we are nearing the end of this problem.

In addition, people have practically stopped using the mouth mask, restrictions and lockdowns are no longer required, and many people have chosen not to undergo further boosters. As a test case, a significant resurgence in cases was expected in September and October as people returned from vacation, but this did not happen.

Public health officials will continue to recommend vaccinations to people, particularly the most vulnerable and the elderly, but advances in technology mean that the world will get one shot a year instead of multiple booster shots throughout the year.

Furthermore, competition is very stiff for CureVac’s anti-COVID-19 vaccine product candidate, which is still in the first phase of a clinical trial against the coronavirus, due to the presence of drug giants like Pfizer Inc. (PFE) and Moderna, Inc. (MRNA), as well as Johnson & Johnson (JNJ) and AstraZeneca PLC (AZN), just to name a few.

The company is also developing a prophylactic vaccine against rabies based on mRNA technology. The disease is almost risk-free in developed countries. As a guideline, no more than 3 cases per year are reported in the US. The product has completed a phase 1 clinical study.

Another product has completed phase 1 clinical trials for influenza, Lassa fever, yellow fever, common cold and malaria.

Lassa fever and malaria are of no concern in developed and developing countries. Either because the disease is confined to certain areas of the world not normally visited by tourists, or because very few cases pose no danger to the public in the country to which the virus is imported.

The company is also investigating whether its technology could one day provide a potential treatment for patients with skin and salivary gland cancers. While development is still in phase 1 clinical trials to test safety in a small number of healthy volunteers, the target diseases are rare cancers.

With such a portfolio and prospects pointing to no profit generation in the near term, the stock’s underperformance is not surprising.

Third Quarter 2022 Financial Results

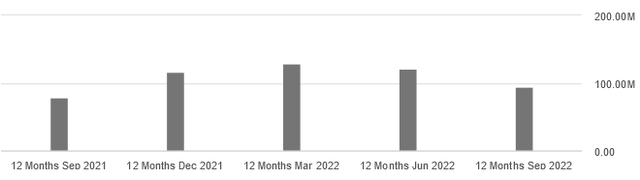

Q3 2022 revenues came in at €11.2 million, down 62% year-on-year due to the termination of certain collaborations last year.

As the chart below shows, CureVac’s 12-month sales are trending down, which could indicate a loss of confidence in treatments in development as the company’s portfolio of collaborations has shrunk over the past year.

The operating loss of €52.4 million improved by €90.7 million from the same quarter last year as the ending of clinical trials evaluating the company’s potential vaccine against the COVID-19 virus resulted in a significant reduction in research and development expenses. In terms of effectiveness, the product was not up to the task.

Before the application of taxes, the company suffered a loss of €47.7 million, which was better than €143.5 million in the same quarter last year.

At the end of the third quarter of 2022, the balance sheet reported €540.9 million in cash and cash equivalents, which dropped from €811.5 million at the end of 2021.

Total debt was €41.3 million, which today funds a business that costs more than it earns as evidenced by CureVac NV’s weighted average cost of capital [WACC] of 8.8% versus CureVac NV’s return on invested capital [ROIC] of -23.34%.

The company burns money instead of creating resources, and as long as this state of affairs persists, values will be destroyed.

The Stock Price

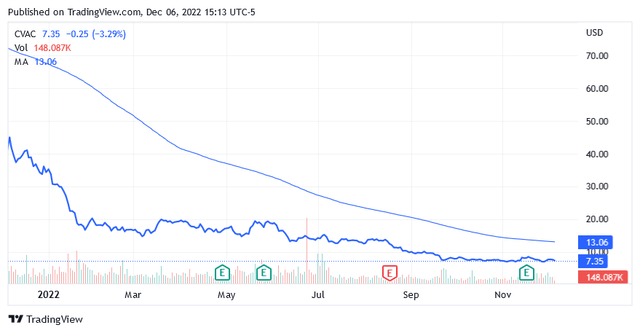

After the year-to-date tumble, shares are trading very low at $7.35 per unit as of this writing, compared to the long-term trend of the 200-day moving average of $13.06.

The stock price, which drives a market cap of $1.47 billion, is also well below the midpoint of $26.02 of the 52-week range of $6.81 to $45.23.

While low, these valuations are not enough to encourage a purchase as there appears to be no momentum in the portfolio of treatments under development.

In collaboration with GSK, the company is investigating its modified mRNA technology as a potential treatment for influenza and COVID-19 virus, with clinical data expected to be released sometime in the first quarter of 2023. Perhaps some sort of rally could take place after this event, but it doesn’t seem like there’s a lot of opportunity for that. Should this happen, it will have a short-term impact on the stock price.

Shares should not deviate significantly from these levels.

Conclusion

What the company hopes to achieve with its mRNA technology are vaccines that prevent diseases for which the market is highly competitive, mostly because of the presence of drug giants.

Among other things, targeted diseases by the company are rare or no longer an emergency, so they cannot be the core on which to build future success, but at best complement a portfolio of highly profitable treatments.

Due to a lack of drive in the pipeline, this is a stock that currently does not deserve a Buy rating, but a Sell rating.

Be the first to comment