Natali_Mis

Crispr Therapeutics AG (NASDAQ:CRSP) is an unusual stock on my dashboard, because it got there not through any of my usual screens for companies with profitable growth, but rather because of how significant CRSPR technology might be to the future of medicine, as explained even in this podcast on 401k investing. In this article, I wanted to share three main reasons on why I think it may be worth starting with a very speculative-looking 1-2% “buy and forget” position on this name, and why I’m curious to learn more about how this company will develop.

Factor #1: Earnings Estimates

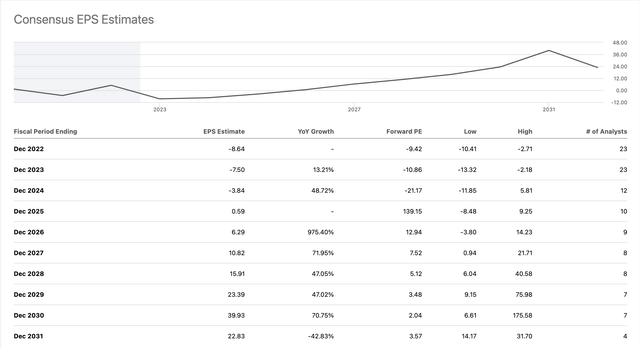

As admitted above, Crispr is a company I know relatively little about, and am just starting to learn about by reading its website and 2021 Annual Report. Although the company headquarters is less than a two hour train ride from where I live, I haven’t yet tried to reach out them for an investor’s meeting or visit, partly because I don’t feel ready, but also because much of the actual work and hiring seems to be taking place across the pond in Boston. On top of that, developing gene-based medicines is not a simple-to-value business like those of many of the boring dividend growth companies I usually focus on, so the best starting point for me would be to look at what earnings estimates better-informed analysts on this company have put together so far. Fortunately, CRSP has no less than 7 analysts estimating earnings per share on this name out to 2030, and 4 estimating out one more year to 2031:

As someone who assumes I know less about this company than even the least informed of the 23 analysts estimating CRSP’s 2023 earnings, I am happy to accept these numbers at face value without running my own models or second guessing their estimates at this stage. Of course, I understand these are estimates, and that the future earnings of such a speculative-looking company could be much higher or much lower than these estimates, but that’s the risk we can focus on as we follow this company year to year.

If it wasn’t obvious already, CRSP is a stock I would look to buy only for “growth”, not for “income”, and my preferred way to model growth of non dividend paying stocks is through growth in book value. If we start with CRSP’s book value per share of $31.17 at the end of 2021 (almost all of which was tangible), and then assume all of the above EPS estimates simply get added on to book value year by year (that is, we assume no dividends, and no share buybacks or issuance), we get the following projections of CRSP’s future book value per share:

| Year Ending Dec 31st | EPS Estimate | BVPS Estimate |

| 2022 | -8.64 | 22.53 |

| 2023 | -7.5 | 15.03 |

| 2024 | -3.84 | 11.19 |

| 2025 | 0.59 | 11.78 |

| 2026 | 6.29 | 18.07 |

| 2027 | 10.82 | 28.89 |

| 2028 | 15.91 | 44.8 |

| 2029 | 23.39 | 68.19 |

| 2030 | 39.93 | 108.12 |

| 2031 | 22.83 | 130.95 |

From the limited experience I have trying to value biotech stocks, my guess is that at least a few of these earnings estimates are based on a “real options” valuation methodology, where a significant portion of CRSP’s value comes from its ability to continue investing in promising developments, and abandoning dead ends. More on this in the next section on moats.

Based on that estimated book value per share of $130.95 at the end of 2031, our rate of return would be driven by what multiple of that book value CRSP shares are trading at in early 2032 when that 2031 number comes out. In other words, even a contraction of CRSP’s P/B multiple to 1.0x (which would be difficult to imagine for a profitable technology company) would leave us with a rate of return almost double that of 10-year US treasuries, while maintenance of a ~4x P/B multiple would give us a very healthy rate of return over 20%/year over 8.5 years. It is also worth noting that at $500/share, CRSP would still have a market cap of less than $40 billion, which would be very low if it were to truly revolutionize gene editing, and of course too high if it never makes money doing so.

| P/B in 2032 | Share Price | Annualised Rate of Return |

| 1.0 | 130.95 | 5.8% |

| 1.5 | 196.43 | 10.9% |

| 2.0 | 261.90 | 14.7% |

| 2.5 | 327.38 | 17.8% |

| 3.0 | 392.85 | 20.3% |

| 3.5 | 458.33 | 22.5% |

| 4.0 | 523.80 | 24.5% |

| 4.5 | 589.28 | 26.2% |

| 5.0 | 654.75 | 27.8% |

So as painful as it might be to look at another three years of negative earnings expectations, the $6.4 billion question (CRSP’s current market cap) is what is the likelihood of CRSP’s EPS rounding the J-curve and getting to $20-40/share/year by 2030, versus staying at or below zero for much longer than expected.

Factor #2: Does CRSP have a moat?

While the obvious first risk factor is whether CRSP manages to develop genetic therapies that are not just commercially profitable, but revolutionarily so, the second is what moat, if any, CRSP has to protect those future developments and their profits. According to Morningstar, as of April 2022: “CRISPR Therapeutics currently has no approved drugs and a largely early-stage pipeline, so we refrain from awarding the company an economic moat”. My read on this is that Morningstar does not want to be “ahead of the curve” by awarding a moat rating before CRSP has clearly demonstrated one, but if I were to look ahead, the questions I would be asking would include:

- Does CRSP actually have a significant portfolio of intellectual property and commercial developments that no one else does?

- Related to #1, are top genetic engineers likely to prefer to working at CRSP than at a competitor?

- Might the recent decline in CRSP’s share price have an impact on #2?

One reason I prefer brand value as a type of moat around a stock that I buy is that brand value an easy moat to see and assess versus a competitor. CRSP’s moat, if any, would be in intellectual property that would be very difficult for me to understand, especially before it’s profitable, and that intellectual property is preserved by a group of people I don’t know. That is why if I do continue looking into this company for the next several years, it will probably be more important than with most other companies I own for me to go meet some of the management and scientists and try and get a feel of the company culture and internal dynamics.

Factor #3: Good enough for Cathie Wood, Good Enough for Me

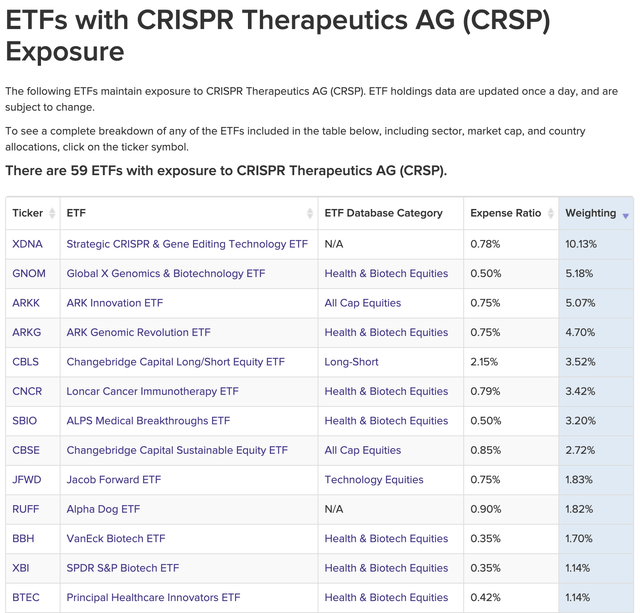

In addition to analyst estimates and Morningstar ratings, another place I look when I first want to learn more about a stock I know little about is which ETFs hold that stock, especially active ETFs with significant weights in it. Below are the results from VettaFi’s ETF database of the ETFs with exposure to CRSP, which I cut off at the top 13 with at least 1% invested in CRSP. None of these are ETFs a conservative investor is likely to allocate more than 10% of a portfolio to, so even a starter position of 1-2% in CRSP will provide a more significant allocation than any of these ETFs in most portfolios.

Of all the ETFs holding CRSP, the two which most stand out to me are the ones managed by Cathie Wood, the ARK Innovation ETF (ARKK) and the ARK Genomic Revolution ETF (ARKG), which allocate a little over 5% and a little under 5% to CRSP respectively. For a while I have considered ARKK the “anti-Tariq” fund, meaning a fund which invests in the exact opposite way that I do: focusing on unprofitable stocks that might be revolutionary in the future, rather than business proven to be profitable and well-valued. This means I have been OK with holding small positions in ARKK in accounts to diversify away from my own value-oriented approach, and I follow what Cathie Wood says to stay on top of any blind spots I might have missed. While I may disagree with Cathie’s team on the importance of current profits and valuation, I highly respect their ability to research and check which companies are truly innovative versus which ones are peddling “vaporware“. If a ~5% position in CRSP is good enough for two of Cathie’s funds, a 1-2% position is probably good enough for me.

Conclusion

Although CRSP still seems far from being a profitable cash cow like most of the other businesses I like to invest in, it seems well valued enough relative to its possible (if not likely) future profits that it seems worth a 1-2% starter allocation. I will need to have to discipline to not only leave this name alone for the next several years, likely through several years of negative earnings, but also to keep reading and learning along the way to see if this really is as revolutionary as we hope, or if this just ends up being one of many losing biotech stocks in the scrapheap of financial history. It should be no surprise that options on CRSP are so expensive, given how extreme these two likely outcomes are, which this stock might be best for a “buy and forget” strategy, followed by a “buy and homework” strategy as long as I don’t sell too much too early. Time will tell, but at least I know if this one goes to zero, I’ll probably have fewer disruptions to worry about in the other 98-99% of my portfolio.

Be the first to comment