Scott Olson/Getty Images News

Cannabis stocks imploded after showing great promise. We remain bullish for the long-term on Cresco Labs Inc. (OTCQX:CRLBF) and for the future of the American marijuana industry.

Mega-Merger

This week, I interviewed a Cresco Labs ($1.24B market cap) investor relations official. The person offered insights into the company’s $2B takeover of rival MSO Columbia Care (OTCQX:CCHWF). The stock swap payment is expected to clear with regulators. Conflicting holdings by CRLBF will be sold before the end of 2022.

The rep anticipates the assets Cresco Labs is selling will yield $300M or more; the income will pay expenses incurred from the buyout, possibly forefend any potential shareholder dilution, expand synergies, and be used to merge the companies’ retail products.

98.55% of CCHWF shareholders already approved the “Arrangement.” May 1st CCHWF shares were selling for $2.06. The stock closed at $1.47 on July 13th. CRLBF hit $4.50 in May and closed at $3.00 on July 13th.

The deal is transformational. Cresco Labs will operate 130 retail dispensaries in 18 markets. Both companies hold sales leads in high volume cannabis states of Colorado, Illinois, Pennsylvania, and Virginia. They are among the top three cannabis companies in densely populated New York and New Jersey. Cresco Labs is the fourth-largest seller of flower cannabis in California with its FloraCal brand, according to the company representative.

The Cresco Labs business plan is positioning the company to control retail sales market share in high-volume, densely populated sales states. Its favorite strategy for growth is M&A; it executed about a dozen mergers and acquisitions over the past 5 to 6 years. Consumer products constitute 64% of the M&As and agriculture 19%.

A Vertically Integrated Company

Chicago-based Cresco Labs Inc. cultivates, manufactures, and sells recreational and medical cannabis products preferably under proprietary brand names. For instance, marijuana flower sells under the FloraCal brand. Concentrates sell under the High Supply brand. Gummies sell under the Good News brand. Check out products and brands here.

Cresco Labs ended the distribution of third-party branded products in dispensaries. It prefers selling its own brands that are more profitable. Over time, this may be the model for invigorating gross profit from Columbia Care sales. It was expensive upfront. Management had to restate future revenue and earnings after the decision. The company representative reports management is undertaking a thorough cost-benefit analysis of the Columbia Care branded products before any decisions are made on what to keep and replace. That includes the Sunnyside brand products, which is the store name for retail locations.

As of January 27, 2022, Cresco Labs owned and operated 48 dispensaries. Marketing products can be daunting depending on federal and state laws and regulations. They are stricter for marijuana than alcohol and cigarettes.

In his Q1 ’22 Earnings Call Transcript, CEO Charlie Bachtell touted to shareholders two positive portents potent for the future of Cresco Labs’ footprint when the federal government decriminalizes marijuana:

We maintained our position as the number one wholesaler of branded cannabis products in the industry, as well as having the highest per store revenue of any scale national retailer.

Brand familiarity increases profitability and cuts the need for third-party distribution; brands bolster confidence and loyalty among consumers. They build trust in the company among consumers. Consistency is key for medical marijuana. Patients want consistency and effectiveness.

Buy Land, They Ain’t Making More of It

In addition to retailing and branding, success in the cannabis business is all about having adequate supply. Land to grow and cultivate cannabis is vitally important. Cannabis is an agricultural crop. Some companies are exploring methods of growing cannabis from stem cells in laboratories. Grow rooms control for light, temperature, nutrient feeding, and pest management to keep yields high. Cresco Labs currently operates 15 cultivation facilities in 8 states. Cresco Labs has built a quality genetic stock and uses a sophisticated program of data analytics at each stage of production.

Both Cresco Labs and Columbia Care are getting expanded cannabis facilities on the East Coast. The Ulster County Industrial Development Agency unanimously approved almost $28M in property tax reductions over 15 years and $10M in sales-tax exemptions for a new cannabis cultivation and manufacturing facility. Columbia Care announced in June government approval for a second cultivation and production facility that is 270,000 square feet in New Jersey. Columbia Care picked up a 34-acres marijuana grow site on Long Island in May 2021.

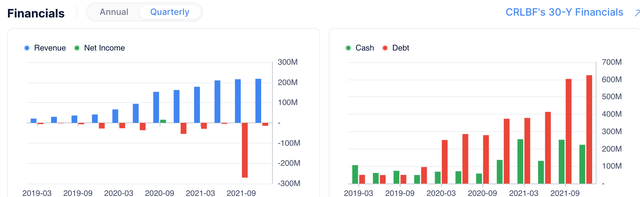

Revenue is Strong, Finances Weak

In May 2022, Cresco Labs reported its first-quarter revenue of $214 million. That is a 20% increase year-over-year. The adjusted growth margin of 53% was up. Adjusted EBITDA margin was 24%, an increase of 400 basis points year-over-year. Short-term and long-term assets total ~$1.8B. Short-term and long-term liabilities total almost $1.1B.

Cresco Labs Revenue and Cash (gurufocus.com)

Downers

On the downside, the company has $409.7M in debt. That is a 52.1% debt-to-equity ratio. The company had no debt just a couple of years ago. Debt grew and shareholders were diluted in the past year by 5%.

In our opinion, future revenue and earnings estimates are wishful thinking at the moment. Cresco Labs found out after buying California-based Origin House for $1.1B that markets may not be what you anticipate; i.e., margins and market retail accessibility change, and the company had added branding costs. Cresco Labs posted five consecutive years of losses; it currently reports a -37.78% net profit margin.

We do not foresee any significant changes in federal law, rules, and regulations during 2022, and certainly not if Republicans sweep both Houses of Congress in November. CRLBF is likely to hover around $3 per share through the first quarter of 2023.

Good News

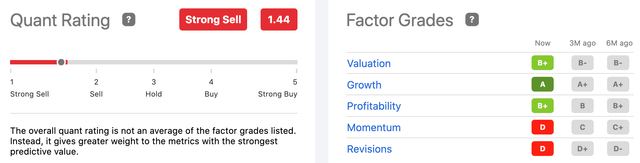

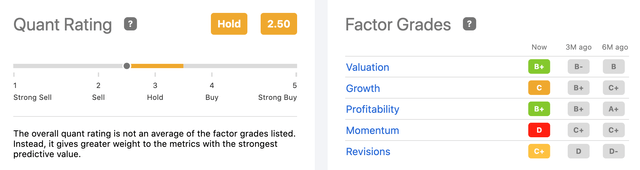

On the good news side, a company co-founder reportedly is exercising options to buy ~$482K of stock this summer. The CFO reportedly bought 24K shares too. Seeking Alpha’s authors and Wall Street analysts are bullish on both stocks, but Seeking Alpha’s Quant Ranking for CRLBF is a “Strong Sell” and a “Hold” for Columbia Care.

Cresco Labs, at the current time, seems a good value. Its price-to-sales ratio of 1.1x compares favorably to the industry’s average of 4.8x. We were anticipating positive earnings-per-CRLBF-share (~$0.23) for next year, but the acquisition stymies forecasts at this time. We have faith in management’s capabilities, so we anticipate the gross margin will top 50%.

Here is how Cresco & Columbia Care size up respectively:

Cresco Labs Quant and Factor Grades (seekingalpha.com) Columbia Care Quant and Factor Grades (seekingalpha.com)

Last Puff

In our opinion, states want more tax money; more states will legalize medical and recreational marijuana. Meantime, we see nothing to spark an upside to marijuana stock prices. The Global Cannabis Stock Index dropped 60.7% over 12 months. CRLBF shares fell 73% over the past year.

It is an anomaly that the industry is well-liked by consumers of marijuana according to reports; sales are up, while stock prices are crushed. The legal marijuana multi-billion-dollar industry will have a compound annual growth (CAGR) rate of nearly 27% over the next five years. That is worth $70.6B by 2028.

Marijuana is being traded as an international agricultural crop. Israel’s Tikun-Olam-Cannabit company signed a marketing agreement with a UK distributor. But because of the federal status of cannabis, Cresco Labs cannot take advantage of the opportunity. Cresco Labs is ending Columbia Care’s foreign arrangements on close of the deal.

CRLBF is a potential opportunity stock for a risk-tolerant investor with a long-term view. We believe there are too many unknowns now to be more bullish. However, Cresco’s California cultivation licenses and 221,000 sq. ft of indoor and outdoor cultivation space position the company for massive savings and margin expansion should interstate marijuana transport be legalized. This will allow Cresco to capitalize on one of the finest agricultural regions in the USA. CRLBF will then bloom.

Be the first to comment