Richard Villalonundefined undefined/iStock Editorial via Getty Images

Company Overview

When covering Crédit Agricole (OTCPK:CRARF)(OTCPK:CRARY), it is important to make a disclaimer regarding its company structure.

Crédit Agricole Group consolidates “the Regional Banks, the Local Banks, Crédit Agricole S.A. and their subsidiaries. This is the scope of consolidation that has been selected by the competent authorities to assess the Group’s position in the recent stress test exercises.“

On the other hand, Crédit Agricole S.A., which this article is about, is the stock exchange listed entity. It owns “the subsidiaries of its business lines (Asset gathering, Large customers, Specialized financial services, French retail banking and International retail banking)“.

With that out of the way, Crédit Agricole S.A. reports results in four main segments excluding the Corporate Centre, namely Asset Gathering at 28.1% of Q3 2022 revenues, Large Customers at 28.9% of Q3 2022 revenues, Specialized Financial Services at 12.6% of Q3 2022 revenues and French & International Retail at 31.3% of Q3 2022 revenues.

Operational Overview

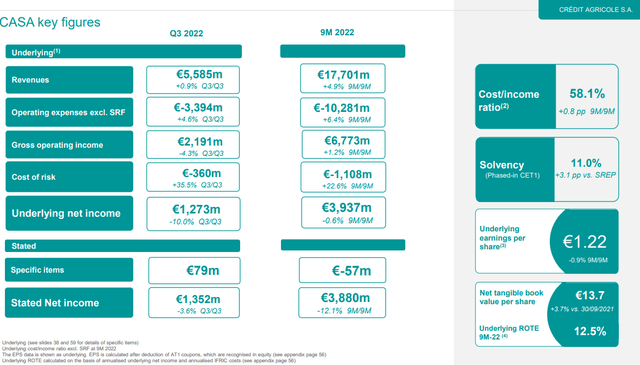

In terms of profitability (9M 2022 Underlying RoTE 12.5%) and Cost/Income ratio (58.1%), Crédit Agricole ranks above largest French peers BNP Paribas (OTCQX:BNPQF) and Société Générale (OTCPK:SCGLY):

Credit Agricole Q3 2022 Results Presentation

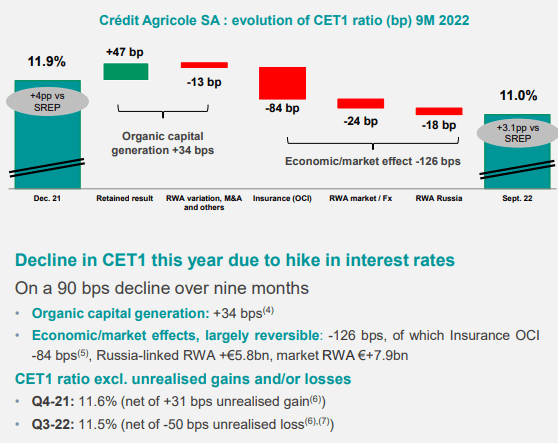

The capital position is more nuanced. On the one hand, on the Crédit Agricole S.A. level (which at the end of the day is what you are buying), the CET 1 ratio is just 11%, unimpressive when compared to large French, German or Dutch banks. On the other hand, on the Crédit Agricole Group level, the CET 1 ratio is 17.2%, the highest among systemically-important banks in Europe.

In essence, the capital buffer held in Crédit Agricole S.A. is by no means impressive, and may to an extent explain the elevated profitability as compared to other French banks (the less capital you hold, the smaller the drag on profitability). Nevertheless, there is no question of imposing some sort of red flag on the bank for its capital position, since in an adverse event Crédit Agricole Group can step in and boost the capital of Crédit Agricole S.A. (of course, this may be dilutive to common shareholders).

On a year-to-date basis, Crédit Agricole capital also took a hit due to losses in Other Comprehensive Income in its Insurance business, offsetting organic capital generation:

Credit Agricole Q3 2022 Results Presentation

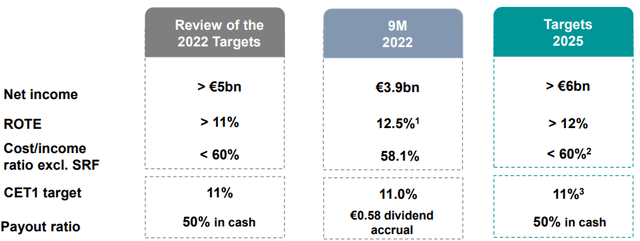

Overall, Crédit Agricole is already achieving its 2025 targets, and is even ahead of its 2022 plan in terms of profitability:

Credit Agricole Q3 2022 Results Presentation

It is safe to say Crédit Agricole is one of the more optimized European banks in terms of business performance. In the years ahead it needs to maintain its solid operational track record but has relatively little room for improvement as compared to other European banks. Looking at competitors across the Atlantic, such as JPMorgan Chase (JPM), there is still a long way to go to catch up with the 16%-18% RoTE they manage to achieve.

Post Q3 Developments

On 30 August 2022, Crédit Agricole completed a capital increase for employees which offered a 20% discount to the share price, calculated according to the arithmetic average of the opening prices of the share between 30 May and 24 June 2022. As a result, 16,658,366 shares were issued.

On November 30, 2022, Crédit Agricole reported the completion of a buyback which aimed to offset the dilute impact of the above-mentioned capital increase. The company repurchased 16,658,366 for an aggregate purchase price of 160,297,995 euros, or 9.62 EUR/share. Hence, in Q4 2022 there should be a boost to tangible book of about 0.04 EUR/share. As a reminder, tangible book per share was 13.65 EUR in Q3 2022.

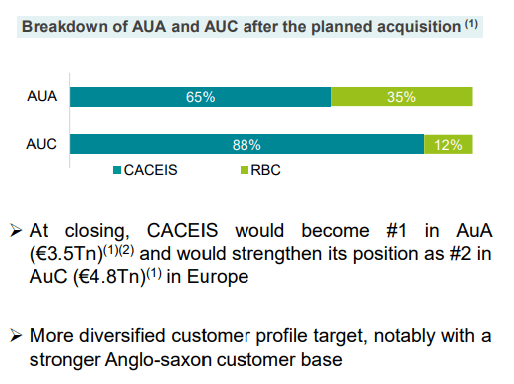

On October 17, 2022, Crédit Agricole signed a memorandum of understanding for the acquisition of Royal Bank of Canada’s (RY) Investor Services in Europe. The purchase will happen through the asset servicing arm CACEIS (in which Crédit Agricole holds a 69.5% stake, while Santander (SAN) holds 30.5%):

Credit Agricole Q3 2022 Investor Presentation

The deal will rank CACEIS as the largest European entity for assets under administration (AuA) and the second largest in terms of assets under custody (AuC). The expected closing is in Q3 2023 and the impact on CET 1 is seen at less than 10 basis points, with a ROI of over 10% in three years.

Peer Comparison

I will now proceed to compare Crédit Agricole with BNP Paribas and Société Générale:

| Crédit Agricole | SocGen | BNP | |

| RoTE | 12.5% | 10.5% | 11.4% |

| P/Tangible Book | 0.7 | 0.39 | 0.67 |

| CET 1 Capital | 11% | 13.1% | 12.1% |

| MDA Requirement | 7.9% | 9.27% | 9.4% |

| MDA Buffer | 3.1% | 3.83% | 2.7% |

Source: Author calculations based on Q3 2022 company disclosures

Clearly, the valuation of Crédit Agricole is very similar to that of BNP Paribas, with a higher RoTE for Crédit Agricole standing out. What’s more, BNP Paribas’s 2025 RoTE goal is above 11%, compared to above 12% for Crédit Agricole, implying a long-term structural outperformance for Crédit Agricole.

The higher return comes with a lighter capital position at Crédit Agricole S.A., with CET 1 capital 1% lower than BNP Paribas. However, BNP is about to close on its Bank of the West sale to BMO Financial Group. The transaction is expected to boost BNP’s CET 1 ratio by 1.1% (after an offsetting buyback to compensate for the lost income). Thus, from a capital standpoint, BNP clearly comes out ahead. What’s more, BNP will boost its tangible book per share from the transaction and buyback.

Clearly, Crédit Agricole outperforms Société Générale from a profitability perspective, but not enough to compensate for the tangible book gap. In essence, Crédit Agricole delivers a 19% higher return but trades at a 79% premium to Société Générale.

Investment Thesis

Crédit Agricole S.A. is among the most profitable stock exchange-listed large French banks, partly thanks to its business mix and excellent operational performance, and partly thanks to holding excess capital in Crédit Agricole Group.

I think the stock is an excellent long-term hold, but in the immediate term I would prefer BNP Paribas if you are looking for solid operational performance at a fair price. I see no short-term catalyst for Crédit Agricole, while BNP will likely execute a buyback if Bank of the West sale is finished as planned.

The main risk I see for not accumulating a position in Crédit Agricole S.A. at the current valuation is that from the perspective of Crédit Agricole Group the S.A. entity may well be an excellent investment opportunity among the various other businesses, trading well below tangible book value but delivering a 12% RoTE. Hence, whether you get the chance to buy Crédit Agricole at a better valuation is far from certain.

Thank you for reading.

Be the first to comment