Over the last few weeks, I covered several companies from many different sectors: I covered retailers like Target (TGT) as well as Kroger (KR) which will probably not be hit very hard by the consequences of COVID-19. But I also covered companies like the coffee-chain Starbucks (SBUX) or the media giant and social network Facebook (FB), which will see declining revenue in the quarters ahead. In this article, I will continue the series with 3M Company (MMM), which has been in the news quite a bit during the last few weeks as the company is producing medical masks and respirators, which are extremely important in this pandemic. And when just looking at the increased demand for masks all over the world, 3M Company should be one of the profiteers of this pandemic. But 3M Company is a very diversified company and not only producing medical equipment.

And compared to all the other companies covered so far in this series, we now have a huge advantage as 3M Company has already reported quarterly results giving us several hints as well as data to assess the consequences of COVID-19 in a better way.

(Source: Pixabay)

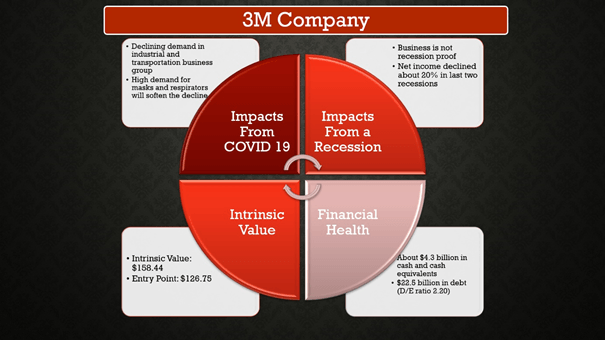

All these articles will follow the same structure and focus on four different aspects that seem to be very important right now:

- Impacts from COVID-19: I am trying to analyze how COVID-19 as well as the measure and political decisions (lockdowns, social distancing, closures, etc.) will affect the business model.

- Impacts from a potential recession: As a global recession seems to be inevitable, I will also analyze how a recession will impact the business model.

- Solvency and Liquidity: In turbulent times, debt levels, solvency and liquidity are especially important and we are therefore taking a closer look at the balance sheet.

- Intrinsic Value Calculation: Although I included a potential recession in the near future in almost all calculations and considered a declining free cash flow, COVID-19 might call for an update of the intrinsic value.

(Source: Author’s own work)

In the case of 3M Company, I will add a fifth aspect that seems to be important – the company’s dividend as well as the safety of the dividend, which might be an important aspect for many investors.

Impacts From COVID-19

On April 28, 2020, 3M Company reported its quarterly results for the first three months of the year 2020 and could beat expectations for revenue as well as earnings per share. Revenue in the first quarter increased 2.7% compared to the same quarter last year and GAAP earnings per share actually increased 47% from $1.51 to $2.22. Adjusted earnings per share, however, decreased by 2.7% from $2.22 in the same quarter last year to $2.16.

When looking at the results a little closer, we see that revenue from the Health Care segment increased from $1,738 million in last year’s quarter to $2,103 million this quarter. And while 3M doubled global respirator output to 100 million per month (it is worth mentioning, that about 35 million respirators are for the United States and 3M Company will increase capital investments to double the respirator output again), this increase is actually stemming from the acquisition of Acelity. The consumer segment increased sales by 4.6% while the Safety and Industrial segment declined 1.0% and the Transportation and Electronics segment declined 5.0%.

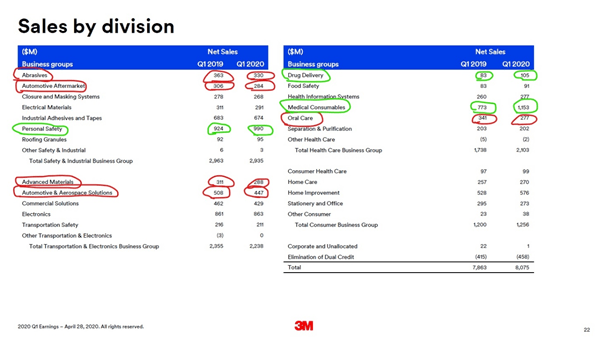

(Source: 3M Presentation highlighted by author)

When looking even closer at the different product categories and divisions, we see sales are being split. We see a sharp increase in sales of “medical consumables” as well as “drug delivery” and also an increase of 7.1% in “personal safety” sales. And while sales for these divisions increased, we saw declines for categories like “automotive & aerospace solutions” or “abrasives” and similar products that are used in industrial production. The transportation and electronics segment also saw sales declining in all three regions (Americas, Asia-Pacific and EMEA).

And even if 3M Company will double the production of masks and respirators again and might be able to sell the products for higher prices due to the increased demand all over the world, this won’t make up for the revenue decline expected for other products. Management is expecting the increased respirator-related demand to contribute only about 150bps to Q2 organic sales growth. And therefore, it is not surprising, that sales in April are down in the mid-teens so far with a particular steep decline in Americas (about 20%) and the EMEA region (about 15%) while the Asia-Pacific region is seeing growth in the low single digits (especially due to China).

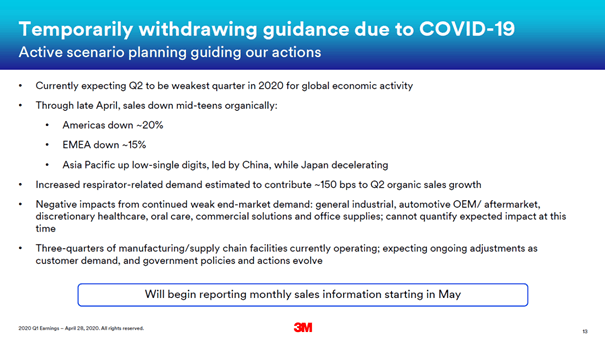

(Source: 3M Presentation)

Impacts From Recession

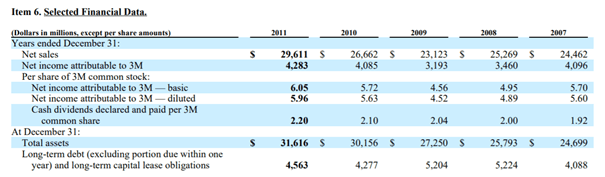

Similar to many other companies, 3M Company will not only be hit by the consequences of COVID-19 (like factories closing down entirely or reducing the production due to decreased demand), but also by the upcoming recession. 3M Company is not really a recession-proof business and saw decreasing revenue as well as lower profitability in past recessions. During the Financial Crisis, revenue declined 8.5% from $25.3 billion in 2008 to $23.1 billion in 2009 and net income declined from $4,096 million in 2007 to $3,460 million in 2008 to $3,193 million in 2009. This reflects a decline of 22% from 2007 to 2009.

(Source: 3M Company 10-K 2011)

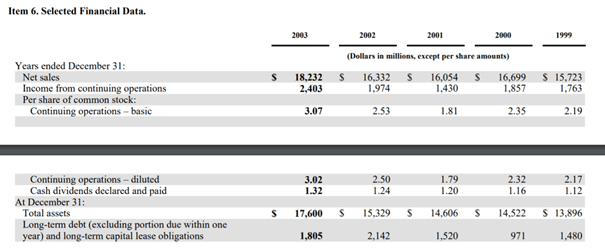

When looking at the recession before the Financial Crisis, the recession following the Dotcom Bubble in 2001 and 2002, revenue declined from $16.7 billion in 2000 to $16.1 billion in 2001 reflecting a decline of 3.9%. Additionally, net income declined from $1,857 million in 2000 to $1,430 million in 2001 reflecting a decline of 23%.

(Source: 3M Company 10-K 2003)

As the upcoming recession will probably be worse than the last two recessions, we can assume that 3M Company will see at least a similar decline with the automotive sector being hit hard again (in China as well as Europe we saw the steepest declines of car sales ever). Millions of people being unemployed all over the world will lead to decreased demand for several products (not just cars) and the factories producing these goods will need less items from 3M Company, which is a supplier for many different industries. We have to expect a severe recession hitting 3M Company pretty hard again although the decline will be offset a little bit by the increased demand for masks, respirators and other healthcare products.

Financial Health

In times of high uncertainty where companies don’t know what’s ahead combined with the risk of declining revenue and/or declining profitability, the financial health of companies is extremely important. First of all, we are looking at the company’s liquidity. On March 31, 2020, 3M Company increased its cash and cash equivalents to $4,253 million (mostly due to $1.75 billion in cash due to the March 2020 debt issuance with an average interest rate of 3.2%). Additionally, 3M Company has $224 million in marketable securities and these $4.5 billion in highly liquid assets should provide enough liquidity for the near-term future.

Aside from liquidity, we also have to look at the company’s solvency. On March 31, 2020, 3M had $3,248 million in short-term debt and $19,247 million in long-term debt. With total equity being $10.2 billion, the company currently has a D/E ratio of 2.20. When comparing the outstanding debt to the operating income ($6,060 million in 2019) it would take a little more than three and a half years to repay the outstanding debt. In the last eight years, the operating income was actually higher and fluctuating between $6.0 billion and $7.2 billion. All these ratios are not perfect (with the D/E ratio being particularly high) and the financial health of 3M Company could be better, but we should not worry about bankruptcy or any other serious trouble for the company.

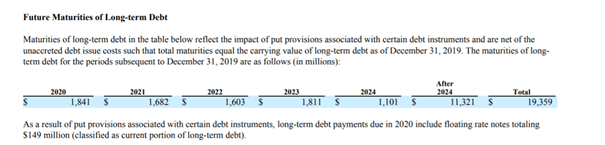

(Source: 3M Company 10-K)

And when looking at the next few years and the amounts of debt that are due, the situation seems to be controllable for 3M Company. The chart above is taken from the last 10-K and does not include the $1.75 billion in debt the company took on in March 2020. In the year 2020, $1.2 billion in debt will mature – $700 million are due in May 2020 and $500 million are due in August 2020 and in the following years the amount will be between $1 billion and $2 billion (with the exception of 2021 as more than $3 billion are due next year).

Dividend

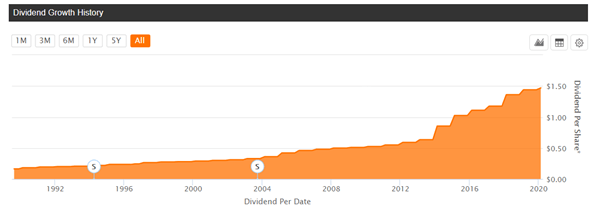

In the case of 3M, we also have to look at the company’s dividend as many investors probably invested in 3M Company because of its dividend. The dividend safety is therefore an important aspect. Right now, 3M Company is paying an annual dividend of $5.88 resulting in a payout ratio of 75% (when taking 2019 full-year GAAP results). Such a high payout ratio should really make us question the safety of the dividend.

But in the case of 3M, two aspects are important. First of all, 3M Company will try to keep its status as dividend aristocrat (with a history of 61 consecutive years of growing dividends). Additionally, management also stated in the press release that 3M is prioritizing the dividend and suspending the share buyback program (after the company still repurchased about $365 million worth of shares in the first quarter).

(Source: Seeking Alpha)

While I consider the dividend to be safe – despite the high payout ratio – investors should not expect high dividend increases in the years to come – due to the already high payout ratio. In the past few years, we saw high dividend increases, but for 2021 and 2022 we should probably expect the dividend increase to be in the very low single digits (probably just a few cents).

Intrinsic Value Calculation

When trying to calculate an intrinsic value for 3M Company, we face similar problems as with other companies: it is particularly difficult to estimate revenue, earnings per share or free cash flow in this environment of extremely high uncertainty. While I think the recession will be worse than the last one, the increased demand for masks and respirators will counterbalance the decline a little bit. Overall, I will assume a similar decline in 2020 as we saw during past recessions (about 20% decline). To account for the severity of COVID-19 and the recession, I will assume free cash flow staying at that low level in 2021 and assume that 3M Company will not recover before 2022. For the three years between 2022 and 2024, I will assume 10% annual growth as 3M came out strong after recessions in the past. Following that, we assume 5% growth till perpetuity.

Using these assumptions as well as a 10% discount rate will lead to an intrinsic value of $158.44 for 3M Company. I mentioned above that it is difficult to make assumptions and a 20% margin of safety (like in all the other articles in this series) should set off mistakes or false assumptions I might have made. This leads to a preferred entry point of $126.75.

Conclusion

In the introduction I wrote that the available earnings results and data will help us to make better assumptions. Nevertheless, we have to admit that we are still faced with a high level of uncertainty. While the first-quarter results are solid, 3M Company will be hit hard by COVID-19 as well as the upcoming recession (3M is a cyclical business). The increased demand for masks and respirators will soften the decline, but I still expect earnings to decline in a similar way as during the last two recessions.

3M Company is also struggling with high debt levels and the dividend payout ratio is also high. But we should not worry about the company’s liquidity and solvency as well as the safety of the dividend. 3M Company might not be the best business one can find in the market, but it is trading at a reasonable price making it at least a good investment right now.

(Source: Author’s own work)

Stay safe, stay healthy, don’t panic!

If you enjoyed the article and like to learn more about wide moats, please check out my marketplace service: Moats & Long-Term Investing.

Subscribers get access to extensive background information on wide-moats, at least weekly exclusive research, a watchlist of wide moat companies and a chatroom where members can ask questions and exchange opinions about long-term investing and companies with a competitive advantage.

For investing in companies that can beat the market over the long term and create a portfolio with companies you can (almost) hold forever, please check out my marketplace service. You can also take advantage of a free trial offer.

Disclosure: I am/we are long MMM, TGT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment