Cate Gillon

Crocs (NASDAQ:CROX) is a shoe company that was founded in 2002 and went public in 2006. It has been through several ups and downs in a relatively short time. They neared bankruptcy around the time of the GFC, due to excess inventory which couldn’t be sold quickly, and was funded by taking on debt. In 2013, Blackstone invested $200 mil via convertible preferred shares and installed a new CEO in an effort to turn things around.

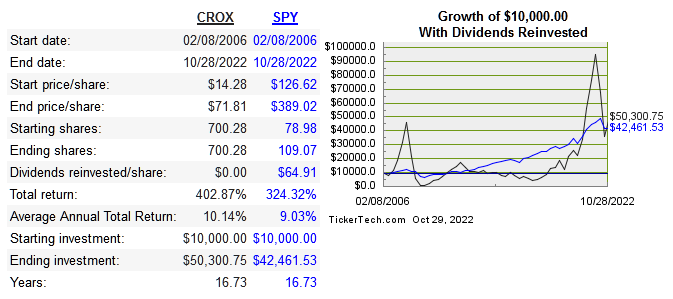

This did seem to help initially, but the top line stayed relatively flat until 2019. Now the company has entered a new era. Below is the share price CAGR since IPO”

dividend channel

At first glance, the stock performance would suggest that this is just another cyclical company. I don’t think this is the case, as the company has improved qualitatively and is increasing its brand power over time.

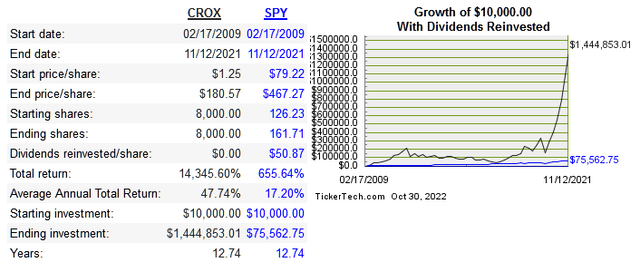

Next is the best total return from the stock if picked at the absolute bottom and top:

Below are returns on capital and earnings metrics:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGT |

|

CROX |

8.7% |

11.1% |

9.2% |

24.8% |

21.4% |

|

7.2% |

29.9% |

24% |

13.3% |

12% |

|

|

3.2% |

15.7% |

12.4% |

12.3% |

16.8% |

|

|

0.9% |

19.3% |

14.1% |

3.8% |

-4.8% |

|

|

8.3% |

17.8% |

17.4% |

16.8% |

14.6% |

|

|

14.6% |

13.8% |

11.1% |

54.3% |

n/a |

The fundamentals look better than ever right now. Returns on capital and margins at all levels were at record highs in 2021. Although they are lower over the TTM they have been trending upwards since 2018. They also do hold IP over the material that makes up the shoes, which widens their moat.

Capital Allocation

There have been less than 10 acquisitions, with the biggest by far being the $2.5 billion USD for privately held “HeyDude” which closed this February as a cash and stock deal. So far the acquisition has added $232.4 million in revenue. Dividends were paid from 2014 to 2019, and stopped as a result of the pandemic. They began reducing share count starting in 2012 and it is currently 32.2% lower since then. Long term debt has been increasing since 2018, but at $921 million it is very manageable considering free cash flow is at $511 million and the current cash balance is $187.3 million USD.

Risk

The biggest risk is the brand losing steam and fading over time. If this is a high probability, then the price paid won’t matter longer term if secular forces drive the business performance down. I don’t see this as probable given that their products are popular among many age groups. The unique look and name differentiates from the biggest shoe companies. There is a possibility of a takeover or merger from one of the bigger brands, but I don’t count on it.

The brand has proven itself, there is no uncertainty over whether it is a fad.

Valuation

Shares are down 60% from the 2021 high and getting hit so hard is presenting an opportunity

Below is a comparison of price multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

CROX |

2.8 |

10 |

28.7 |

12.7 |

n/a |

|

NKE |

3.1 |

20.3 |

40 |

9.3 |

1.3% |

|

ADDYY |

0.7 |

4.7 |

5.4 |

2.1 |

3.4% |

|

VFC |

0.9 |

8.5 |

113.7 |

3.3 |

7.4% |

|

DECK |

2.6 |

14.3 |

48.9 |

6.2 |

n/a |

|

SKX |

0.7 |

6.4 |

-16.6 |

1.4 |

n/a |

There’s a bit too much variation among the multiples to see a true discount being presented.

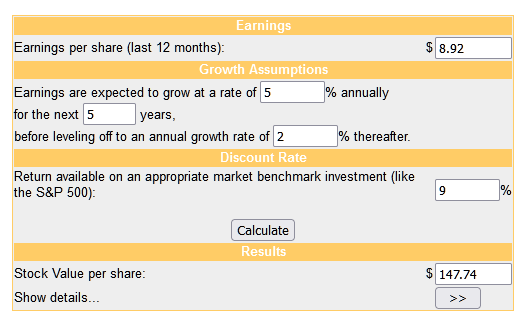

Below is the dcf model:

money chimp

The EPS growth isn’t very extreme, considering I’m saying they could be a mature business within five years. The growth of this market is actually harder to determine than just looking at shoes. We can estimate roughly how many shoes will be sold over the next few years but CROX has created a unique category within the footwear industry. So far the brand power has increased and proven that it was never a fad in my opinion.

Conclusion

Investing in CROX at any period before 2019 would have come with plenty of uncertainty about the power of the brand and its staying power. I don’t see the same uncertainty at all today. The brand has been solidified and it reaches across many demographics of age, income level, and nationality. This doesn’t mean it will go down as one of the greatest brands for decades, but it holds a very unique place in the mind of the consumer when compared to most other footwear.

In spite of the share price being a wild ride, CROX did beat the market since the IPO. I think the next decade will be promising because the brand power is much stronger today than at any point in the company’s history. The price is too low for the cash flow strength right now, and I definitely consider it a buy.

Be the first to comment