tsingha25/iStock via Getty Images

Investment Thesis

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is a great quality company. And after its fiscal Q3 2023 results, most of the bullishness is now out of the stock.

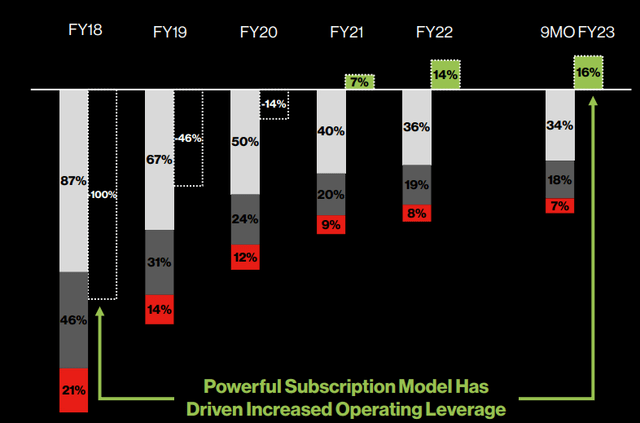

The main thing that’s plaguing CRWD stock is that there’s a chasm between pretend non-GAAP profits and actual GAAP “real” earnings.

That being said, so that there’s no ambiguity in my rating, I want to highlight for you the following chart:

I went headlong bullish into these earnings. So what have I learned? I can’t really say that I’ve learned much. But whatever I have learned, my hope is that through my blunder and poor decision-making, you may, hopefully, take away some lessons.

I remain bullish on the name. And explain that within 18 months, I expect that CrowdStrike will be GAAP profitable. At that point, investors will look very differently towards the cybersecurity company.

What’s Happening Right Now?

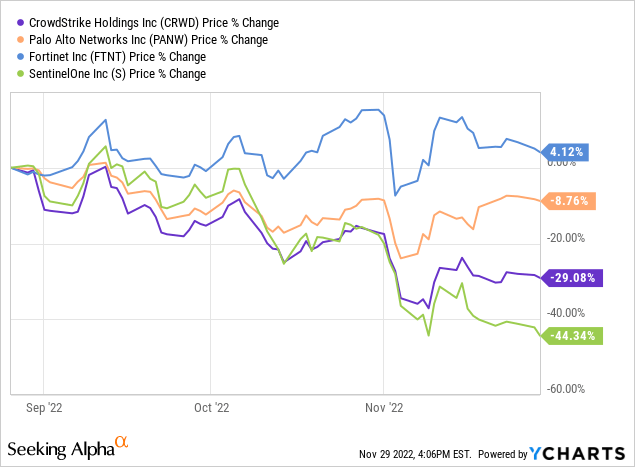

The graphic that follows seems to speak louder than my own articulations.

Companies that are growing the fastest, with clean GAAP profits further out into the future, have been punished the hardest.

While companies that have clean GAAP earnings have been better treated by the market.

And that’s the core of the problem. I’ve been arguing for some time, even earlier today, that across cybersecurity, it’s the same echo all over. There are more checks and balances, and the sales cycle is getting elongated for cyber companies to get customers boarded.

Indeed, practically verbatim, this is what CrowdStrike said,

[…] increased macroeconomic headwinds elongated sales cycles with smaller customers and caused some larger customers to pursue multi-phase subscription start dates

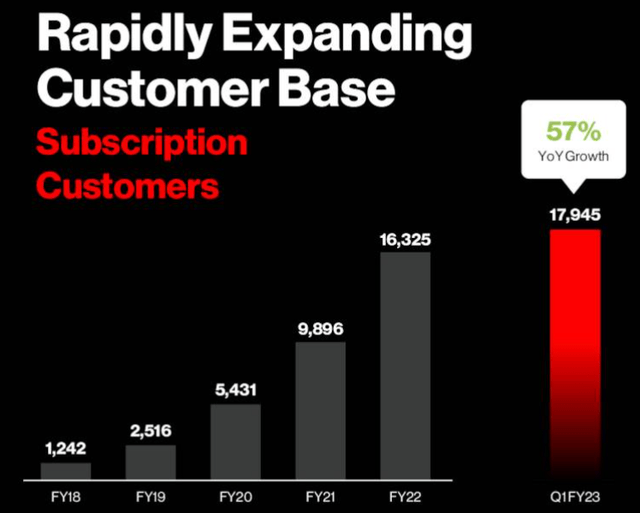

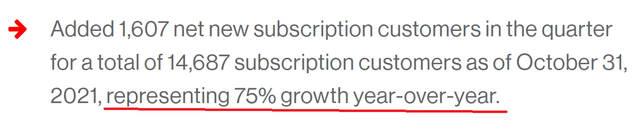

As a point of fact, note CrowdStrike’s Q1 2023 results, from 6 months ago, subscription customers were up 57% y/y.

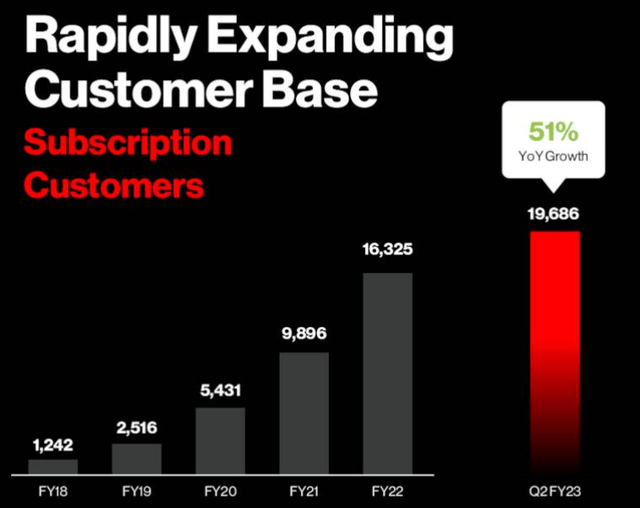

Next, see how subscription customers were at the end of Q2 2023, last quarter:

Subscription customers were up 51% y/y.

And now? For Q3 2023, subscription customers were up 44% y/y. And if we look back to the same period a year ago?

Last year, subscription customers were up 75% y/y.

This rapid deceleration in customer adoption leaves me wondering whether we may not have extrapolated this secular growth story too far?

Naturally, with that in mind, the market is more forgiving for companies that are guiding for slower growth, provided their businesses are already profitable on a GAAP basis.

But for those businesses that are pointing for slower growth and are still struggling to figure out how to get to GAAP profitability, the market isn’t looking too favorably towards these companies.

And that leads us to discuss CrowdStrike’s growth prospects.

Revenue Growth Rates, A Problem

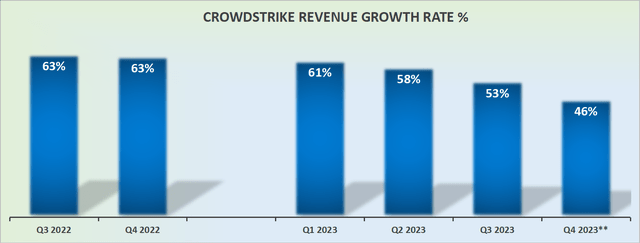

It’s difficult to pretend that CrowdStrike isn’t slowing down.

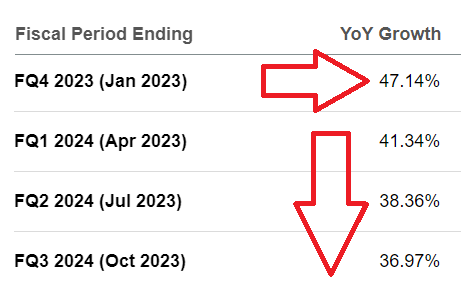

Given that the high end of its Q4 2023 guidance points to 46%, which is short of analysts’ consensus figures for Q4 2023, this brings into question CrowdStrike’s ability to grow early in fiscal 2024 at a rate in line with analysts’ estimates.

CRWD analysts’ revenue expectations

One way or another, CrowdStrike’s growth rates are slowing. How much of that is a temporary impact of the macro environment? And how much of that is the impact of competition?

CrowdStrike will obviously deploy all its energy to highlight the macro environment. But I nevertheless have to wonder, whether some of CrowdStrike’s competitors are taking market share.

Profitability Profile, Mind the GAAP?

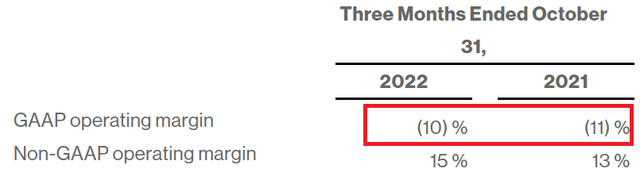

I wonder whether there’s much point in articulating anything when I see this here:

As you can see above, there’s a 2500 basis point hole between GAAP and non-GAAP operating profits. And until that crevasse gets dealt with, I believe that investors will continue to look unfavorably towards this stock.

And this leads me to postulate the next problem. Will C-level executive management eye up the share price and question whether it will take a while for their stock-based compensation (“SBC”) to be worth something again?

Or perhaps, some C-level executives are happy enough to call it a day on CrowdStrike and go elsewhere, where their stock-based compensation can be reset at a lower price point?

CRWD Stock Valuation – Difficult to Quantify

The value investor in me struggles to quantify companies that are slowing down their growth rates. Experience has taught me that no matter how cheap a stock gets, if the company’s growth rates are slowing down, the multiple can continue to compress, and for a lot longer than anyone can stay rational.

On the other hand, rather than throwing the baby out with the bathwater, let’s take a different approach.

If, instead, we contend that CrowdStrike is able to improve its operating leverage, if it can cut back on some of its corporate overhead, possibly CrowdStrike may be able to report GAAP profitability at some point in the next 18 months?

If we take the 2500 basis points – the space between GAAP and non-GAAP earnings – and assume that at some point in fiscal 2024 it can have GAAP earnings in its sights, in that case, investors may look very differently at CrowdStrike.

But again, that’s still going to be a while away.

The Bottom Line

At the time of writing, CRWD stock appears to have retraced back to the share price from two years ago. Put another way, anyone that has come to CrowdStrike in the past 2 years has little more than losses to show for it.

We all read all those books about the dot-com bust. And how we should invest in only the highest quality companies. And we always promised ourselves that we wouldn’t fall prey along with the crowd. And yet, here we are.

I maintain that the bulk of shareholders’ hope has now left the CRWD share price. When a high-quality compounder is down 50% in the past several months, I believe that this is not the time to give up on CrowdStrike Holdings, Inc.

Be the first to comment