jetcityimage/iStock Editorial via Getty Images

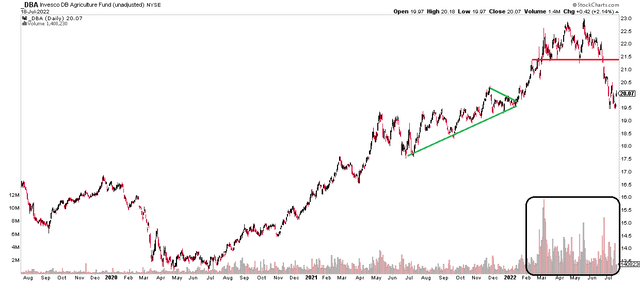

The agricultural and chemical commodities space was a hot trade through much of the second quarter. The Invesco DB Agriculture Fund (DBA) sported a technical breakout to start the year, helping the ETF to lift from under $20 to $23 by the May high. Major volume came into the Ag play following Russia’s invasion of Ukraine in February.

The narrative went that exports, such as wheat, would be severely cut due to geopolitical tensions. That was indeed the case for a few months, but recently DBA has come under attack by the bears. Global recession fears led to an unwind of the commodities trade starting in early June. Ag commodities and their related single stocks have seen intense selling pressure. Is now the time to dip back in? There’s one stock that could be a decent rebound candidate: Corteva (NYSE:CTVA).

DBA Agricultural Commodity ETF: Back to Near UNCH on the Year

According to Bank of America, Corteva, the combined business of Pioneer, DuPont Crop Protection, and Dow AgroSciences, is a pure-play agriculture business specializing in Crop Protection chemicals and Seeds. The company generated $15.6 billion in sales and $2.6 billion in EBITDA in 2021. The company is impacted not only by unfolding events in Russia and Ukraine but also by its exposure to South America.

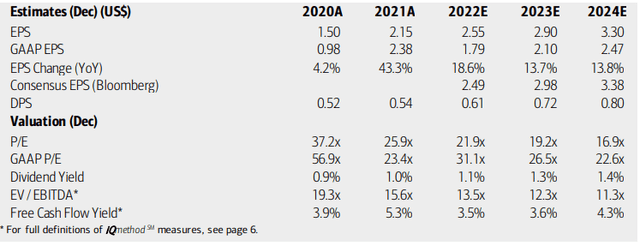

The $38 billion market cap company headquartered in Indianapolis is a key chemicals firm in the Materials sector. The stock trades at a high P/E multiple of 22.4, according to trailing 12-month data from The Wall Street Journal. BofA puts a fair value EV/EBITDA multiple of 12x on the company, which is about the 5-year average of a firm in the industry.

Like all ag stocks, the goings-on with weather and crop production levels, particularly soybean for CTVA, are key variables. Litigation risks are also front and center with Corteva. BofA and the Bloomberg consensus call for a solid EPS growth rate through 2024, which likely accounts for its pricey valuation. Moreover, higher earnings, if they materialize, will make the P/E ratio more attractive.

CTVA’s yield is low and free cash flow is not as strong as you might find in other resource-related stocks.

Corteva EPS, Valuation, Dividend Forecasts

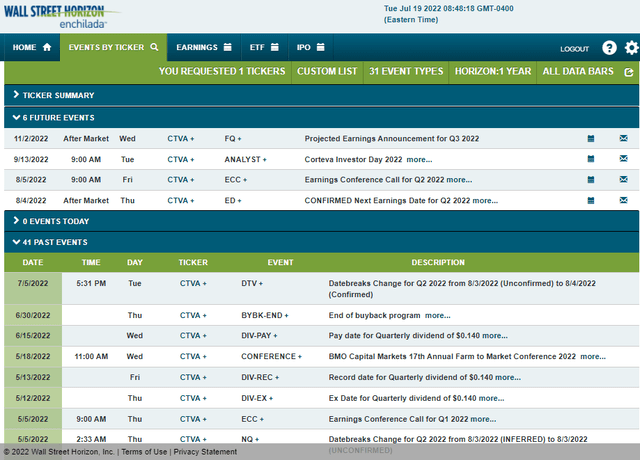

Looking ahead, Wall Street Horizon shows a confirmed Q2 earnings date of August 4 AMC with a conference call the following morning. There is also an Investor Day in mid-September that should cause volatility in the stock price and its options.

Corteva Corporate Event Calendar: Aug 4 Earnings AMC

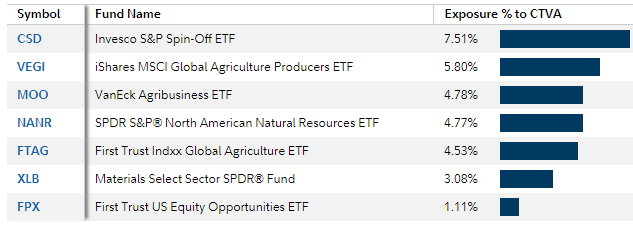

Corteva is a major holding in several agricultural funds.

ETFs with CTVA Exposure

Fidelity Investments

The Technical Take

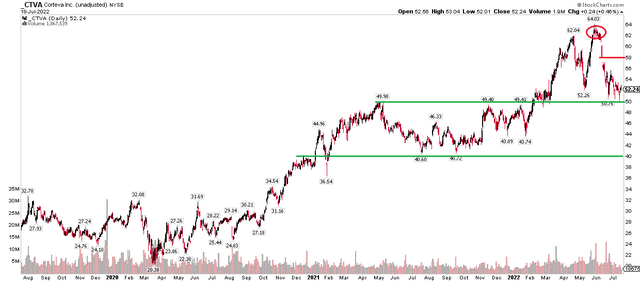

While CTVA does not look particularly cheap on the fundamental side, the technical picture illustrates a bullish opportunity. Notice in the chart below, which dates to about when the company began trading, that there has been a general uptrend. Once $40 was taken out, $50 was the next stop. Shares then surged to $64 this past June after a February bullish breakout. Unfortunately, a bearish false breakout was confirmed by a swift move lower in shares.

A 20% pullback brings CTVA back to $50 support. I think this presents a good risk/reward play. Investors can be long here with a stop below $50. I target a June gap near $58, and there is another gap that could be filled near $61. If shares drop to $40, that could be a great spot for long-term investors to accumulate a position, too.

CTVA: Back to $50 Support

The Bottom Line

The commodities trade came apart in June, but I notice many energy and materials stocks are now back at support. CTVA is one of them. While its valuation is not great, the technical trading setup looks favorable here.

Be the first to comment