dorian2013

Shares of Cullinan Oncology (NASDAQ:CGEM) have fallen by roughly 40% since IPO was priced at $21 in January of 2021. Year to date performance is a more modest -19%.

ROTY member CM.97 reminded me of the merits of potentially revisiting this small oncology player, given its strong cash position of $656M as contrasted to negative enterprise value and deep, multi-faceted pipeline with an attractive mix of validated as well as novel targets on deck.

Couple that with institutional clustering and growing preclinical portfolio (CLN-617 combining the promise of IL-12 and IL-2 within a single cytokine fusion protein), and I’m glad we are taking the time to dig deeper here.

Figure 1: CGEM weekly chart

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see share price was once above the $45 level but has since steadily declined to current levels in the $10 to low teens range. Considering the fact that enterprise value is actually negative, balance sheet is strong, pipeline is deep plus lead asset has been significantly derisked and partnered while still retaining 50/50 US profit share, my initial take is that purchasing a pilot position in the near term would seem to be a logical action.

Overview

Founded in 2016 with headquarters in Cambridge (31 full-time employees), Cullinan Oncology currently sports enterprise value of ~NEGATIVE $100M and Q2 cash position of $656M providing them operational runway through 2026 (a rarity in small cap biotech).

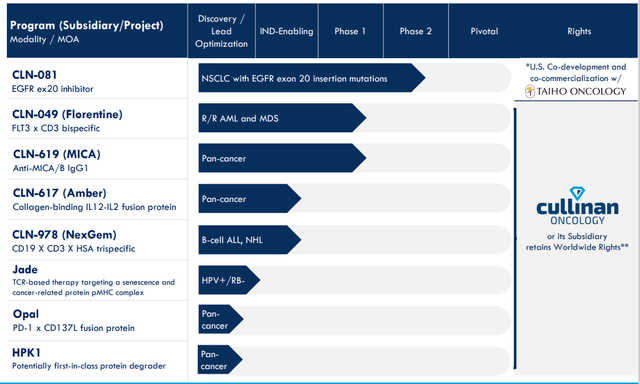

In a recent presentation at Morgan Stanley Healthcare Conference, CEO Nadim Ahmed describes the company as fully focused on cancer with broad pipeline consisting of eight programs (range of hematology and solid tumor indications across a range of different modalities).

Figure 2: Pipeline

3 assets are currently in the clinic and by this time next year they project having 5 programs in the clinic (each being either first-in-class or with best-in-class potential). Leadership team has wealth of relevant expertise across all stages of clinical development team as they continue to build it out.

Cash runway of 4 full years is very uncommon in biotech and even more so for a company this size. It gives them the flexibility to accelerate development of certain programs as well as be on the lookout for novel assets to license in (take advantage of poor market conditions and pessimism).

CEO states “modality agnostic precision oncology” is at the heart of their discovery efforts including focusing on high impact targets, from there identifying the optimal way to pursue those targets (small molecules, biologics, fusion proteins, etc.). The company is also very agnostic to the source of innovation as well (“innovating without borders” referring to external partnerships). Goal is to bring forward only the most promising oncology assets via “thriller or killer” experiment (if it doesn’t meet the criteria, they kill development of said asset and if it does thrill, they double down on the investment to move the asset forward). There are 3 key criteria for advancing (or licensing in) an asset, namely:

- Has to be first or best in class

- Activates immune system or targets key oncogenic drivers

- See monotherapy activity in preclinical work

Ultimately, the goal is then to create new standards of care for cancer (quite a lofty one I might add, but I’m much more a fan of this approach versus companies striving for only incremental improvement over existing drugs).

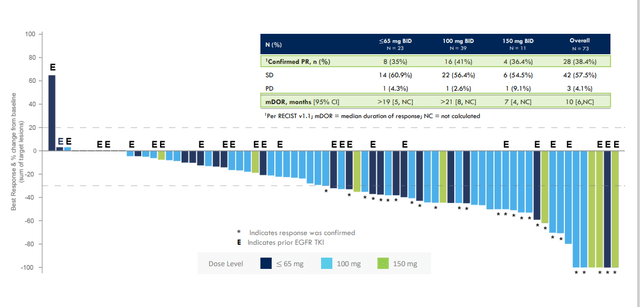

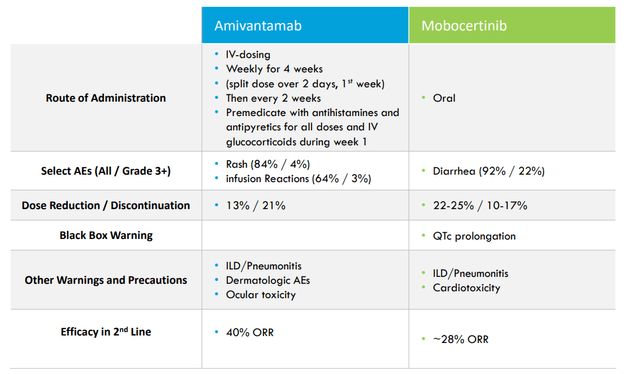

Regarding May 2022 deal with Taiho Pharmaceuticals for lead drug candidate CLN-081 (EGFR exon20 inhibitor), the team looked at a range of options after phase 1/a data produced 41% ORR at the 100mg BID dose comparing favorably (including with safety profile) to such competitors as JNJ’s amivantamab and Takeda’s mobocertinib.

Figure 3: CLN-081 data across multiple dose levels

It was a competitive process and they picked the deal with best financial and strategic terms for them ($275M upfront in an environment where cash is king, $130M milestone payments for US regulatory milestones and 50/50 profit share in US). Strategically, the ultimate goal is to become a commercial stage biotech company and so profit share versus royalty stream allows them to build commercial infrastructure in a lean and cost-efficient way that can be applied to the rest of the pipeline. They will make the co-commercialization decision as they get closer to launch (personally, given competition in the space I hope they pass and use the cash to focus on clinical development of earlier-stage drug candidates instead of putting together a salesforce).

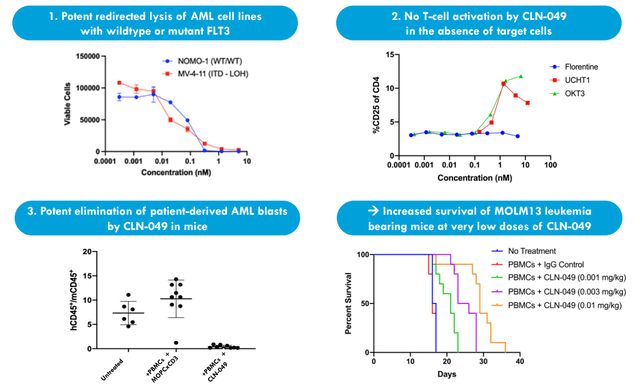

Moving on to CLN-049, one would think at first glance this is just a me-too FLT3 inhibitor (following the likes of quizartinib and gilteritinib). However, CEO notes this is the first bispecific antibody targeting FLT3 in AML patients to enter the clinic. Approved FLT3 agents focus on the mutant form of FLT3 (accounts for 20% to 30% of AML patients). CLN-049 addresses the extracellular domain of FLT3 (does not matter whether wild type or mutant) and thus targets 80%+ of patients (much larger addressable pool).

Figure 4: CLN-049 preclinical data shows broad AML cell elimination resulting in improved survival

Through AML cell line experimentation they showed significant tumor cell lysis across both mutant and wild type FLT3. As for safety profile, they showed preclinically that their antibody only activates T cells in the presence of FLT3 (much more specific molecule). In mice they showed improved survival with very low doses and complete eradication in some cases. Phase 1 dose escalation study is ongoing with data expected in mid-2023 (primary objective is safety, but closer to that time more clarity regarding expectations will be provided). FDA is very cautious with T cell engagers, meaning dose escalation can take much longer.

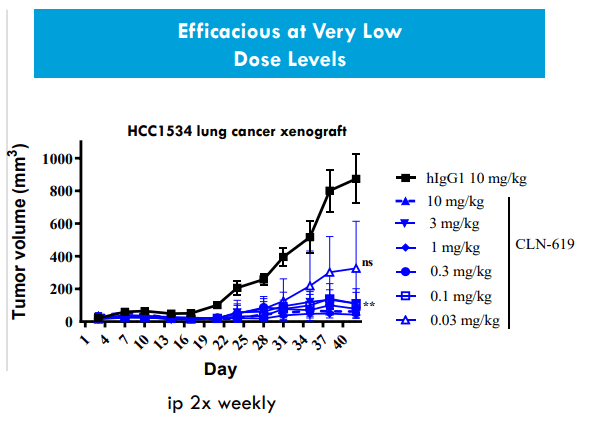

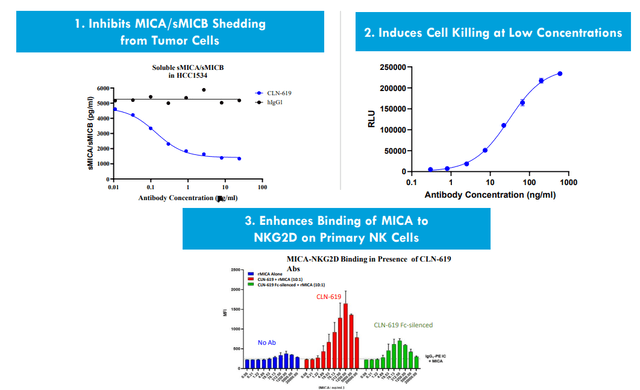

As for CLN-619 targeting MICA/B, this target is found across various conditions in the human body (stress cells, tumor cells, etc.). Normally MICA/B can invoke immune cells (especially NK cells and subsets of T cells) which come in to destroy the stress cell or tumor cell. In tumor microenvironment, proteases can cleave MICA/B off the cell surface of tumor cells and thus renders those cells invisible to the immune system (evading the immune system). CLN-619 is the first antibody to enter the clinic targeting MICA/B (ubiquitously expressed across heme and solid tumors, representing a pan-cancer approach). The antibody prevents the shedding of MICA/B (tagging tumor cells to be attacked by NK cells and T cells) and tumor cells can no longer hide from the immune cells. 619 also induces ADCC (antibody-dependent cellular cytotoxicity), invoking both adaptive and innate immune systems (dual mechanism of action). Biology here is exciting and molecule could uniquely address this pan-cancer opportunity.

Figure 5: CLN-619 preclinical data supports multiple MOAs

Literature shows that MICA/B shedding in cancer patients portends poor survival. Across variety of different diseases, the ligand most expressed across tumor types is MICA followed by MICB. Xenograft models show significant tumor shrinkage even at low doses of 619 as a monotherapy agent. They also show reduction in shedding of MICA/B (preclinical package tying up nicely with the hypothesis). One of the advantages of having robust cash position is that they can do things in parallel instead of sequentially (doing parallel development of monotherapy and pembrolizumab dose escalation).

Figure 6: CLN-619 shows efficacy at very low dose levels in xenograft lung cancer model

Corporate Slides

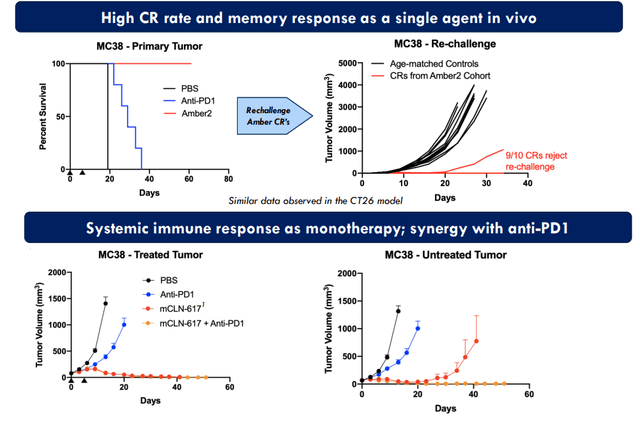

Moving on to a highly intriguing drug candidate, CLN-617 (first-in-class cytokine therapy combining IL-2 and IL-12), CEO notes that historically cytokines are very potent molecules but have shown tremendous toxicity limiting widespread use of these agents. 617 is a fusion protein combining these two cytokines for the first time to deliver them intratumorally (collagen binding domain helps limit it to stay within the tumor). They’ve also seen preclinically robust memory T cell response and abscopal effect (go beyond the tumor to reach other lesions, an attractive aspect of such therapies I highlighted prior in my due diligence on ROTY holding Replimune with its intratumoral injectable oncolytic virus therapy). CLN-617 should move into the clinic 1H 23 (so I would not expect meaningful data until 2H 24).

Figure 7: CLN-617 preclinical POC shows robust local and systemic antitumor responses

Lastly, CEO notes that like many companies in the space due to current pessimism they are trading a bit below cash. Modality agnostic approach gives them multiple shots on goal and a diverse pipeline (not limited by a singular platform). Team is very disciplined about advancing only the most promising assets (thrill or kill). In 2021 when CEO joined, they had 1 program in the clinic, now 3 and next year will have 5 (all first or best-in-class). They are still looking externally for the right assets at the right price that are a strategic fit to bring in as well as efficiently move programs forward in parallel (operational flexibility again due to the strong cash position).

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $656M as compared to R&D expenses of $26.4M (increased slightly). G&A also rose to $10.7M. While management is guiding for runway through 2026, my overly conservative estimates ($200M annual burn) equate to a 3-year operational runway (again, likely to be extended via additional milestones and payments via partner Taiho). Also, keep in mind from management’s language in the prior call that licensing in new assets is highly possible and depending on the price tag has the potential to substantially reduce their cash runway.

As for needle moving catalysts, I noted above that mid 2023 provides a confluence of catalysts with initial data for FLT3 and MICA/B programs (key question being whether we see sufficient activity to warrant valuation rebounding higher or it’s mainly about safety this early on).

In order to gain greater perspective on the Taiho collaboration for CLN-081, I listened to the May 12th call. Here are a few nuggets that stood out:

- 081’s unique chemical structure is distinct from other exon 20-directed TKIs. It is not active against wild-type or mutant HER2 which could provide a tolerability advantage. 100mg BID dose shows best-in-class profile (41% confirmed response rate, 15-month median duration of response and 12-month median PFS. Importantly, they’ve seen favorable safety and tolerability including no grade 3 or greater EGFR-related toxicity and low rates of discontinuation or interruption.

Figure 8: CLN-081 shows efficacy at the high end of EGFR exon20 inhibitors with more favorable safety profile

- Drug candidate has Breakthrough Therapy Designation and strategic collaboration comes 3 years after in-licensing this compound. Interestingly, Taiho discovered CLN-081 and already has strong oncology infrastructure in the US (markets Lonsurf and Inqovi, FGFR1-4 inhibitor futibatinib has September 30th PDUFA date).

- Value creation here is very apparent, as the company realized $295M in transaction revenue on CLN-081 to date versus $42M R&D expense (could grow to $425M with regulatory milestones not to mention US profit share).

- 2023 data set should be of interest, considering the phase 2b portion of trial will enroll patients with active CNS metastases as well as those who have relapsed after prior exon 20 therapies (ASCO update showed 2/3 responses in patients who failed amivantamab or mobocertinib).

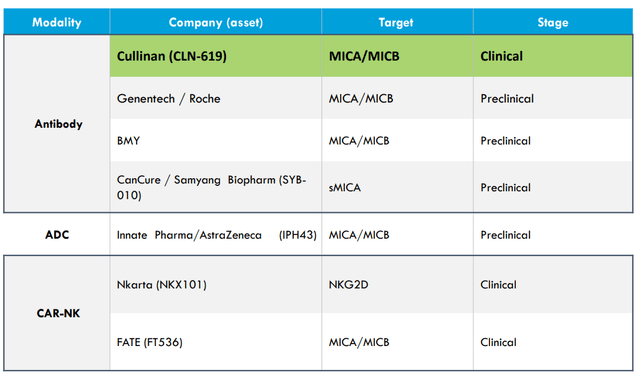

As for competition in MICA/B, given broad applicability one would not think it’s a zero-sum game. Still, it’s interesting that a variety of approaches are being evaluated including ADC (antibody drug conjugate) and CAR-NK.

Figure 9: Multiple competitors and approaches to MICA/B in very early innings of development

As for institutional investors of note and insiders, BVF has been adding exposure with 12.3% ownership stake (including with June 6th $8.3M purchase at $11/share). Insider selling over the past year does not inspire confidence and CEO Nadim Ahmed owns just under 10,000 shares.

As for relevant leadership experience, CEO Nadim Ahmed served prior as President of Hematology at Bristol-Myers and before that as President, Global Hematology & Oncology at Celgene. Chief Scientific Officer Patrick Baeuerle is an executive officer at MPM Capital (owns over 7.6M shares of the company) and served prior as VP Research at Amgen Munich (developed BiTE antibody Blincyto approved in 2014 for ALL). Chief Medical Officer Jeffrey Jones served prior as VP Global Drug Development at Bristol Myers Squibb.

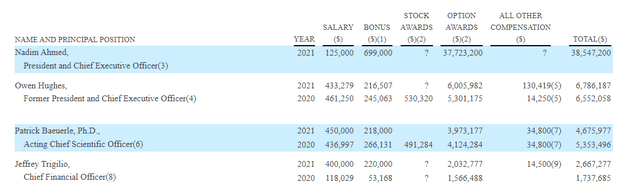

Moving on to executive compensation, I know that the company has a solid balance sheet but cash portion of CEO pay at over $800k appears on the rich side. Also, bonus in form of options awards also seems very excessive including CEO at $37.7M. To be fair, I acknowledge that the CEO started in October 2021 and company needed to offer sufficiently attractive pay package for him to come on board ($625k sign on bonus).

Figure 10: Executive compensation table

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

Moving on to IP, patent portfolio consists of 10 patent families including 2 issued US patents, 38 patents issued in foreign jurisdictions and 129 patent applications pending worldwide (earliest expirations in 2034). Later patents that could arise from pending applications are expected to expire between 2037 and 2041.

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), we are reminded that competition for certain drug candidates looks quite fierce (makes me wonder if these will truly move forward in the clinic from early to pivotal stage studies, even if significant antitumor activity is observed). For example, CLN-049 in AML faces bispecifics from Amgen, CD123-directed agents in the clinic, T-cell engagers, AbbVie’s Venclexta and other targeted agents. A number of larger companies are tackling cytokines including IL-2 and IL-12 including Core Biotech holding Ascendis Pharma with its long-acting version, Alkermes, Roche and Dragonfly Therapeutics to name a few. CD19 especially is one area I wish they would not venture into via CLN-978 (competing with CAR-T, CAR-NK, ADCs, and T cell engagers).

Final Thoughts

To conclude, as a value play with negative $100M enterprise value, I can see the rationale for long term investors to buy and hold as the company pursues assorted attractive targets in the clinic (further investing only in those where data merits moving forward into the next stage of development). Approach is certainly unique, dubbed “modality agnostic precision oncology” by the CEO and starkly contrasts to peers trying to use one specific technology platform to pursue all targets on their radar.

Much like some of our current holdings with strong balance sheets, solid cash position should allow Cullinan to take advantage of current market and sector pessimism to bring in promising new assets on the cheap if preclinical or clinical data is sufficiently promising. One point of caution is that mid 2023 data readout might center more around safety and tolerability for second and third drug candidates (FLT3 and MICA/B) with only initial signs of activity (perhaps not a “needle-mover”).

For readers who are interested in the story and have done their due diligence, CGEM is a Buy with long term timeframe in mind as it will take years for thesis to play out (promising drugs to move forward in the clinic as data merits, setbacks likely as some will get killed off due to disappointing data or rapidly evolving competitive environment).

From an ROTY perspective (focus on next 12 months), I’m likely to wait until after mid 2023 update before revisiting. If we see a situation in which there’s a “sell the news” reaction even as safety data looks good and broader hypothesis for FLT3 and MICA/B assets get incrementally derisked, that would make for a potentially attractive entry point for our purposes.

Risks include fierce competition in certain areas they are pursuing (EGFR exon20, AML, MICA/B, CD19, etc.), delays to clinical timelines and disappointing data for lead assets. The company could also overpay for licensing in new drug candidates which would shorten its operational runway, and my instinct is that participating in co-development of CLN-081 might not be the wisest move (investing in commercial infrastructure instead of letting partners do the heavy lifting at least this early on in the story).

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment