JENNIFER E. WOLF/iStock via Getty Images

The following segment was excerpted from this fund letter.

COUNTRYSIDE PARTNERSHIPS (OTC:CUSPY)

Countryside Partnerships (CSP) is a homebuilder and renovator servicing the local authority (LA) and home association (HA) market located in the United Kingdom. CSP is part of our transformation theme described above. Countryside is transforming itself from a traditional homebuilder that owns land and builds homes on that land which then sell to individuals to a homebuilder who builds and upgrades homes on a contract and partial ownership basis for nonprofit LAs and HAs (the “partnerships business”) which are quite common in the UK.

There are two advantages to this model:

(1) HA home construction can be scheduled because HA payments are known in advance, thus providing homebuilding economies of scale; and

(2) the payments for land can be deferred until the sale. This transformation was facilitated by activists Browning West and David Capital, who together hold 20% of the equity of CSP and have a board seat.

Many of the LA and HA homes were built around World War II, so many are in the need of renovation and expansion. About 72% of CSP’s earnings are currently associated with partnerships and will transition to 100% by 2024. Over the past five years, the partnership segment has grown earnings 14% per year.

HA and private rented sector (PRS) contracts provide stability of revenue for homebuilders, as the affordable housing and renovation revenue is not dependent upon cyclical private home sales but on HA steady cash flows and ability to borrow at low interest rates. This allows homebuilders to gain economies of scale in homebuilding that can be shared with the HA. Partnerships also require less capital, as the land is provided by the HA or other UK government agencies—like Homes England—on a deferred payment basis. PRS sales are purchased by institutional investors that rent the units to individuals. Finally, the UK government is directly funding (£1.8 billion for regeneration and £11.5 billion for new affordable housing over the next five years) both LAs and HAs to develop affordable housing. A minimum of 25% of the new affordable housing built with these funds must be built using modern methods of construction (MMC), including modular housing. Currently, there is a waiting list of 1.2 million households to live in affordable housing units, including PRS. CSP’s mix of affordable and PRS to market rate housing is higher than most of its peers at 60%/40%. The affordable housing segment is expected to grow by 10% per year and the PRS segment by 10% to 15% per year over the next five years.

In a mixed tenancy arrangement (CSP’s focus), the partnership receives a portion of homes to sell into the local market in exchange for developing or renewing an HA development. The other arrangement is partner delivery, where homebuilders outsource homebuilding but not development. Most HAs do not have the operational capability to perform the development themselves, thus outsourcing this function to partnership firms such as CSP. To develop relationships with LAs and HAs (to successfully bid and win contracts), CSP has established 15 regional teams in the Home Counties, the South, the Midlands, and the North of the UK. HA bid selection is based upon pricing (40% weighting) and non-pricing/design criteria (60% weighting). Historically, CSP has been strong in the South and Home Counties regions. To enhance their position in the Midlands and the North regions, CSP purchased a partnership firm, Westleigh, in 2018.

In addition to the partnership business, CSP has a manufacturing business which provides modular housing, including open and closed panels and prebuilt timber framing of housing. This is important to win bids, as one of the HA’s criteria for developer selection is the building of homes in a modular fashion.

In addition, modular construction increases inventory turns, as the time to build a home is less than traditional stick or brick construction. CSP has three factories—two located in the Midlands and one in the North region—with a total capacity of 6,000 units per year. This division is expected to run at breakeven at a volume of 4,600 units and supply CSP with modular housing. CSP has the highest quality rating for homebuilders in the UK—five stars.

Another UK property developer, Vistry Partnerships, has a similar division focusing only on HAs with about 50% mixed tenure and 50% partner delivery (where the homebuilding is outsourced). Similar capital-light models are currently being implemented by NVR in the United States (via options versus land purchases), Kaufman & Broad (OTC:KFMNF), and Nexity (OTCPK:NNXXY) (via the homeowners owning the land before purchase) in France and Shinoken Group (OTC:SHIOF) (via homeowners receiving corporate subsidies) in Japan. These capital light firms have higher inventory turns than their homebuilding peers. CSP has the largest market share in the UK partnership mixed tenure business of 8% with a run-rate of about 4,000 homes per year. CSP’s ASP is about £285,000 per home. Most homes in the partnership market are provided by the HA themselves via partner delivery (about 70% of the total) so there is room for further missed development penetration in this market. Each of these markets is a local market and CSP has region-specific teams that service the HAs in each of four UK regions (Home Counties, Midlands, North, and South). CSP’s current backlog is about 6,000 homes, and its pipeline includes 20,000 homes where terms have been negotiated and an additional 50,000 homes where terms are under negotiation.

CSP has developed the partnership by region. In 2021, in more mature regions (32% of volume), CSP generated RoICs of 36%, while underperforming and developing regions generated RoICs of 3.2%. CSP plans on migrating the underperforming regions to mature regions and the developing regions to mature regions by 2025. A developing region requires about five years to reach maturity.

CSP has little debt and is liquidating its homebuilding assets. To date, CSP has liquidated £150 million and plans to receive an additional £300 million over the next two years. Management has stated that they will perform buybacks totaling £450 million and satisfy legacy liability such as safety retrofits (£110 million estimate) with these proceeds. Given the decline in CSP’s stock price, these buybacks are very accretive. CSP has repurchase 5% of its shares since it began its repurchase program last year. Currently, CSP sells at 7.6x 2022 estimated EPS.

UK Partnership Business

The overall UK real estate market has historically grown as its population has grown, and this is expected to continue into the future. According to Deutsche Bank (DB), the UK is expected to increase the number of households by 3.5 million by 2037 from a base of 28.2 million in 2021, a rate of about 220,000 new households per year. Housing completions are currently about 170,000 per year.

Typically, homebuilding is a good business but requires capital-intensive land to build on to provide the end product to customers. Thus, the business is comprised of a good business (building homes) and a not-so-good business (owning land until the houses are built). The homebuilding-only business can generate RoEs in the 20% to 40% range while land ownership generates RoEs in the single digits. In addition, homebuilders typically borrow money to purchase the land. Some homebuilders have found ways to make homebuilding less capital intensive and thus have higher returns on capital. First, some homebuilders have used option contracts which they have exercised when they have an order. Second, some have required homeowners to purchase the land themselves and they will then build on the homeowners’ land. Finally, some (partnership business) have built and remodeled homes in exchange for selling some of the new or remodeled homes to customers.

The UK partnership business includes HAs and LAs completions. The total UK market size is about 170,000 homes pre year, of which 120,000 per year are private development and 50,000 per year are HA and LA development. Since many of the HAs have not been updated since their founding (around World War II), there is a lot of pent-up demand for partnership housing. HAs and LAs provide about 70% of the development themselves (outsourcing the construction) while 30% of the developments are outsourced to firms like CSP (mixed tenancy). The largest mixed tenure third-party firms include CSP (8% market share), Vistry Partnerships (6% market share), Kier Living (4% market share), and Lovell (3% market share). All of the competitors except CSP also have traditional homebuilding groups. The levers for future growth are market share growth and greater third-party penetration into the HA development market.

CSP has developed a growing pipeline of mixed tenancy projects that should increase recurring revenue by 10% to 15% per year over at least the next 10 years. In addition, the partnership business has generated higher margins of 15% than the traditional homebuilding business of 7%.

Downside Protection

CSP has no debt and will be returning capital via buybacks as the homebuilding assets are monetized. The consistency of the cash flows from HA and PRS contracts will allow local economies of scale to be achieved that are not dependent upon local pre-sales. The nature of the contracts with HAs and PRS investors will lead to more predictable cash flows than building and then selling homes. For most partnership projects, the cash for the land will be deferred until sale of affordable or PRS units, thus lowering the inventory investment and risk versus a traditional homebuilder.

Another protection is that the partnership business is less affected by interest rates than traditional homebuilding, as the end customers—HAs and LAs—have steady income streams from tenants and can borrow at lower interest rates versus tradition homebuilding customers who are interest-rate sensitive.

With the opening of offices in the North, Midlands, and South, CSP’s geographic footprint was widened and smoothed out regional variations in housing demand. The history and projected financial performance for CSP is illustrated below.

| 9/30/16 A | 9/30/17 A | 9/30/18 A | 9/30/19 A | 9/30/20 A | 9/30/21 A | 9/30/22 E | 9/30/23 E | 9/30/24 E | |

| Revenue | 776.98 | 845.8 | 1,018.60 | 1,422.80 | 988.8 | 1,526.20 | 1,573.81 | 1,782.58 | 1,945.99 |

| % Change YoY | 8.90% | 20.40% | 39.70% | -30.50% | 54.30% | 3.10% | 13.30% | 9.20% | |

| EBITDA | 124.4 | 166.7 | $219.10 | $248 | 68.9 | 180 | 152.2 | 205 | 321.09 |

| % Change YoY | 34.00% | 31.40% | 13.30% | -72.30% | 161.20% | -15.40% | -15.40% | 34.69% | |

| % EBITDA Margins | 16.00% | 19.70% | 21.50% | 17.50% | 7.00% | 11.80% | 9.70% | 11.50% | 16.50% |

| Net Income Normalized | 73.2 | 125.3 | $161.20 | $182 | 34 | 123.9 | 128.88 | 178.26 | 291.9 |

| % Change YoY | 71.30% | 28.70% | 12.60% | -81.30% | 264.40% | 4.00% | 4.00% | 38.31% | |

| % Net Income Margins | 9.40% | 14.80% | 15.80% | 12.80% | 3.40% | 8.10% | 8.20% | 10.00% | 15.00% |

| EPS Normalized | 0.16 | 0.28 | 0.36 | 0.4 | 0.07 | 0.24 | 0 | 0.35 | 0.57 |

| % Change YoY | 69.90% | 28.20% | 13.50% | -81.90% | 221.90% | 5.70% | 21.50% | 12.80% | |

| Free Cash Flow | -35.8 | 51.4 | 85 | 47.7 | -183.2 | -47.5 | 356 | 202.75 | 63.5 |

| % Change YoY | 243.40% | 65.40% | -43.90% | -484.10% | 74.10% | 849.50% | -43.00% | -68.70% | |

| FCF/Share | -0.08 | 0.11 | 0.19 | 0.11 | -0.38 | -0.09 | 1 | 0.46 | 0.15 |

| % Change YoY | N/A | 65.27% | -44.62% | N/A | N/A | N/A | -33.89% | -67.09% | |

| Book Value / Share | 1.52 | 1.77 | 2.01 | 2.35 | 2.12 | 2 | 2.24 | 2.65 | |

| % Change YoY | 16.40% | 13.80% | 16.60% | -9.90% | -16.30% | 26.60% | 18.30% | ||

| Return on Equity (%) | 24.17% | 18.42% | 20.34% | 19.90% | 2.98% | 11.32% | 14.12% | 15.44% | 21.37% |

Management and Incentives

CSP’s management has been focused on developing its partnership business by evaluating association opportunities and focusing on the high return on capital opportunities. In the past, CSP has been focused on growth even if the expected return on capital was not acceptable. This approach (which has subsequently been remedied), in combination with the transformation of the firm, the dismissal of the CEO, and a decline in the UK homebuilder market, has led to the recent price decline. At the same time, CSP is repurchasing stock from the proceeds received from the sale of the asset of the capital-intensive homebuilding business. The senior executives have bonus pay based upon adjusted operating profit and margins, and customer satisfaction targets paid 33% in shares and 67% in cash. For the long-term incentive, the payout is in shares based upon relative total shareholder returns, tangible NAV, and return on capital employed.

The activists on the board (Browning West and David Capital) have facilitated the transition and own about 20% of the equity. Another activist firm, Inclusive Capital Partners headed by Jeff Ubben, has recently acquired an approximately 10% stake. The firm is looking for a new CEO and is now co-led by the leaders of the London and South partnership cluster groups.

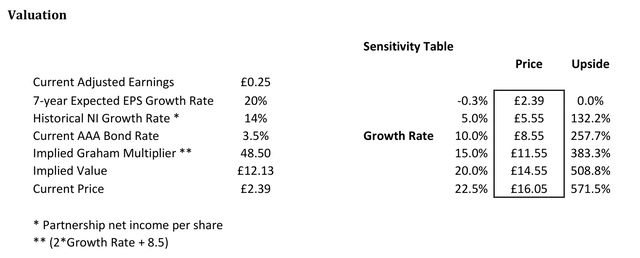

The key to the valuation of CSP is the expected growth rate. The current valuation implies an earnings/FCF decline of -0.3% into perpetuity using the Graham formula ((8.5 + 2g)*(4.4/AAA bond rate)). The historical 10-year FCF growth per share has been 14% per year including acquisitions, with a current FCF return on equity of 20%.

A bottom-up analysis, based upon growth rates of new homes in the pipeline and to be built, results in a 20% growth rate (see below) with the affordable housing market growing by 10% and the PRS market by 10% to 15% per year. The resulting current multiple is from 48.5x (assuming a 20% growth rate) while CSP trades at an FCF multiple of 8.7x. If we look at firms with lower growth rates (Kaufman & Broad), they have FCF multiples of 14x FCF. If we apply 14x FCF to CSPs 2024 EPS of £0.48, then we arrive at a value of £6.72 per share, which is a reasonable short-term target. If we use a 20% seven-year growth rate, then we arrive at a value of £14.55 per share. This results in a five-year IRR of 44%.

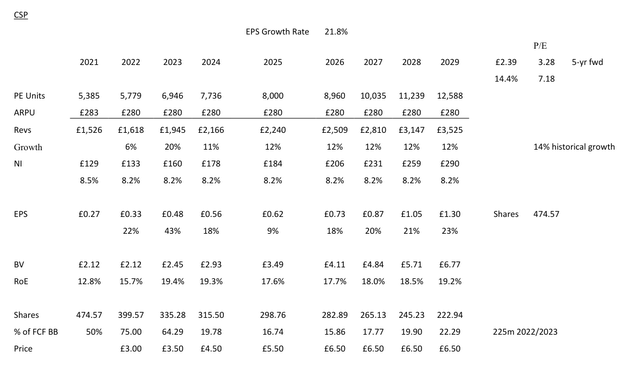

Below is a forwarding-looking cash flow estimate for CSP based upon management’s guidance in terms of home delivery rates.

In this analysis, we assume the £450m in sale proceeds from the legacy homebuilding will be used to repurchase in 2022 and 2023, as well as 50% of the net income thereafter. We also assume reaching the 8,000 per year home delivery level by 2025 based upon management’s expectations. This results in a forward P/E ratio in 2026 of 3.3x using the current share price. The five-year EPS growth rate using these assumptions is 21.8% per year.

Comparables

|

High RoE Home Builders |

Inv Turns |

EBIT Margin |

Return on Equity |

Debt/ Equity |

P/E |

P/BV |

20-23 Growth Rate |

|

NVR (USA) |

3.70 |

18.3% |

40.5% |

0% |

13.9 |

5.21 |

9% |

|

Vistry Group (UK) |

1.01 |

13.2% |

11.1% |

0% |

6.2 |

1.22 |

12% |

|

Countryside Partnerships (UK)* |

2.20 |

11.0% |

27.5% |

5% |

8.7 |

1.41 |

20% |

|

Dream Finders (USA) |

2.08 |

7.6% |

36.0% |

53% |

13.5 |

1.57 |

56% |

|

Shinoken (Japan) |

2.49 |

9.4% |

13.9% |

4% |

5.9 |

0.79 |

0% |

|

Kaufman & Broad SA (France) |

2.65 |

8.0% |

24.4% |

19% |

14.2 |

8.69 |

5% |

|

JM (Sweden) |

1.37 |

14.0% |

22.6% |

27% |

12.4 |

2.51 |

2% |

|

* Adjusted for the sale of homebuilding assets (£450m) |

|||||||

The comparable firms are homebuilders worldwide which have a capital-light approach to homebuilding (either through optioning of land purchases or having third parties purchase the land) and generate a high return on equity. All of these firms have high inventory turns and decent EBIT margins. Compared to these firms, CSP is undervalued given its high growth rate, inventory turns, and return on equity. CSP is also less levered than most of the comparable firms. One differentiating factor for CSP is a large portion of their revenue (60%) is from nonprivate market sales and thus is less dependent upon cyclical housing sales trends.

Risks

The primary risks are:

- slower than expected partnership starts or new contract wins; this can be either from new pandemic delays (if one pops up) or for HA specific reasons; and

- government decides to limit the amount of HA contracts awarded to third-party developers.

Potential Upside/Catalyst

The primary catalysts are:

- more HA partnership market penetration;

- larger-than-expected repurchases;

- recovery in private real estate market; and

- more government funding for affordable and PRS housing.

Timeline/Investment Horizon

The short-term target is £6.72 per share, which is 181% higher than today’s stock price. If the successful transition to partnerships thesis plays out over the next five years (with a resulting 20% FCF growth per year), then a default adjusted value of £14.55 could be realized. This is a 44% IRR over the next five years.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment