DjordjeDjurdjevic/E+ via Getty Images

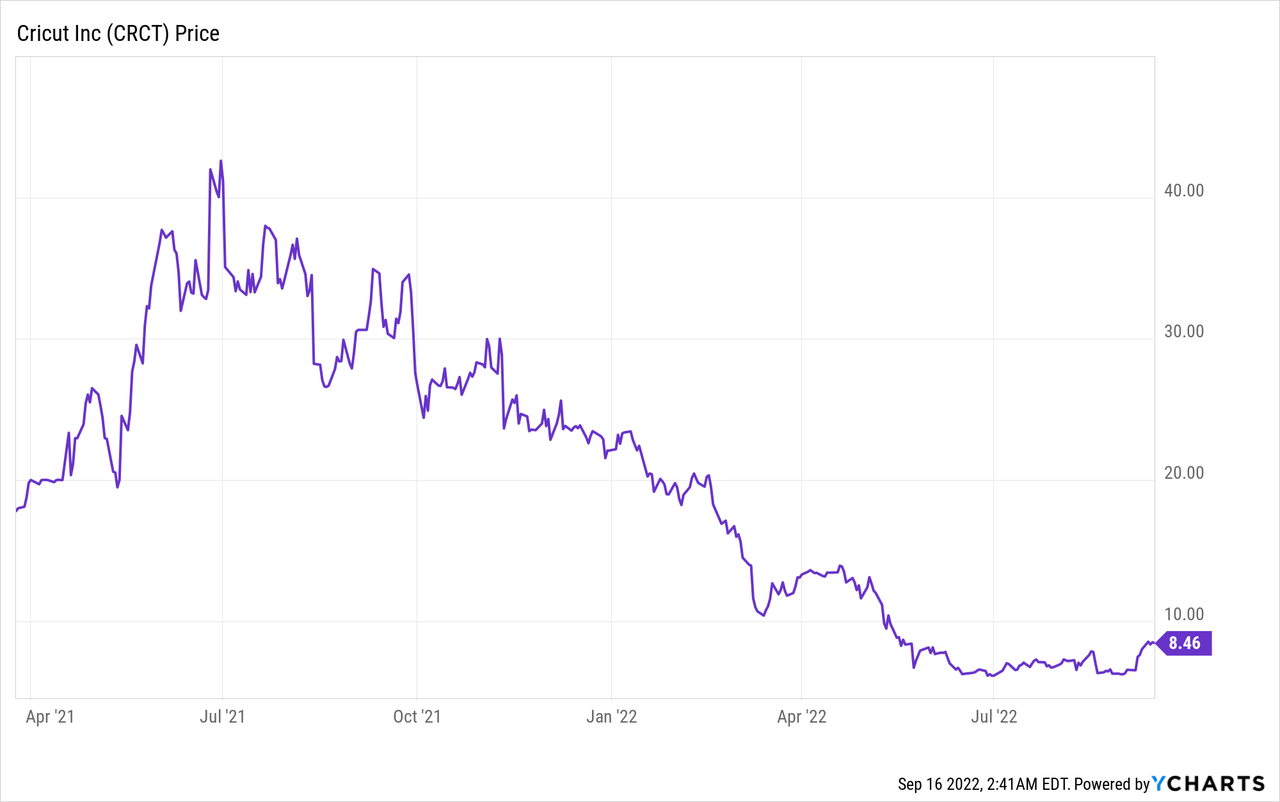

Investment Thesis

Cricut (NASDAQ:CRCT) went IPO in early 2021 and its share price skyrocketed by over 130% in a little over three months. However, as the pandemic waned and the lockdown eased, investors started to worry about whether the company can continue to outperform. The broad market also took a hit as the high inflation rate and supply chain blockage forced the Fed to raise rates while the economy continue to weaken. This resulted in the company’s share price plummeting over 75% from its all-time high last year, now trading at $8.46 a share.

Cricut is a US-based company that sells connected DIY cutting machines and heat presses machines. These machines enable users to easily create and craft different items with fabrics like wood, leather, plastic, and more. The company also provides an in-house app that allows users to design and search for ideas. Cricut performed very well during the pandemic as the nationwide lockdown forced people to stay at home, which significantly increased the demand for DIY crafting machines. It also benefited from the stimulus check handed out to households that boosted their spending power.

Despite the huge drop in share price, I believe investors should stay away from Cricut. The company has multiple growth avenues ahead and continues to remain profitable with a strong balance sheet. However, the current macro headwind is likely to persist and will continue to significantly impact the company in the near term. This is shown in the latest quarterly earnings with revenue down 45%. Therefore I rate the company as a sell and will revisit if the macro outlook and the company’s financials improve.

Growth Avenues

As the pandemic tailwinds faded, demand for Cricut’s DIY machines has returned to pre-pandemic levels. However, despite the slowdown in demand, the company still has multiple long-term growth avenues. Unlike most typical machinery companies, Cricut doesn’t only generate revenue from machinery revenues. It also has other revenue streams like subscription revenue and accessories and materials revenue. This allows them to continue to generate income from the consumer even after the machine is sold. Subscription revenue vastly improved revenue visibility and profitability as the revenue is recurring and has a high gross margin. Currently, Cricut has over 7 million users on its platform with over 2.3 million paid subscribers.

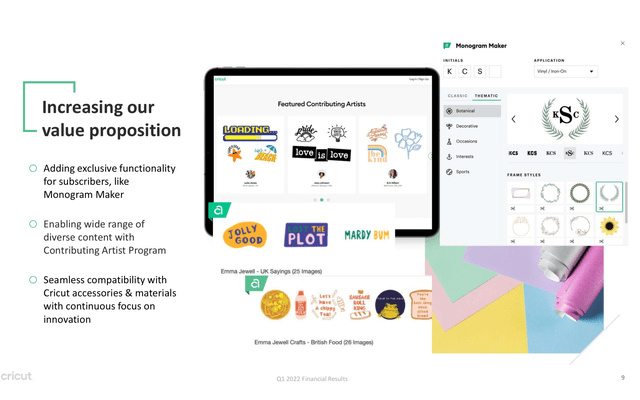

Therefore, the company had been focusing on driving growth in its subscriptions and accessories and materials businesses. On the subscription side, it is aiming to gain more subscribers by enhancing the value proposition of subscriber products. For example, it is launching a new software exclusively for subscribers called Monogram Maker, which allows users to quickly create beautiful, personalized monograms from a wide library of template designs and fonts.

On the accessories and materials side, it is continuing to launch new materials that are specifically catered to the Cricut machine and software. In my opinion, the rollout of these new offerings will be able to improve users’ engagement rate. Cricut is also focused on international expansion. In newer markets like Germany and France, it is constantly adding new stores with existing retailers and onboarding new e-commerce partnerships. The company also recently launched in Turkey and is expected to launch in Japan and South Korea soon.

Ashish Arora, CEO, on future growth:

Our focus is on driving deeper engagement, including improving the onboarding process and making it easier for our new users beginning their journey. Driving more engagement in turn leads to more opportunities to monetize the user base through subscriptions and accessories and materials. We continue to invest in our future growth through continued innovation that will extend and expand our connected platform. In turn, this will enable us to continue to deliver profits and delight users around the world.

Cricut

Disappointing Financials

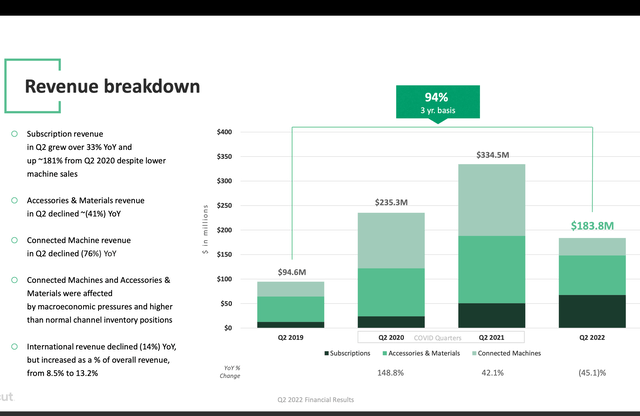

Cricut reported its financial earnings last month and the growth rate is very disappointing as the macro economy continues to weigh on the company. It reported revenue of $183.8 million, down 41.5% YoY (year over year) compared to $334.5 million. The decrease in growth is largely due to a slowdown in machinery sales and accessories and materials sales, which are down 75.8% and 41.3% respectively. Subscription revenue continues to be the highlight, up 3.4% YoY. This is driven by the increase in paid subscribers, which was up 34% to 2.4 million. Total users on the platform increased by 34% to 7.2 million, while engaged users increase by 17% to 3.7 million. International revenue was also underwhelming, down 14.3% from the prior year.

Ashish Arora, CEO, on Q2 results:

“Our Q2 performance reflects the current macroeconomic environment, coupled with elevated channel inventory as a result of the pandemic. While top line results were disappointing, we believe those inventory levels will be rebalanced in the second half of the year,”

The company remains profitable for the 14th consecutive quarter but the bottom line worsened as sales disappoints and expenses increased. Gross profit was $85.4 million compared to $130.3 million a year ago, down 34.5%. The gross profit margin was 46.5% compared to 39% in the prior year. Net income was $13.8 million, down 71.9% YoY from $49.1 million. The net income margin also decreased from 14.7% to 7.5%. The company’s balance sheet is very strong. It ended the quarter with $245.7 million in cash and only $21.9 million in debt, providing it with excessive dry powder for further re-investment into the business.

Strong Macro Headwinds

The turbulence in the macro economy is posting significant headwinds on Cricut on different ends. The economy is starting to weaken as inflation continues to persist at high levels. We are already seeing signs of a broad economic slowdown with companies like Target (TGT), and Snap (SNAP) lowering guidance, and companies like Microsoft (MSFT), Apple (AAPL), and Tesla (TSLA) laying off employees. According to the Michigan Consumer Sentiment data, consumer sentiment has also plummeted, currently at levels not seen since the great financial crisis. Consumer purchasing power decreased substantially due to rising prices for goods. This is impacting Cricut as the weak economy lowered demand for their product, with consumers spending less on discretionary items and more on essentials.

The supply chain blockage is also impacting the company, which has recently worsened due to the zero-COVID policy implemented in China. This caused very tough inventory management. Some retailers decided to overstock inventories, resulting in excess supply, while some others are struggling to build up their stocks. I believe these headwinds are likely to stay for a while and will continue to impact the company’s financial performance.

Conclusion

In conclusion, I believe Cricut will underperform in the near term. The company has multiple long-term growth avenues, including the growth in its subscriptions and accessories and materials businesses and also its international expansion into Asia countries like Japan and South Korea. However, macro headwinds are likely to persist and will continue to weigh on the company heavily. The supply chain blockage is impacting retailers’ inventory management and delivery cost. While the weakening economy is reducing consumers’ purchasing power and lowering demand for Cricut’s products. This is significantly affecting the company’s financials and I believe will continue to do so in the near term. Therefore, I rate the company as a sell at the current price.

Be the first to comment