Sundry Photography

We live an increasingly interconnected world that is now more vulnerable to Cyberattacks than ever before. Therefore, it is no surprise that the Cybersecurity market is forecasted to grow at a solid 13.6% compounded annual growth rate [CAGR] and reach a value of $376 billion by 2029. CrowdStrike is poised to benefit from this trend as a Gartner leader in endpoint security protection which includes the protection of your computer, laptop, smartphone, IoT devices, etc. The rise in remote/hybrid working has expanded the “attack surface” and caused a greater need for “endpoint” protection.

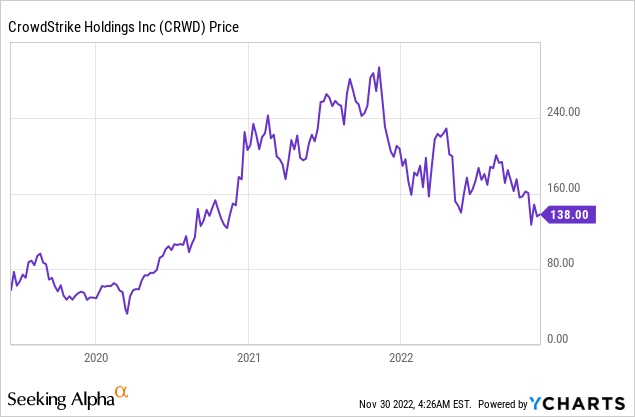

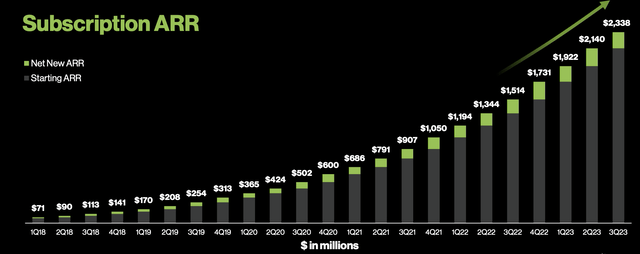

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) has grown its revenue at over a 50% clip historically, and recently produced solid financial results for the third quarter of fiscal year 2023. The company beat analyst expectations on revenue and earnings, however, it missed expectations on Annual Recurring Revenue [ARR] and reported lower-than-expected guidance moving forward.

Stock investors were spooked by the guidance and have been merciless in selling the stock, which has plummeted by 19% in pre-market trading. However, I believe this is a market overreaction given CrowdStrike has still increased its customer base by 44% year-over-year to 21,146 and boasts 15 of the top 20 banks in the U.S as customers. Thus, in this post, I’m going to break down the company’s business model, financials, and valuation, so let’s dive in.

Business Model Recap

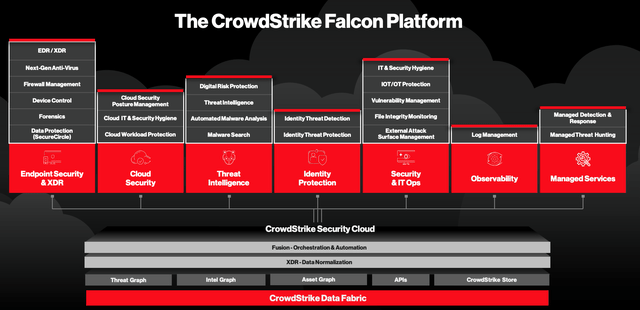

In my previous posts on CrowdStrike I have covered its business model in more detail, but here is a quick recap. CrowdStrike is a leader in endpoint protection but it has also expanded its flagship Falcon platform to cover Cloud Security, Threat Intelligence, Identity Protection, and much more. Vendor consolidation is a growing trend, as companies wish to reduce their operational overhead of dealing with multiple endpoint solutions.

CrowdStrike Platform (Investor Presentation Nov 2022)

CrowdStrike also is a leader in Artificial Intelligence-based threat detection. The company uses AI to map the “security posture” of your endpoint device (laptop) and then look for anomalies or changes in the system.

AI CrowdStrike (Investor presentation)

Secure Third Quarter Results

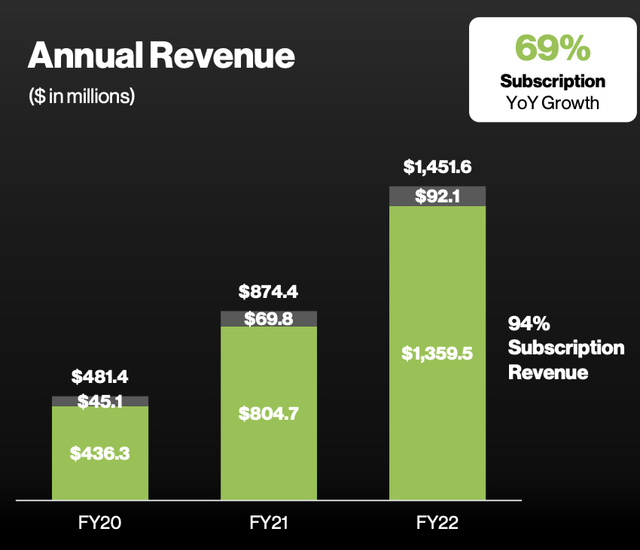

CrowdStrike reported solid financial results for the third quarter of FY 2023. Revenue was $580.88 million, which increased by a rapid 53% year-over-year and beat analyst estimates of $575 million. This was driven by strong subscription revenue, which increased by 53% year-over-year to $547.4 million. Subscription revenue is the largest revenue contributor, making up ~94% of revenue in the fiscal year 2022.

This is fantastic to see, as subscription-based SaaS companies operate using my favorite business model, which enables consistent revenue, easy forecasting, and cross-sell opportunities. Professional Services revenue was also a record $33.5 million and increased by 46% year-over-year. This is the lower margin part of the business, but one that helps to improve retention rates and customer loyalty. By geography, the U.S market continued to grow by a solid 46% year-over-year, while international revenue increased by 72% year-over-year.

Annual Recurring Revenue (ARR) is often used as the true “north star” metric for SaaS companies. In this case, ARR increased by a rapid 54% year-over-year to $2.338 billion. Keep in mind this includes ~$1 million related to the acquisition of Reposify. This is an External Attack Surface Management (EASM) tool that helps to discover and map out unknown internet exposures. This includes old subdomains, unknown remote access IP addresses, and more. I believe this was a great acquisition overall, as the company is aligned with CrowdStrike’s endpoint security platform. In addition, it offers insight into the growing attack surface and was a 2021 emerging vendor by Gartner.

Net new ARR increased by 17% year-over-year to $198.1 million. This was below management expectations and driven by longer sales cycles as a result of the macroeconomic environment. This effect was most pronounced for smaller non-enterprise businesses, which asked for extra approvals from decision-makers before purchases. This resulted in average days to close increasing by 11%. Management believes the vast majority of these deals are “not lost,” just delayed.

The good news is enterprise sales cycles were relatively consistent with the prior quarter. For example, those “millionaire customers” with ARR of over $1 million increased by 67% year-over-year as the cohort surpassed $1 billion in Q3 FY23. However, these companies did face challenges with managing operating expenses and cash flow. To solve this problem, many customers signed contracts with “multiphase” start dates, which pushes out recognized ARR into future quarters. In Q3 FY23, the result was $10 million more in ARR was deferred.

Notable customer wins in the third quarter of 2022, included a Global Fortune 500 manufacturer, which opted to purchase 10 modules to help with the consolidation of its cybersecurity tech stack. In addition, two global Fortune 500 financial institutions replaced legacy cybersecurity technology with CrowdStrike, a large luxury goods manufacturer, and more. The company also reported strong public sector results with one of the largest federal agencies in the U.S.A, adopting the Falcon platform. CrowdStrike has also expanded across multiple U.S states, and now boasts 40 U.S. states as customers, with 21 states “standardizing” on the platform.

CrowdStrike’s diverse range of customers across industries and sizes, means the company is likely to be less susceptible to a cyclical downturn in a single industry. Federal customers and government contracts also offer immense stickiness and consistency in payments. The company has also focused on growing its partner network, which resulted in Partner-sourced ARR increasing 55% year-over-year.

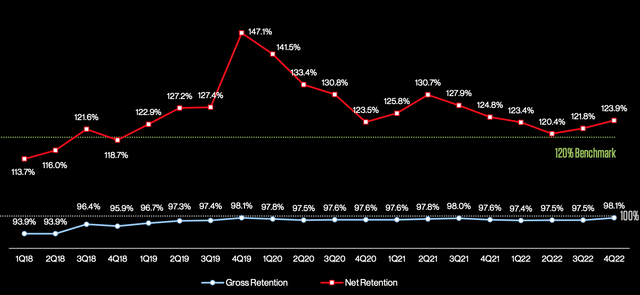

CrowdStrike has a super high dollar-based net retention of 123.9% which is down slightly from the 127.9% reported in Q3 2021. However, this retention rate is still above its 120% benchmark and higher than the prior quarter. These are fantastic results overall as CrowdStrike executes a “land and expand” strategy. This strategy involves winning a client account with relatively few “modules” but then using upsells and cross-sells to increase the account value. For example, 60% of its customers have adopted 5 or more modules, with 21% of customers adopting 6 or more modules. More modules also mean higher stickiness and increased switching costs if a customer wanted to move to another vendor.

Retention and Expansion (Q3,22 report)

Profitability and Expenses

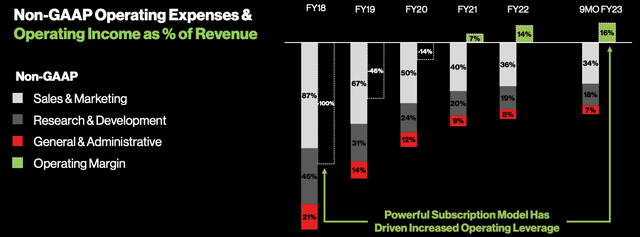

Despite the tough economic environment the company reported a non-GAAP gross margin of 75%, which was consistent with prior rates.

Operating income (non-GAAP) increased by a fantastic 77% year-over-year to $89.7 million. Earnings Per Share was $0.40, which beat analyst estimates by 26.51%, (Google Finance data).

These great results were driven by improved operating leverage in its operating expenses. Total non-GAAP operating expenses made up 60% of revenue ($348.6 million) in Q3 FY23, which was an improvement over the 63% of revenue in the prior year. This resulted in the operating margin increasing by 2% year-over-year to 15%. This was mainly driven by an improvement in Sales & Marketing efficiency, which improved from 36% of revenue in the Fiscal year of 2022 to 34% in the trailing 9 months. The company is optimizing its marketing spend by focusing on top-of-the-funnel brand awareness marketing. This is a solid strategy as it means, even if customers aren’t ready to buy right now (due to the macroeconomic climate), they will build a relationship with the brand.

CrowdStrike Earnings (Q3,22 report)

The company reported a solid increase in Cash flow from operations, which grew 53% year-over-year to a record $242.9 million. Free cash flow also expanded by a rapid 41% year-over-year to $174.1 million, or ~30% of revenue.

CrowdStrike has a robust balance sheet, with cash and cash equivalents of $2.47 billion. Total debt is ~$771.9 million, although this figure has not fully been updated at the time of writing on the Seeking Alpha Balance sheet.

Tepid Guidance

Moving forward, management is expecting fourth-quarter revenue of between $619.1 million and $628.2 million, which is below analysts prior forecasts of $634.2 million. These lower expectations are driven by the macroeconomic environment, longer sales cycles, and the expected lower security budget for organizations in Q4. A positive is the company has forecasted earnings per share of between $0.42 and $0.45, which is greater than analyst estimates of $0.34.

For FY 2024, management is expected a 10% year-over-year headwind against Net new ARR. This would imply a “low 30s” growth rate in ARR. However, longer-term management is still bullish on growing its ARR to $5 billion by the end of fiscal year 2026.

Advanced Valuation

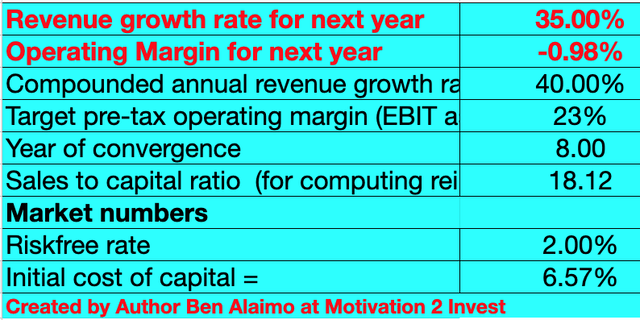

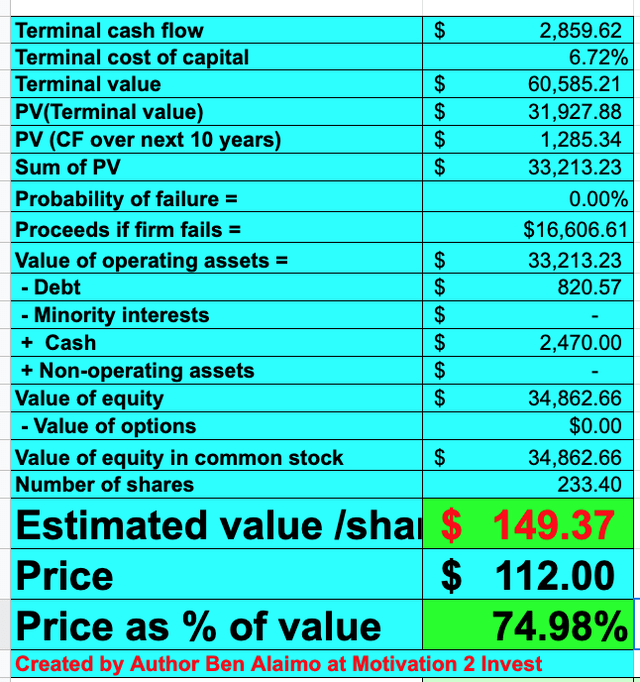

In order to value CrowdStrike, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow (“DCF”) method of valuation. I have forecasted 35% revenue for next year and 40% over the next two to five years. This is aligned with management expectations and fairly conservative, as the company has a prior growth rate of above 50%.

CrowdStrike stock valuation 1 (created by author Ben at Motivation 2 Invest)

In order to increase the accuracy of the valuation I have capitalized R&D expenses, which has lifted net income. In addition, I have forecasted the business will increase its operating margin to 23%, which is the average of the software industry over the next 8 years. I expect this to be driven by continuous improvements in operating efficiency, high retention, and upsells.

CrowdStrike stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $149.37 per share. The stock is trading at $112 per share, and is thus ~25% undervalued at the time of writing.

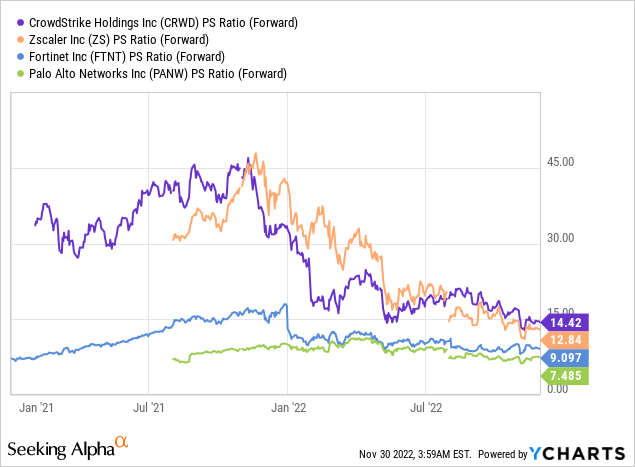

As an extra datapoint, CrowdStrike trades at a Price to Sales ratio of between 14 and 17, which is between 40% and 50% cheaper than its 5-year average. I have added the range as the stock price is moving downward in premarket trading. Relative to industry peers, CrowdStrike does trade at a higher valuation, although the majority of these companies aren’t growing as fast and don’t have the same strong leadership position.

Risks

Longer Sales Cycles/Recession

The volatile macroeconomic environment (high inflation, rising interest rates) has caused business decision-makers to be more fearful about splashing out expensive software. Thus, we are seeing a lengthening of sales cycles. The silver lining is the cybersecurity industry is one of the best-protected industries from a recession, as often the purchases are considered necessary to avoid larger losses such as from a ransomware attack.

Final Thoughts

CrowdStrike is a tremendous company and a true leader in endpoint security. The company has continued to produce strong financial results and has high customer retention. Management has adjusted its guidance moving forward and we are seeing a little slowdown in net ARR. However, I believe these are just temporary issues and a small speed bump on the road to CrowdStrike’s continued success.

Be the first to comment