bymuratdeniz

Oil and gas exploration and production company Crescent Point Energy (NYSE:CPG) had some interesting developments when it revealed financial results covering the third quarter of its 2022 fiscal year. In addition to posting robust cash flows, management updated shareholders on stock buybacks and declared a special dividend. On top of all of this, the company also gave investors a look at what the 2023 fiscal year is likely to be like, as well as provided their own guidance through the 2027 fiscal year as well. Although this space can be incredibly volatile, shares are priced at incredibly low levels and leverage for the company looks low as well. For those who don’t mind the volatility that oil and gas prices bring to the table, I would make the case that shares have significant upside potential, leading me to rate the company a solid “buy” at this time.

A necessary disclosure

For the purpose of this article, all references to the ‘$’ or word ‘dollar(s)’ will relate to Canadian dollars, not US dollars, unless otherwise specified. And even then, each instance will refer to that singular instance only.

Really great results

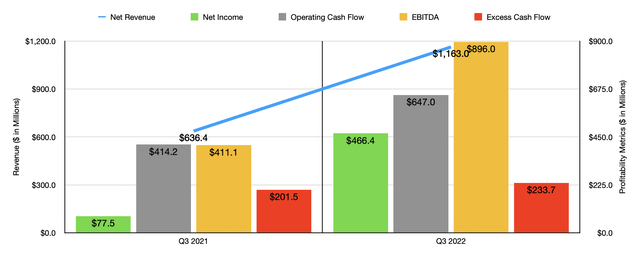

So far, the 2022 fiscal year has proven positive for many companies in the energy space. The same can be said of the shareholders who own said stocks. But not every quarter has been the same. In this latest quarter, the third quarter of the 2022 fiscal year, Crescent Point Energy posted some really impressive data for shareholders to consider. Consider, for instance, revenue reported by management to pay. During the quarter, sales came in at $1.16 billion. That was up from the $636.4 million reported the same time last year. For those not familiar, revenue for a company like this is a bit tricky since it involves not only revenue brought in from oil and gas sales and other income, but also deducts royalties and accounts for commodity derivative gains and losses.

Author – SEC EDGAR Data

The rise in revenue for the company also brought with it significantly improved profitability. Net income for the quarter came in at $466.4 million. That’s up from the $77.5 million reported the same time last year. Even more important though would be cash flow. Operating cash flow came in at $647 million for the quarter. That compares to the $414.2 million reported in the third quarter of 2021. Meanwhile, EBITDA for the quarter came in at $896 million. That compares favorably to the $411.1 million reported last year. Another important metric that management keeps track of is referred to as excess cash flow. This is defined as free cash flow minus a few other items, such as payments on lease liabilities and decommissioning expenditures. During the quarter, this metric totaled $233.7 million. That was up from the $201.5 million reported one year earlier. This number would have been higher had it not been for the fact that capital expenditures saw a rather meaningful increase year over year, climbing from $198.1 million to $324.2 million.

Author – SEC EDGAR Data

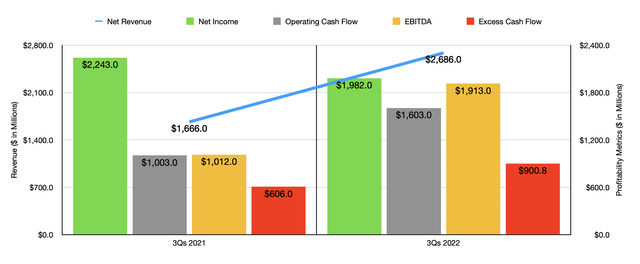

Purely from a valuation perspective, we need to figure out what the rest of the 2022 fiscal year might look like. We already know that for the first nine months of the year, the company generated operating cash flow of $1.60 billion, EBITDA of $1.91 billion, and excess cash flow of $900.8 million. These numbers stack up against the $1 billion, $1.01 billion, and $606 million, respectively, generated the same time last year. Interestingly, management has not provided too much in the way of guidance for the final quarter. But some estimates I calculated based on what management did reveal for the rest of the year indicates that operating cash flow should be around $2.25 billion, EBITDA should be around $3.93 billion, and excess cash flow should be roughly $1.26 billion.

Author – SEC EDGAR Data

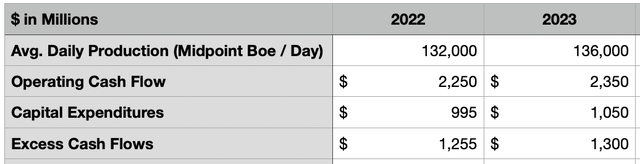

While management has not provided a great deal of information for the rest of the year, they have been quite transparent when it comes to the 2023 fiscal year. During that year, production for the company should average between 134,000 and 138,000 boe (barrels of oil equivalent) per day. That’s up from the midpoint guidance for this year of 132,000 boe. But this will require additional capital expenditures, totaling between $1 billion and $1.10 billion for the year, up from the $950 million in development capital expenditures forecasted for 2022. For this year, the company is anticipating a further $45 million in capital expenditures associated with capitalized administrative costs. For 2023, this number will reduce slightly to $40 million. The company has, however, provided an excess cash flow estimate for next year of between $1.10 billion and $1.50 billion. A reasonable estimate for operating cash flow would be $2.39 billion. And my own estimate when it comes to EBITDA is roughly $4.11 billion.

Author – SEC EDGAR Data

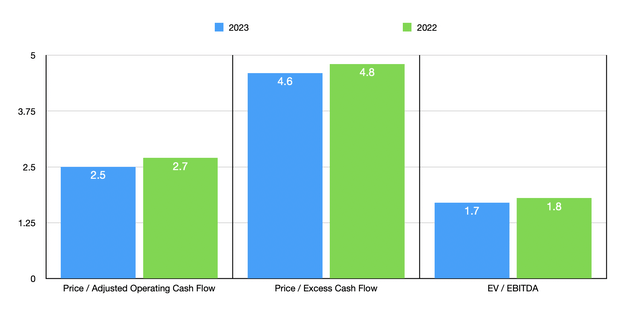

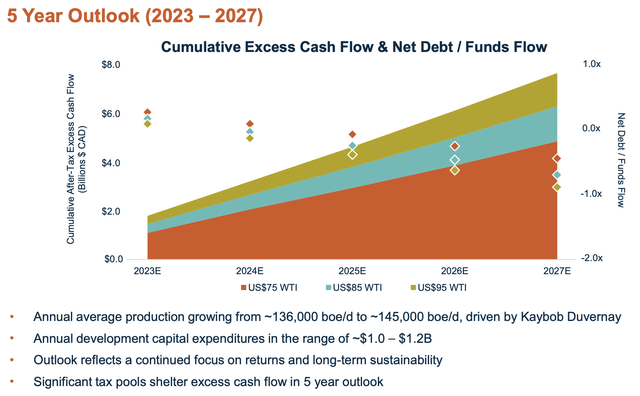

Based on these figures, the company is trading at a price to adjusted operating cash flow multiple for this year of 2.7 and at a price to excess cash flow multiple of 4.8. The EV to EBITDA multiple is even lower at 1.8. On a forward basis, meanwhile, these multiples would be 2.5, 4.6, and 1.7, respectively. All things considered, these numbers are very low on an absolute basis and are even lower than many of the other oil and gas exploration and production firms that I cover in my Marketplace service. And if management is correct about the future, shares could get even cheaper. You see, current guidance for next year assumes WTI crude prices of between US$75 and US$85 per barrel. As long as prices remain elevated like this, management sees production climbing year after year, eventually averaging 145,000 boe per day by 2027. Even though the company will certainly have to spend more in order to grow its output, they’re still forecasting aggregate excess cash flow, net of taxes, of between $5 billion and $6 billion over this window of time. And with net debt right now of only $1.20 billion, the company will likely find creative ways to return excess capital to their shareholders.

Crescent Point Energy

Already, in fact, management has been working on that. In the third quarter alone, the company repurchased 8.2 million shares for a combined $75 million. And through October of this year, ending on October 25th, the company purchased another 3 million shares for $29 million. So long as energy prices remain elevated and shares of the enterprise remain cheap, we should anticipate further stock buybacks. But management has also gotten creative in other ways. For instance, they just announced a special dividend totaling $0.035 per unit, payable at the time when the company pays out its regular dividend of $0.08 per share. This special dividend alone will cost the company $19.86 million, while the regular dividend will come at a cost of $45.39 million. Personally, I would prefer that the company focus its excess cash flows on additional share buybacks, especially given how cheap shares are. But any form of rewarding shareholders at a time when leverage is definitely in check is not necessarily a bad thing.

Takeaway

Based on the data provided, it seems to me as though Crescent Point Energy is doing quite well for itself and its shareholders. The company looks incredibly attractive from a valuation perspective right now. I love the sheer buybacks that the enterprise is doing, though I see the special dividend as a nothingburger. In general, I don’t like the dividend at all. But considering how affordable CPG stock is and factoring in management’s reasonable growth expectations, I do think it could make for a solid “buy” prospect right now.

Be the first to comment