yuelan

There are plenty of rumors (especially on Twitter) that Credit Suisse (NYSE:NYSE:CS) is on the verge of collapse and the financial system is on the brink of a European Lehman’s moment.

I do not believe that we are on the precipitous of a financial crisis ala 2008/2009. The global financial system is much stronger and in fact, has been rewired to ensure the global financial crisis (“GFC”) is not repeated. The large U.S. and European banks have been de-risked to a large extent, maintain high levels of capital, highly liquid and CS is no exception.

In this article, I will separate facts from fiction. The key takeaway from this article is that the CS business model is in deep trouble but this is not solvency, liquidity, or a systemic risk event for the markets.

All charts in this article are sourced from CS Investor Relations Q2 presentations.

Understanding the capital and liquidity position of CS

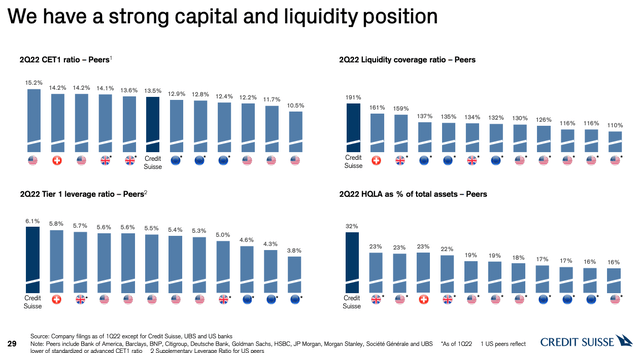

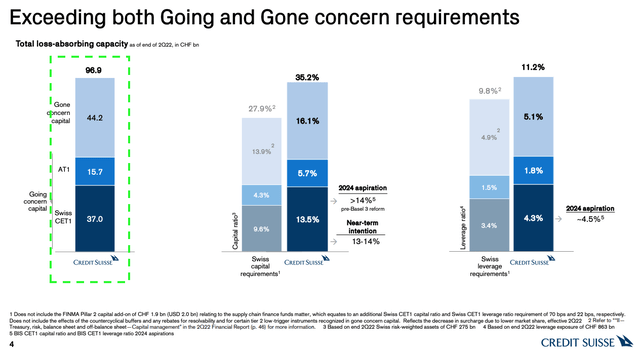

As can be seen below, as of Q2’2022, CS has a CET1 ratio of 13.5% and a liquidity coverage ratio of 191%:

CS Investors Relations

The minimum capital requirement (“CET1” for CS is 10.5%). At 13.5%, it has a significant headroom and buffers above the minimum requirement.

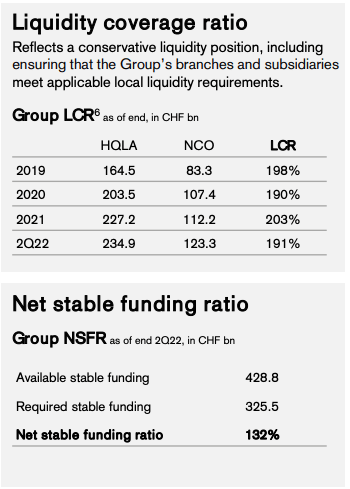

Importantly, the liquidity coverage ratio (“LCR”) is exceptionally high at 191% compared to a minimum of 100%. The LCR measures the proportion of highly liquid assets held by financial institutions, to ensure their ongoing ability to meet short-term obligations. In a sense, the LCR is meant to protect the bank in a stressed liquidity outflows scenario or otherwise known as a bank run.

CS (as of Q2’2022) holds CHF239 billion of high-quality liquid assets (typically cash or securities readily converted to cash) and essentially all liquidity metrics are flashing bright green:

CS Investor Relations

So putting all this together, it is clear, that capital and liquidity position are not the concern.

How about the risks on the asset side?

Risk of asset impairments

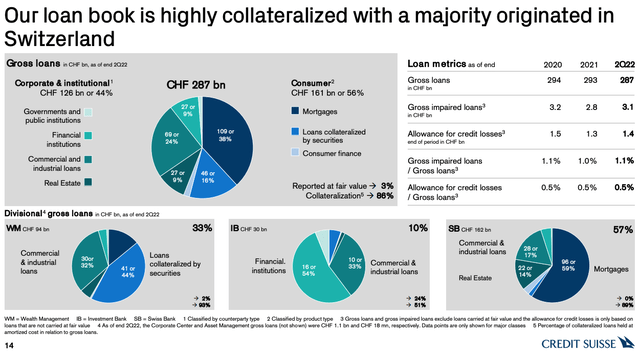

The loan book of CS is set out below:

CS Investor Relations

The total gross loan book is CHF287 billion. On the consumer side, it is 86% collateralized (e.g. mortgages and collateralized lending backed by securities). The corporate and institutional loans are mostly to low-risk borrowers such as large MNCs, other FIs, and governments. The run rate of loan losses appears low and steady.

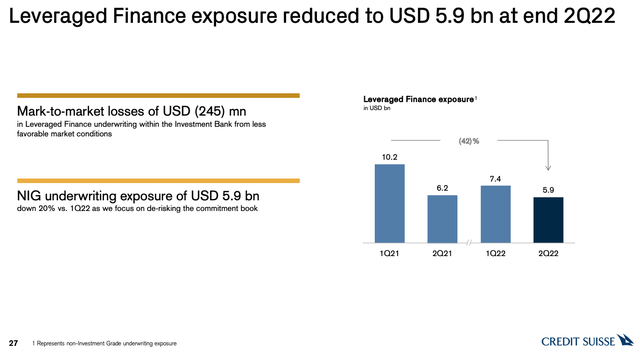

The riskier exposures for CS are in its leveraged finance business where they take risk commitments upfront. The risk can manifest when the macroeconomic environment changes rapidly and CS is stuck with the commitment. However, the current exposure for CS, whilst still high, is manageable and declining:

CS Investor Relations

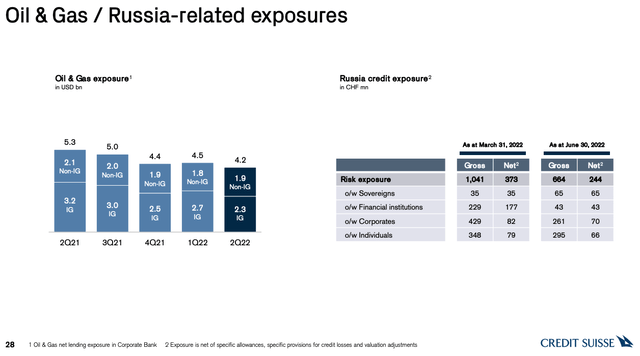

Finally, the Russia and gas-related exposure is another material item to account for as set out below:

CS Investor Relations

So whilst CS is exposed to material credit risk due to the macroeconomic backdrop, these exposures are not outsized in the context of its strong capital and liquidity position.

So why is the stock imploding and CDS premiums rising?

It is all to do with the Investment Bank (“IB”). The IB is in a tailspin due to persistent risk management lapses (e.g. Archegos Capital debacle where it lost over $5.1 billion), litigation costs, high cost of funds, departure of key staff, and a business model that is significantly disadvantaged by the current macro environment. In recent quarters it really just couldn’t catch a break.

I have written on this extensively in my recent article (see link here).

CS has no choice but to fundamentally restructure the IB and the market is smelling blood.

The problem is that restructuring an investment bank is a long, arduous, risky, and costly exercise. CS will likely need to raise capital, set up a non-core bank that will bleed losses for many years to come and it will lose key staff to competitors. There is no easy way of achieving this and especially so in the current bear market. Raising capital at the current market valuation is highly dilutive, it may need to sell some of its crown jewels. There are no real good options now, just less bad ones.

Finally, CS is caught in a vicious cycle (similar to Deutsche Bank in 2018) where high funding costs adversely impact profitability which in turn feeds into even higher funding costs. Getting out of this tailspin will require both skill and not a small amount of luck.

So why is this not a systemic issue?

The simple answer is that the post-GFC regulatory guardrails almost guarantee that 2008/2009 episode won’t repeat.

Take a look at the capital buffer available to protect creditors’ claims:

Investor Relations

There is a full CHF97 billion of “going concern” and “gone concern” capital to protect the system (other counterparties and depositors).

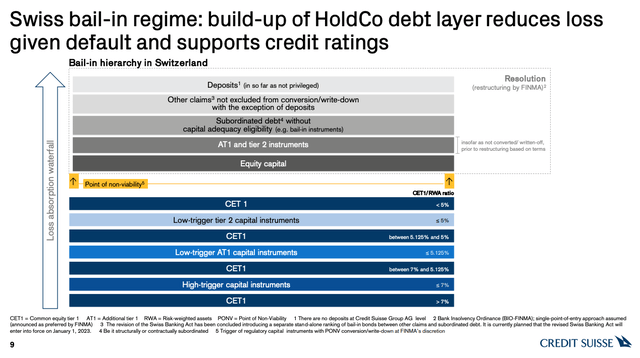

The waterfall arrangement through a bail-in regime is presented below:

Investor Relations

Finally, the Swiss National Bank (“SNB”) will likely act as a lender of last resort and a backstop (in a very unlikely scenario). It cannot afford to let CS fail, simply put.

Final thoughts

CS is in trouble and should have no doubt about that. I am staying away from the equity stub like the plague until there is more clarity. I suspect they will need to bring forward the announcement on their restructure (currently scheduled on the 27th of October) to much earlier, possibly as early as this week. There could be a fire sale.

However, this is not solvency, liquidity, or a systemic risk event. This is not Europe’s Lehman moment.

Be the first to comment