Drazen_

Construction company CRH (NYSE:CRH) has seen a 15% jump in price in the past month, far bigger than the 5% rise seen for the S&P 500 (SP500). This rise has been long overdue in my opinion. And the best is yet to happen for the stock. Consider the following:

- Its price is still 15% down year-to-date. It’s just a little above its pre-pandemic price levels even though CRH has seen growth in both revenues and earnings since.

- The Inflation Reduction Act is likely to boost its prospects, not just because of the spending and incentives but also because of a multiplier effect, which in turn can have a salutary impact on its price.

- Its market multiples are clearly below both the sector average and those of its closest peers despite faster earnings growth compared to peers.

Inflation Reduction Act Play

The Inflation Reduction Act, which came into effect earlier this year can be a boost to CRH, which has three business segments of Americas Materials, Europe Materials and Building Products. The materials segments, as the names suggest, provide construction materials like cement, lime and concrete among others, as well as paving and construction services. The Building Products segment covers architectural, infrastructure and construction accessories.

The company’s a multinational with materials’ operations across the US, Canada, Europe and Asia. However, the US is the key market for it accounting for over 55% of its revenues. This is why the Inflation Reduction Act could be significant to the company, given the almost $400 billion package’s focus on infrastructure creation and energy-efficient buildings.

Further, implementation of the act might even buoy some growth in the US economy, which is expected to slow down to just 1% growth in 2023 as per the IMF. It’s not just the fiscal stimulus in itself that can add to GDP, but also the fact that it catalyses consumer spending also known as the ‘multiplier’ effect. According to one study, every dollar of stimulus spending by the US government boosts consumer spending by 64 cents (1.64 multiplier.) If this were indeed the case, the impact of the act on the US economy would actually be around $650 billion. This is 2.8% of the US’s GDP.

Strong construction momentum

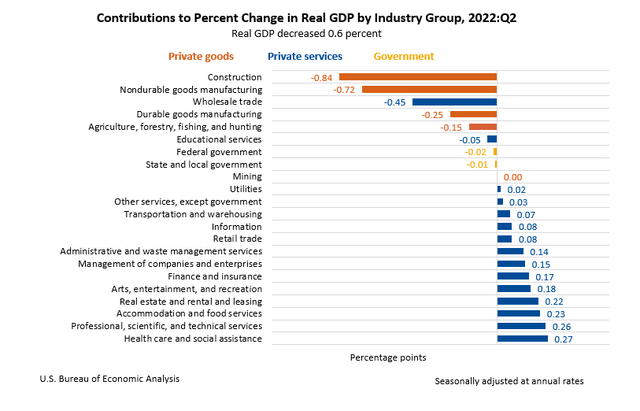

The construction industry could certainly do with a lift for now. For Q2 2022, it was the biggest drag on the US GDP (see chart below). There are positive signs, though. Construction starts were up 8% in October from the month before. Over the first 10 months of 2022, they are up 16% from the corresponding months of the year before. The Dodge Momentum Index, a lead indicator of nonresidential building projects, is also up 9.6% on a month-on-month basis and 28% on a year-on-year (YoY) basis. With both the Inflation Reduction Act and construction uplift in place, there are then encouraging signs for companies like CRH.

Source:https://www.bea.gov/news/2022/gross-domestic-product-third-estimate-gdp-industry-and-corporate-profits-revised-2nd

Largely healthy financials

In any case, CRH continues to grow fast. Its latest trading update for the nine months of 2022 shows sales growth of 13%, keeping pace with the rise seen in the first half of the year. This is faster growth than the 12.3% rise seen for 2021 as well. This is due to acquisitions in the Building Products segment, higher prices and a genuine increase in demand.

Its EBITDA growth, though, came off significantly to 7% in the third quarter of 2022 bringing down that for the nine months to 14%. Rising cost inflation, particularly for labour, materials and freight is cited as the reason for this trend. This is also evident in the slight decline in its gross profit margin to 31.7% for the first six months of the year, as the cost of revenues increased.

With inflation continuing to stay high, it’s no surprise that earnings are expected to continue softening in growth in the final quarter of the year. This is also evident from the fact that the company pencils in an EBITDA growth of 10% for the full year to $5.5 billion. So far though, it’s worth pointing out that its earnings growth is higher than forecast for the full year.

Market multiples show undervaluation

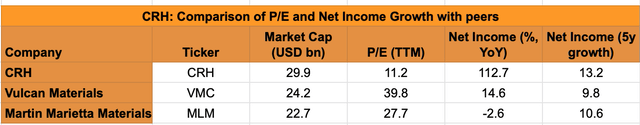

Despite clear positive trends for the company, though, its market multiples are relatively muted so far. The company’s price-to-earnings (P/E) ratio is at 11.2x is lower than 12.15x for the materials sector as such. It’s even lower than its own historical median P/E over the past 13 years of almost 20x.

It’s also much lower compared to peers in construction materials like Martin Marietta Materials (MLM) and Vulcan Materials (VMC) which have P/Es of 28x and 40x respectively. This is despite the fact that CRH has seen faster growth in net income over the past year and even the past five years than both of them (see table below).

Sources: Seeking Alpha, Financial Times

Based on this, I believe that there’s at least a 10% upside to the CRH price in the short term. Its full-year results, which will also contain its outlook for 2023, will tell us more about how the company expects its next year to shape up.

What next?

Over the long term, CRH has been a rewarding investment, with a 128.2% return over the past ten years. Its current dividend yield of almost 3% adds to the returns. With continued growth in revenues and earnings, despite the increase in costs, the company is in a healthy financial position. It can also stand to gain from the Inflation Reduction Act and the pickup in construction indicators in the US, its biggest market, in the next year.

There could be risks as the US economy could well continue to slow down next year. High-cost inflation is already a concern for the company. While inflation is now showing some signs of cooling off in the US, if it takes its sweet time to come back to manageable levels, CRH’s earnings could be impacted.

All said and done though, its P/E ratio is way below that of its peers despite faster growth in net earnings and the fact that they are faced with similar market conditions. This suggests further upside to CRH making it a Buy for me.

Be the first to comment