Alistair Berg

High expectations = disappointment

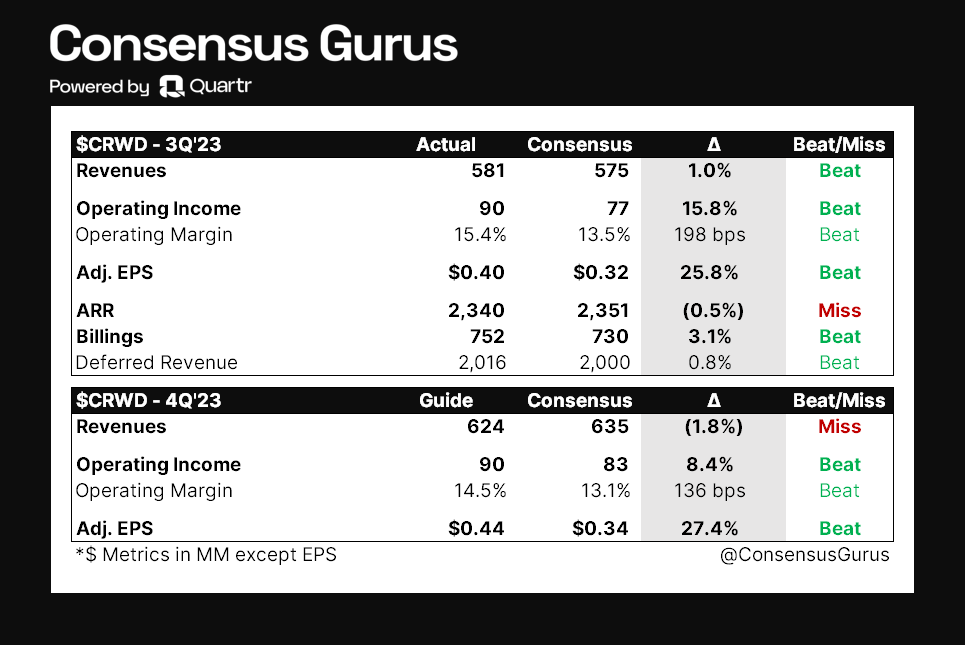

Shares of CrowdStrike Holdings, Inc. (NASDAQ:CRWD) are down 19% following the company’s disappointing FY4Q23 (C4Q22) revenue guidance of $624 million at the midpoint (+45% YoY) vs. $635 million consensus. This again highlights the notion that when a high-growth business like CrowdStrike is being lavishly valued at almost 11x forward sales (pre-earnings), results/outlook will have to materially exceed investors’ expectations just to keep the stock from falling.

Consensus Gurus

Before C3Q22, investors had become used to CrowdStrike surpassing consensus estimates with a median revenue beat of 5.2% over 12 quarters. With Q3 revenue beating consensus by just 1% and Q4 guidance coming in 1.8% below the Street, CrowdStrike is suddenly in the penalty box. Of the 40 analysts on Wall Street, 38 had a Buy rating on the stock with an average price target of $228 before the earnings release. Obviously, expectations will be adjusted to better reflect reality.

Is the growth story broken?

There’s not much wrong with CrowdStrike from a revenue standpoint, as calendar Q3 revenue growth remained quite heathy at 53% YoY in a rather challenging macro environment. Though Q4 revenue is guided slightly below consensus, the projected 45% YoY growth is still materially better than most software companies. That said, management did highlight longer deal cycles (multi-phase deals with enterprise customers + contract commits/+11% avg. days to close in smaller customers/net new ARR down $15 million from Q2) as companies delay their spend and focus more on OPEX. However, CEO George Kurtz saw no signs of budget cuts given robust cybersecurity demand (consistent discounting and ASP with Q2).

On the other hand, Q3 ARR of $2.34 billion grew 54% on a very strong 2021 comp (+67%). Total subscription customers grew 44% to 21K, all regions (U.S. ~70% of revenue) showed sequential growth, and the percentages of customers buying 5/6/7+ modules were 60%/36%/21%, up 55%/66%/81% YoY. Identity Protection solutions were the largest ARR contributor with increasing attach rates on new logos, given 80% of cyberattacks today are based on identity theft.

Despite a slower macro, management reiterated its $5 billion ARR target by FY26/C25. Assuming Q4 ARR growth to be inline with revenue growth (+45% YoY), this implies an annualized 26% ARR growth from C2022-25. While growth will understandably moderate going forward, CrowdStrike remains a solid revenue performer.

There’s also the debate on whether investors should focus on CrowdStrike’s cRPO (current remaining performance obligations) or ARR going forward. On the conference call, management discussed a few reasons why the former is a “noisy metric.” First, cRPO include subscription contracts that have 1-3 year terms and are mostly non-cancellable. Since existing customers typically renew their multi-year subscriptions with one-year contracts, these renewals are not recognized in cRPO. Second, cross-sells are usually added to existing contracts, and thus usually have <1-year durations and do not go into cRPO. Third, CrowdStrike has consumption-based deals (e.g., MSSPs or managed service security providers) that are billed monthly, which are again excluded from the calculation of cRPO.

What does the market want then?

CrowdStrike has always been a luxuriously valued business, with forward EV/sales reaching as high as 43x in 1Q21 when the pandemic accelerated the shift towards the cloud. The stock began 2022 with a forward EV/sales multiple of 22x and is now being valued at roughly 8x C2023E sales (lower than 9x in March 2020) based on the post-market price of $111.60. Evidently, the market is done paying a silly revenue multiple for the business.

While 8x revenue on a 35% 2023 growth may seem like an attractive deal, it’s worth noting that investors are increasingly focusing on profitability for valuation support. This is an area where CrowdStrike performs rather poorly considering quarterly OPEX growth trailed revenue growth by an average of just 6 points over the last 8 quarters, indicating very little operating leverage. As much as management thinks the company is profitable on an adjusted basis, the majority of non-GAAP operating income comes from adding back stock-based compensations. In Q3, SBC of $140 million accounted for 58% of $243 million in operating cash flows.

In my view, the market wants good old-fashioned GAAP earnings. While CrowdStrike remains a fast-growing business, its earnings quality is frankly not great. If I were in charge, stock-based compensation (“SBC”) would be the first item on my cut list. I believe employees have every right to become shareholders and participate in the appreciation of a company’s stock price, but diluting shareholder interest through excessive stock-based compensations completely defeats that purpose.

What to do with the stock?

I believe CrowdStrike is a Buy for tactical traders but not necessarily for long-term investors, as the company’s path to profitability remains a concern. Based on consensus estimates, CrowdStrike is likely to finish the current year with a GAAP net margin of -8% vs. -16% in 2021. If CrowdStrike can somehow engineer a positive net profit margin of say 10% on $3 billion in revenue in 2023, that comes down to GAAP diluted EPS of ~$1.24 for a still demanding forward P/E multiple of 90x. As a result, I see a strong case for buyers to rent CrowdStrike vs. own the stock in the current environment.

Be the first to comment