AdrianHillman

The legend of the little boy who cried wolf too many times is well known to all of us. Eventually when the wolf did arrive and the boy cried wolf once more, nobody responded. The press had called “pivot” so many times that nobody is watching for a pivot any more but in any case, “pivot” is not the defining event. The defining event is whether inflation is dissipating. The real question is, are the Central Banks back in control to revert to the status quo as stated by the USA Federal Reserve in its statutory mandate: “The Federal Open Market Committee (“FOMC”) is firmly committed to fulfilling its statutory mandate from the Congress of promoting maximum employment, stable prices, and moderate long-term interest rates.”

Note the three objectives,

- Stable prices which are usually linked to a targeted 2% inflation rate;

- Promoting maximum employment; and

- Moderate long-term interest rates.

Reverting to the status quo or even making visible progress towards the return to the status quo, will most likely trigger the next bull market. No “pivot” required, and interest rates can remain higher for longer without impeding a return to a bull market. None of the Fed targets are absolutes, these targets are to be understood with reference to the general economic environment in the USA and globally.

Snapshot of the markets

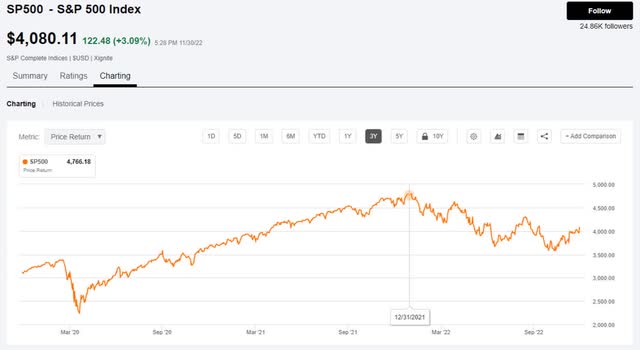

S&P 500

We can, with obvious hindsight, trace the start of the bear market to the end of December 2021. The “market” did not at that time believe that a bear market had commenced but the bear certainly ravished the market since Jan 2022. The first hints of a bottoming came in June 2022 but it was just a bit too early. More evidence of success towards a return to the status quo was required. The market essentially tracked sideways since the June 2022 bottom until mid-October 2022. This latest break up is supported by significant macroeconomic megatrends.

We will investigate the return to the status quo together in the next sections.

The S&P500 has been hinting at a 2nd bottoming since mid-October 2022. Will it stick?

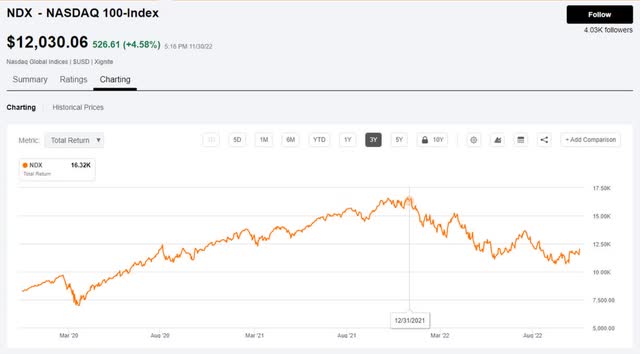

Nasdaq-100

Same with the Nasdaq. The bear market commenced at the end of 2021. Any mention of a “bear” at that stage would have been ridiculed but with the certainty of hindsight it’s obvious. This was a serious bear market, just compare the COVID bear against the Inflation bear. With the Nasdaq100, we can also track the June 2022 and October 2022 bottomings and ask the question, will it stick?

I have previously discussed the bear market and also referenced my algorithmic oscillator trading models during the bear market phase. Both my S&P500 and Nasdaq models have transitioned to long term bullish oscillators, and both are on buy signals since early November 2022 which, for the record, supports the bottoming theses. This article, however, is about the economic fundamentals required by the central banks to regain the mandated status quo.

Positive trends in inflation

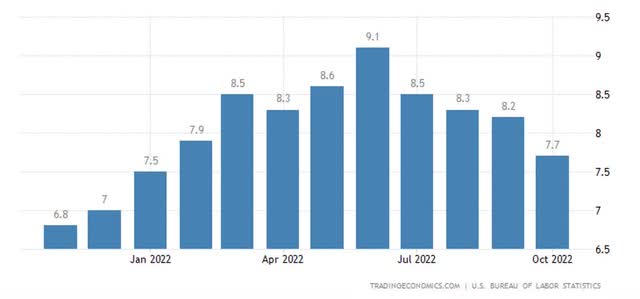

The battle against inflation is not yet won but the market bottoming is not dependent upon declaring victory. We only require solid evidence that such a victory is likely and approaching.

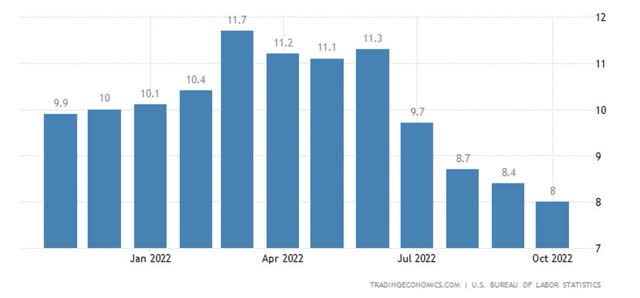

USA Consumer Inflation (“CPI”)

The USA CPI peaked in June 2022 and has declined already for over four months from 9.1% in June 2022 to 7.7% in October 2022.

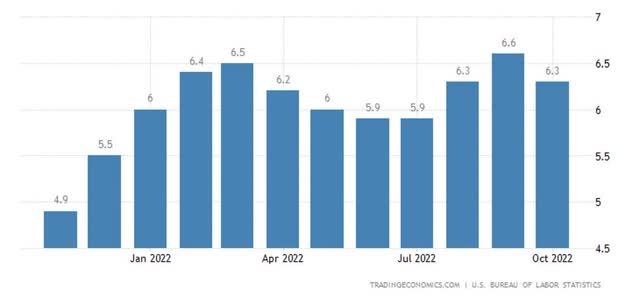

USA Core Inflation Rate

Core inflation excludes the price changes in food and energy. The trend in core inflation is somewhat different though still compelling. Core inflation peaked at 6.5% in March 2022 similar to CPI, declined into June 2022, to only peak once again in September 2022 at 6.6%. Yet, that peak in September was only 0.10% higher than the March 2022 peak. The downtrend is not yet fully established in core inflation, but it would be a push to argue that core inflation is still in an uptrend. I view core inflation as stabilized with the next probable development to establish a downtrend.

USA Producer Prices Change

Producer inflation (“PPI”) is the inflation experienced by manufacturers and business generally. It is usually an early indicator of inflation pressures in the pipeline as “producers” will make every attempt to pass that inflation on to consumers. So, producer inflation is an early warning system of inflationary pressures, or not. US PPI has been declining for some time since peaking in March 2022, eight months ago. Please note that any positive number on “inflation” means that prices are still increasing but declining numbers indicate that the “inflation” is increasing at a slower pace.

It will not serve any purpose to try and review all geographical inflations globally and we already have a few hyperinflations brewing in countries such as Turkey, Sri Lanka and Pakistan. Some EU countries other than Turkey are also grappling with serious inflation, as is the UK. I will review Germany as the largest economy in the EU as indicative of inflationary pressures in the EU. Please keep in mind that the EU and the European Central Bank (ECB) have been positively dragging their feet in the fight against inflation leaving the USA to do all the heavy lifting.

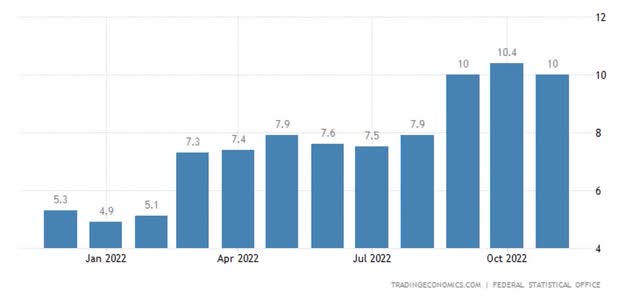

Germany Inflation Rate (“CPI”)

It’s clear that there is still some work required to bring the German inflation rate under control. The small decline from October to November 2022 is encouraging but hardly definitive.

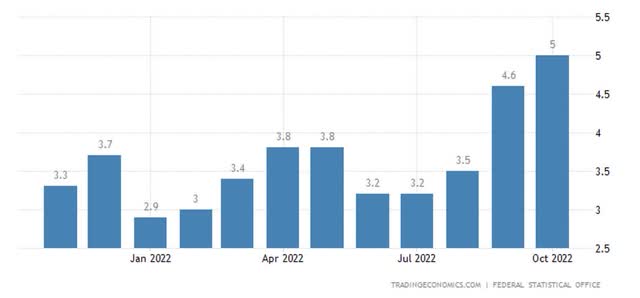

Germany Core Inflation Rate

No battles won on core inflation in Germany as yet, but the relatively lower level of the German core inflation at 5% is indicative of the impact of the energy crises in the EU. That 5% core inflation is still less than the USA core inflation for the time being.

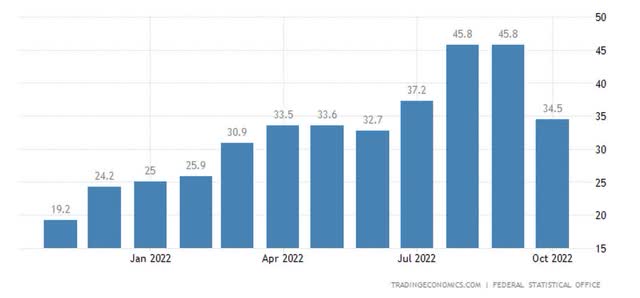

Germany Producer Prices Change

Once again, the picture on PPI for Germany is not yet definitive and certainly not flattering at all. The extent of the decline in PPI from 45.8% to 34.5% in Germany is a positive development which bears watching for the next couple of months. It is expected that this trend will continue. The war in the Ukraine does play a significant role in the German inflation story and any conflict resolution developments should positively influence German inflation. Any other progress on resolving the energy crises will similarly contribute to returning German PPI numbers to acceptable levels.

Inflation comment

The USA has taken the lead in the fight against inflation and the USA has already made significant progress in that fight. The rest of the global economies still have some work to do but the USA as the largest single global economy leads and will be the master of its own markets. The USA progress in restoring the inflationary status quo as defined by the USA Federal Reserve Bank (the Fed) is already significant and can no longer be ignored.

The Global Crude Oil Market

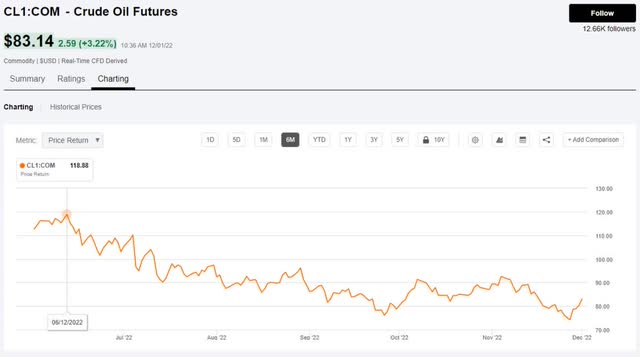

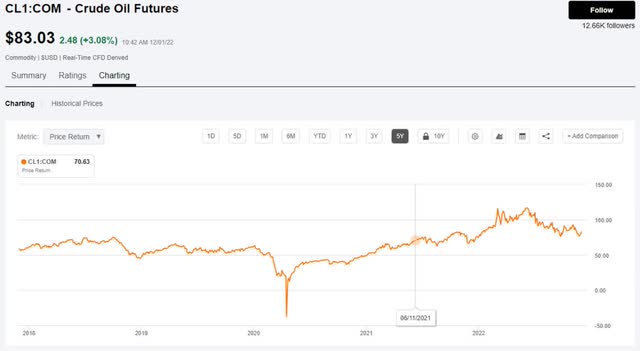

The crude oil prices increased well before the Ukrainian war (see the period from late 2021 to 24 February 2022 when the Ukrainian war started) but was pushed even higher by that geopolitical development. The WTI crude oil price was trading in a general range of between $65 and $75 before the advent of accelerated inflation which saw the WTI crude oil price approach $120.

The benchmark crude oil for the USA market is WTI. The WTI crude price peaked in June 2022 at near $120 and has since declined steadily, in line proportionally with international crude oil prices, to trade around $80 recently. That is a 33% decline in the crude oil price. The pre-inflation crude oil price was around the $70 levels.

It follows that the impact of crude oil on the inflation rate is also declining fast and nearing the no inflation impact levels which should start showing up in future CPI numbers globally. The around $70 oil price is historically stable and indicative of supply and demand harmony. The economic principle of “the cure for high prices is high prices” seems to be reasserting itself on the crude oil market.

Russian oil selling at as low as $52 to India and China removes much of the latter countries’ general crude demand and must certainly exert downwards pressure on crude oil prices.

This trend in crude oil is, as expected, also confirmed in gas prices.

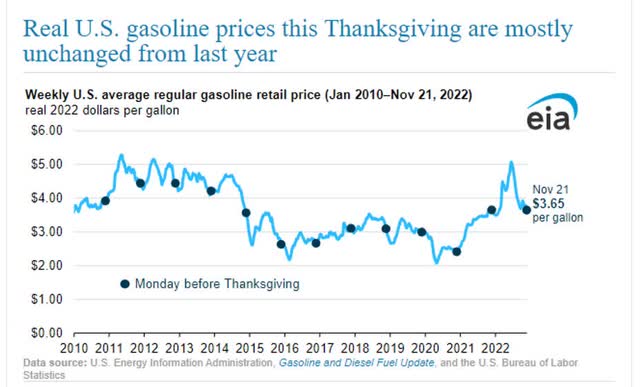

Real USA Gas Prices (Energy Information Administration)

The latest price print is now $3.47 which is a price level lower than what prevailed before the Russian/Ukrainian war. Current expectations are that gas prices could fall below $3 by Christmas.

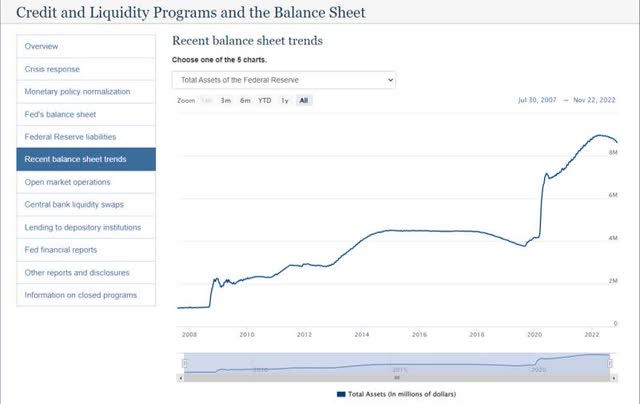

The Fed’s Balance Sheet

The expansion of the balance sheet of the Fed was a major contributor to the inflationary crises and it had been discussed in my previous article “Inflation: The BIG Market Crash Risk?”. It is not a requirement for the Fed to reduce its balance sheet for inflation to decline as inflation will decline as soon as the Fed stops expanding its balance sheet (stops inflating). Actively reducing the Fed’s balance sheet will accelerate the decline in inflationary trends.

Credit where credit is due, the Fed has stuck to its guns and have actively reduced its balance sheet for most of 2022 which is contributing to its success in containing inflation with the objective to return to its 2% inflation target.

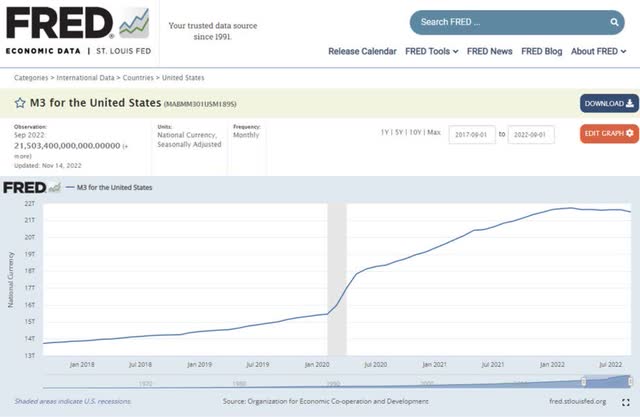

M3 Money Supply

Expanding the money supply is equally inflationary. The same principle of, what’s done is done, with regards to expansion of the money supply and its impact on inflation applies. The requirement is not that the money supply must decline for inflation to decline, it is only that the expansion of the money supply must cease.

Again, the Fed demonstrated its commitment to regain its inflation targets by actually reducing M3 money supply for most of 2022. Note how the money supply was aggressively expanded from the COVID crisis March 2020 event to the advent of sticky high inflation by late 2021.

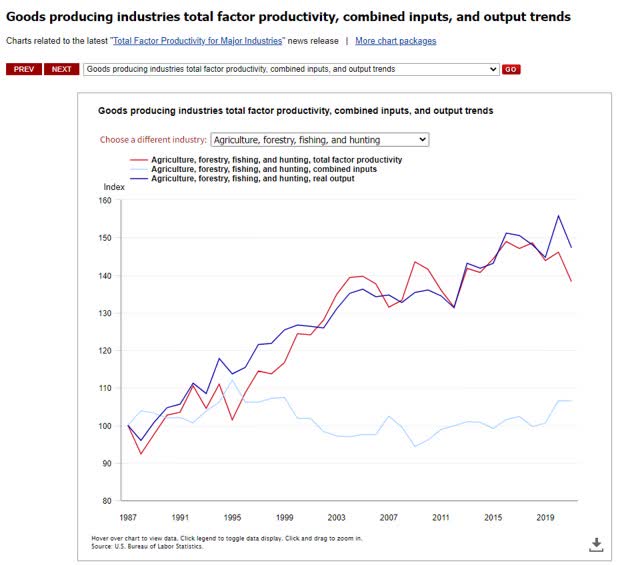

The Role of Productivity Advances

It is not well known that productivity advances collectively is one of the most effective counters for inflation. For a comprehensive explanation see my previous article. The simplified explanation is that productivity advances are always deflationary and inflation mitigation happens when one combines deflationary forces with inflationary forces. The COVID pandemic resulted in a decline in productivity which had the effect of exacerbating inflationary pressures. The data for 2022 is not yet available but it is reasonable to expect that exiting the COVID pandemic would have restored productivity to at least near the previous historical levels. That would again contribute to mitigating inflationary expansion in a less visible or followed manner.

USA Government

Source: Goods producing industries total factor productivity, combined inputs, and output trends

Opening up the USA and global economies would most certainly unleash productivity advances and the economic innovation which took place in coping with the COVID pandemic would also be expected to contribute productivity advances. Businesses actively streamlining activities as a result of higher interest rates and potential declines in business activities as a result of the Fed’s anti-inflation actions would further contribute to productivity advances.

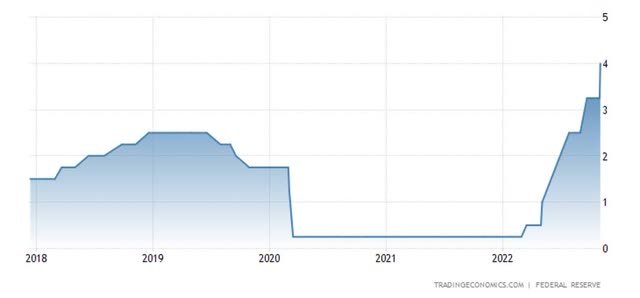

Interest Rates

The Fed also deployed interest rates as the main thrust of its battle against inflation. The Federal Funds Rate was increased to 4%. It is expected that the Federal Funds Rate will increase by at least another 1%, or perhaps 0.25% more to 5% or 5.25%. We are now migrating towards a crossover of interest rates and inflation rates where the Fed Funds Rate may stay above the inflation rate until it is back within the 2% target range. I would expect the Fed to keep the Fed Funds Rate above inflation even when the 2% target is reached as the USA economy is not in any need of stimulatory monetary policy based on available information at this stage.

Scope to start reducing interest rates may develop earlier than what is generally expected given the potential for productivity advances, the declining energy prices and the progress made by the Fed on money supply reduction as well as on its balance sheet reductions.

A number of interesting developments are noticeable from the Fed Rate increases. The interest rate is already considerably more than the level at which the Fed abandoned its interest rate increases in 2019. It follows that the USA economy coped much better with the interest rate increases than the market participants had expected and compared to the 2019 experience. The USA’s latest GDP is still positive at 2.9% for Q3 2022. Consumer spending has not collapsed as expected under a bear scenario in the wake of higher interest rates coming in at a solid 0.8% in October 2022 and is well up from the 2020 and 2021 levels. Consumer spending after inflation is still positive and growing. These are bullish economic outcomes and not supportive of an impending bearish calamity at these higher interest rate levels.

The higher Fed Funds Rate gives the Fed much leeway to manage monetary policy and to deploy stimulatory interest rate reductions at the appropriate time when needed. The outcomes of the fight against inflation have so far favored a soft landing with victory in sight. A crossover between the Fed Funds Rate and the core inflation rate is only a few data points away.

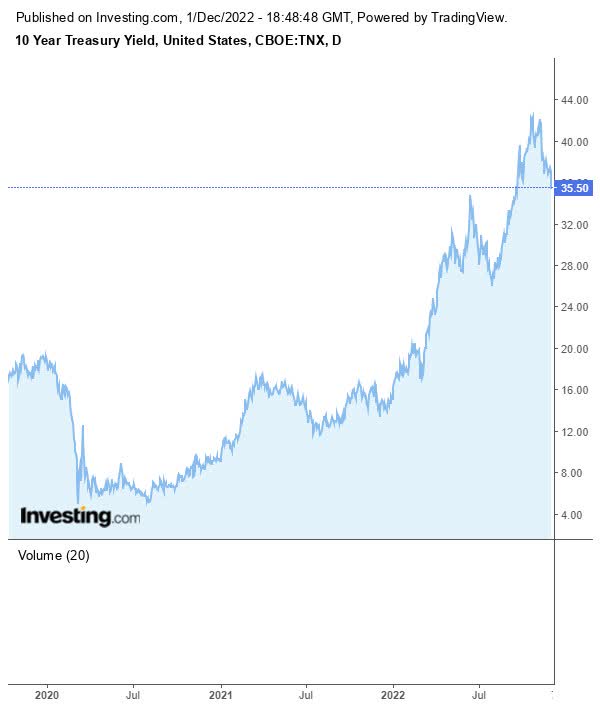

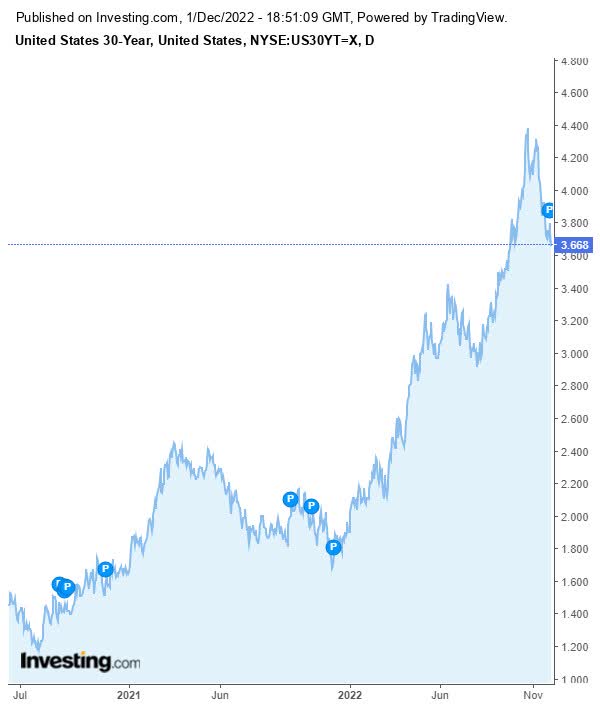

USA long bond rates have recently made a peak and though early days, may be reverting to a measured decline.

Investing.com

Investing.com

It is even more noticeable with the 30-year USA bond yield, making a decisive move down. Again, it is still near term, but the evidence keeps piling up in the same direction. Mortgage rates have also picked up on this trend, “Mortgage rates drop by largest amount in 41 years”.

Switching from the SQQQ to the NASDAQ:TQQQ

The variables above strongly suggest that the bear market is on its way out yet the weight of trading is concentrated in bearish positions. Bloomberg recently reported that “Traders Pump Record $658 Million Into Bet Against Tech Stocks” in a massive short play against the Nasdaq100 right when it is bottoming. The Nasdaq100 has declined from a high of 16212 in November 2021 to the current levels of around 11500. My preferred trade right now, based upon shifting macroeconomic trends, is to buy the TQQQ to position me for a 3x leveraged upturn in the Nasdaq100. I prefer the Nasdaq100 trade over a S&P 500 trade from a risk-on perspective. The risk-reward profile is very attractive even though it is a 3x leveraged ETF.

The TQQQ is trading around the $23.60 levels on 1 December 2022. My target price for the end of December 2022 is $38 which loosely correlates with a Nasdaq100 level of 13100, target price for end of February 2023 is $60 which loosely correlates with a Nasdaq100 level of 14500, and a target price of over $80 by the middle of 2023 which loosely correlates with a Nasdaq100 level of 16000. These target prices are based upon the success of the investment thesis and the macroeconomic outcomes materializing as expected. There is a fairly good chance that the bull market may run faster and hotter than expected to achieve these target prices earlier.

The TQQQ is my preferred play into 2023. Please be aware that this is a leveraged trade and do not attempt the trade if you are not knowledgeable in managing a highly volatile leveraged trade. The risk advantage offered by this product is that it is linked to the Nasdaq100 index with the implied diversification. It is always important to achieve a good entry point on a volatile asset such as TQQQ. I have disclosed target prices through to mid 2023 but this type of leveraged ETF is not meant to be a buy-and-hold or portfolio hold as it suffers time decay, it is meant for expressing a strong shorter term view which should be actively managed. The, let’s call it a trading thesis here, is to position for the return of the Nasdaq100 to its pre-bear levels and then to exit, or to take profit at a suitable risk reward level in line with your risk profile.

The Pareto Principle

The Pareto principle states that for many outcomes, roughly 80% of consequences come from 20% of causes (the “vital few”).

The Pareto Principle or generally referred to as the 80/20 rule is derived from the work of Italian economist Vilfredo Federico Damaso Pareto who found that the a few vital elements or variables would dominate the overall outcomes. This is a very useful technique to apply in a world where we are all overloaded with information. Applying the Pareto Principle would allow us to seek out those elements or variables in a thesis which would dominate the outcomes of that thesis. This article actively selected those “vital few” dominating macroeconomic variables which would dictate the bottoming of the investment markets given the origin of the bear market from excessive inflationary pressures.

Risks to the renewed bull market thesis

We are only in the initial phase of the market bottoming and though the weight of evidence collectively would suggest that the likelihood is that the bull market will gain traction, it is not yet fully established. Waiting for certainty will of course also mean that potential gains from an early move would all disappear.

These are not the expected outcomes but:

- Inflation may prove more tenacious and flare up on 2nd and 3rd round effects.

- Variables not known or not considered Pareto vital few may negate or defeat the bottoming of the market.

- The Fed may choose to revert to expanding its balance sheet and to increase money supply, losing the fight against inflation.

- Liquidity needs of governments without the support of central bank funding may trip up longer term interest rate yields pushing long-bond rates back upwards.

- Crude oil prices may spike again due to influences such as the market activities of OPEC+ or the consequences of an escalation in the Ukrainian war.

Conclusions

A number of Pareto vital few important macroeconomic megatrends have developed.

- The S&P500 and the Nasdaq 100 are in an early bottoming phase and building towards a new bull market.

- Inflation, and USA inflation in particular, is now stabilized and in the case of the USA is already in a downwards trend.

- The Fed’s balance sheet is shrinking and the M3 money supply is also trending down.

- Productivity advances are expected to contribute to mitigating inflationary pressures.

- Interest rate increases in the Fed Funds Rate is expected to moderate from this point and stop increasing altogether within 1%-1.25%, while long bond rates have made a decisive short-term top.

- Room to start dropping the Fed Funds Rate may develop earlier than expected especially once the inflation rate, interest rate crossover takes place and the inflation rate declines below the Fed Funds Rate.

- Market sentiment had become overbearingly bearish with massive trading positions on the SQQQ.

These megatrends materially impact the direction of the financial markets which is generally bullish when the Fed regains or is in control of the status quo as defined in its statutory mandate. These megatrends support a conclusion that the Fed is regaining its statutory mandate parameters and a return to the status quo is being anticipated by a developing bull market.

The bear is now heading into hibernation and it’s time to run with the bulls.

Be the first to comment