shaunl

One of the downsides to running a highly concentrated portfolio is that you might find more companies that are worth buying into than what you are willing to purchase. When this works out for the best, the end result is a maximization of returns. But sometimes, it also means missed opportunities. A great example of a missed opportunity involves a company called Covenant Logistics (NASDAQ:CVLG). This enterprise may not seem all that exciting. After all, the firm operates as an expedited freight transportation provider, not as some high-flying technology company that seeks to materially change the world. But in recent months, robust financial performance achieved by management, combined with a low share price, has been instrumental in driving shares higher. Ultimately, it looks to me as though upside potential still exists, though it may not be as impressive as it was before. Due to this, I still have decided to keep my ‘buy’ rating on its stock, reflective of my belief that shares should continue to outperform the broader market moving forward.

Fantastic results

In early July of this year, I wrote a follow-up article discussing whether or not it made sense for investors to consider a purchase of Covenant Logistics shares. In that article, I talked about how well the company had performed in the months leading up to that point. Strong revenue and cash flow growth was continuing throughout that stage of 2022, even though there were concerns about a potential recession. On top of that, the stock still looked cheap enough to me to warrant some enthusiasm. At the end of the day, these findings led me to keep my ‘buy’ rating on the company. So far, the firm has outperformed even my own expectations. While the S&P 500 is up 3.7%, shares have generated a return for investors of 50.5%. If we go back even further to when I first rated the company a ‘buy’ back in January of this year, the return disparity is even greater. From that time, the S&P 500 is down 16.3%. By comparison, Covenant Logistics has generated upside for investors of 61.9%.

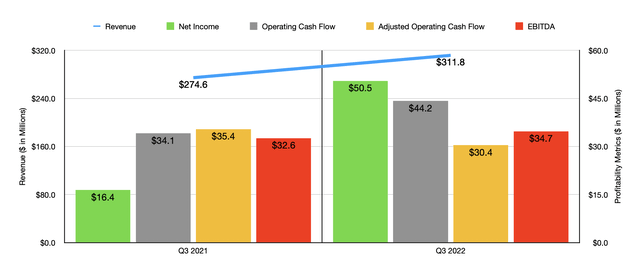

This massive return disparity can be understood only by looking at the company’s financial results in recent months. In the most recent quarter alone, the third quarter of 2022, sales came in at $311.8 million. That’s 13.5% higher than the $274.6 million the business reported for the third quarter of 2021. To be clear, the most rapid revenue growth for the company involved the revenue it generated from fuel surcharges. That number jumped from $24.3 million to $45.2 million. Excluding this, the increase in sales would have been a more modest 6.5%. The greatest increase on that front came from the company’s expedited operations, with revenue driven by an increase in average freight per tractor per week of 14.6%. All of this was driven by an acquisition the company had engaged in during the first quarter of this year.

With the rise in revenue, profits followed suit. Net income in the latest quarter totaled an impressive $50.5 million. That’s roughly triple the $16.4 million reported the same time last year. Naturally, the increase in revenue played a role here. But in addition to that, the company benefited from a massive gain on the disposition of property and equipment of $38.7 million. Without that, and without a more than doubling of its income from an equity method investment from $3.2 million to $7.4 million, net income would not have been nearly as positive. Other profitability metrics for the company also increased though. Operating cash flow went from $34.1 million to $44.2 million. Though if we adjust for changes in working capital, it would have decreased from $35.4 million to $30.4 million. Despite that little bit of pain, EBITDA for the company also managed to increase year over year, climbing from $32.6 million to $34.7 million.

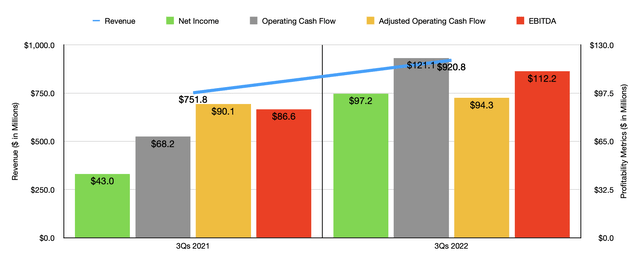

The results achieved in the third quarter were not the only positive results so far this year. For the first nine months of 2022 as a whole, revenue came in at $920.8 million. That stacks up favorably against the $751.8 million reported the same time last year. In this case, excluding the fuel surcharges, revenue would have risen a more modest 15.8% compared to the 22.5% that total revenue increased. Bottom line results for the company also came in strong, with net income of $97.2 million dwarfing the $43 million reported the same time last year. Once again, a large gain on the disposition of property and equipment, combined with a sizable amount of income from its equity method investments, were instrumental in this regard. Even so, other profitability metrics also rose year over year. Operating cash flow went from $68.2 million to $121.1 million, while the adjusted figure for this expanded from $90.1 million to $94.3 million. At the same time, EBITDA for the company also increased, climbing from $86.6 million to $112.2 million.

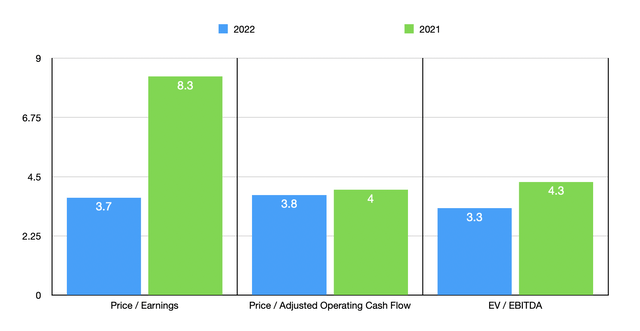

Unfortunately, management has not really offered any guidance for the current fiscal year. Simply annualizing the results experienced so far would give us net income of $137.2 million, adjusted operating cash flow of $131.9 million, and EBITDA of $163.6 million. Because of the nature of the profitability gains this year, I don’t put a lot of faith in these estimates. But as you can see in the chart above, they would result in the company looking dirt cheap. Even if we rely on data from 2021 though, shares of the enterprise would still be quite cheap. The price-to-earnings multiple, for instance, would come in at 8.3. The price to adjusted operating cash flow multiple wouldn’t be too much different than what we would see using data from 2022, with the number coming in at 4. And the EV to EBITDA multiple for the company would still be quite low at 4.3. As part of my analysis, I also compared the company to five similar firms. But because of the nature of profit figures for this year, I decided to compare the company using its 2021 results to these other firms. On a price-to-earnings basis, these companies ranged from a low of 5.2 to a high of 16.9. In this case, three of the five companies were cheaper than our prospect. Using the price to operating cash flow approach, the range for the companies was from 1.9 to 13.3, with two of the five companies being cheaper than Covenant Logistics. And when it comes to the EV to EBITDA approach, the range was from 3.2 to 9.4. In this case, four of the five were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Covenant Logistics | 8.3 | 4.0 | 4.3 |

| Daseke (DSKE) | 8.4 | 2.8 | 3.8 |

| P.A.M. Transportation Services (PTSI) | 6.0 | 4.1 | 3.9 |

| ArcBest Corporation (ARCB) | 6.1 | 4.6 | 3.2 |

| Saia, Inc. (SAIA) | 16.9 | 13.3 | 9.4 |

| Ryder System (R) | 5.2 | 1.9 | 3.2 |

Takeaway

By this point, I do believe that the easy money has already been made for shareholders in Covenant Logistics. Even so, shares of the company do look cheap on an absolute basis and they don’t look bad when priced relative to similar firms. I do acknowledge that financial performance may eventually reverse back to what it was in prior years. But so far, we aren’t seeing a great deal of movement in that direction. In the meantime, the company continues to generate robust cash flows that can be used for further growth, debt reduction, or rewarding shareholders directly. When it comes to purchases and share buybacks, the company has already proven itself. In February of this year, for instance, it acquired 100% of AAT in a deal valuing the enterprise at $54.7 million. And in the latest quarter alone, the company purchased back nearly 1 million shares of stock for $34.1 million. Due to all of these factors, I still believe the company warrants a ‘buy’ rating, even if it’s not as appealing as it was previously.

Be the first to comment