Felipe Cruz/iStock Editorial via Getty Images

Cosan SA (NYSE:CSAN) recently disclosed the acquisition of a minority stake in Vale SA (VALE) through a complex deal comprising both direct investments and derivatives. Based on Vale’s ~$67bn market cap at the time of the announcement, this implies Cosan’s stake is worth a massive ~$3.3bn (or >50% of its market cap). Cosan sees the funding risk as capped, given it is using a limited amount of leverage to acquire Vale equity; yet, the deal structure guarantees are tied to dividend flows from its operating companies (opcos), implying a significant opportunity cost to shareholders. Plus, the accretion potential remains unclear – not only will Cosan’s influence be limited, but there also seem to be limited synergies between the two groups. Overall, it’s hard to see how the Vale acquisition justifies the increased complexity post-deal, particularly as investors can already get exposure to Vale directly. Given the prospect of a wider conglomerate discount on the stock, I remain sidelined.

Announcing A Material 6.5% Stake in Vale

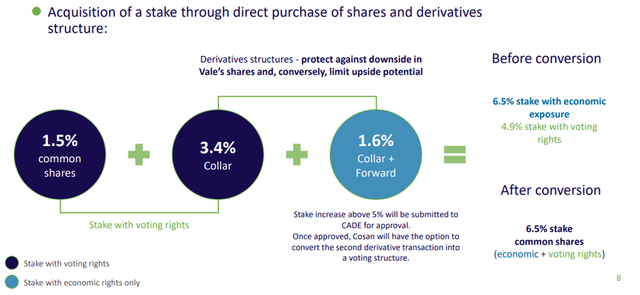

Cosan filed a material fact announcement in recent weeks disclosing that it had acquired an initial 4.9% in Vale common shares with the intention to further increase that stake to 6.5% within five years (pending antitrust approval). The deal amounts to a massive ~BRL21bn, almost two-thirds of Cosan’s ~BRL35bn market value pre-deal announcement. The disclosure also highlighted the complexity of the transaction structure, which in addition to a direct investment, will involve a derivatives component to retain the optionality of unwinding a part of the deal and reducing the leverage burden.

In turn, the transactions will entail a guarantee by Cosan’s opco dividend stream from Raizen and Compass, and eventually the Vale shares that Cosan already has and will have over the coming years. Perhaps more importantly, the acquisition of a full 6.5% voting stake at Vale only makes Cosan a top-three shareholder (above former co-controlling shareholder Mitsui’s (OTCPK:MITSY) stake but without a clear majority).

Unpacking the Strategic Merits of a Minority Stake in Vale

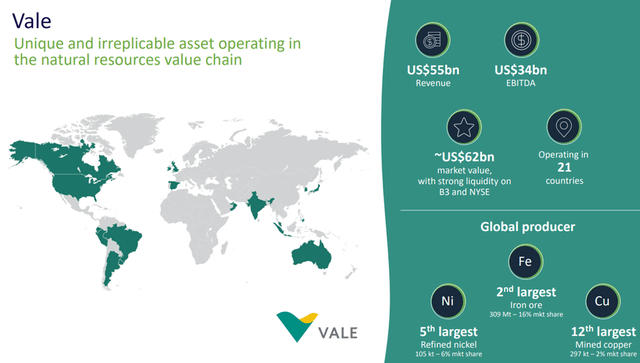

As an addition to the Cosan portfolio, Vale makes a lot of financial sense. Per management (call transcript here), the investment ticks all the right capital allocation boxes – these include a leading competitive position in the global mining industry (helped by its geography), its unique asset base, as well as its hard currency exposure. The stated rationale makes this seem like a mostly valuation-driven investment decision, though, in contrast with Cosan’s synergy/turnaround-focused track record on the capital allocation front.

For now, Cosan has only outlined its plan to elect a board member and contribute to Vale’s management strategic decisions as a significant (albeit minority) shareholder, leaving the path to value creation unclear at this point. Pending further visibility on the company’s contribution to unlocking value or improving Vale’s positioning, I am concerned about the increased complexity post-transaction, which could, in turn, entail a widening of the company’s conglomerate discount.

Post-Deal Financial Concerns Loom Large

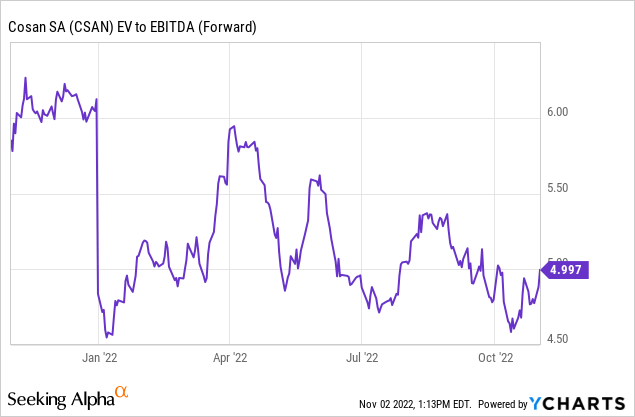

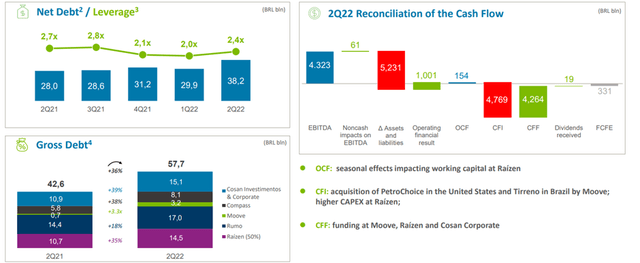

Beyond the strategic implications, the financial impact will be top-of-mind for investors, given Cosan currently has a sizable debt load at the holding level and ended its last quarter with a pro-forma net debt/EBITDA of ~2.4x. On the flip side, the cash buffer is more than adequate, and no maturities are due in the international markets over the near term. Thus, Cosan has ample headroom to navigate an investment cycle through the coming years, although the company will eventually need to address its holdco debt to optimize the capital structure. In the meantime, the Vale deal shouldn’t increase indebtedness – per the deal terms, any increase in gross debt will be compensated by divestment solutions or by unwinding a part of the transaction.

That said, the financial case doesn’t seem to include a worst-case scenario, which could raise investor concerns about the financial expense implications at the holdco level should a severe recession or cyclical downturn materialize. Plus, the deal comes with a hefty opportunity cost for shareholders, as the status quo dividend flow from the opcos to the holding company will be interrupted to accommodate the Vale acquisition. Per the deal terms, R$8bn of the financing will come from a non-recourse bridge loan, where banks receive a portion of the dividends from the Cosan opcos. This means less headroom to service the existing debt load and to fund growth opportunities across the existing portfolio at a time when many opcos are embarking on an investment cycle (e.g., Rumo’s light rail expansion and Raízen’s new ventures into biogas). Coupled with the prospect of lower shareholder returns post-deal, it would not surprise me if the market assigned a deeper discount to Cosan stock going forward.

Vale Stake Could Weigh on the Stock

Net, Cosan’s decision to acquire a minority stake in Vale now makes it a leveraged play on Vale over Raizen, Compass or the other opcos. To recap, this is an acquisition amounting to >50% of Cosan’s market cap, funded by a complex mix of debt and derivative structures. While the leverage implications are limited at first glance, the deal guarantees are backed by dividend flows from Cosan’s opcos, which will weigh on the shareholder return potential. The path to value accretion at Vale remains largely unclear as well (beyond being a valuation-driven acquisition), while the added complexity creates an unnecessary overhang on the stock. Given the prospect of a widening conglomerate discount (investors could instead get exposure to Vale directly vs. through Cosan), I see limited upside to Cosan in the near term.

Be the first to comment